This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

Rhode Island Outline of Considerations for Transactions Involving Foreign Investors

Description

How to fill out Outline Of Considerations For Transactions Involving Foreign Investors?

Selecting the optimal legitimate document format can be a challenge. Naturally, there are numerous web templates accessible online, but how do you secure the legitimate form you need.

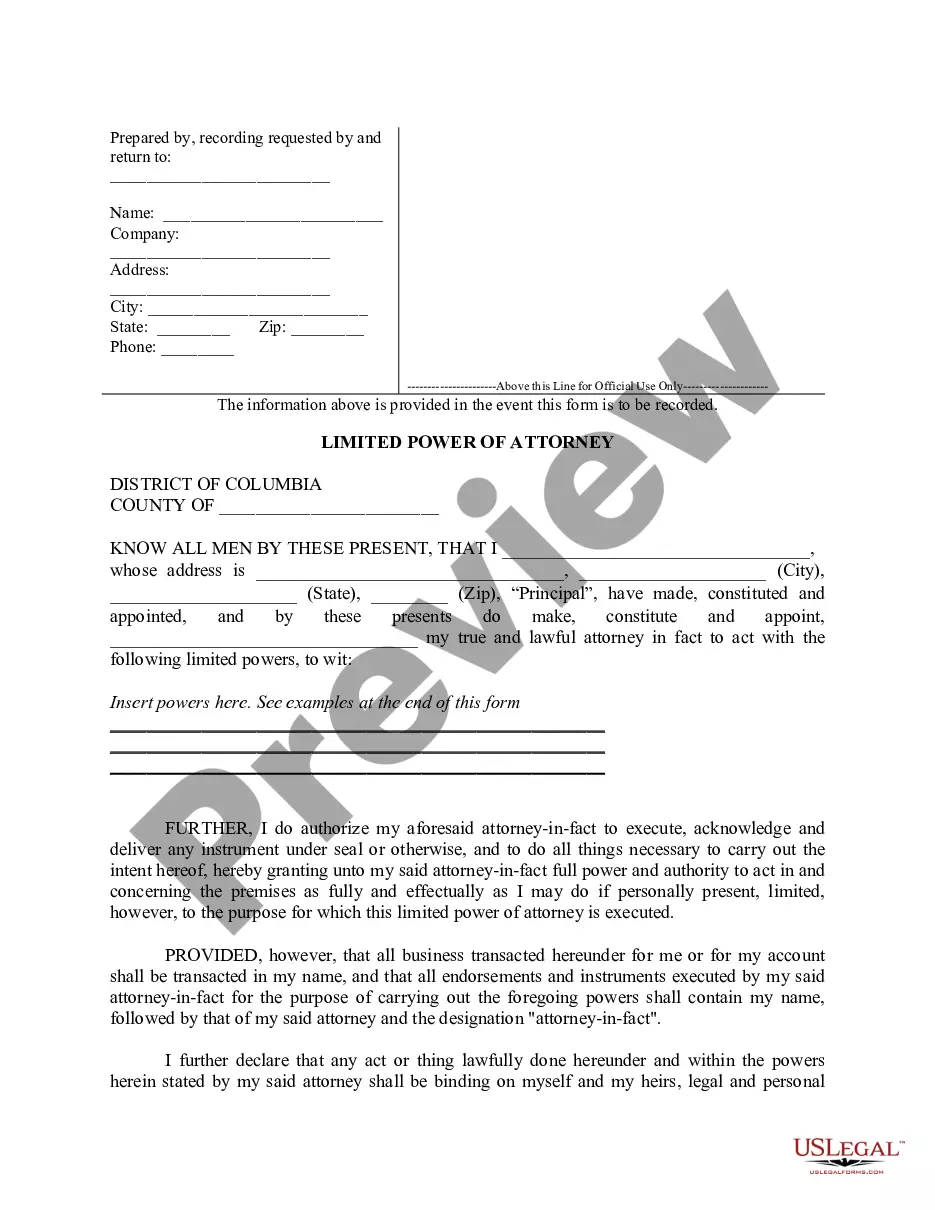

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors, which can be utilized for both business and personal purposes.

All of the forms are reviewed by professionals and comply with federal and state regulations.

When you are confident that the form is correct, click on the Get now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legitimate document format for your device. Finally, complete, edit, print, and sign the received Rhode Island Outline of Considerations for Transactions Involving Foreign Investors. US Legal Forms is the largest repository of legitimate forms where you can find a diverse assortment of document templates. Leverage the service to download professionally-crafted documents that adhere to state requirements.

- If you are already registered, sign in to your account and click on the Acquire button to obtain the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors.

- Use your account to review the legitimate forms you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your city/county. You can view the form using the Preview button and read the form details to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

As of this moment, there has been no confirmation of an extension to the 2025 tax deadline. Keeping informed about upcoming deadlines is crucial when working with the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors. Staying updated on tax regulations can help you plan your transactions better. Consider using uslegalforms for timely updates and resources related to tax deadlines.

Missing the October 15 tax extension deadline can lead to significant penalties and interest on unpaid taxes. This situation can adversely affect those engaged in the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors. To mitigate risks, it is advised to act quickly and consult with a tax professional. Utilizing the tools and resources on uslegalforms can help you address these issues effectively.

Blue sky laws in Rhode Island refer to state regulations that oversee the offering and sale of securities. These laws protect investors from fraud and require transparency in transactions. When exploring the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors, being aware of blue sky laws is essential for legal compliance. Resources available on uslegalforms can help you understand and comply with these regulations.

A US Nexus in a transaction typically arises from various activities, such as having a physical presence or conducting business operations in the U.S. For those involved in the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors, identifying the factors that establish nexus is vital. This understanding can guide compliance with tax regulations. Our platform provides insights into these complexities to help you navigate your obligations.

As of now, there has been no official announcement regarding an extension for audit dates in 2025. When dealing with the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors, it is essential to stay updated on any tax law changes. Being proactive in understanding your obligations can help avoid complications. Utilize resources offered by uslegalforms to keep informed about potential updates.

Filing Form 7004 after the deadline is generally not permitted. However, if you missed the deadline for the Rhode Island Outline of Considerations for Transactions Involving Foreign Investors, you may still file for an extension under specific circumstances. It is crucial to understand the consequences of missing deadlines, as penalties may apply. Consulting with a tax professional or using a platform like uslegalforms can help clarify your options.

Control under CFIUS refers to the ability of a foreign entity to influence the actions of a U.S. business significantly. This often relates to ownership of voting power or the right to appoint members to the board. In Rhode Island's investment climate, comprehending what constitutes control is vital; hence, utilizing a Rhode Island Outline of Considerations for Transactions Involving Foreign Investors can provide clarity on potential implications.

CFIUS reviews transactions that may affect national security involving a foreign person's control over a U.S. business. This includes both direct and indirect investments, especially in critical sectors like defense and technology. For those investing in Rhode Island, a Rhode Island Outline of Considerations for Transactions Involving Foreign Investors serves as an informative resource to grasp the review process.

A CFIUS filing is triggered when a foreign investor intends to acquire control over a U.S. business. Specific activities, such as purchasing voting shares or acquiring assets, can prompt this requirement. Understanding the nuances of these triggers in Rhode Island is essential; therefore, leveraging a Rhode Island Outline of Considerations for Transactions Involving Foreign Investors can guide you through the complexities.

CFIUS applies to any foreign investor seeking to invest in or gain control of a business in the United States. This includes various entities, whether they be individuals, companies, or government bodies. For investors in Rhode Island, having a Rhode Island Outline of Considerations for Transactions Involving Foreign Investors at hand can clarify responsibilities and requirements, ensuring compliance.