Rhode Island Long Term Incentive Program for Senior Management

Description

How to fill out Long Term Incentive Program For Senior Management?

If you wish to full, obtain, or produce legal record templates, use US Legal Forms, the greatest selection of legal varieties, that can be found on-line. Take advantage of the site`s simple and easy practical lookup to get the papers you need. Different templates for business and person functions are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to get the Rhode Island Long Term Incentive Program for Senior Management with a couple of mouse clicks.

Should you be already a US Legal Forms customer, log in for your bank account and click on the Down load button to have the Rhode Island Long Term Incentive Program for Senior Management. You may also accessibility varieties you in the past acquired within the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your appropriate area/land.

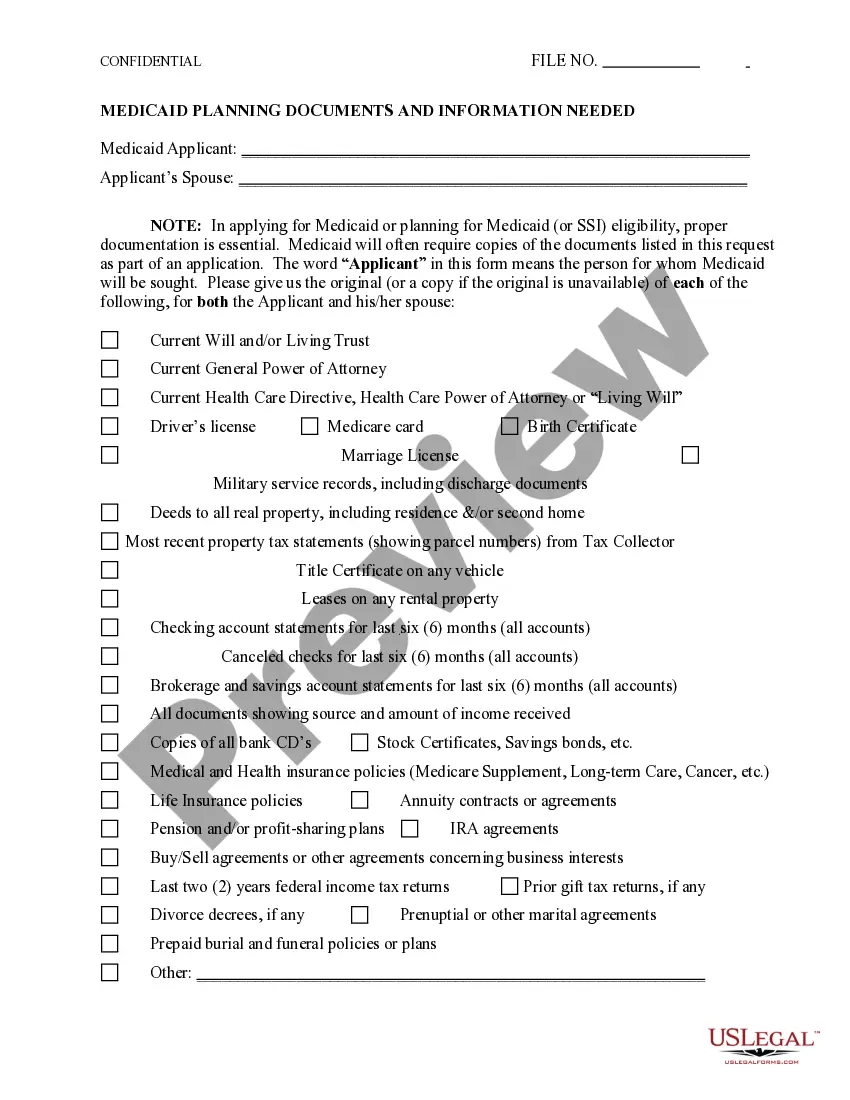

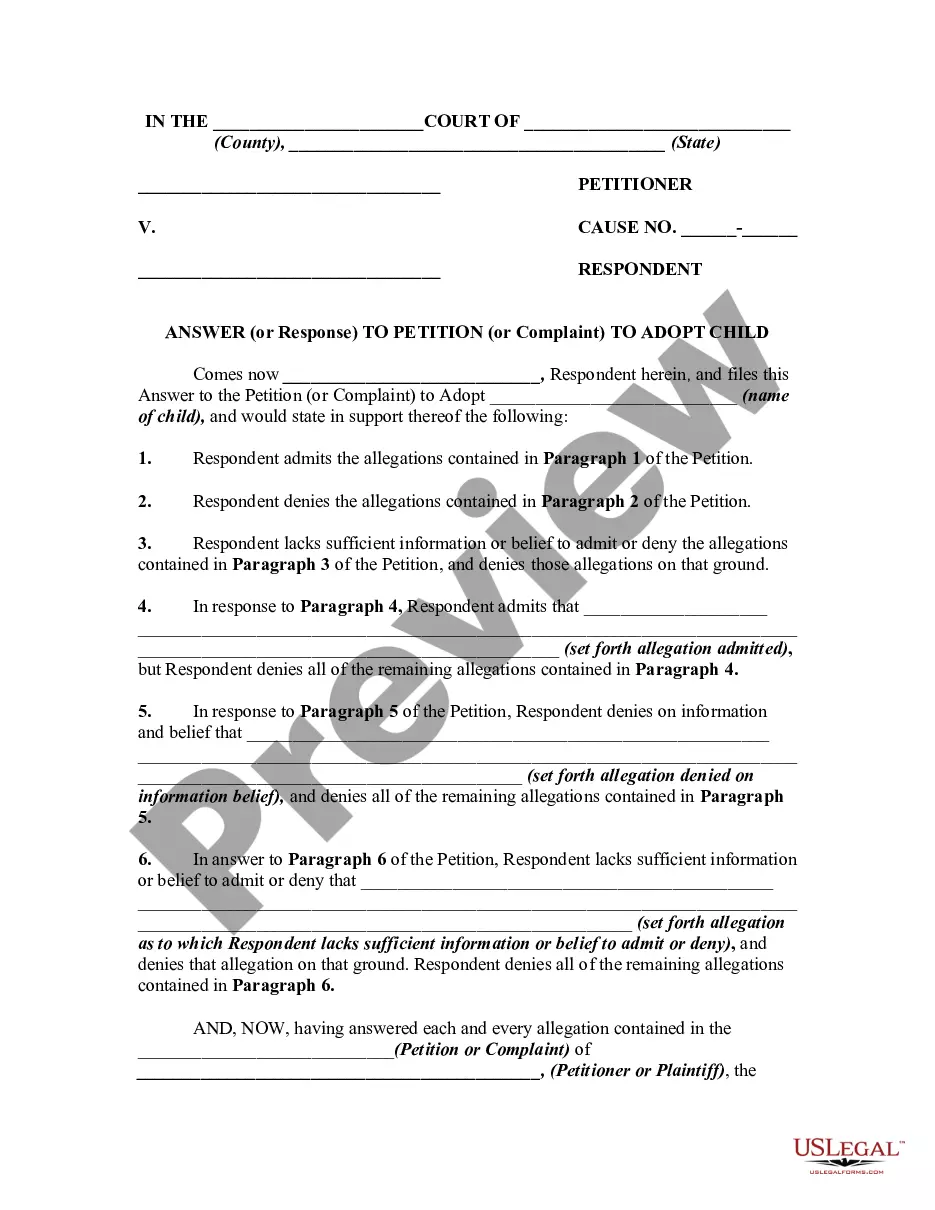

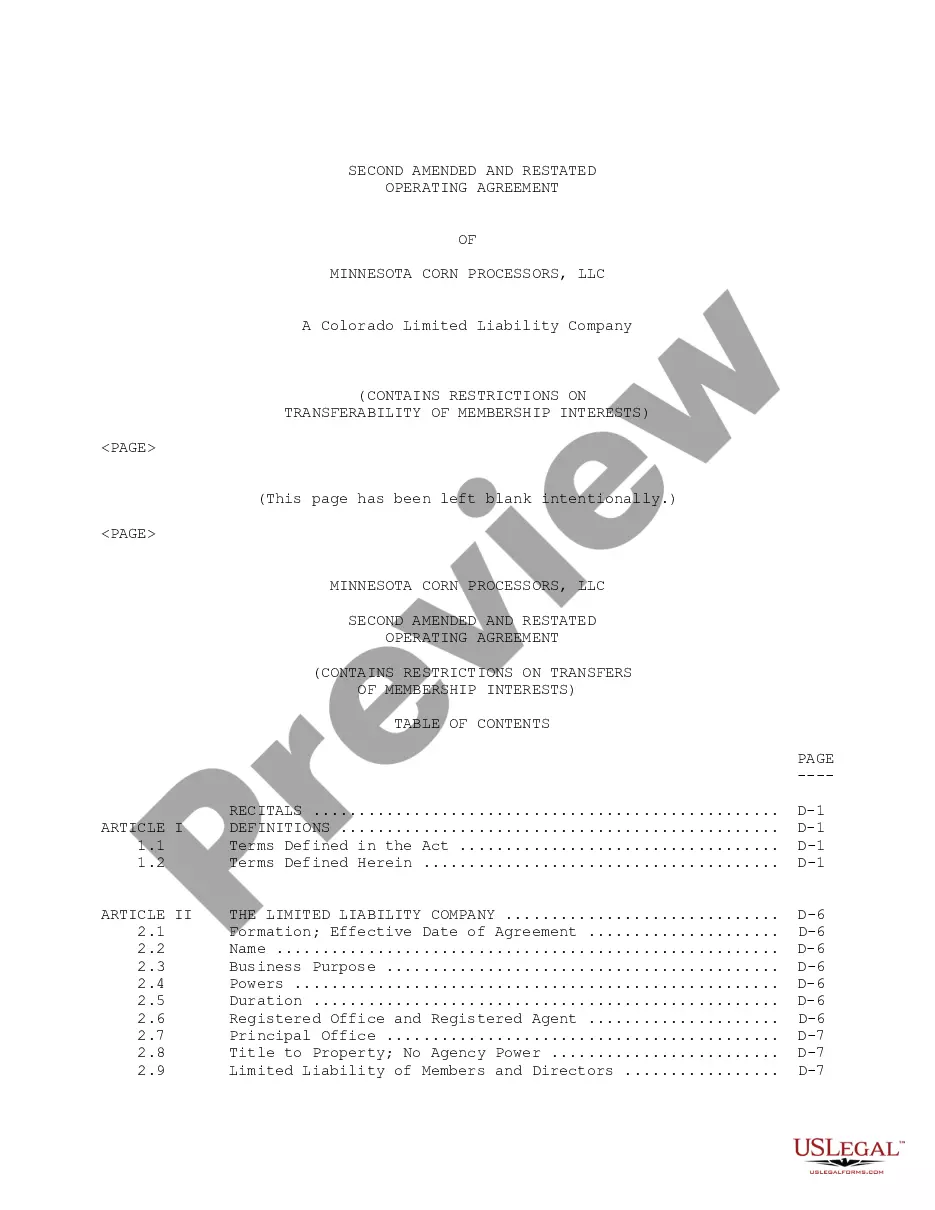

- Step 2. Use the Review solution to look over the form`s content. Never neglect to read the information.

- Step 3. Should you be not happy with the form, take advantage of the Lookup field at the top of the monitor to locate other versions from the legal form template.

- Step 4. After you have located the form you need, go through the Acquire now button. Pick the pricing prepare you choose and include your qualifications to register for the bank account.

- Step 5. Method the purchase. You can utilize your credit card or PayPal bank account to perform the purchase.

- Step 6. Choose the formatting from the legal form and obtain it in your device.

- Step 7. Complete, change and produce or indication the Rhode Island Long Term Incentive Program for Senior Management.

Each and every legal record template you acquire is yours eternally. You have acces to each form you acquired within your acccount. Click the My Forms section and choose a form to produce or obtain again.

Compete and obtain, and produce the Rhode Island Long Term Incentive Program for Senior Management with US Legal Forms. There are thousands of specialist and state-certain varieties you can use to your business or person requires.

Form popularity

FAQ

If you leave your job and terminate employment with a participating employer but are vested in the system (currently 5 years of contributing service), you may begin collecting your pension benefit when you meet your retirement eligibility criteria ? as long as you do not withdraw your contributions.

A modern grid will provide resilience, reliability, security, affordability, flexibility, and sustainability, ing to the U.S. Dept. of Energy. But still, utility profits are driven by capital investments. Rhode Island Energy is allowed to recoup a 9.275% return on investment, or ROE, on authorized capital costs.

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

State of Rhode Island 457(b) Deferred Compensation Plan A 457(b) plan allows eligible employees to defer compensation to the future, lowering current taxable income and offering potential tax-deferred growth.

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

Qualified Jobs Incentive Tax Credit Expand your workforce in Rhode Island or relocate jobs from out of state, and you can receive annual, redeemable tax credits for up to 10 years with the Qualified Jobs Incentive program. Credits can equal up to $7,500 per job per year, depending on the wage level and other criteria.

More details on the retirement plan limits are available from the IRS. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024. Employees age 50 or older may contribute up to an additional $7,500 for a total of $30,500.