Rhode Island Stock Option and Stock Award Plan of American Stores Company

Description

How to fill out Stock Option And Stock Award Plan Of American Stores Company?

Are you presently within a situation the place you will need documents for sometimes company or personal reasons almost every time? There are plenty of lawful record templates available on the net, but finding types you can depend on is not easy. US Legal Forms offers 1000s of kind templates, such as the Rhode Island Stock Option and Stock Award Plan of American Stores Company, which can be created in order to meet state and federal requirements.

If you are currently acquainted with US Legal Forms website and possess an account, simply log in. Following that, you can acquire the Rhode Island Stock Option and Stock Award Plan of American Stores Company design.

Should you not have an bank account and want to start using US Legal Forms, follow these steps:

- Discover the kind you want and ensure it is to the proper metropolis/state.

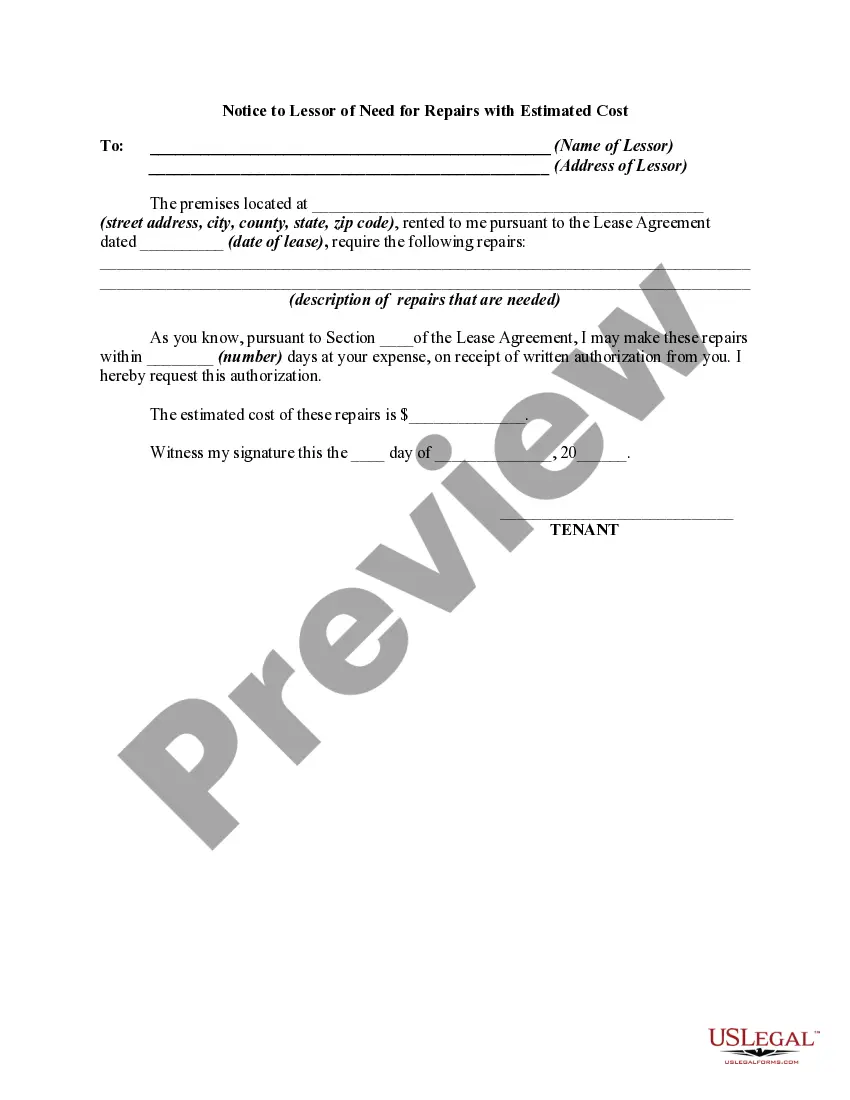

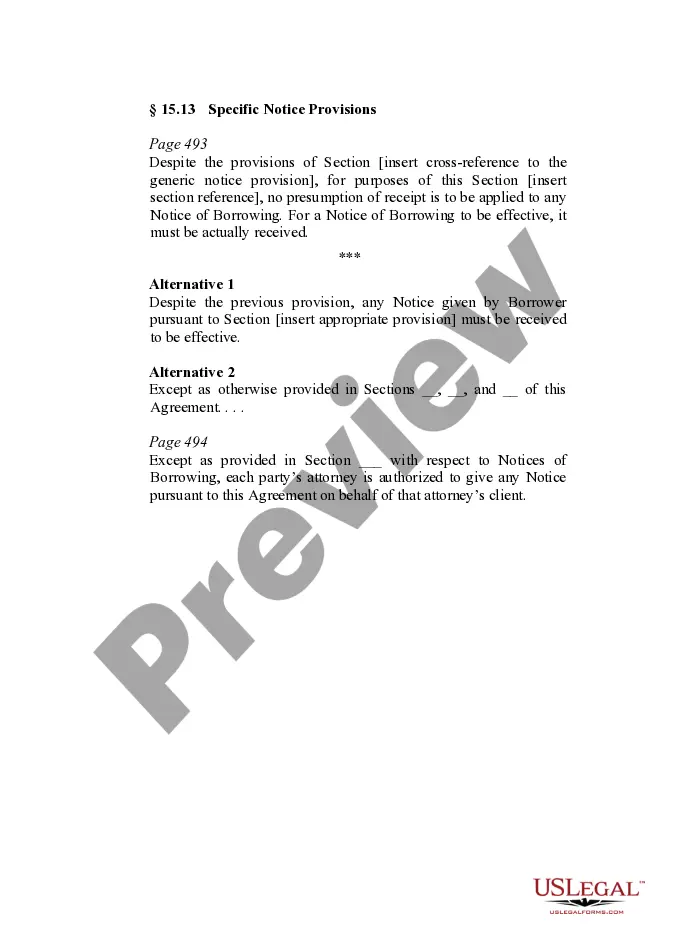

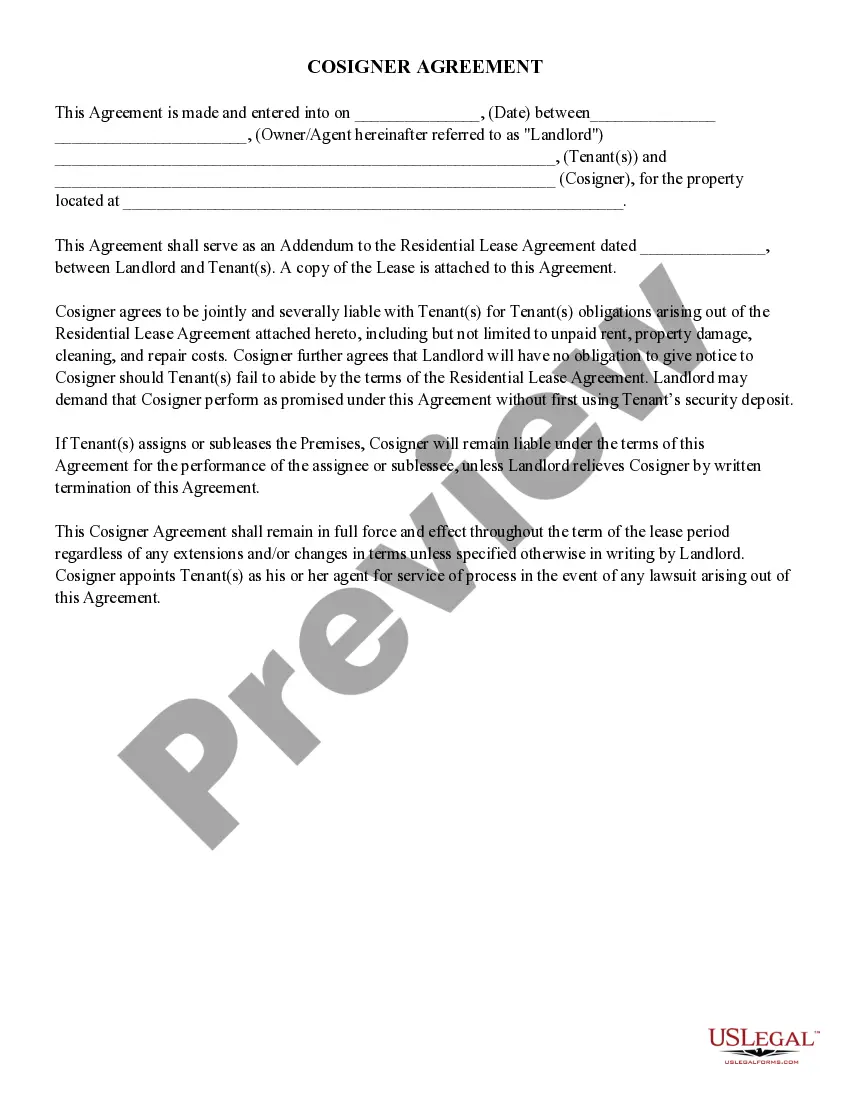

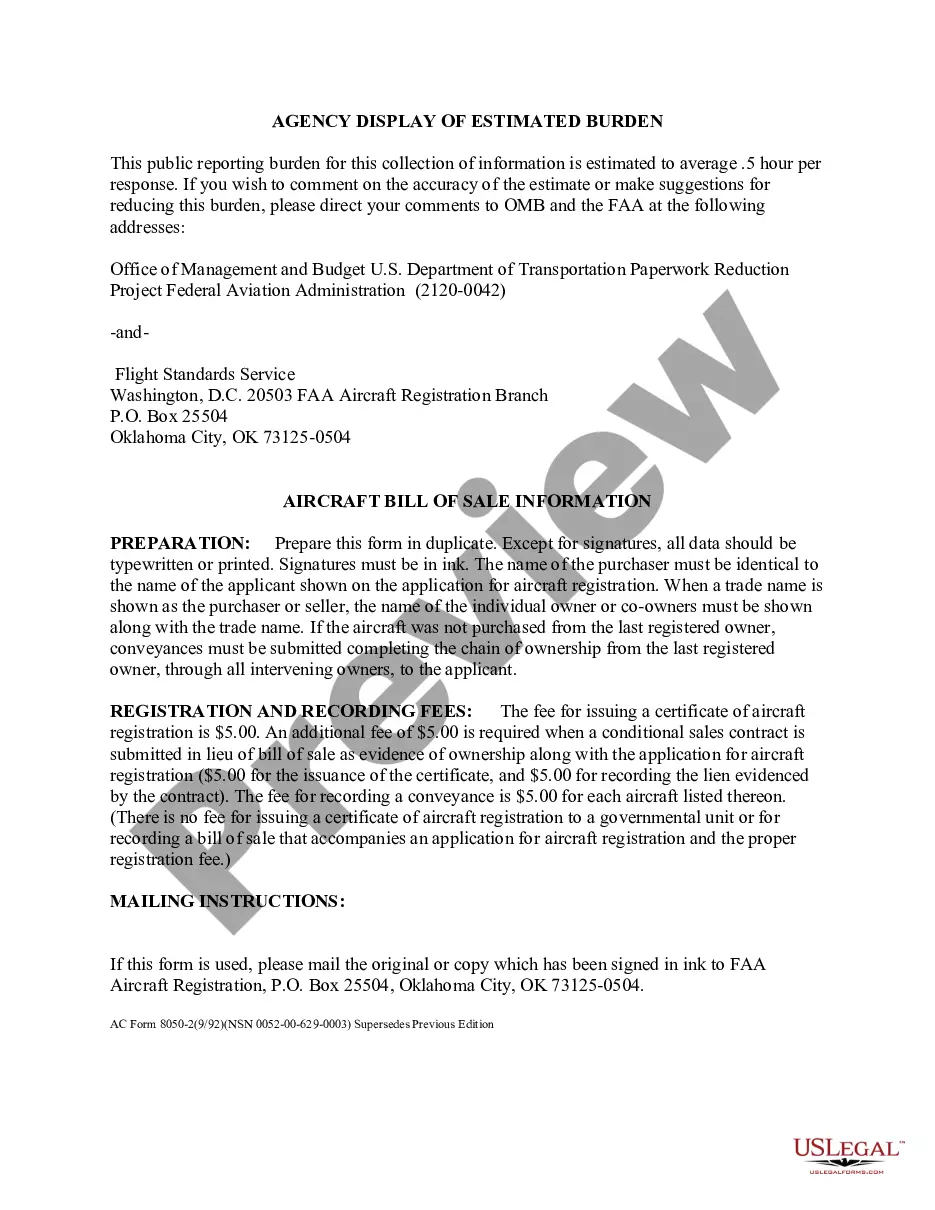

- Use the Review switch to examine the form.

- Browse the information to actually have selected the correct kind.

- In case the kind is not what you are looking for, utilize the Search industry to obtain the kind that meets your requirements and requirements.

- If you get the proper kind, simply click Acquire now.

- Opt for the rates strategy you would like, complete the desired information and facts to make your money, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper formatting and acquire your copy.

Get every one of the record templates you possess purchased in the My Forms menus. You can get a additional copy of Rhode Island Stock Option and Stock Award Plan of American Stores Company anytime, if possible. Just select the needed kind to acquire or print out the record design.

Use US Legal Forms, the most substantial variety of lawful types, to save lots of time as well as steer clear of mistakes. The service offers skillfully created lawful record templates which can be used for a range of reasons. Generate an account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

RSAs vs. RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

With incentive stock options (ISOs), the value of the exercise income appears on Form W-2 only if you made what is technically called a disqualifying disposition. That means you sold or gifted the stock before you met the required holding periods of one year from exercise and two years from grant.

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

ISOs aren't taxed when granted, upon vesting or when exercised. Taxes are deferred until shares are sold, and if you meet certain holding requirements, ISOs are subject only to capital gains taxes.

Until the vesting requirements of the RSU are met, the employee will not have any tax on them. Once the RSUs have vested they will be treated as earned income and the employee will be subject to tax. Sometimes an employer may withhold the taxes for the RSUs.

If your employer grants you a statutory stock option, you generally don't include any amount in your gross income when you receive or exercise the option. However, you may be subject to alternative minimum tax in the year you exercise an ISO.