Rhode Island Nonexclusive Foreign Sales Representative Agreement

Description

How to fill out Nonexclusive Foreign Sales Representative Agreement?

You might spend time online trying to locate the correct document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of valid forms that are examined by experts.

You can download or print the Rhode Island Nonexclusive Foreign Sales Representative Agreement from our service.

To locate another version of the form, use the Search box to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and click the Acquire button.

- Then, you can complete, edit, print, or sign the Rhode Island Nonexclusive Foreign Sales Representative Agreement.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, make sure you have selected the right document template for the region/city of your choice.

- Read the form description to ensure you have chosen the correct template.

Form popularity

FAQ

You might be better off starting as a W2 employee to build up some experience, savings, and contacts before going straight commission. However, if you have objectively looked at your survival resources and believe you can make it successfully through the first 90 days, to go 1099 / straight commission is a no-brainer.

The Value Of Independent ContractorsA 1099 sales representative is essentially an independent contractor. The name comes from the tax form they fill out, a 1099 misc. This form puts things like benefits and financial liability on their side.

In order to qualify, the company must not have a W-2 employee doing identical tasks to the contractor, must consider the person to be an independent contractor for the whole tax year, have a good reason for considering the person to be a contractor versus an employee, and treat him or her like a contractor for all the

A sales representative, quite simply, sells products or services for a company and represents their brand. They manage relationships with customers, serving as the key point of contact, from initial lead outreach to when a purchase is ultimately made.

A sales representative contract, sometimes known as a sales representative agreement, is a contract between a company and the contractor performing sales and marketing services on behalf of the company.

The enclosed document is a non-exclusive sales representative agreement. This means that the company is entitled to hire additional representatives to sell the same products perhaps even in the same geographical area.

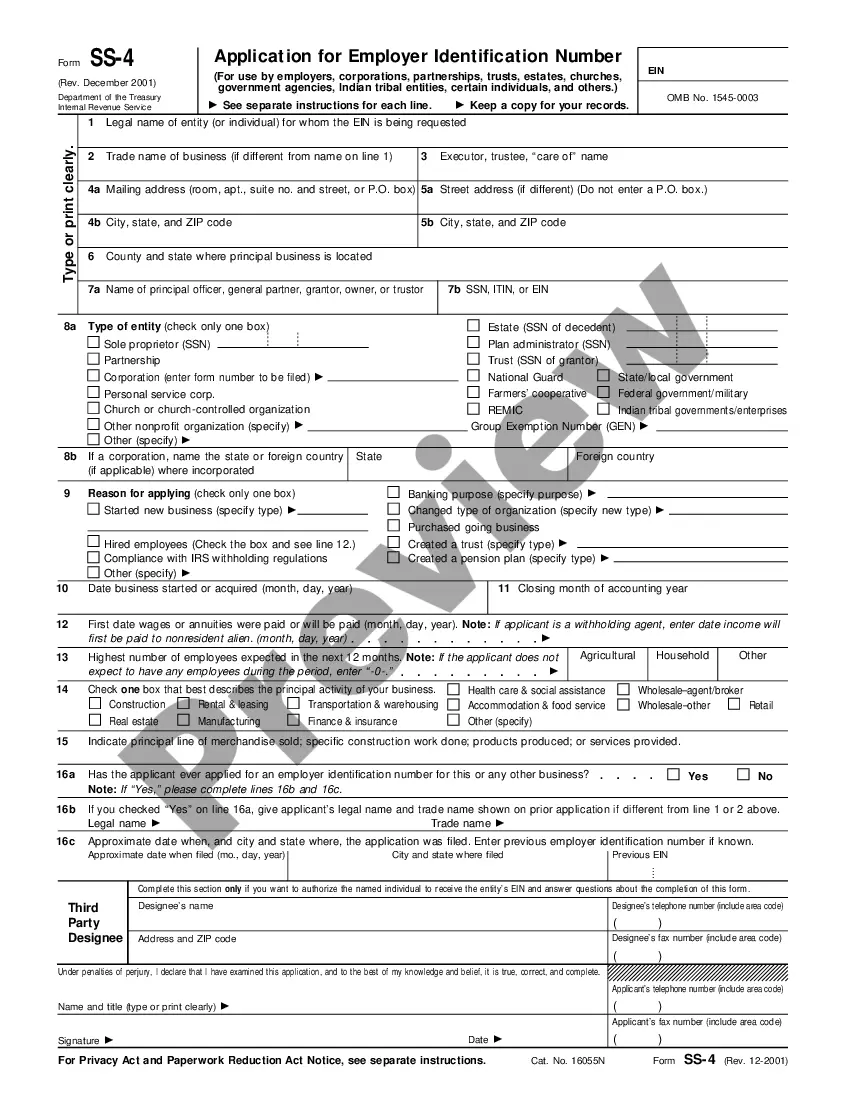

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.Complete Form 1099-NEC, Nonemployee Compensation.

Decide what products you want to rep. These should be products you like and know something about.Establish your legal business.Prepare your pitch.Contact manufacturers or retailers to offer your services as an independent sales rep.Negotiate your commissions and expense reimbursements.