Rhode Island Sample Letter for Attempt to Collect Debt before Acceleration

Description

How to fill out Sample Letter For Attempt To Collect Debt Before Acceleration?

Discovering the right authorized papers format can be quite a struggle. Obviously, there are tons of layouts available on the Internet, but how would you obtain the authorized form you want? Utilize the US Legal Forms web site. The assistance gives thousands of layouts, for example the Rhode Island Sample Letter for Attempt to Collect Debt before Acceleration, which can be used for organization and private requirements. All the varieties are examined by specialists and satisfy state and federal specifications.

When you are previously registered, log in in your profile and then click the Acquire switch to find the Rhode Island Sample Letter for Attempt to Collect Debt before Acceleration. Utilize your profile to appear through the authorized varieties you may have acquired previously. Check out the My Forms tab of the profile and get yet another copy of your papers you want.

When you are a fresh user of US Legal Forms, listed here are straightforward guidelines that you can adhere to:

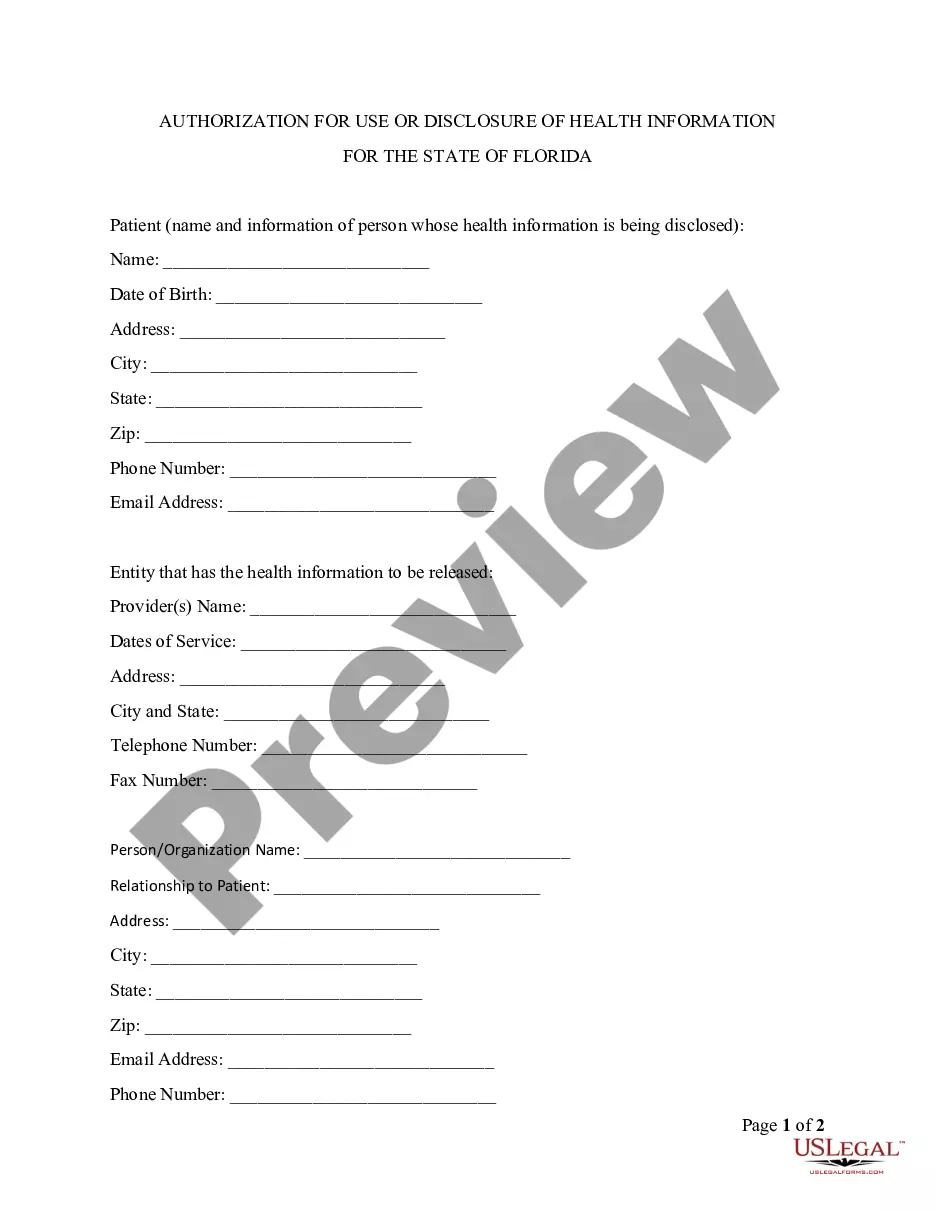

- First, make sure you have selected the proper form for your metropolis/area. You are able to look over the shape making use of the Review switch and read the shape description to guarantee this is basically the best for you.

- If the form is not going to satisfy your requirements, make use of the Seach industry to obtain the appropriate form.

- When you are certain that the shape is acceptable, select the Acquire now switch to find the form.

- Pick the costs prepare you want and enter in the needed information and facts. Design your profile and pay for the transaction utilizing your PayPal profile or credit card.

- Select the document formatting and download the authorized papers format in your gadget.

- Total, modify and produce and indicator the received Rhode Island Sample Letter for Attempt to Collect Debt before Acceleration.

US Legal Forms is definitely the most significant collection of authorized varieties where you can find various papers layouts. Utilize the service to download skillfully-created files that adhere to condition specifications.

Form popularity

FAQ

I am/We are writing to you because I am/we are in financial difficulties. My/our financial statement is enclosed. Briefly explain the reasons for your financial difficulties and why you do not expect them to improve sufficiently for you to make payments to credit (non-priority) debts in the future.

I am/We are writing to you because I am/we are in financial difficulties. My/our financial statement is enclosed. Briefly explain the reasons for your financial difficulties and why you do not expect them to improve sufficiently for you to make payments to credit (non-priority) debts in the future.

Here are some of the details a demand letter needs to include: Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment.

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Dear Sir/Madam: I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it.

Sole proprietorships write off bad debts on line 27a of Schedule C, Profit or Loss From Business. Partnerships use line 12 of Form 1065, U.S. Return of Partnership Income. Bad debt deductions for S corporations go on line 10 of Form 1120-S, U.S. Income Tax Return for an S Corporation.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);