Rhode Island Checklist - Leasing vs. Purchasing Equipment

Description

Every lease decision is unique so it's important to study the lease agreement carefully. When deciding to obtain equipment, you need to determine whether it is better to lease or purchase the equipment. You might use this checklist to compare the costs for each option.

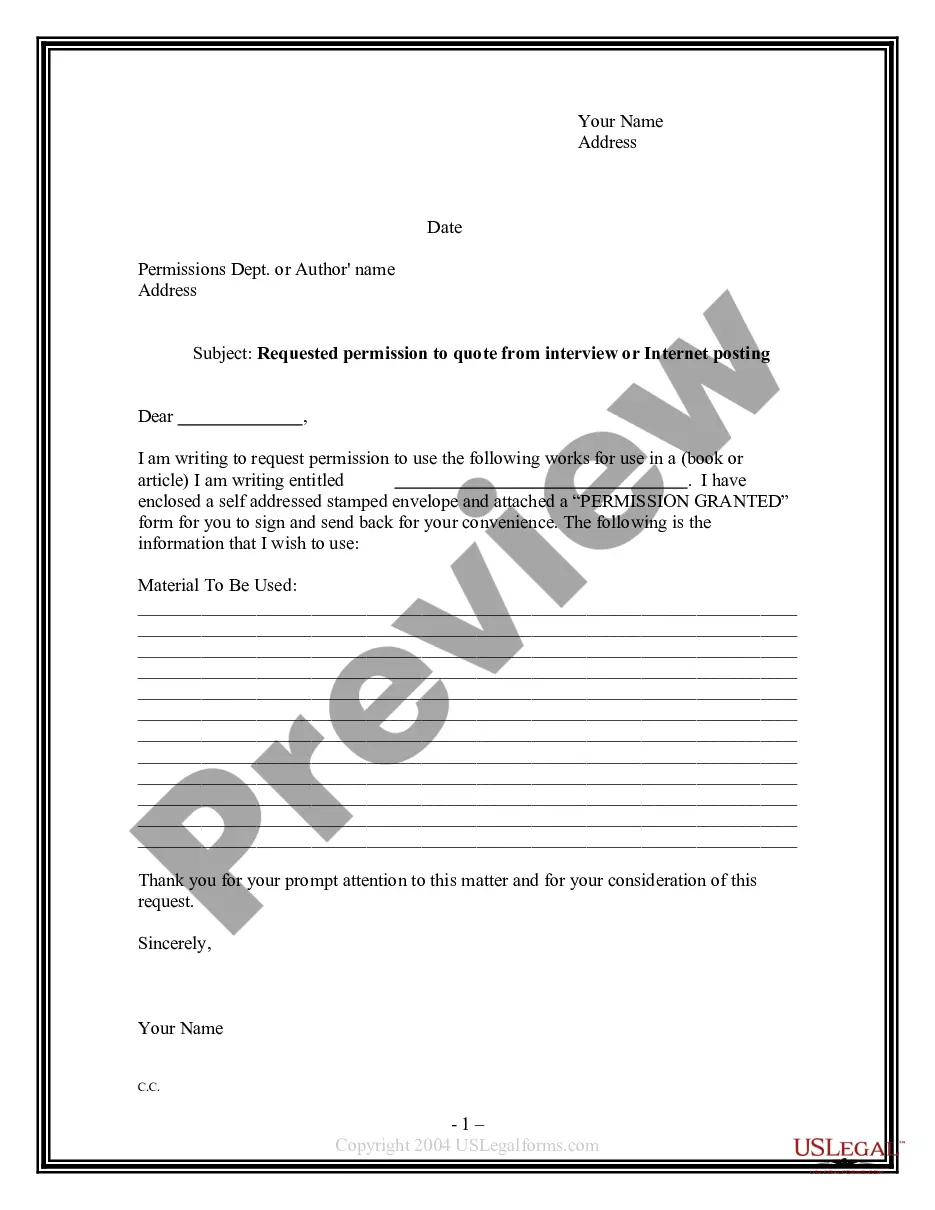

How to fill out Checklist - Leasing Vs. Purchasing Equipment?

US Legal Forms - one of the largest repositories of legitimate templates in the USA - offers a variety of legal document formats that you can download or generate.

Through the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of documents such as the Rhode Island Checklist - Leasing vs. Purchasing Equipment in moments.

If the document does not meet your needs, utilize the Search bar at the top of the screen to find the one that does.

Once you are satisfied with the document, confirm your selection by clicking the Get now button. Then, choose your desired payment plan and provide your details to register for an account.

- If you have an account, Log In to download the Rhode Island Checklist - Leasing vs. Purchasing Equipment from the US Legal Forms collection.

- The Download button will be visible on each document you view.

- You can access all previously downloaded documents from the My documents tab in your account.

- If this is your first time using US Legal Forms, here are some basic tips to get you started.

- Ensure you have selected the correct document for your city/region.

- Click the Review button to check the content of the document.

Form popularity

FAQ

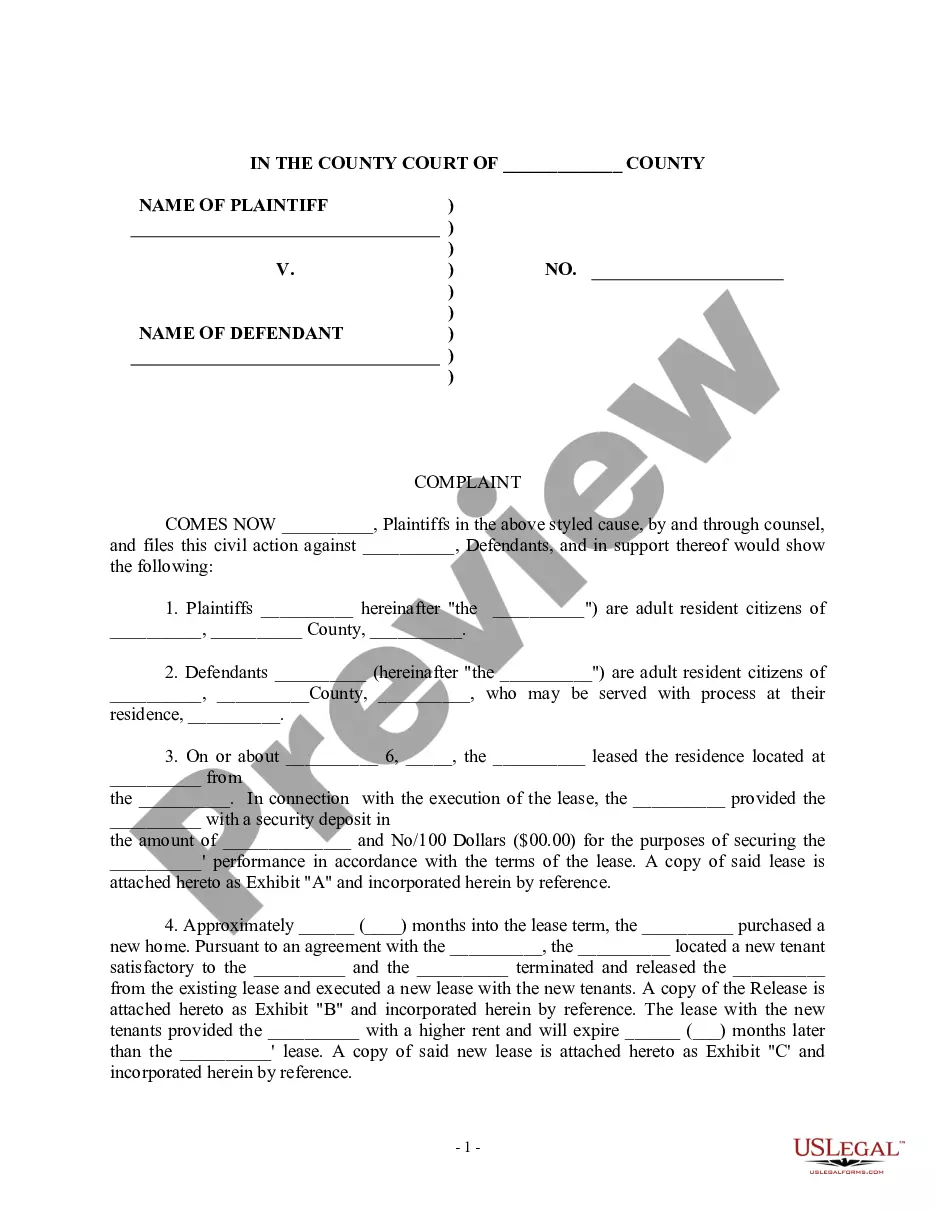

Leasing equipment often provides lower upfront costs, tax advantages, and flexibility to upgrade. Businesses can adapt quickly to changing needs without being tied down to ownership. Exploring the Rhode Island Checklist - Leasing vs. Purchasing Equipment can help you understand these benefits more clearly and make informed decisions.

Leasing equipment can lead to higher long-term costs due to ongoing rental payments. Moreover, at the end of a lease term, you do not own the equipment, which may affect your operational capabilities. It's important to evaluate these disadvantages against the advantages by consulting the Rhode Island Checklist - Leasing vs. Purchasing Equipment.

Companies prefer leasing because it can offer tax benefits, lower monthly payments, and opportunities to upgrade equipment regularly. Leasing helps avoid the depreciation that comes with ownership, ensuring that businesses can always access high-performance tools. This strategy aligns with the Rhode Island Checklist - Leasing vs. Purchasing Equipment to help manage financial planning effectively.

Qualifying for a tax exemption involves meeting specific criteria set by the state, such as purchasing specific types of goods or being a certain type of organization. Thus, as you create your Rhode Island Checklist - Leasing vs. Purchasing Equipment, familiarize yourself with what qualifies under exemptions to maximize your benefits. This knowledge can greatly enhance your financial planning.

Certain items exempt from sales tax in Rhode Island include food, prescription medications, and some medical devices. Understanding these exemptions is crucial when assembling your Rhode Island Checklist - Leasing vs. Purchasing Equipment. Make sure to consult relevant resources for the most current exemption criteria.

In Rhode Island, individuals do not stop paying property tax based solely on age. However, some exemptions may apply to seniors who meet specific income criteria. It’s advisable to review these details during your planning process to include in your Rhode Island Checklist - Leasing vs. Purchasing Equipment.

Exemptions from Rhode Island sales tax include certain raw materials, items for resale, and specific non-profit purchases. To get the most out of your Rhode Island Checklist - Leasing vs. Purchasing Equipment, it's crucial to identify these exemptions. This understanding allows you to navigate the tax landscape effectively.

A variety of services are taxable in Rhode Island, including but not limited to telecommunications, landscaping, and personal services. When creating your Rhode Island Checklist - Leasing vs. Purchasing Equipment, be aware of these taxable services to manage your overall costs effectively. Knowing what falls under this category helps in budgeting accurately.

In Rhode Island, installation labor is typically considered taxable unless it is incidental to the sale of tangible personal property. Therefore, if you are engaged in leasing equipment, be sure to clarify whether installation fees apply to your Rhode Island Checklist - Leasing vs. Purchasing Equipment. This can influence your total budget.

Yes, equipment rental is generally taxable in Rhode Island. This means that when you lease equipment, you may face additional costs due to sales tax. It’s essential to factor this into your Rhode Island Checklist - Leasing vs. Purchasing Equipment to avoid unexpected expenses.