Rhode Island Agreement to Compromise Debt by Returning Secured Property

Description

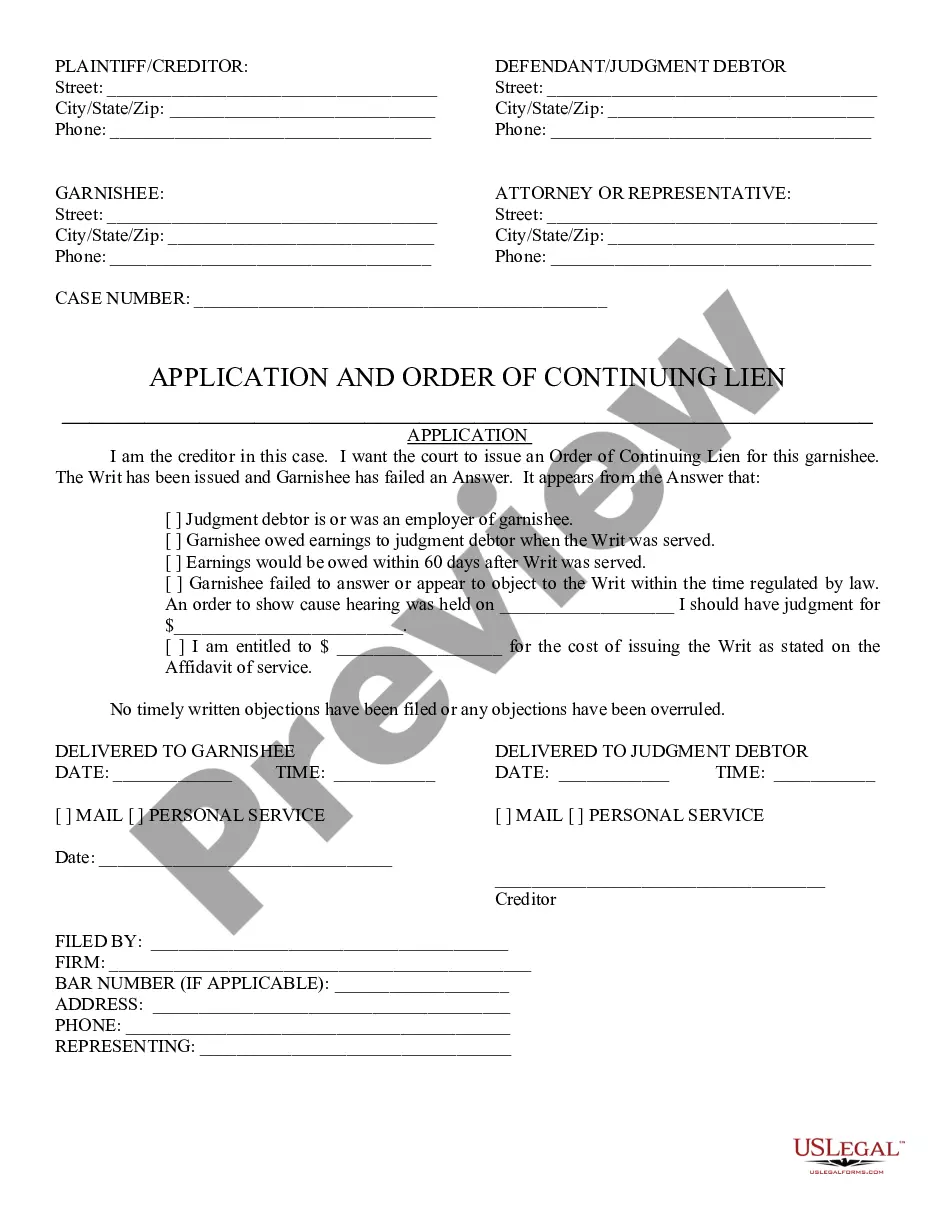

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Finding the appropriate legal document format can be challenging.

Clearly, there is an abundance of templates available online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website. This service provides numerous templates, including the Rhode Island Agreement to Compromise Debt by Returning Secured Property, which can be used for both business and personal purposes.

If you are a new user of US Legal Forms, follow these simple steps: First, ensure you have selected the correct form for your location/county. You can review the form using the Preview option and check the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search feature to find the appropriate form. Once you are sure the form is correct, click on the Purchase now button to obtain the form. Choose your preferred payment method and enter the necessary details. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document to your device. Complete, edit, print, and sign the received Rhode Island Agreement to Compromise Debt by Returning Secured Property. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use this service to obtain professionally crafted documents that adhere to state regulations.

- All forms are reviewed by experts.

- They comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Rhode Island Agreement to Compromise Debt by Returning Secured Property.

- Use your account to browse through the legal forms you have previously acquired.

- Go to the My documents section of your account to obtain another copy of the required document.

Form popularity

FAQ

During a reaffirmation hearing, the court reviews the terms of a reaffirmation agreement that involves the Rhode Island Agreement to Compromise Debt by Returning Secured Property. This hearing allows you to confirm your understanding of the agreement and its implications. The judge ensures you understand your rights and the impact of reaffirming the debt. Ultimately, the reaffirmation hearing is an essential step in securing your financial future while managing your debts responsibly.

A debtor might choose to reaffirm a debt to retain secured property such as a home or car. Reaffirmation can help maintain the ownership and potentially improve credit scores by demonstrating a commitment to repay. Additionally, understanding the Rhode Island Agreement to Compromise Debt by Returning Secured Property may provide alternatives for managing secured debts in a beneficial manner.

You typically have until your bankruptcy discharge is entered to file a reaffirmation agreement. It is important to act promptly to ensure your intentions are recognized legally. If your goal is to keep secured property, the Rhode Island Agreement to Compromise Debt by Returning Secured Property could be a useful option to explore.

No, a reaffirmation agreement cannot be filed after discharge. It is essential to finalize the reaffirmation before the court grants the discharge. If you need assistance with your situation, consider examining the Rhode Island Agreement to Compromise Debt by Returning Secured Property, which might offer a different path.

Generally, you cannot create a reaffirmation agreement after your bankruptcy discharge. The agreement must be made before the discharge is finalized. However, discussing your situation with a legal expert can help determine if any alternatives, like the Rhode Island Agreement to Compromise Debt by Returning Secured Property, might be appropriate for your case.

Yes, you can reaffirm your mortgage after discharge. This means you agree to keep the mortgage and continue making payments, even though the debt would typically be discharged through bankruptcy. By doing this, you retain your home and maintain its equity. Exploring the Rhode Island Agreement to Compromise Debt by Returning Secured Property can help clarify this process.

Writing a debt agreement involves stating the debtor and creditor’s names, detailing the amount owed, and specifying payment methods. You’ll want to include any concessions made, such as debt reduction or property return terms. Mentioning the Rhode Island Agreement to Compromise Debt by Returning Secured Property can clarify the conditions of your agreement. Templates from USLegalForms can make this task easier and more structured.

In Rhode Island, the statute of limitations for most debts is generally 10 years. This means creditors have a decade to collect on debts before they may be considered uncollectible. However, older debts might still exist legally, so exploring options like the Rhode Island Agreement to Compromise Debt by Returning Secured Property may be beneficial. Platforms like USLegalForms can help you understand your rights and obligations.

The 777 rule refers to a guideline suggesting that once a debt is 180 days past due, it should be reported to credit agencies. After that, if a debt remains unpaid for more than 7 months, it generally becomes less collectible. Understanding this can help you make informed decisions about debts, possibly leading you toward the Rhode Island Agreement to Compromise Debt by Returning Secured Property for resolution. Consulting resources on platforms like USLegalForms can clarify your rights and options.

To write a settlement agreement, start by identifying both parties and outlining the terms of the agreement. Specify the debts involved, the total owed, and the proposed amount as part of the settlement. If applicable, reference the Rhode Island Agreement to Compromise Debt by Returning Secured Property, to clarify your terms. Tools like USLegalForms can provide templates that guide you through this writing process.