A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Rhode Island Notice of Default and Election to Sell - Intent To Foreclose

Description

How to fill out Notice Of Default And Election To Sell - Intent To Foreclose?

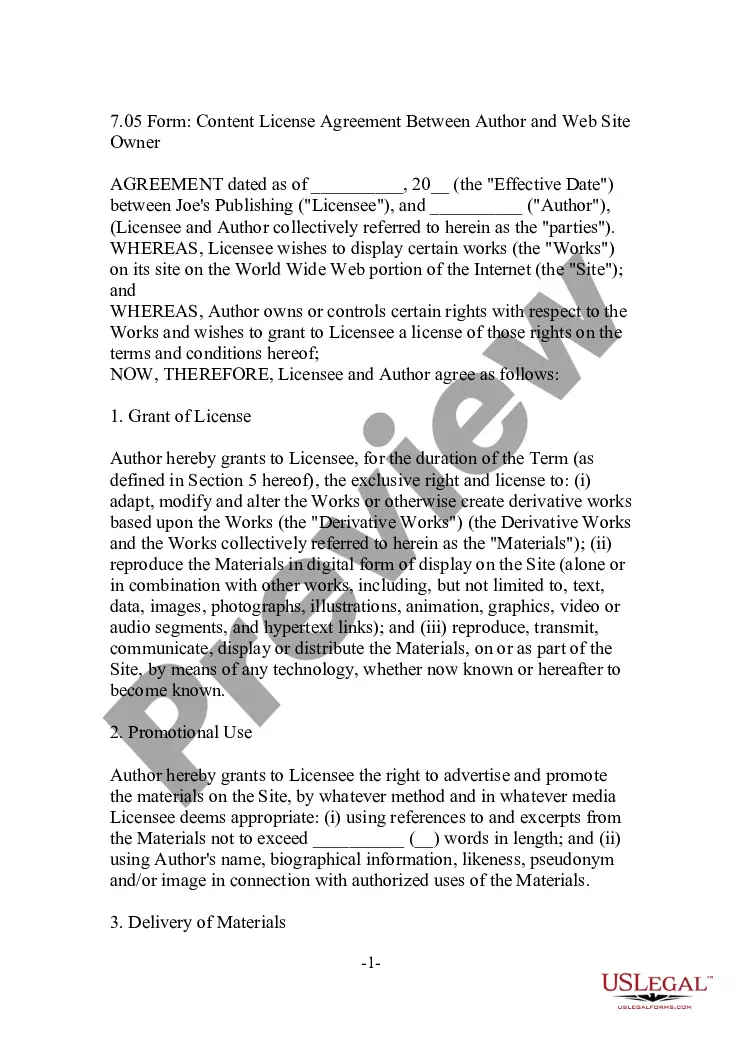

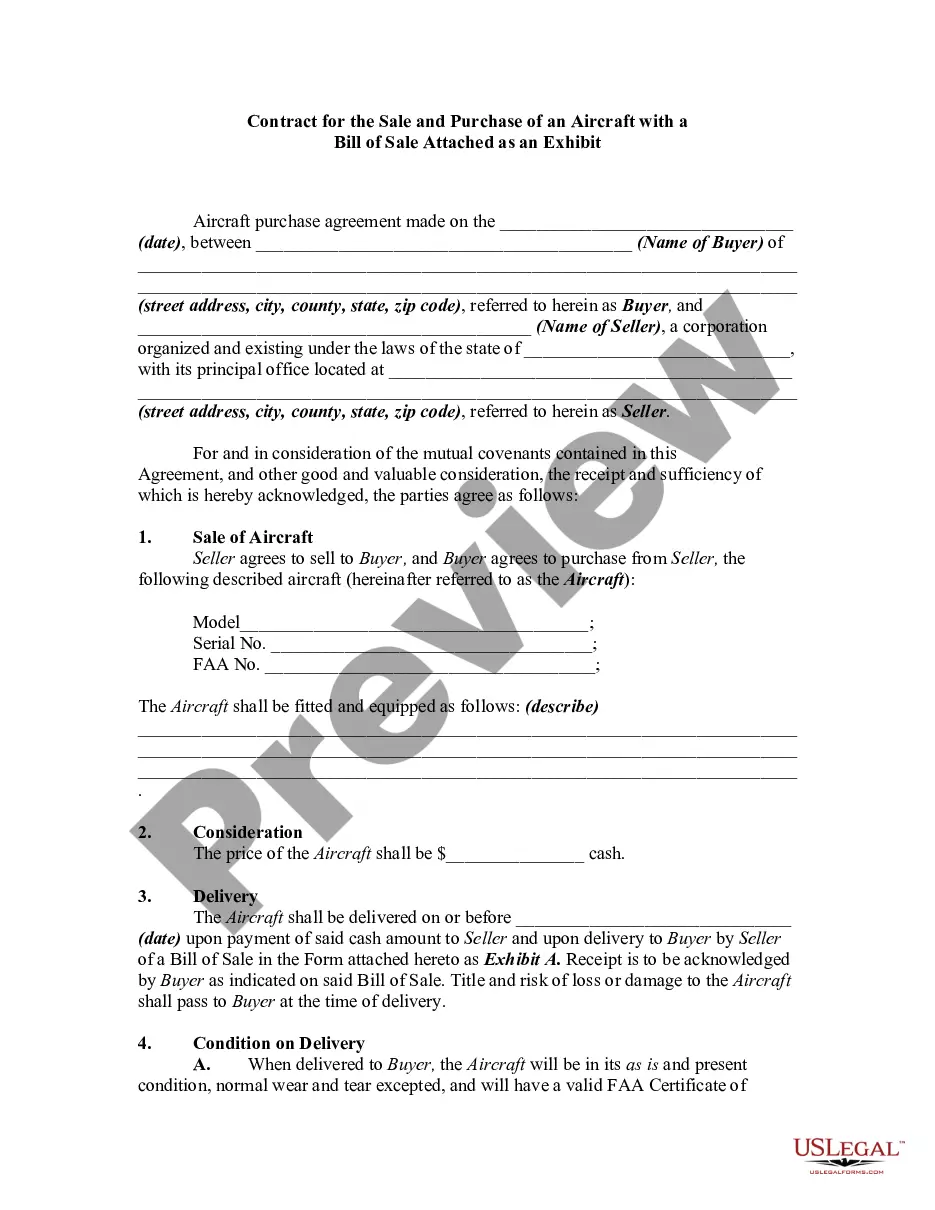

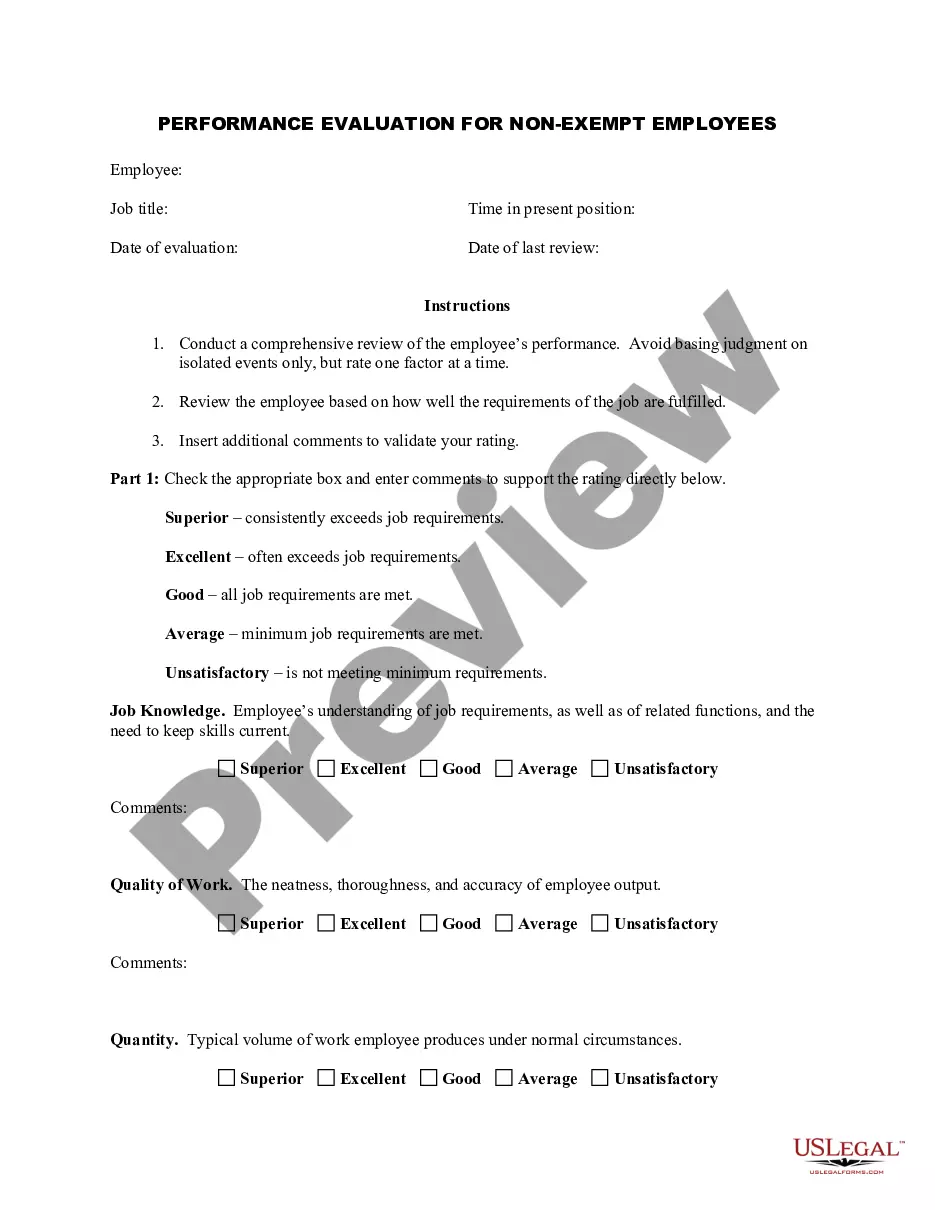

If you wish to obtain, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search to locate the documents you require. Numerous templates for business and personal use are organized by categories and states, or keywords.

Employ US Legal Forms to find the Rhode Island Notice of Default and Election to Sell - Intent To Foreclose with just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you acquired in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Rhode Island Notice of Default and Election to Sell - Intent To Foreclose with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to obtain the Rhode Island Notice of Default and Election to Sell - Intent To Foreclose.

- Additionally, you can access forms you have previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

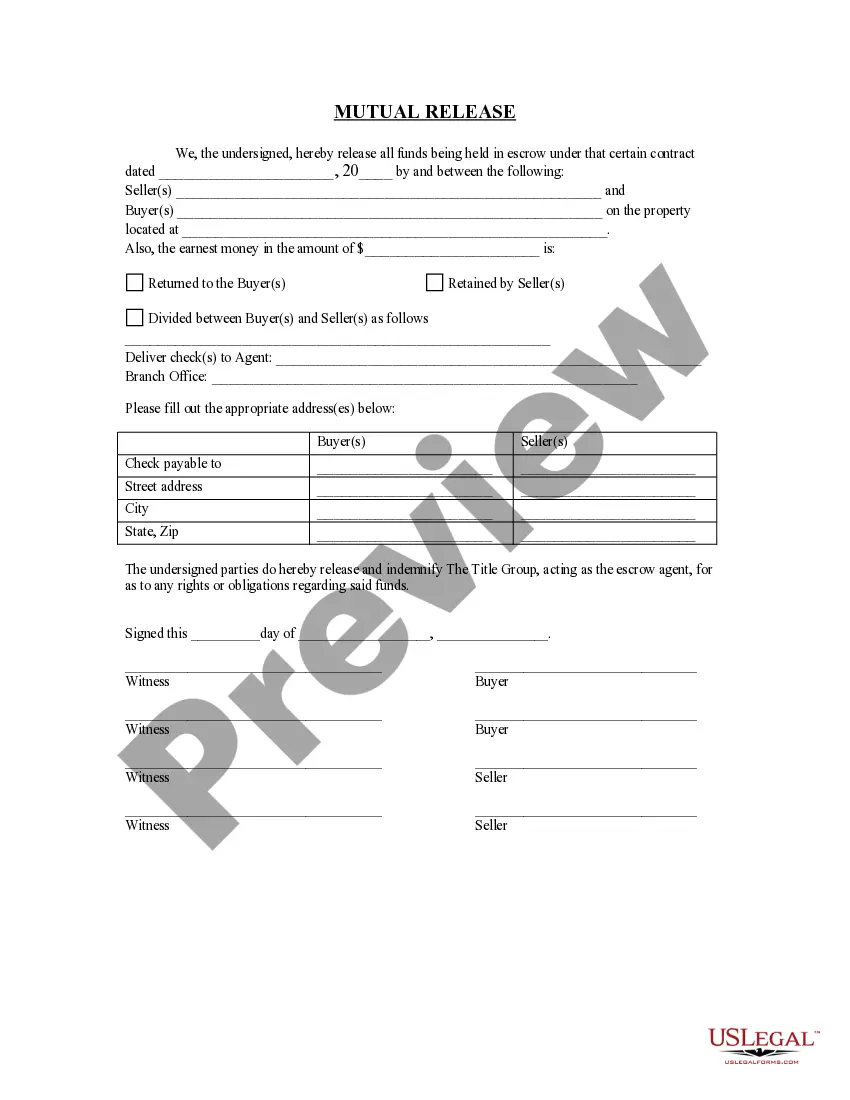

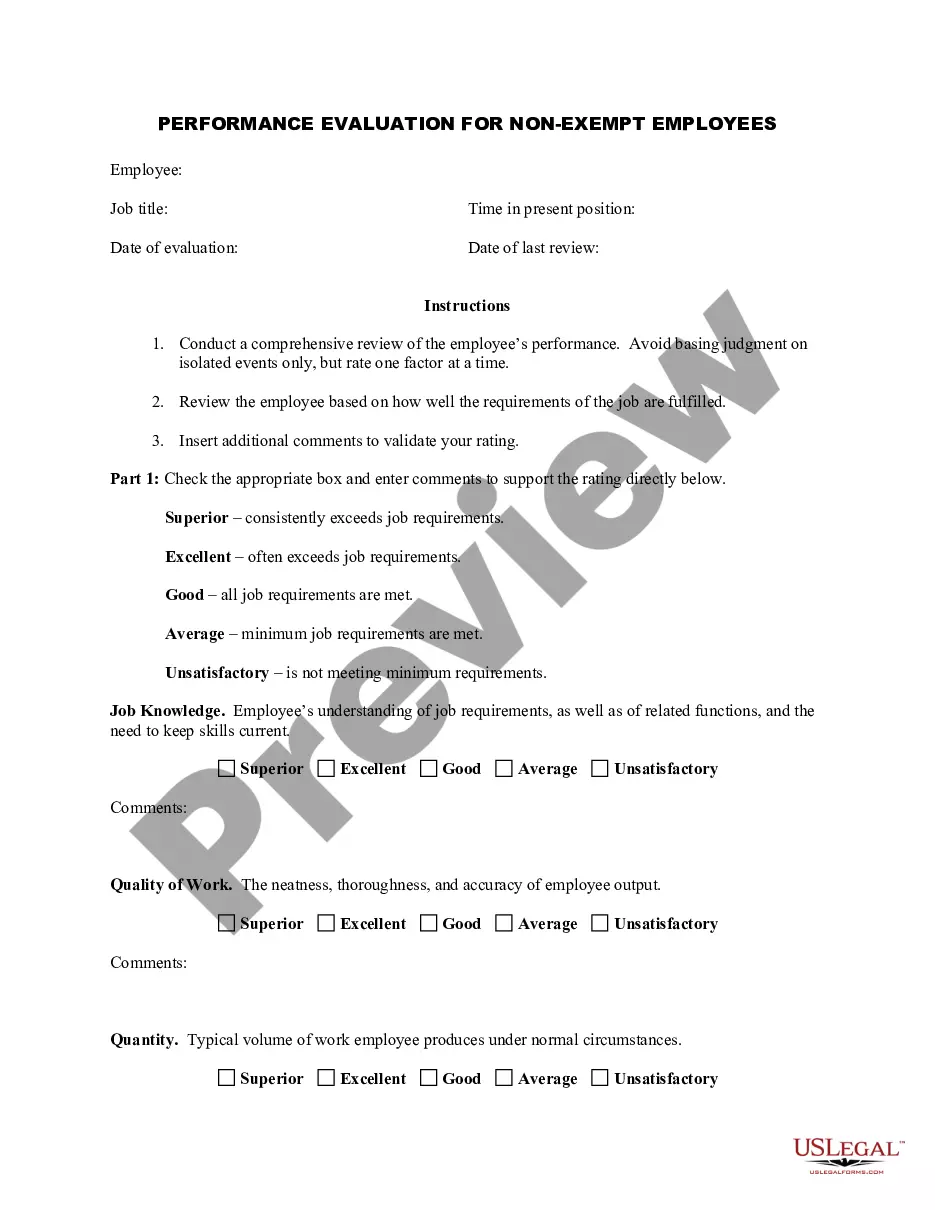

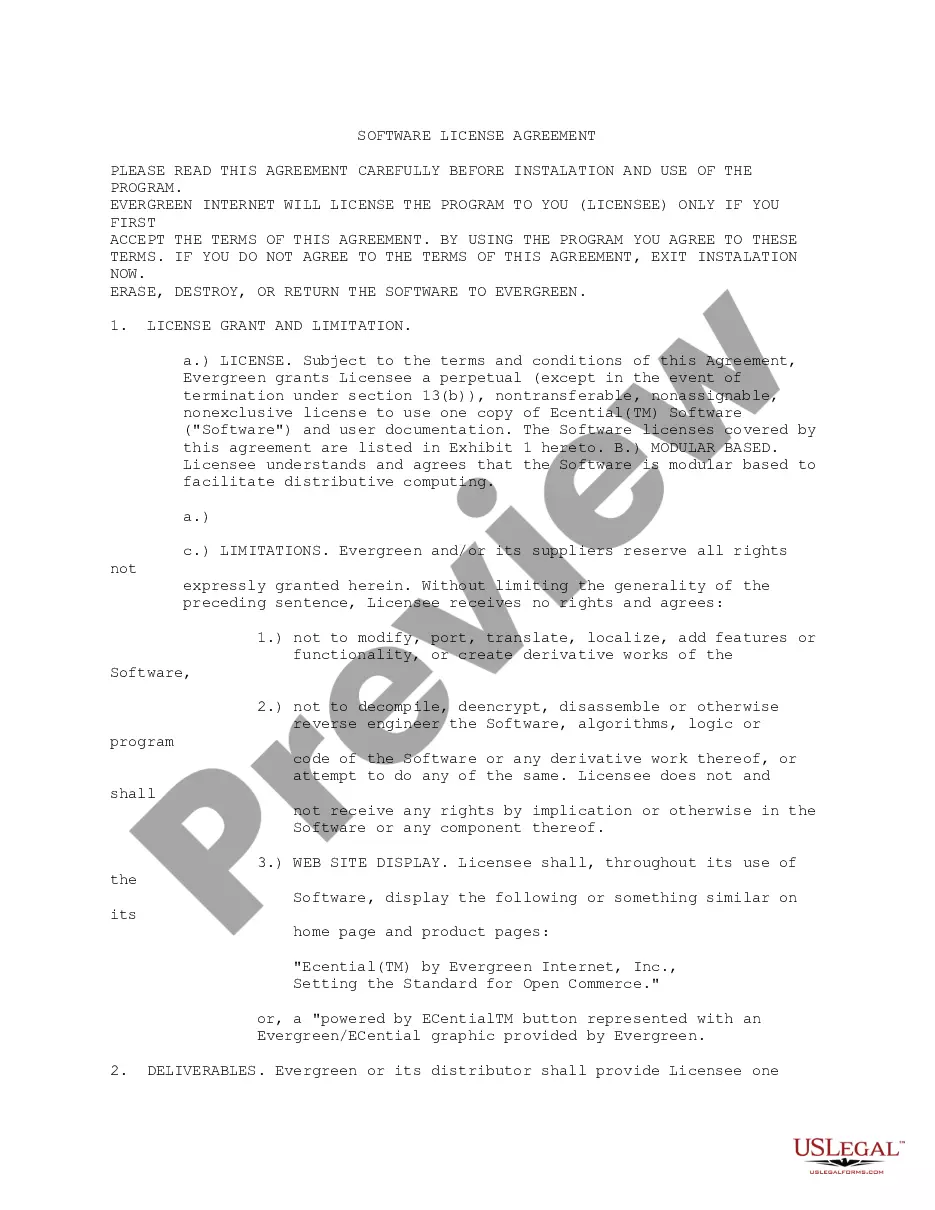

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your MasterCard or Visa, or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Rhode Island Notice of Default and Election to Sell - Intent To Foreclose.

Form popularity

FAQ

The California foreclosure process can last up to 200 days or longer. Day 1 is when a payment is missed; your loan is officially in default around day 90. After 180 days, you'll receive a notice of trustee sale. About 20 days later, your bank can then set the auction.

Once a default notice has been issued, the debt can be passed or sold to a debt collector. You may then start receiving letters and phone calls from the debt collector to chase up on the debt, and payments would need to be made to the debt collector rather than the original creditor.

Once you default on your mortgage loan, the lender can demand that you repay the entire outstanding balance, called "accelerating the debt." If you don't repay the full loan amount or cure the default, the lender can foreclose.

When a borrower repays the entire outstanding loan amount in one payment rather than in EMIs, they need to write a letter for the foreclosure of the loan, which is known as the foreclosure letter.

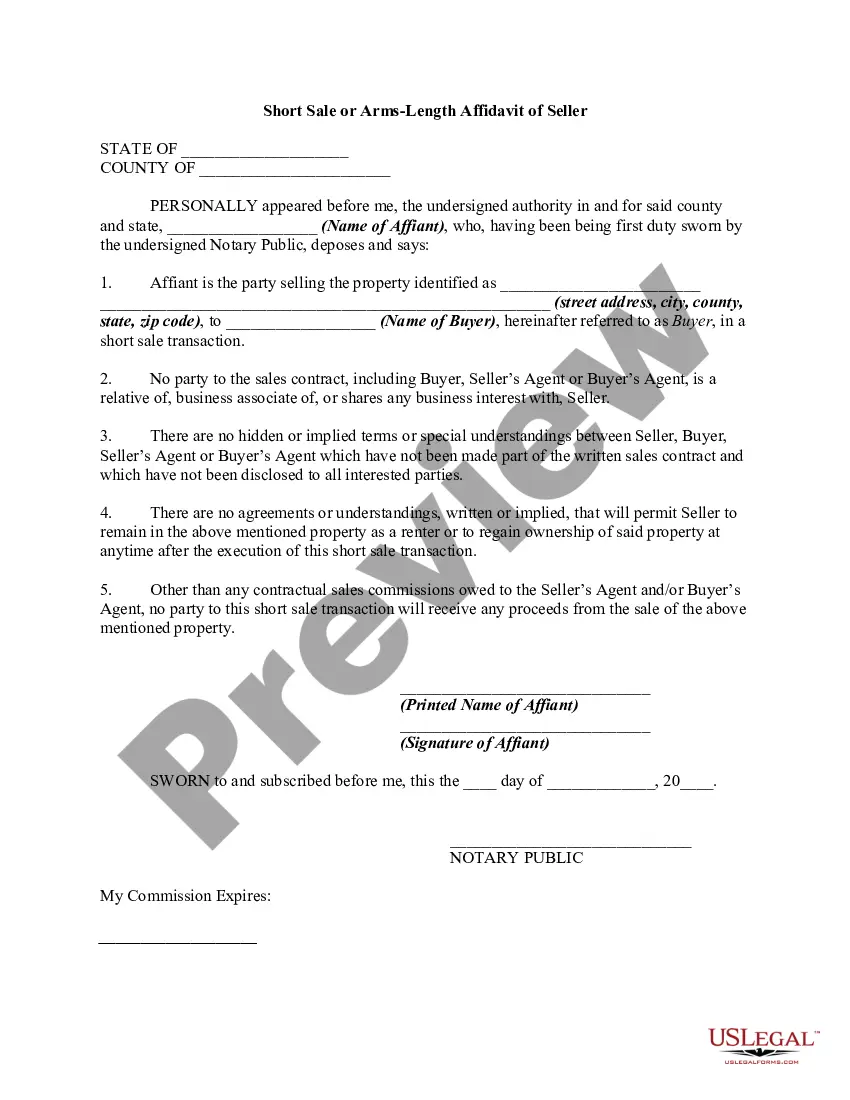

A Notice of Default is your mortgage lender's way of telling you that you have one last chance to address overdue mortgage payments before your lender will foreclose on your home.

While some lenders use notices of default as the final step before foreclosure, others use it as a way to work with borrowers to bring the mortgage up to date. A notice of default and subsequent foreclosure actions are documented and reported to credit bureaus.

You don't automatically lose your home if you default A lender will likely not start to foreclose until after two or three months of missed mortgage payments. If you miss a mortgage payment, the lender will usually send a reminder letter.

In Rhode Island, lenders may foreclose on deeds of trusts or mortgages in default: 1) by using the judicial foreclosure process; 2) by filing a lawsuit seeking eviction; 3) by taking possession of the house; 4) by the borrower voluntarily giving up possession; or 5) by using the non-judicial foreclosure process.

A letter of intent to foreclose (LIF) is a written notice listing all past due amounts owed on a mortgage and a deadline to pay those amounts. After the deadline has passed, the lender may start the foreclosure process.

Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a couple of exceptions. (12 C.F.R. § 1024.41). This 120-day period provides most homeowners with ample opportunity to submit a loss mitigation application to the servicer.