Rhode Island Registration Statement

Description

How to fill out Registration Statement?

Are you currently in a scenario where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but locating ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Rhode Island Registration Statement, that are designed to comply with state and federal regulations.

Once you have the correct form, just click Get now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Rhode Island Registration Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

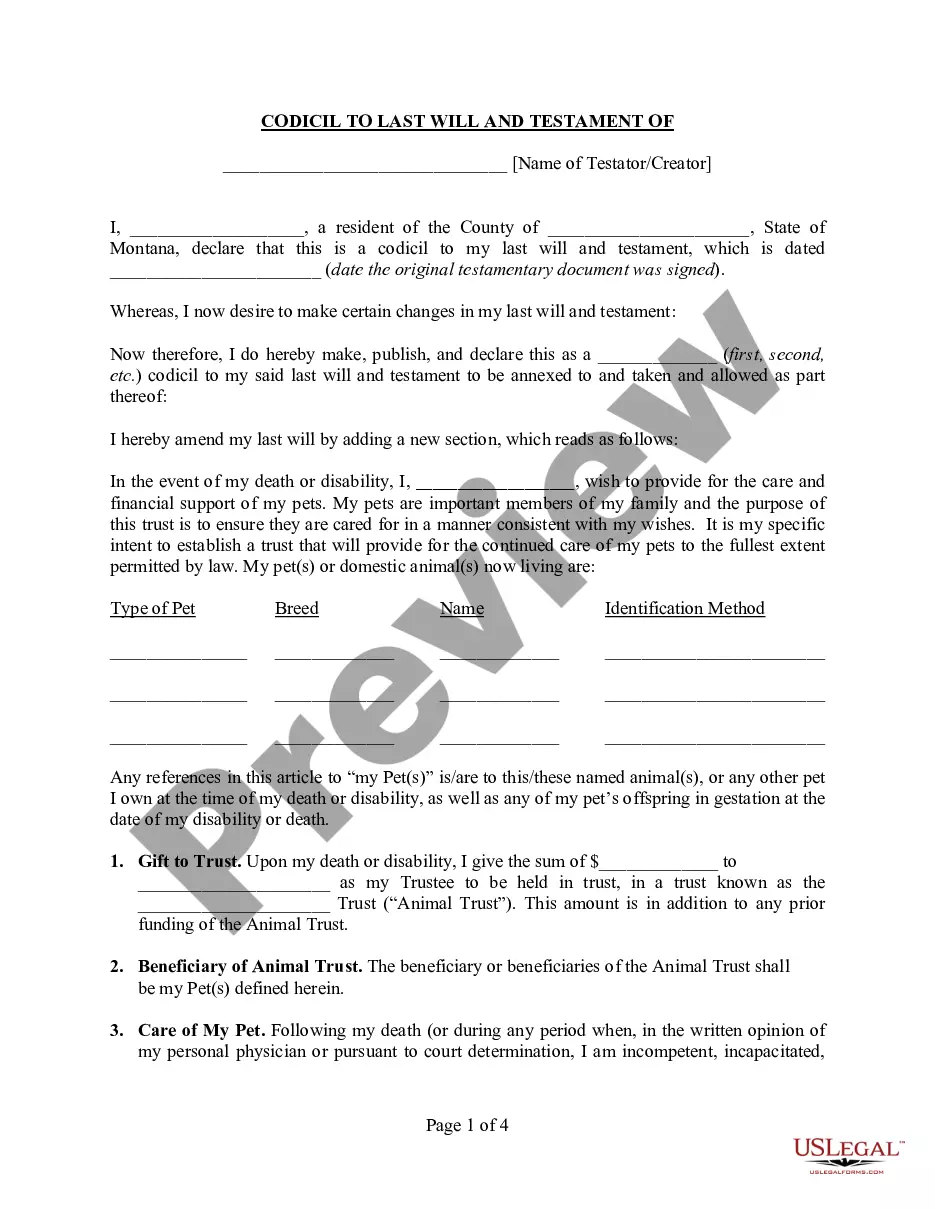

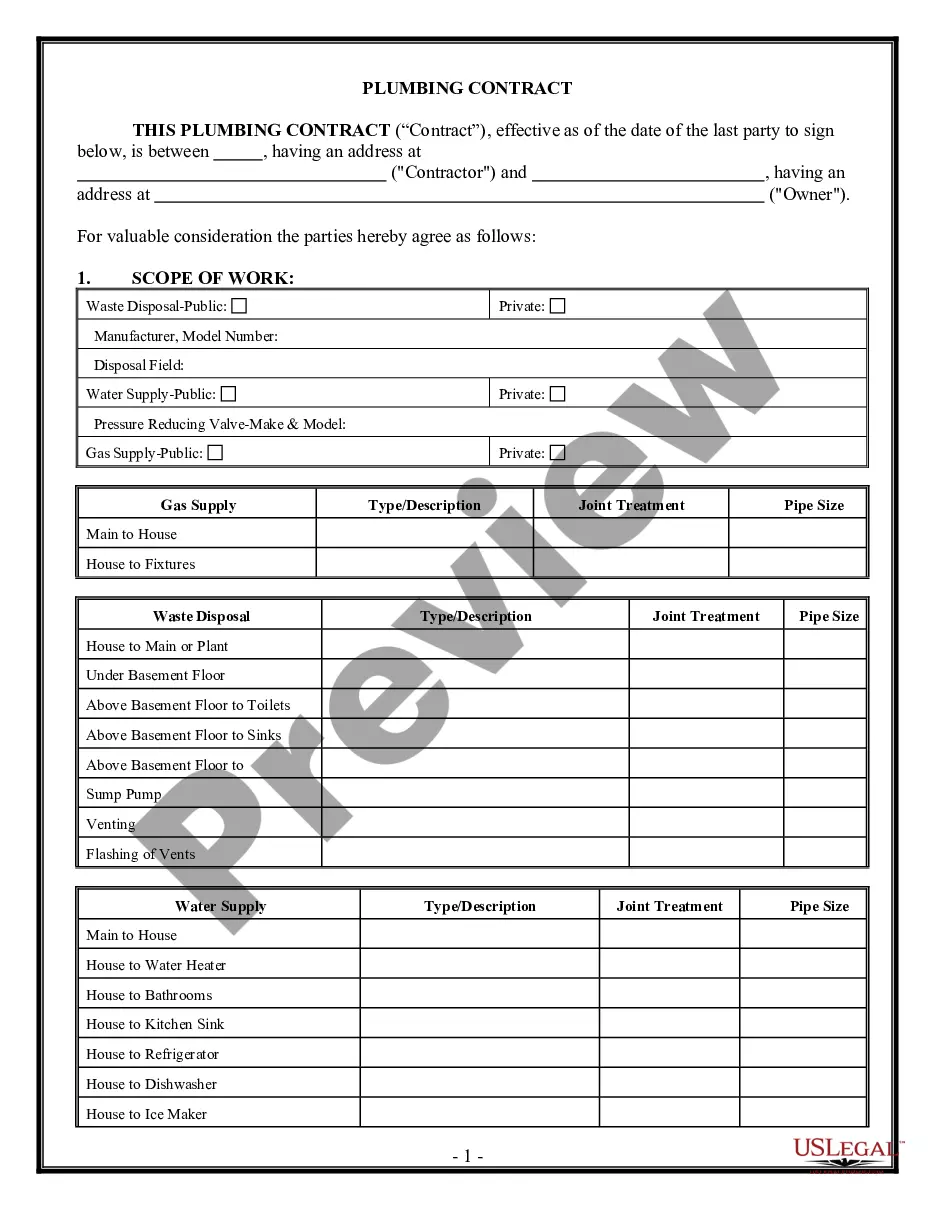

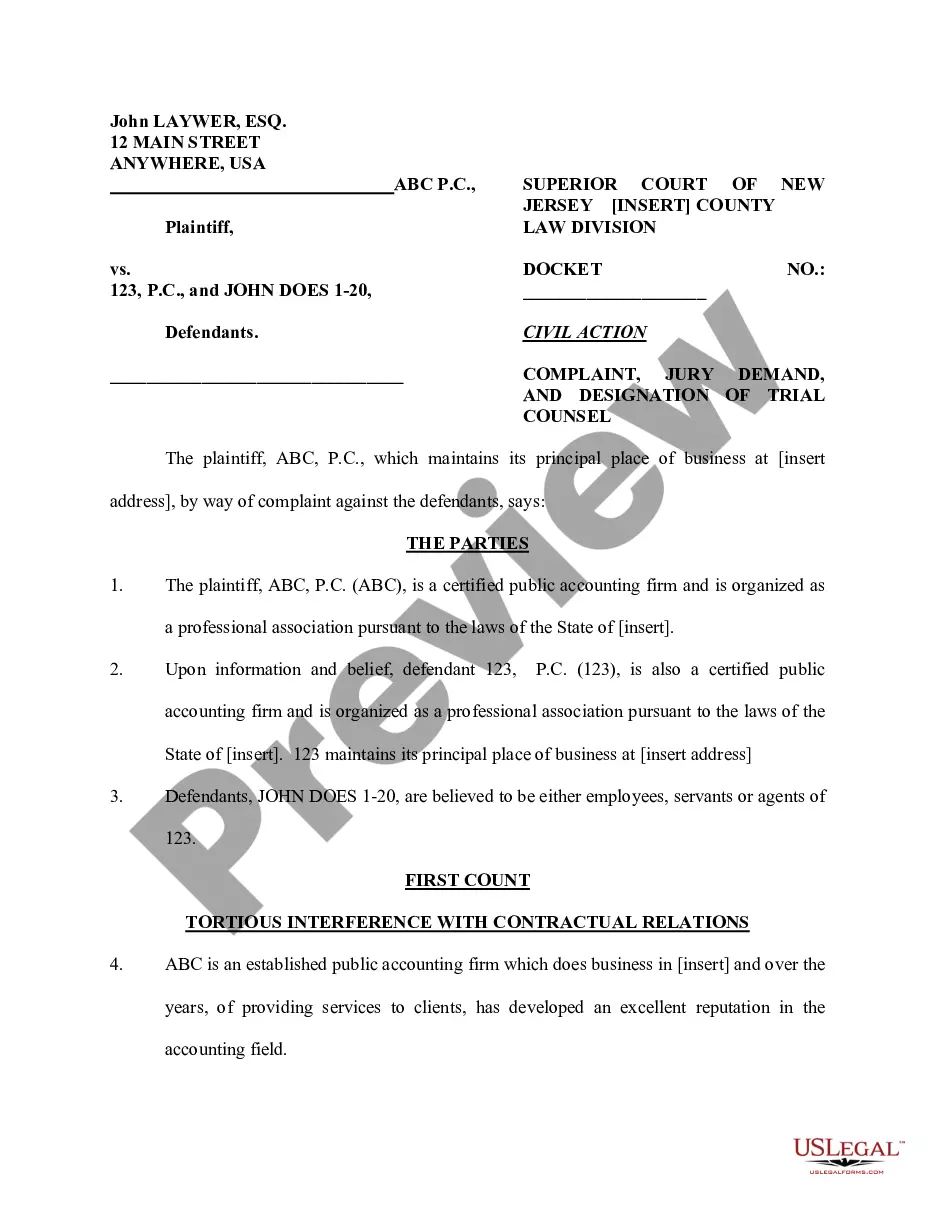

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Registrations for passenger vehicles can be renewed online at this time. However, restrictions may apply to some vehicles. See the full list of vehicles. Leased vehicles can now be renewed online.

Welcome. *RESERVATIONS - RI Division of Motor Vehicles is currently open by reservation only.

All registration renewals must be processed by mail, online with a credit card or deposited in the drop-boxes located at any DMV branch location.

Dealer Sale Insurance Information (valid RI insurance) Dealer Sales Tax form. Bill of Sale. Gross Vehicle Weight (GVWR is found on VIN plate on driver's side door) RI license or identification card. RI Use Tax form (out-of-state dealers only) Power of Attorney (if leased vehicle)

AAA offers select DMV and RMV services at all branches in Massachusetts, Rhode Island and New York. In an effort to best serve our members, AAA DMV services are available at all branches in Massachusetts, Rhode Island and New York. Not all services are offered in all states.

You can renew your Rhode Island driver's license up to 90 days before its expiration date. You can renew online with a credit card, at any DMV branch location or AAA branch office (members only).

EXCEPT AS AUTHORIZED BY LAW, THE DMV WILL NOT DISCLOSE PERSONAL INFORMATION WITHOUT YOUR CONSENT.