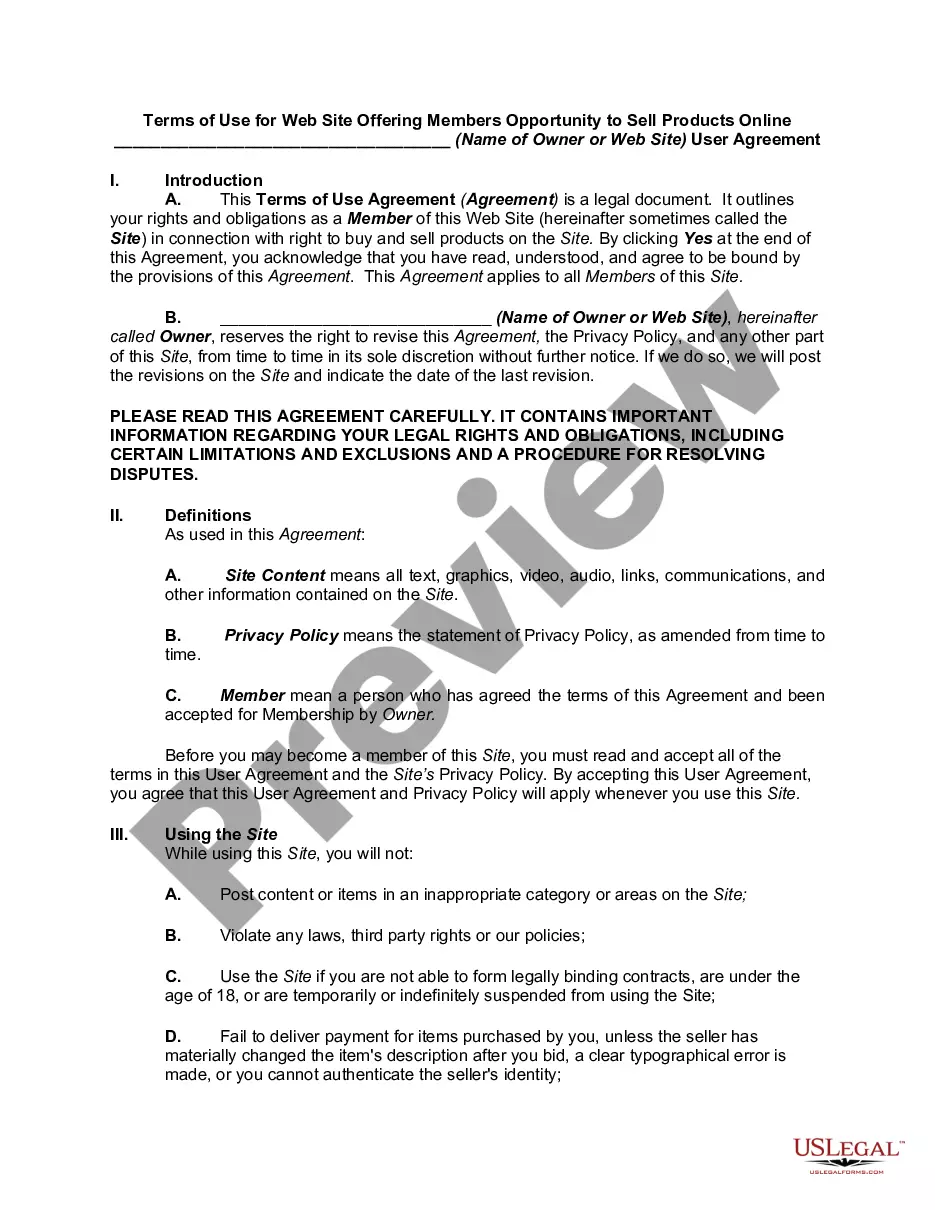

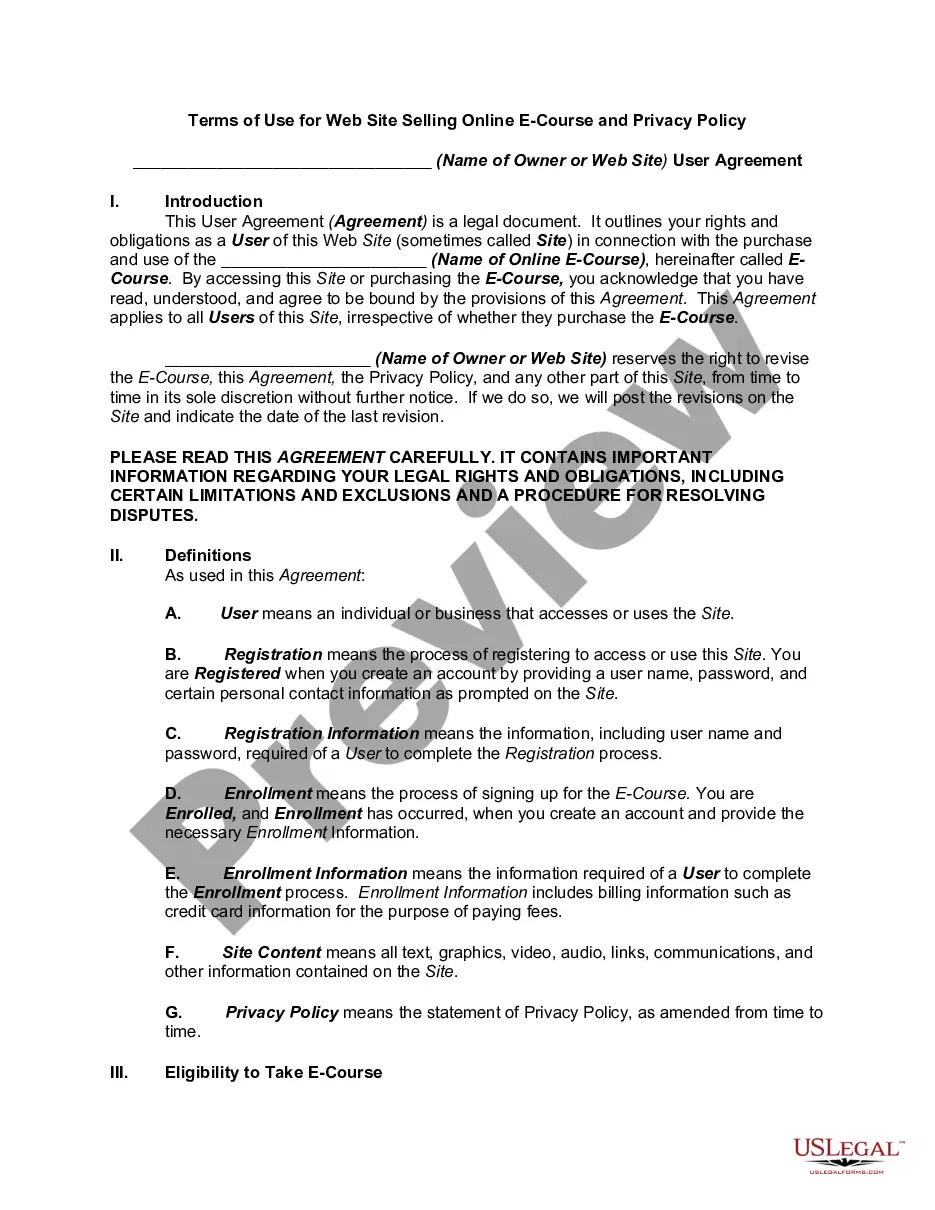

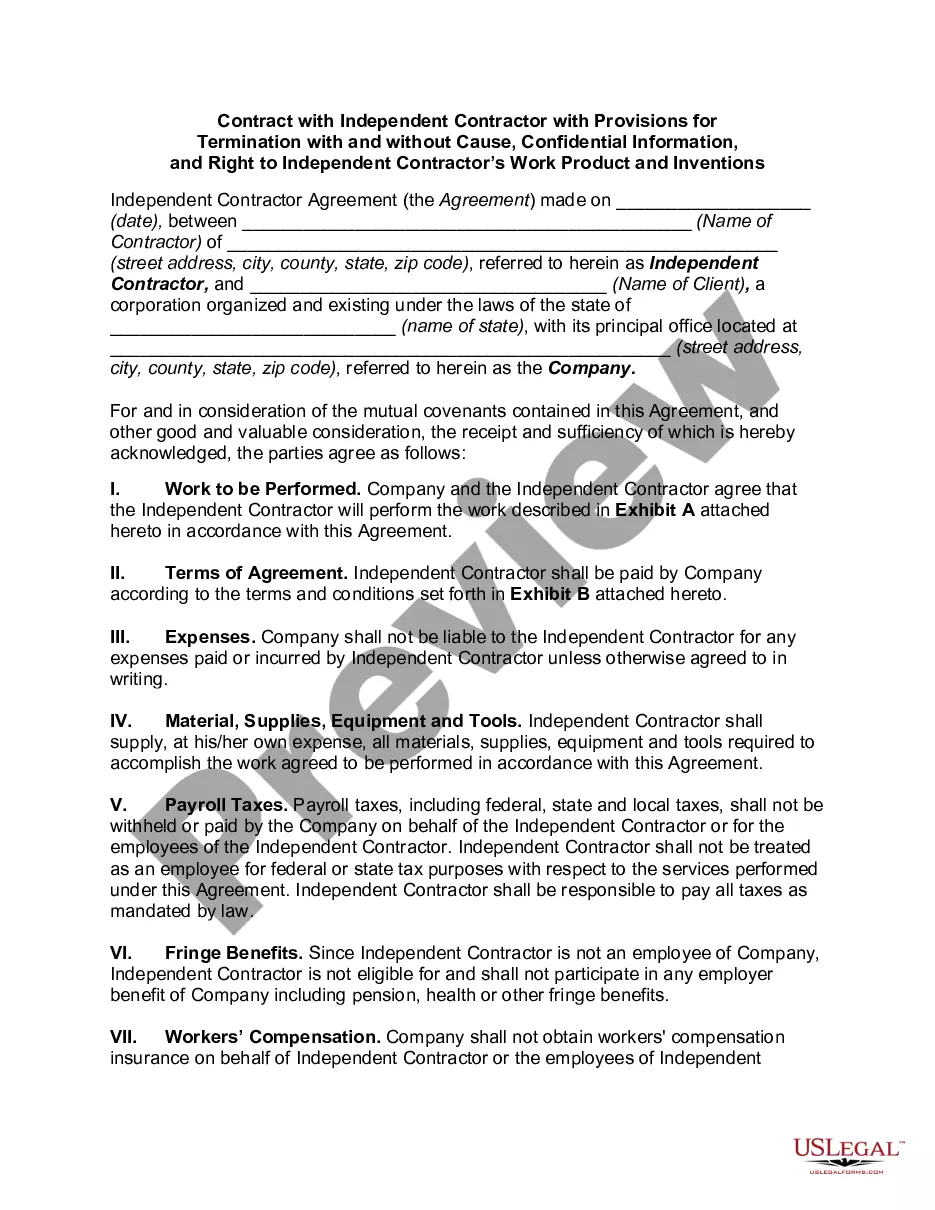

This is a form for a user agreement for an online auction and shopping website in which people and businesses buy and sell goods and services worldwide.

Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website

Description

How to fill out Website Subscription User Agreement For Online Auction And Shopping Website?

If you wish to compile, retrieve, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Make use of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you require, click the Get now option. Select the payment plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to find the Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website within just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain option to acquire the Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website.

- You can also access forms you've previously obtained in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have selected the form for the correct state/country.

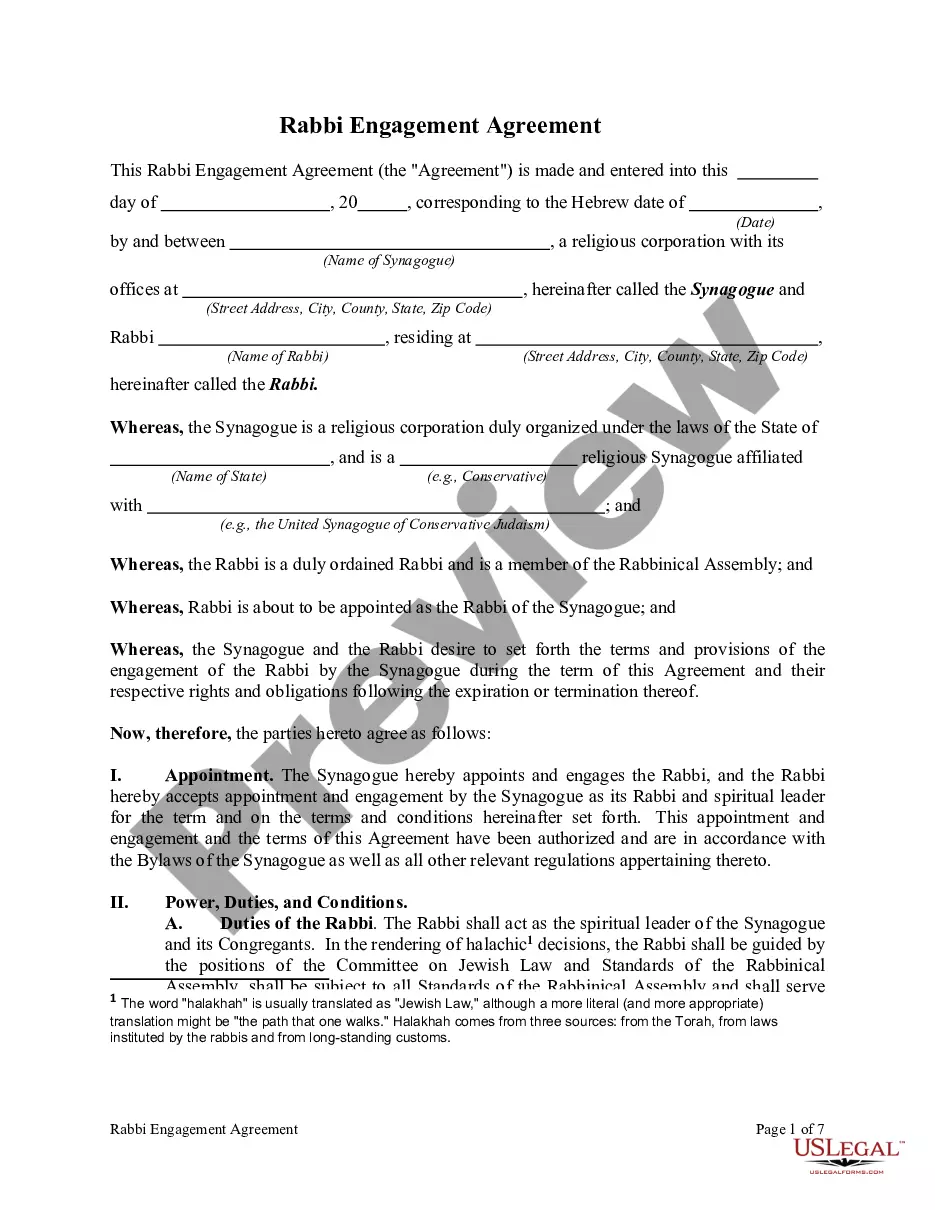

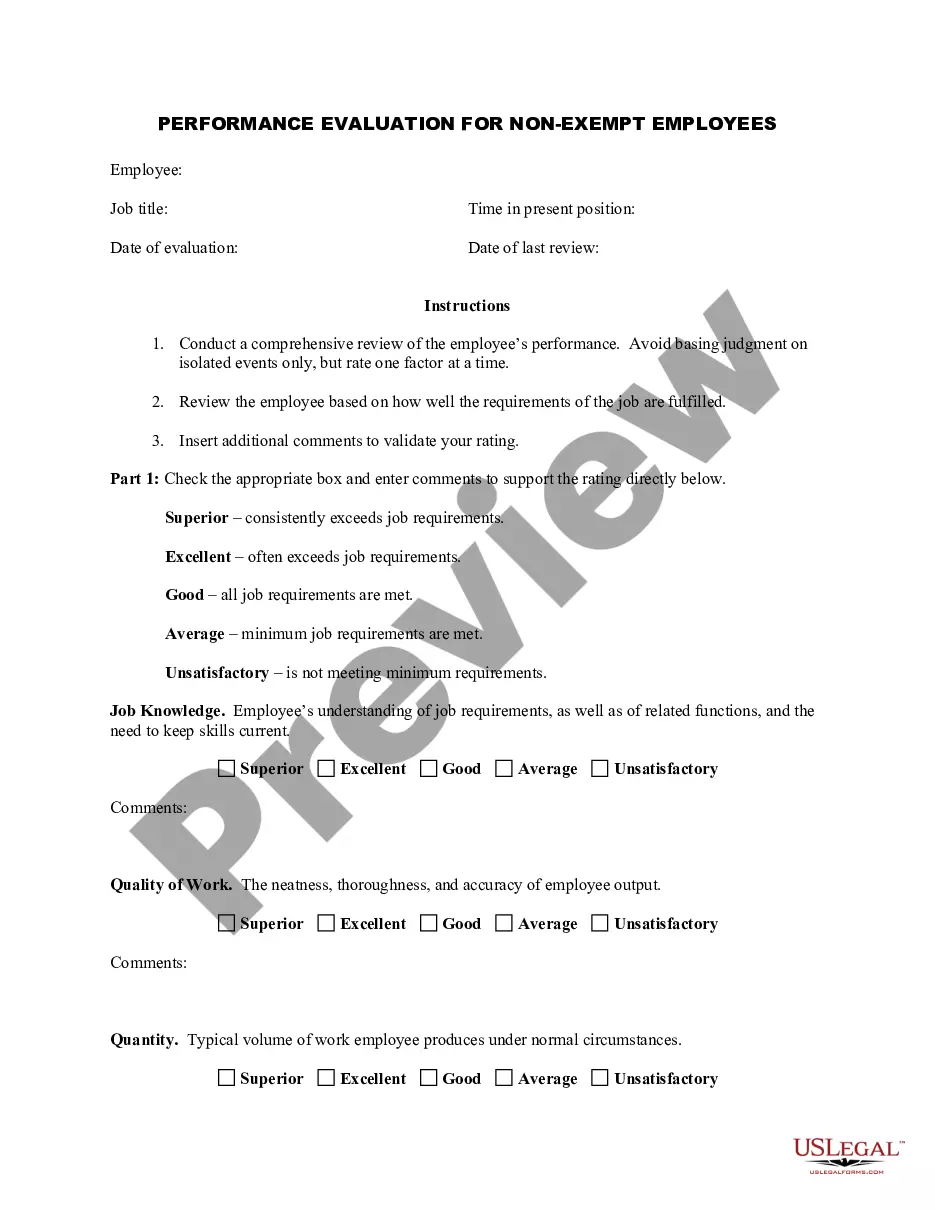

- Step 2. Use the Review option to examine the form's contents. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search section at the top of the screen to discover other versions of the legal form template.

Form popularity

FAQ

In Rhode Island, most services are not subject to sales tax, with some notable exceptions. For example, certain personal and professional services may incur taxes. If you're working within the framework of a Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website, understanding these tax nuances can be beneficial to managing your financial commitments.

Yes, Rhode Island recognizes out-of-state resale certificates for tax-exempt purchases. However, it's essential to ensure that your resale certificate complies with Rhode Island's guidelines. This is especially relevant if you're engaging in transactions related to a Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website, as proper documentation can streamline your purchases.

In Rhode Island, certain items are exempt from sales tax, including most food products, prescription drugs, and some clothing purchases. It's important to review the specific categories that qualify for these exemptions, especially when engaging with a Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website. This knowledge can help you optimize your purchasing decisions.

Service contracts in Rhode Island may be subject to sales tax, depending on the nature of the services provided. Specifically, if the service contract includes tangible personal property, that portion may be taxable. Understanding this is crucial when entering into a Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website, as it may affect your overall costs.

In Rhode Island, Software as a Service (SaaS) is generally considered taxable. This means that when you access software over the internet through a subscription, it falls under the sales tax regulations. Therefore, if you are using a Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website, be mindful of the tax implications associated with your subscription payments.

Yes, FanDuel is legal in Rhode Island and operates under the state's regulated sports betting framework. Rhode Island has embraced online sports betting to provide residents with safe and legal betting options. The Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website highlights the importance of compliant gaming experiences like FanDuel, allowing users to enjoy online betting with peace of mind.

Rhode Island legalized online shopping on June 13, 2018, with the introduction of a framework for e-commerce growth. This decision contributed to the state's goal of fostering a secure environment for online transactions. As part of this legal landscape, the Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website ensures that consumers and businesses understand their rights and responsibilities in this digital marketplace.

Yes, Rhode Island does impose sales tax on specific services. While not all services are taxable, sectors like telecommunications and construction fall under this taxation rule. To ensure compliance, particularly as you operate in conjunction with the Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website, keep an eye on which services incur tax obligations.

In Rhode Island, penalties for late payment of sales tax can be substantial, including interest calculated at a set rate per month on the unpaid amount. Failing to comply with sales tax obligations might result in additional fines, potentially affecting your business operations. To avoid these penalties, follow the guidelines outlined in the Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website.

The Rhode Island use tax complements the sales tax and applies to goods purchased outside the state if you use them within Rhode Island. This tax ensures local businesses are not at a disadvantage compared to out-of-state sellers. If you conduct online purchases not taxed when sold, it is vital to account for the use tax as outlined in the Rhode Island Website Subscription User Agreement for Online Auction and Shopping Website.