New Hampshire Disclaimer of Inheritance Rights for Stepchildren

Description

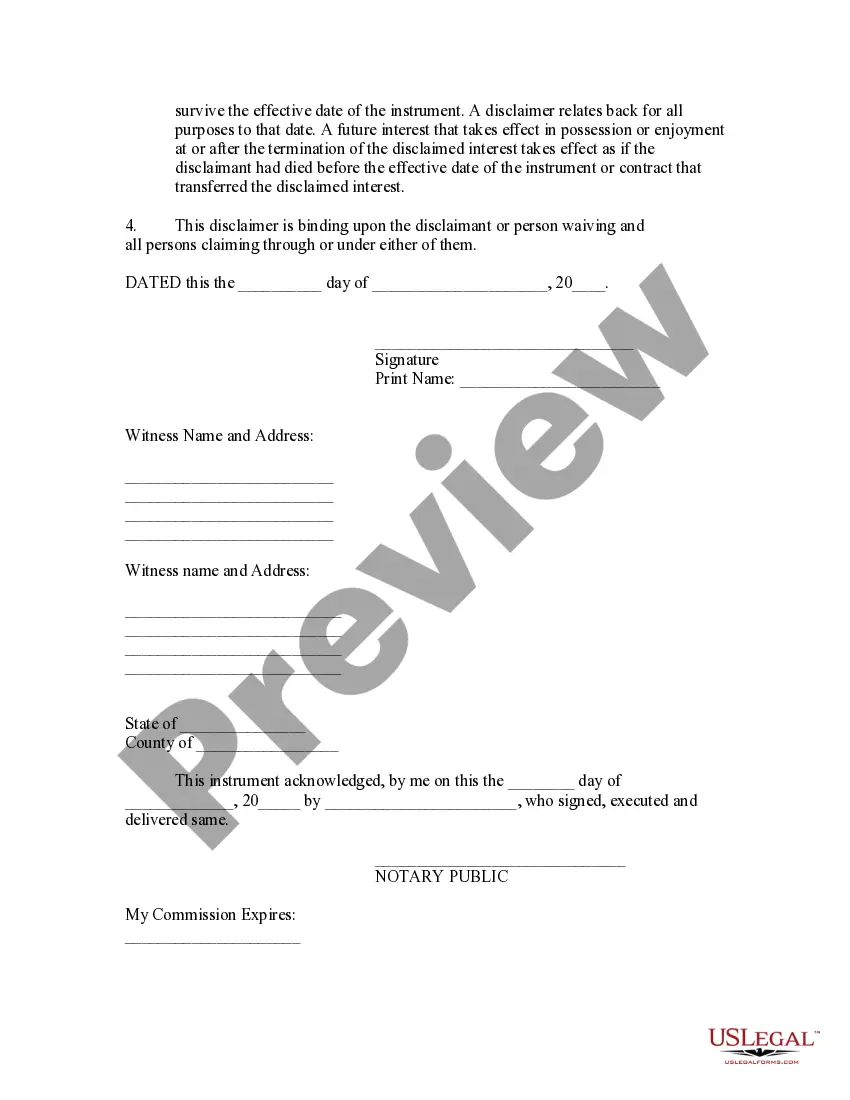

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

It is possible to devote hours online looking for the legal record design that fits the federal and state demands you require. US Legal Forms offers thousands of legal varieties that are analyzed by specialists. You can easily acquire or produce the New Hampshire Disclaimer of Inheritance Rights for Stepchildren from our assistance.

If you currently have a US Legal Forms bank account, you can log in and then click the Down load switch. After that, you can comprehensive, change, produce, or indication the New Hampshire Disclaimer of Inheritance Rights for Stepchildren. Every legal record design you buy is the one you have for a long time. To acquire one more duplicate for any obtained type, visit the My Forms tab and then click the related switch.

If you are using the US Legal Forms website initially, stick to the simple guidelines below:

- Initial, make certain you have chosen the proper record design to the state/city that you pick. Look at the type explanation to make sure you have picked the proper type. If offered, use the Preview switch to appear with the record design also.

- If you would like get one more edition of your type, use the Research discipline to discover the design that suits you and demands.

- When you have found the design you want, simply click Acquire now to carry on.

- Select the pricing strategy you want, key in your references, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your bank card or PayPal bank account to purchase the legal type.

- Select the formatting of your record and acquire it to the system.

- Make alterations to the record if needed. It is possible to comprehensive, change and indication and produce New Hampshire Disclaimer of Inheritance Rights for Stepchildren.

Down load and produce thousands of record themes making use of the US Legal Forms web site, that provides the most important collection of legal varieties. Use expert and condition-particular themes to tackle your organization or person demands.

Form popularity

FAQ

Hear this out loud PauseSimple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

Hear this out loud PauseIn New Hampshire, probate can take at least six months to allow creditors to file claims against the estate. On average, the probate process can take up to a year and a half.

The surviving spouse often elects to take an elective share when the surviving spouse is dissatisfied with the decedent's will. The value of the spousal elective share is one of the following: A one-third share of the real and personal property if the deceased spouse had surviving children.

If you are unmarried and die without a valid will and last testament in New Hampshire, then your estate passes on to your children in equal shares. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

Even without a statutory guideline on executor fees in New Hampshire, the general understanding among legal professionals suggests that an executor can expect to receive about 2-4% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.

Hear this out loud PauseUnder New Hampshire law, Executors, Administrators and their attorneys are allowed reasonable fees; these fees are determined by the nature of the estate. Fees are always subject to the approval of the court.

The Estate Settlement Timeline: There is no specific deadline for this in New Hampshire law, but it is generally best to do so within 30 days to prevent unnecessary delays in the probate process.

Hear this out loud PauseEvery estate is different and can take a different length of time to administer depending on its complexity. There is a general expectation that an executor or administrator should try to complete the estate administration within a year of the death, and this is referred to as the executor's year.