New Hampshire Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Are you currently in the position the place you need documents for either business or specific reasons nearly every time? There are plenty of legitimate record web templates available on the Internet, but locating ones you can depend on is not simple. US Legal Forms offers a large number of type web templates, much like the New Hampshire Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, which are created to meet state and federal demands.

When you are presently familiar with US Legal Forms internet site and have your account, basically log in. After that, you may acquire the New Hampshire Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust template.

If you do not have an bank account and would like to begin using US Legal Forms, follow these steps:

- Get the type you require and ensure it is for that right city/area.

- Utilize the Review switch to review the shape.

- See the description to actually have selected the right type.

- In case the type is not what you are searching for, utilize the Look for industry to get the type that suits you and demands.

- Whenever you find the right type, just click Purchase now.

- Choose the costs plan you would like, complete the desired details to make your bank account, and purchase the transaction utilizing your PayPal or credit card.

- Select a practical data file file format and acquire your version.

Locate every one of the record web templates you may have bought in the My Forms menus. You can obtain a extra version of New Hampshire Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust any time, if necessary. Just click on the needed type to acquire or print the record template.

Use US Legal Forms, by far the most extensive selection of legitimate kinds, to save time and prevent faults. The service offers expertly manufactured legitimate record web templates that you can use for a selection of reasons. Make your account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

Trusts can be used in estate planning to give individuals and couples greater control over how assets are transferred to heirs with the fewest tax consequences. Sometimes, however, disclaiming assets makes the most sense. No special form or document must be completed to disclaim inherited assets.

For example, in her will a decedent leaves $500,000 to her nephew if he survives her, but if he does not survive her, this amount passes to her nephew's children who survive the decedent. If the nephew disclaims the property, it passes to his children who survive the decedent.

Giving part of your inheritance to someone else is possible, but it may or may not be the best option for you. Before doing so, make sure that you're aware of the consequences. Also, consider potential taxes associated with transferring large sums of money to avoid unexpected fees down the line.

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.

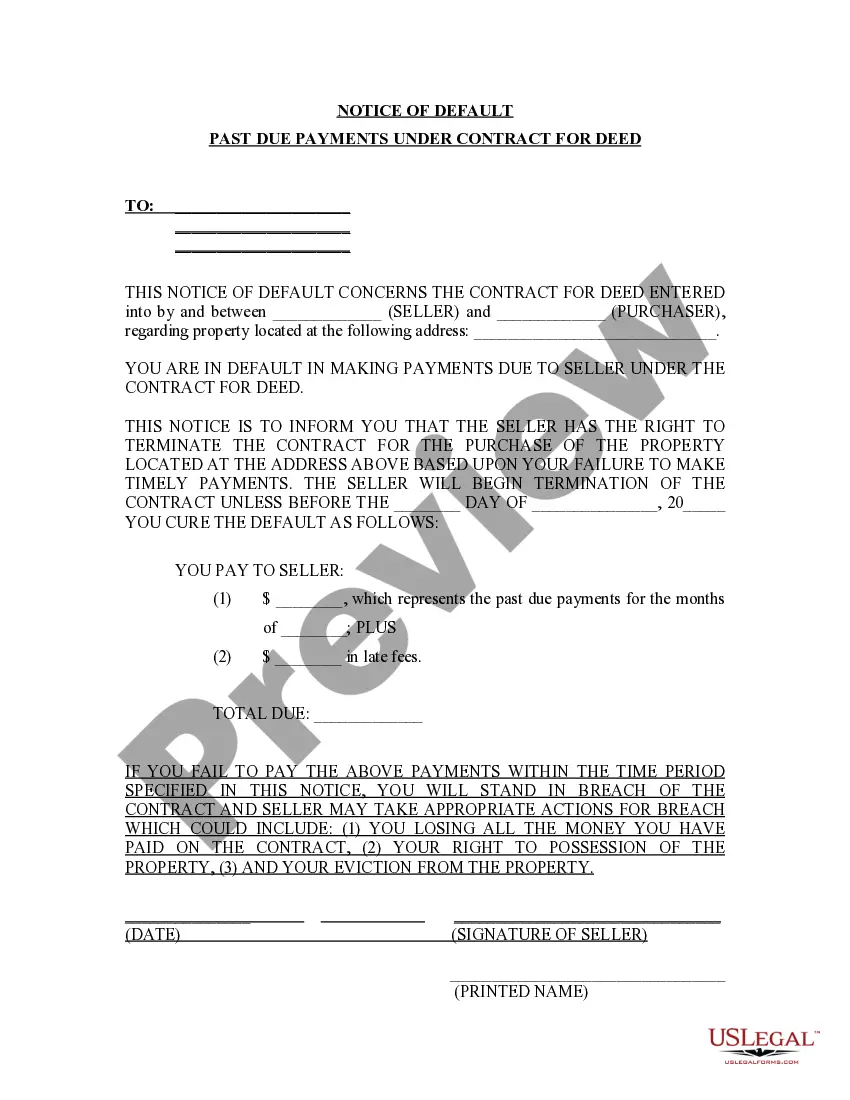

DISCLAIMER OF INHERITANCE RIGHTS I have been fully advised of my rights to certain property of the Estate of __________________ and waive and disclaim my right to same voluntarily and without duress or undue influence. This disclaimer applies to all real and personal property I would have received.

If you are unmarried and die without a valid will and last testament in New Hampshire, then your estate passes on to your children in equal shares. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

You disclaim the assets within nine months of the death of the person you inherited them from. (There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

Once you disclaim an inheritance, it's permanent and you can't ask for it to be given to you. If you fail to execute the disclaimer after the nine-month period, the disclaimer is considered invalid.