An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

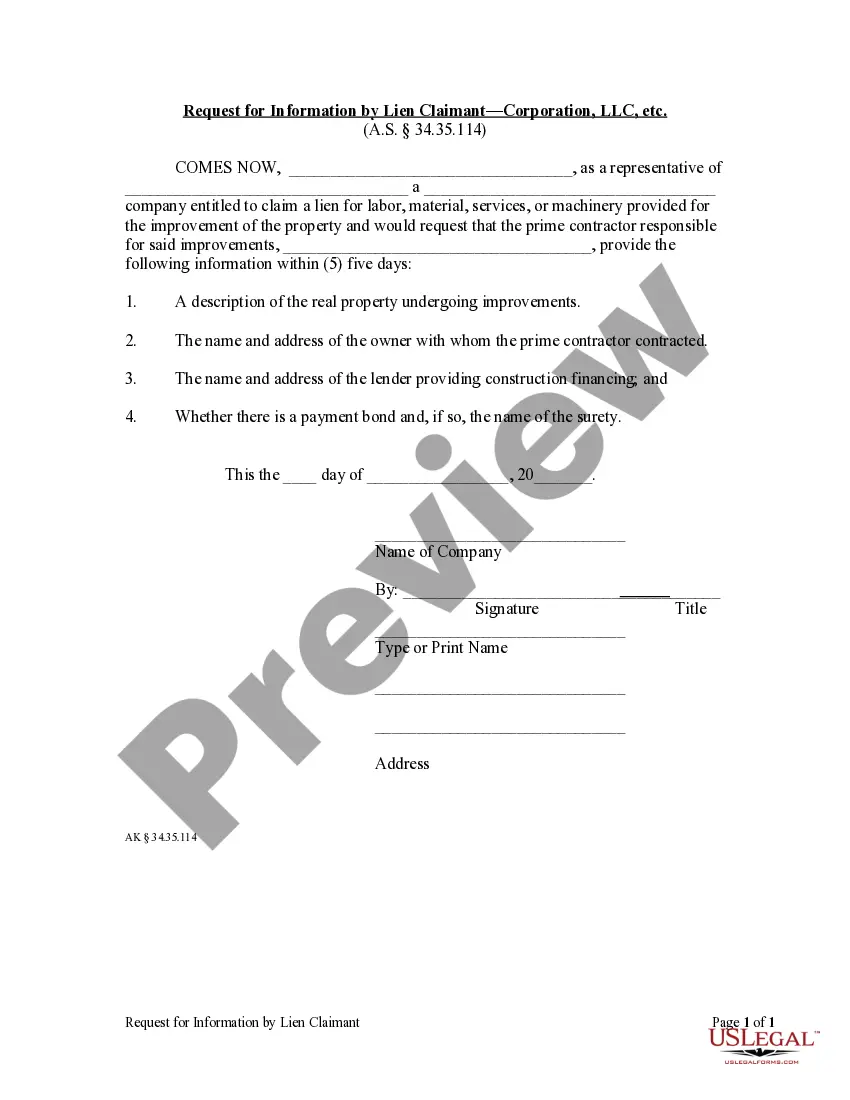

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Selecting the optimal legal document template can be a challenge.

Clearly, there are numerous formats accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service offers a multitude of formats, such as the Rhode Island Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary, that you can employ for both business and personal needs.

You can review the form using the Preview button and examine the form description to ensure this is the best fit for you.

- All of the templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Rhode Island Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- Use your account to browse the legal templates you have purchased previously.

- Go to the My documents tab of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

The interest of a beneficiary refers to the financial entitlement they have concerning the trust assets. This can differ based on the type of beneficiary status, such as income or remainder beneficiary. Understanding this interest is essential, especially if you are pursuing the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

Setting up a trust in Rhode Island involves several steps, including selecting a trustee, drafting the trust document, and funding the trust with assets. It’s vital to ensure the trust complies with Rhode Island laws while clearly outlining the distribution terms. For assistance, you may want to explore the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary as a part of your estate planning.

The interest held in a trust refers to the rights and benefits that beneficiaries possess regarding the trust assets. This can include income generated from investments held in the trust, as well as the potential for receiving the principal at a later date. Understanding your interest in the trust is crucial, especially when dealing with the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

Typically, the interest on a trust account goes to the beneficiaries according to the trust document. This helps ensure that the intended beneficiaries receive the benefits, whether they are income beneficiaries or remainder beneficiaries. To navigate this process smoothly, consider utilizing the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

The income beneficiary of a trust is the individual who receives the income generated by the trust assets during its term. This includes interest, dividends, or rents collected from the trust’s holdings. It is essential to understand your role as an income beneficiary to make informed decisions regarding the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

Yes, simple trusts are mandated to distribute all income each year to avoid tax penalties. This requirement ensures that beneficiaries receive their share, which could have tax implications for them. However, you should also be aware of the intricacies involved in the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as it can help clarify the distribution process. Clarity in understanding these obligations leads to smoother management of the trust.

Form IL-1041, the Illinois Income Tax Return for Estates and Trusts, should be filed with the Illinois Department of Revenue. If you are managing a trust with beneficiaries in Rhode Island, consider using the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary as a complementary step. Ensuring correct filing is essential for compliance with all applicable tax obligations. Consulting with a tax preparer can provide guidance on where and how to file accurately.

Distributions from trusts depend on the type of trust and its terms. A simple trust is required to make annual distributions of income, while a complex trust has more flexibility. If you are managing a trust, understanding the stipulations within the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary becomes crucial. Ensure you abide by these guidelines to avoid legal issues.

If a simple trust fails to distribute income, it may face tax penalties and affect beneficiaries' tax situations. The IRS expects simple trusts to distribute all income annually, which means retained income may lead to double taxation. It's essential to understand your responsibilities under the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary and to distribute funds correctly among the beneficiaries. Consulting with a trust attorney can help clarify potential consequences.

Trusts are typically required to file IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts. Depending on the type of trust, you may also need to file the Rhode Island Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to ensure compliance with state laws. This form indicates to the state your intentions regarding the trust's assets. Always check with a tax advisor to confirm the appropriate forms for your specific situation.