In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

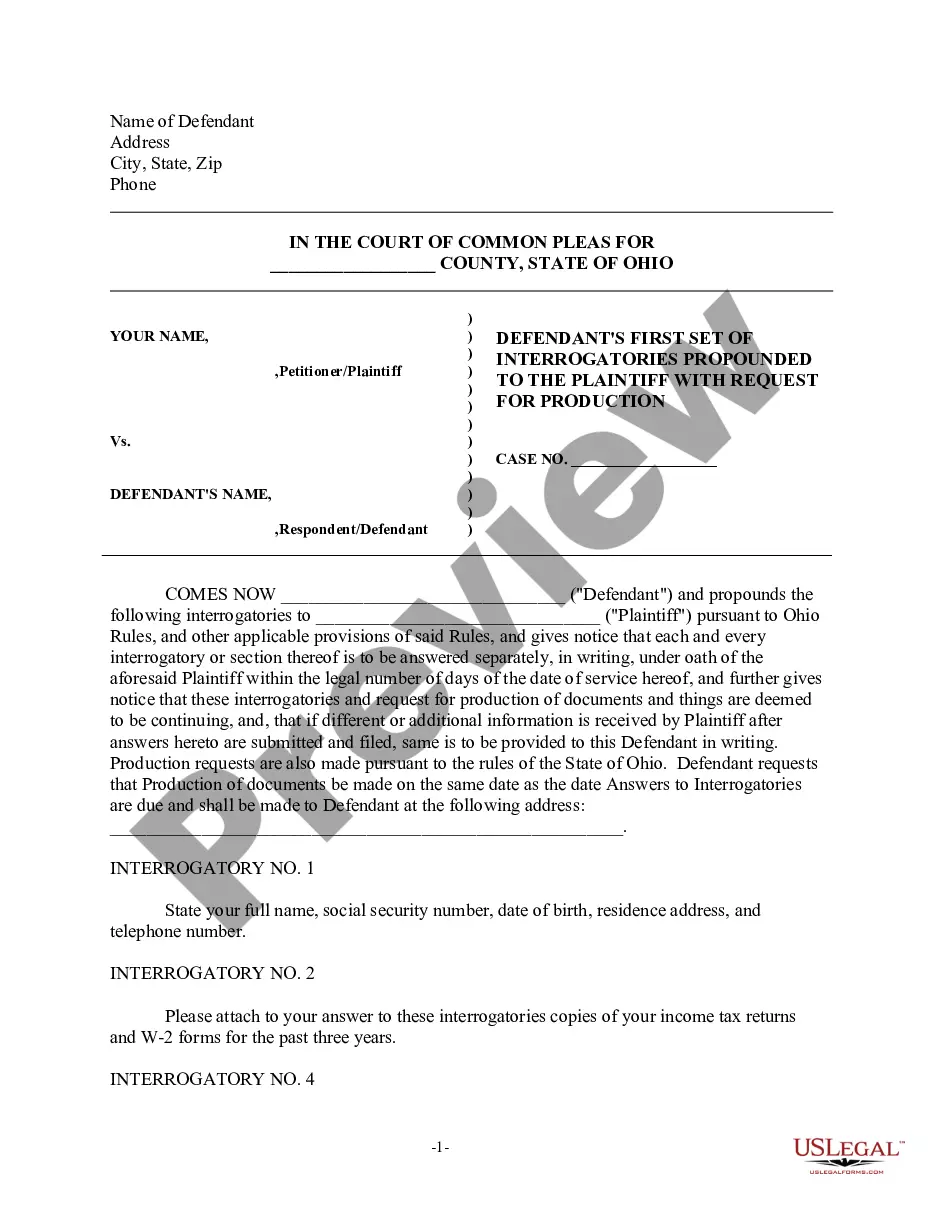

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

Locating the appropriate legal document template can be a challenge. Clearly, there are numerous online templates accessible, but how do you identify the legal form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Rhode Island Termination of Trust by Trustee and Acknowledgment of Receipt of Trust Funds by Beneficiary, which can be utilized for both professional and personal purposes.

All of the forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Download button to acquire the Rhode Island Termination of Trust by Trustee and Acknowledgment of Receipt of Trust Funds by Beneficiary. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

Complete, modify, print, and sign the acquired Rhode Island Termination of Trust by Trustee and Acknowledgment of Receipt of Trust Funds by Beneficiary. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Leverage the service to obtain professionally crafted documents that comply with state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your location/region. You can review the form using the Preview option and examine the form overview to confirm this is indeed the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click on the Buy now option to purchase the form.

- Choose the pricing plan you desire and enter the necessary information. Create your account and complete your order with your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

A beneficiary can terminate a trust by reaching an agreement with the trustee and all other beneficiaries, or by court proceedings if necessary. This often involves the formal process of distributing the trust assets. Understanding the steps for Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is essential, and utilizing platforms like uslegalforms can simplify this process for you.

Yes, under certain circumstances, a beneficiary can seek to remove a trustee from a trust. This may occur when the trustee breaches their duties or fails to act in the beneficiaries' best interests. The Rhode Island Termination of Trust By Trustee offers legal avenues to facilitate such actions, ensuring that beneficiaries can protect their rights.

The rights of trustees and beneficiaries differ in nature. Trustees have a fiduciary duty to manage the trust and follow its terms, whereas beneficiaries have a right to receive distributions as per the trust. In disputes, the intricate rules governing the Rhode Island Termination of Trust By Trustee can provide clarity on the respective rights.

To remove a trustee from a trust, you typically need to follow the procedures outlined in the trust document. If no provisions exist, seeking a court order may be necessary. This process may involve demonstrating that the trustee has acted improperly. For assistance, consider using resources like uslegalforms to navigate the Rhode Island Termination of Trust By Trustee.

In general, a beneficiary cannot directly remove a trustee. However, if the trust document allows for such actions or if the trustee fails to meet their obligations, a beneficiary may have grounds to request removal through a court process. Engaging in the Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary could clarify these rights for beneficiaries.

Yes, a beneficiary can petition for the removal of a trustee under certain conditions, such as evidence of mismanagement or breaches of fiduciary duty. The process typically requires legal proceedings, during which the beneficiary must substantiate their claims. Familiarity with the rules surrounding Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is essential for beneficiaries seeking to invoke this right. Consulting a legal expert or using platforms like uslegalforms can simplify this complex process.

A trust will not be terminated under certain circumstances, such as when the grantor is still alive, or if the trust is deemed to serve its intended purpose. Additionally, if the trust has ongoing obligations or specific conditions that have yet to be fulfilled, termination may not be permissible. Understanding these conditions is fundamental, particularly in terms of Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. This knowledge can help prospective beneficiaries manage their expectations effectively.

Terminating a trust can have several important consequences, such as the immediate transfer of assets to beneficiaries and the dissolution of the trustee's responsibilities. Furthermore, beneficiaries must acknowledge receipt of trust funds, reinforcing their understanding of the distribution. Navigating the implications of Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is vital, as it affects both tax liabilities and estate planning for the involved parties.

The distribution of a trust termination typically involves the transfer of the trust's assets to the beneficiaries as stipulated in the trust document. Each beneficiary receives their share according to the terms outlined by the trustee. It is essential to follow the protocols of Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary to ensure compliance with state laws and provide transparency during the distribution process. This can help prevent disputes and misunderstandings.

An example of a trust termination occurs when the conditions specified in the trust document are met, such as the death of the grantor or the fulfillment of the trust purpose. For instance, a trust designed to hold funds for a beneficiary until they reach a certain age will terminate once that age is reached. Understanding the process of Rhode Island Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is crucial for all parties involved. This ensures that everyone is clear about their rights and responsibilities following the termination.