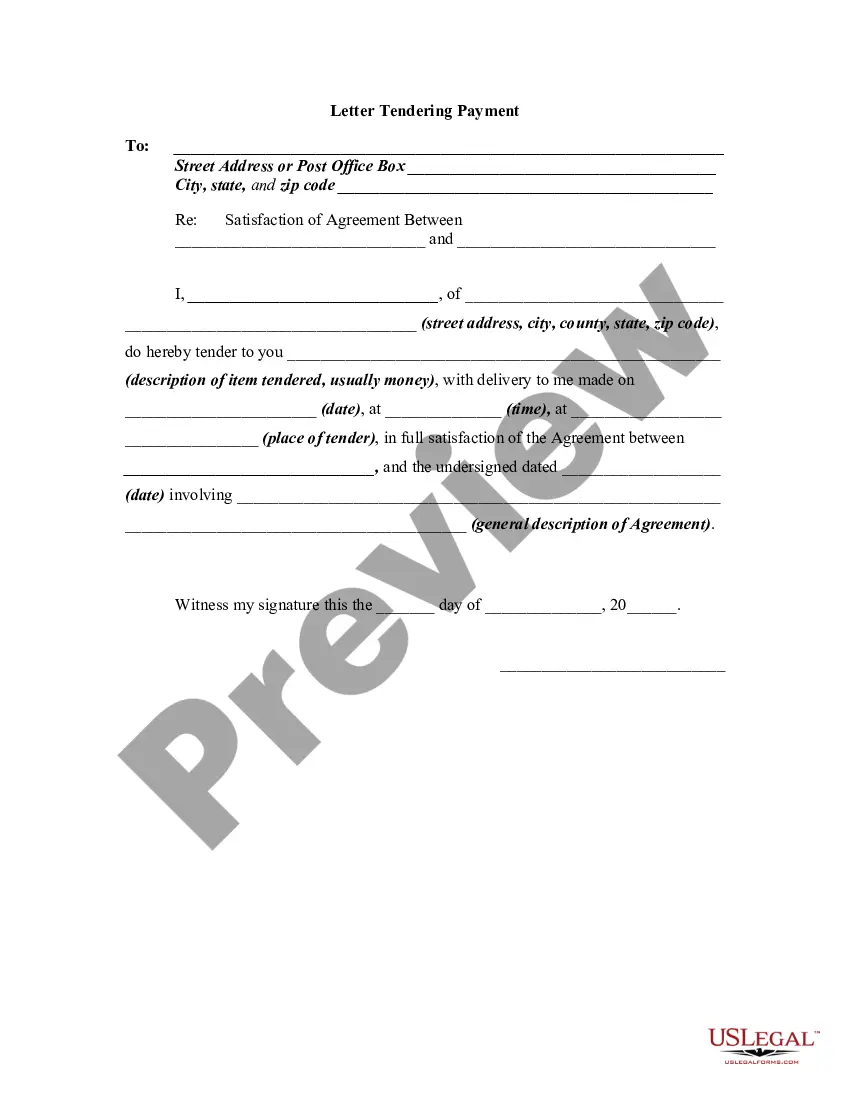

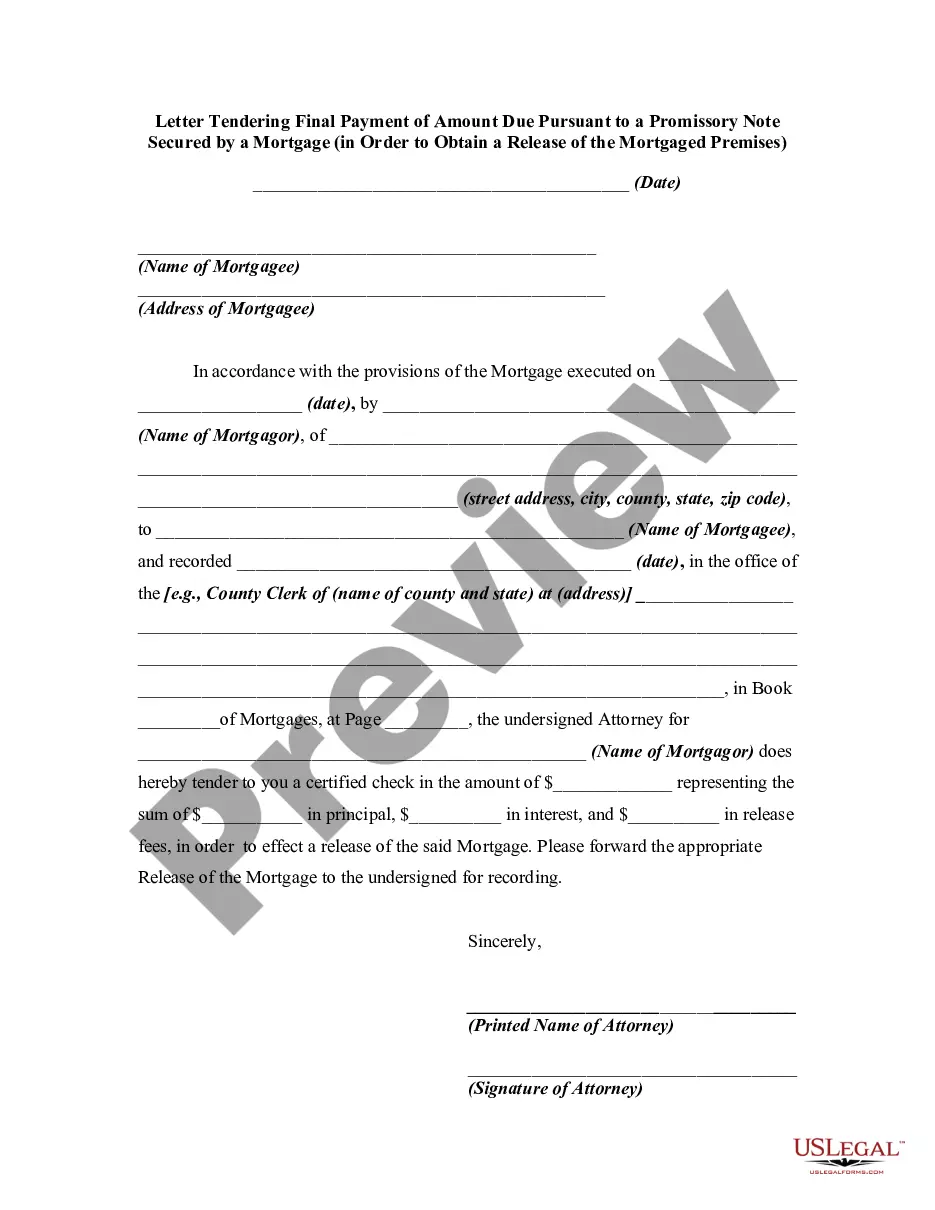

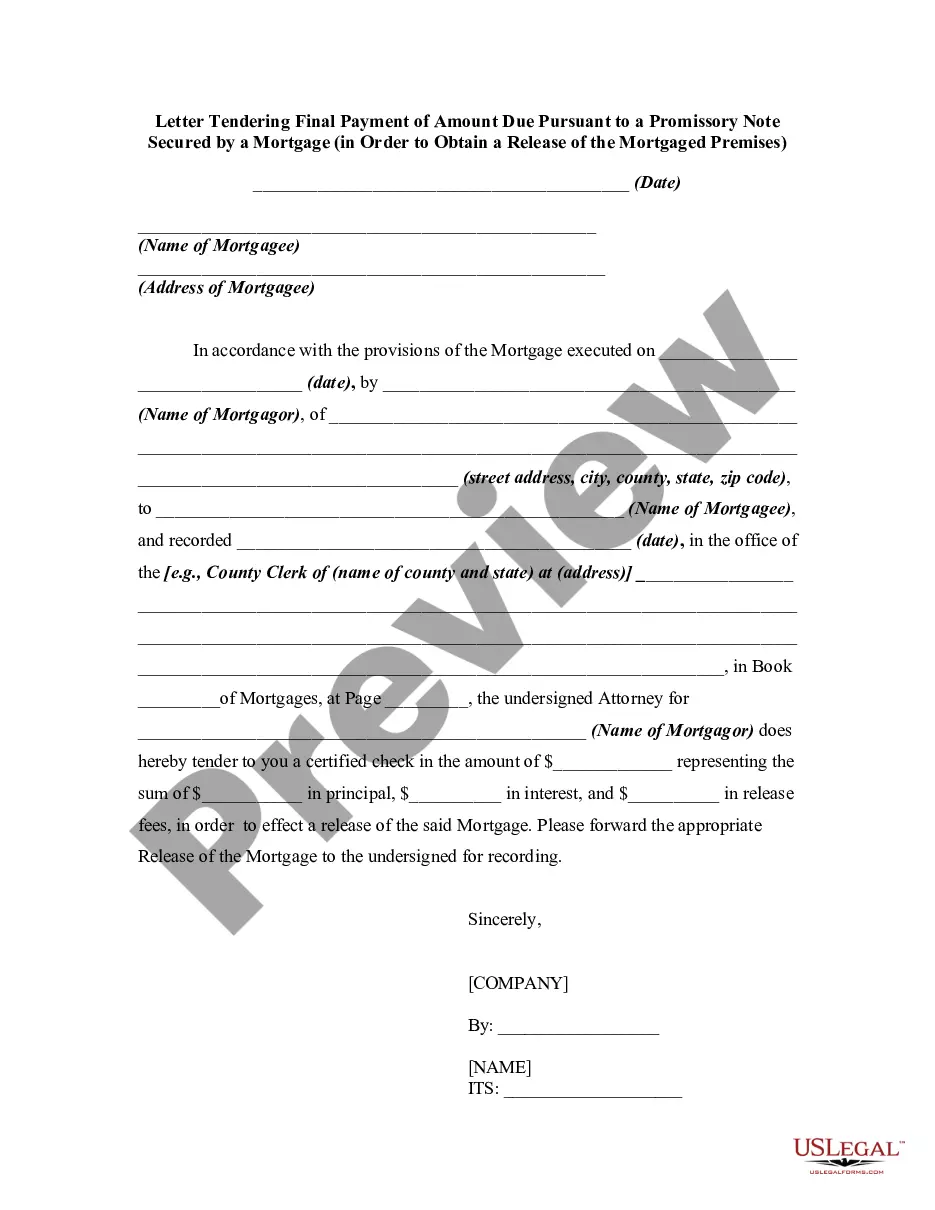

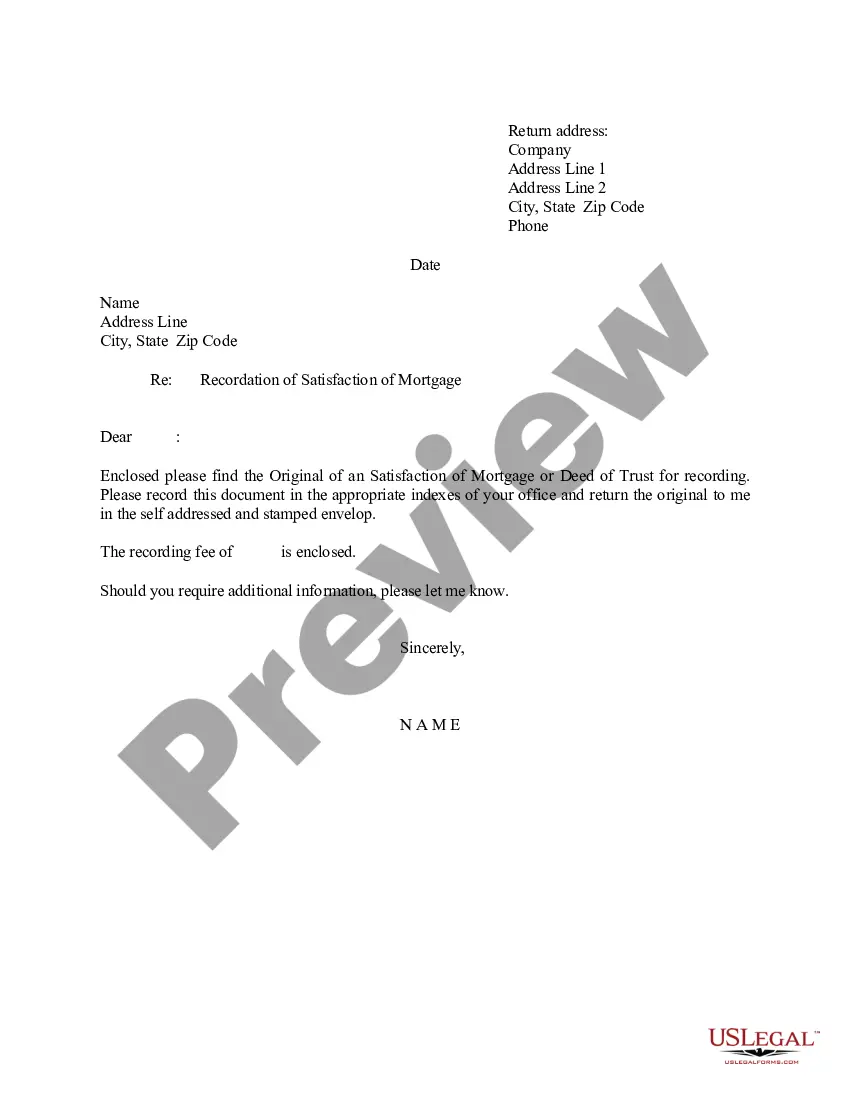

Rhode Island Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises

Description

How to fill out Letter Tendering Payment In Order To Obtain Release Of Mortgaged Premises?

Choosing the right legal file web template can be quite a have difficulties. Naturally, there are a variety of themes available on the net, but how will you discover the legal form you require? Use the US Legal Forms web site. The service gives 1000s of themes, like the Rhode Island Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises, that you can use for organization and personal requirements. Every one of the types are examined by pros and satisfy federal and state specifications.

Should you be previously registered, log in to the account and then click the Download option to get the Rhode Island Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises. Make use of your account to search throughout the legal types you possess bought earlier. Proceed to the My Forms tab of your respective account and obtain one more backup from the file you require.

Should you be a new consumer of US Legal Forms, listed below are simple directions that you should comply with:

- Very first, make sure you have chosen the right form for your town/county. You are able to look over the form making use of the Preview option and look at the form outline to ensure it is the right one for you.

- In case the form does not satisfy your needs, take advantage of the Seach discipline to get the appropriate form.

- When you are certain the form is acceptable, go through the Acquire now option to get the form.

- Select the rates strategy you want and enter in the required information. Build your account and pay for an order utilizing your PayPal account or Visa or Mastercard.

- Pick the data file formatting and obtain the legal file web template to the product.

- Comprehensive, edit and print out and indication the acquired Rhode Island Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises.

US Legal Forms is definitely the most significant library of legal types that you can discover a variety of file themes. Use the company to obtain appropriately-manufactured files that comply with express specifications.

Form popularity

FAQ

NOTICE ABOUT CHANGE IN REAL ESTATE CONVEYANCE TAX Under current law, the tax is equal to two dollars and thirty cents ($2.30) for each five hundred dollars ($500.00) or fractional part thereof that is paid for the purchase of real estate or the interest in an acquired real estate company.

When selling real estate in Rhode Island, all transactions have a real estate conveyance tax, pursuant to RIGL 44-25-1. This payment is collected at closing and a portion of these funds are remitted to the State of Rhode Island and a portion is remitted to the local city or township.

Rhode Island Estate Tax Exemption The estate tax threshold for Rhode Island is $1,733,264. If your estate is worth less than that, you owe nothing to the state of Rhode Island. If it is worth more than that, there is a progressive ladder of tax rates that will determine how much you owe.

Capital gains tax Capital gains are taxable at both the federal and state levels. While the federal government taxes capital gains at a lower rate than regular personal income, states usually tax capital gains at the same rates as regular income.

The title insurance premiums do not include the search and examination fee. The purchaser usually pays the search and examination fee in Rhode Island. The deed transfer tax is known as the realty transfer tax in Rhode Island. The current rate is $2.30 per $500.00.

The Rhode Island (RI) state sales tax rate is currently 7%. Rhode Island is one of the few states with a single, statewide sales tax. Businesses that sell, rent or lease taxable tangible personal property at retail in Rhode Island must register with the state and collect sales tax.

If you are planning to sell your property, you'll have to pay capital gain tax on the profit earned after considering the inflation and indexed cost of acquisition.