Rhode Island General Form of Receipt

Description

How to fill out General Form Of Receipt?

Are you presently in the position where you require documents for both professional or personal reasons on a regular basis.

There are numerous reputable document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, including the Rhode Island General Form of Receipt, that are designed to satisfy federal and state regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card. Choose a suitable document format and download your copy. Retrieve all the document templates you have purchased from the My documents menu. You can obtain an additional copy of the Rhode Island General Form of Receipt at any time, if necessary. Simply click the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and minimize errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Rhode Island General Form of Receipt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for your correct city/region.

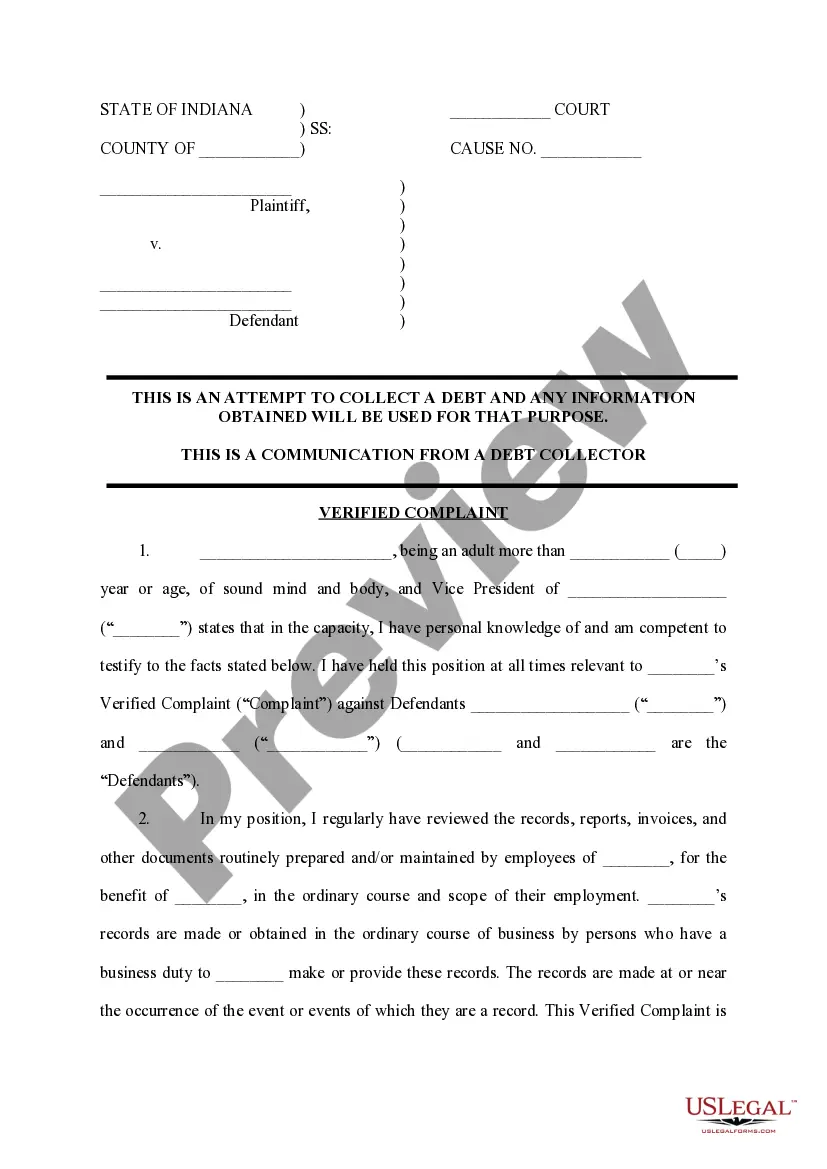

- Utilize the Preview button to review the form.

- Read the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

In Rhode Island, a bill of sale does not have to be notarized to be valid, but notarization can enhance its credibility. A notarized bill of sale serves as a formal record, offering extra protection in case of disputes. If you need a bill of sale template, consider using USLegalForms as an efficient tool to create one that meets your needs.

Form RI 1040 is the Rhode Island personal income tax return form that residents must file to report their state income. This form helps residents calculate their tax obligations based on their federal income tax filings. Using resources like USLegalForms can assist you in filling out your form RI 1040 accurately and efficiently.

The 1040 tax form is a standard individual income tax return form used in the United States. It allows taxpayers to report their income, claim deductions, and determine their tax liability. In Rhode Island, the information from the 1040 can relate to local tax obligations, such as the Rhode Island General Form of Receipt.

Form 1065, also known as the Rhode Island General Form of Receipt, is primarily used by partnerships to report their income, deductions, gains, and losses to the state. This form aids in ensuring tax compliance and provides clarity on the partnership’s financial activities. Properly completing this form is vital for accurate tax reporting and can simplify your annual filing process.

Certain items, such as groceries, prescription medications, and specific types of clothing, are exempt from sales tax in Rhode Island. Understanding these exemptions can significantly reduce your business costs. By using the Rhode Island General Form of Receipt, you can accurately manage and document these exemptions for your records.

The state tax rate in Rhode Island can vary based on income levels and specific business activities. Generally, Rhode Island imposes a flat income tax rate along with various business taxes. Utilizing the Rhode Island General Form of Receipt can help clarify your tax liabilities and assist in maintaining accurate records.

RI withholding refers to the state's process of deducting taxes from payments made to employees or contractors. This withholding ensures that tax obligations are met throughout the year, rather than in a lump sum. Understanding this process, along with the Rhode Island General Form of Receipt, helps you manage payroll effectively and stay compliant.

Any partnership or LLC classified as a partnership in Rhode Island must file Form 1065. This requirement is in place to report the financial activities and income of the business, ensuring transparency and proper taxation. If you are part of a partnership, be sure to complete the Rhode Island General Form of Receipt to meet your obligations.

RI 1065 refers to the Rhode Island General Form of Receipt, which is a key document for certain businesses operating in the state. This form is important for tax purposes because it captures essential financial information. By filing this form, you ensure compliance with Rhode Island tax regulations while also potentially streamlining your reporting process.

You can obtain Rhode Island tax forms online through the Rhode Island Division of Taxation's website. Additionally, you may find the Rhode Island General Form of Receipt available for download. If you prefer a more streamlined approach, uslegalforms offers a variety of tax forms including those specific to Rhode Island. Using uslegalforms ensures you have the correct and up-to-date forms at your fingertips.