Kansas Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

Are you currently in a situation where you frequently require documents for either business or personal purposes.

There are numerous reliable document templates available online, but finding trustworthy ones is challenging.

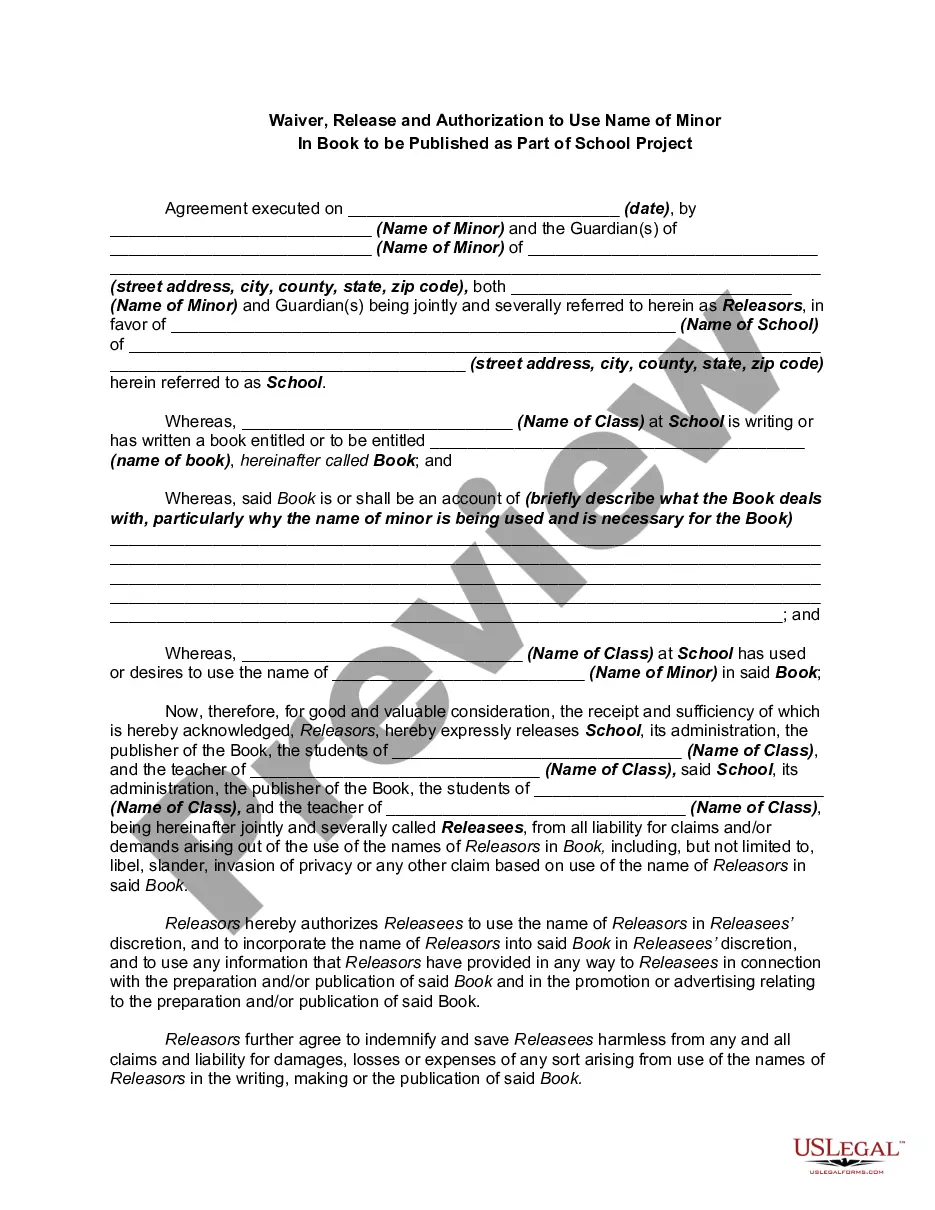

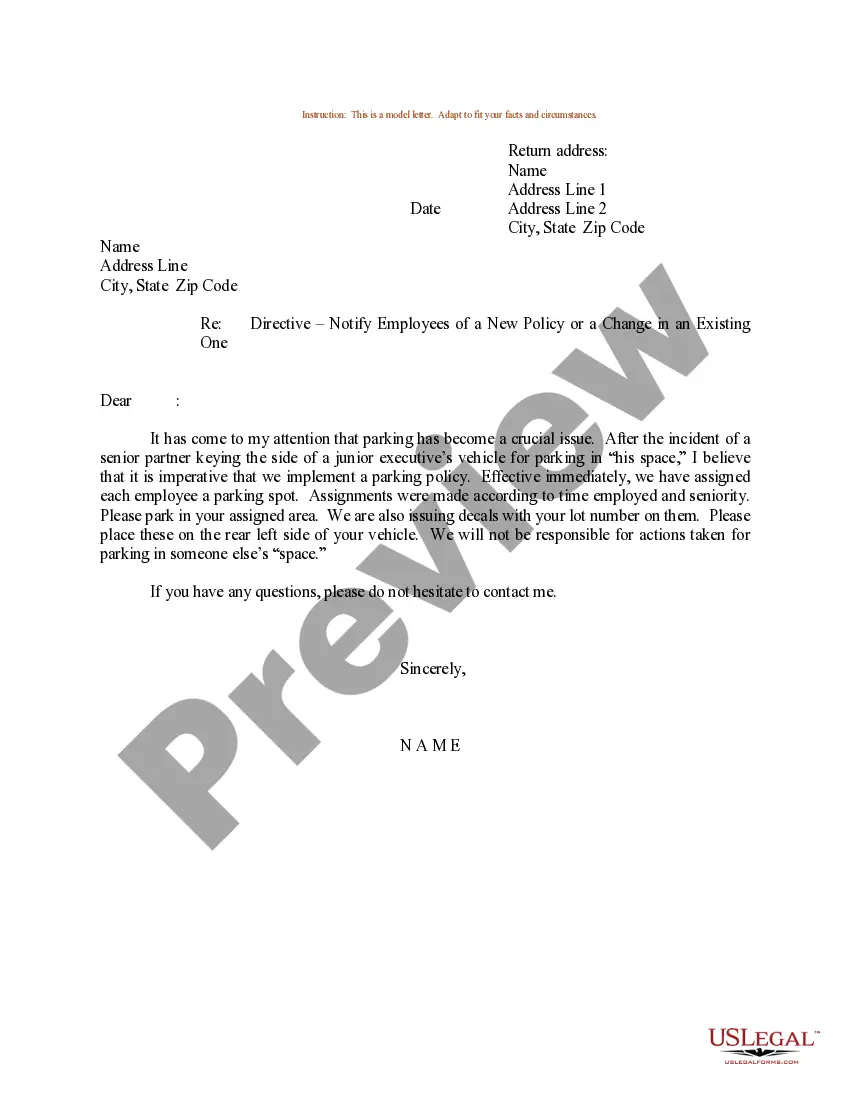

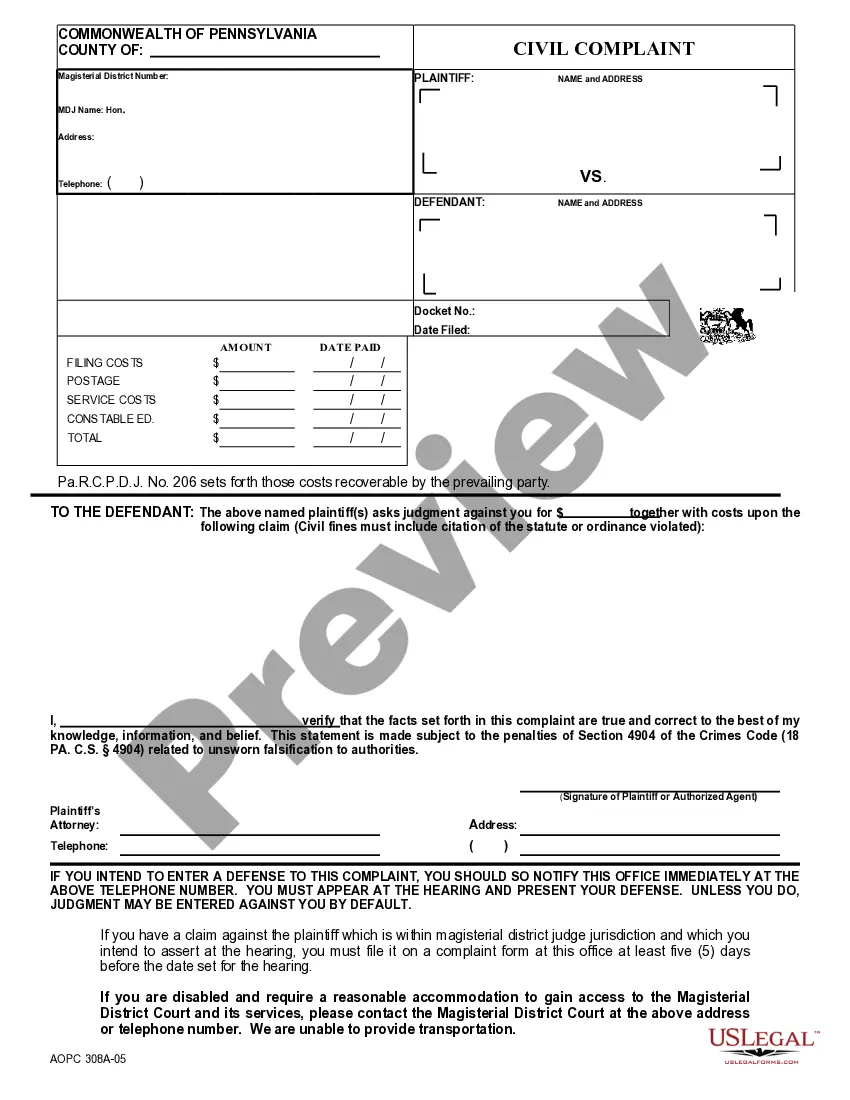

US Legal Forms offers a wide array of form templates, such as the Kansas Demand for Payment of Account by Business to Debtor, which can be generated to comply with federal and state regulations.

Once you locate the correct form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Kansas Demand for Payment of Account by Business to Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to inspect the form.

- Check the details to confirm that you have selected the right form.

- If the form does not match your requirements, use the Search field to find a form that suits your needs.

Form popularity

FAQ

What Is a Set-Off Clause? A set-off clause is a legal clause that gives a lender the authority to seize a debtor's deposits when they default on a loan. A set-off clause can also refer to a settlement of mutual debt between a creditor and a debtor through offsetting transaction claims.

200dThe Treasury Offset Program isn't suspended, but the IRS will wait until November 2022, before it offsets tax refunds for student loan debt owed to the Department of Education. If your money is taken for unpaid taxes, child-support, etc., you can try to get it back by requesting a tax refund offset reversal.

If the debtor does not show up at the hearing, the court may issue a bench warrant for the debtor's arrest. If the debtor shows up, you will have the chance to ask him or her questions about where he or she works and what bank accounts, property, belongings, stocks, or any other assets the debtor may have.

Timeframes for receiving and sending funds Typically, the state child support office that submitted the noncustodial parent's case for tax refund offset receives the funds within two to three weeks.

In every state, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest. And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables.

The Kansas Setoff Program collects monies by withholding money from State payments that are issued to individuals or businesses that owe a state agency, district court, municipality, or a foreign state agency.

Of course, that isn't without risk: if a borrower fails to make required payments, the lender can foreclose on the borrower's home. Unsecured loans can curtail extra expenses. If you take out a home or car loan, the lender will require that you carry insurance on the asset.

What Is a Notice of Intent to Offset? The Notice of Intent to Offset is telling you that you have taxes owed and the government is going to seize part or all of your federal payments. The IRS commonly offsets Federal tax refunds, but they can also take other types of federal payments as well.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.