Kansas Demand for Payment of an Open Account by Creditor

Description

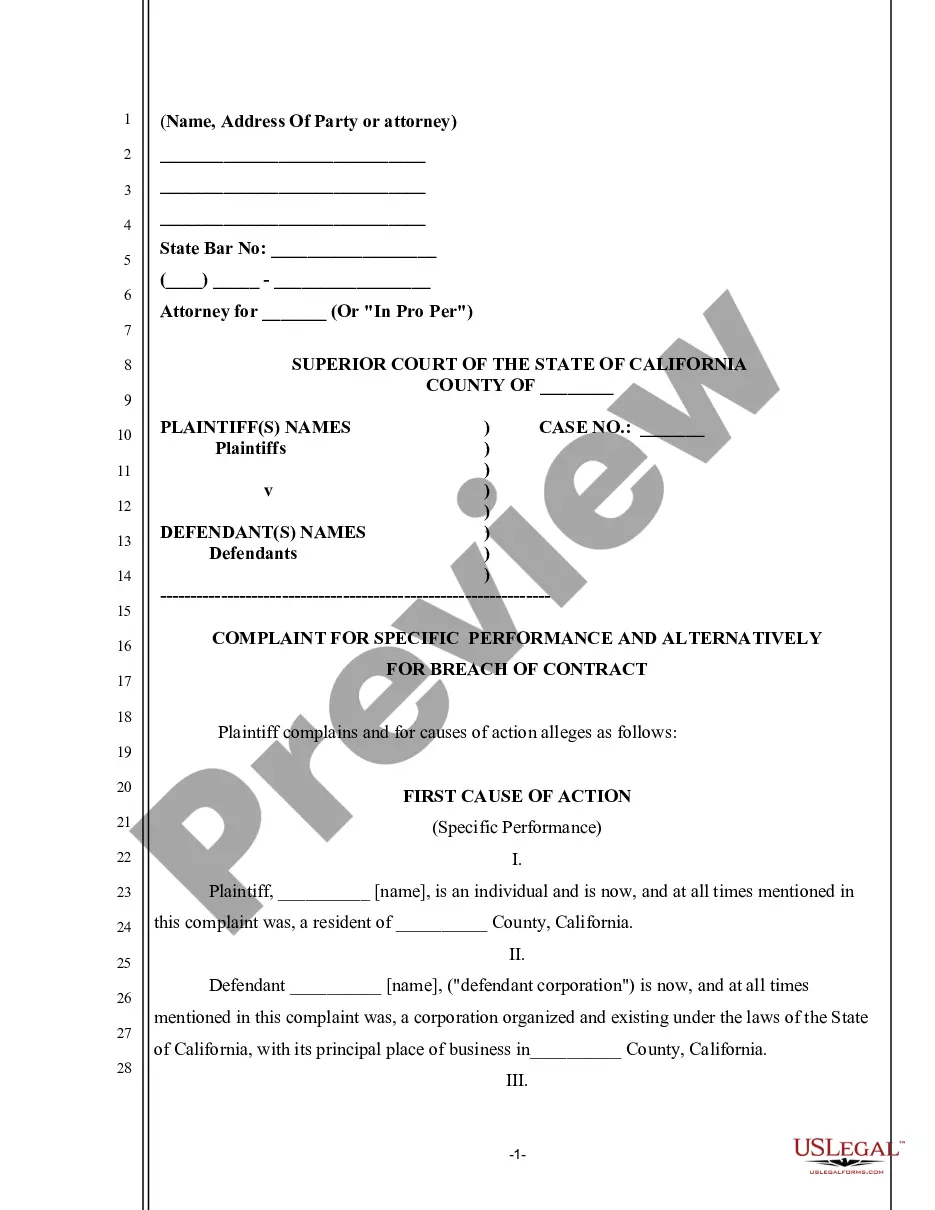

How to fill out Demand For Payment Of An Open Account By Creditor?

You are able to devote hours on-line attempting to find the lawful papers design which fits the federal and state demands you require. US Legal Forms supplies 1000s of lawful kinds which are examined by specialists. It is possible to acquire or printing the Kansas Demand for Payment of an Open Account by Creditor from the assistance.

If you currently have a US Legal Forms accounts, you can log in and click the Acquire key. Next, you can total, edit, printing, or signal the Kansas Demand for Payment of an Open Account by Creditor. Each and every lawful papers design you buy is your own property for a long time. To obtain yet another duplicate for any obtained kind, check out the My Forms tab and click the related key.

If you use the US Legal Forms site the first time, follow the straightforward directions below:

- Initial, be sure that you have selected the right papers design for your region/city of your choosing. Browse the kind explanation to ensure you have picked out the correct kind. If offered, use the Review key to search through the papers design as well.

- In order to discover yet another version of your kind, use the Lookup industry to find the design that meets your requirements and demands.

- Upon having located the design you want, click on Get now to move forward.

- Select the costs prepare you want, type your accreditations, and register for a free account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal accounts to fund the lawful kind.

- Select the format of your papers and acquire it to your system.

- Make modifications to your papers if possible. You are able to total, edit and signal and printing Kansas Demand for Payment of an Open Account by Creditor.

Acquire and printing 1000s of papers themes making use of the US Legal Forms site, that offers the biggest assortment of lawful kinds. Use specialist and status-particular themes to deal with your small business or specific needs.

Form popularity

FAQ

Medical Debt Statute of Limitations StateStatute of LimitationsKansas5 YearsKentucky10 YearsLouisiana10 YearsMaine6 Years45 more rows ?

When your available balance isn't enough to pay for an item and the bank elects to pay it anyway, that's an overdraft. And you may be charged a $29 fee for each overdraft.

Written agreements, promissory notes, or contracts have a statute of limitations period of five (5) years in Kansas. Implied, non-written, or expressed obligations or liabilities have a statute of limitations period of no more than three (3) years in the state of Kansas.

NSF fees are capped by state laws, which typically range from $20 to $40 per transaction.

Pursuant to Kansas law, you may require a fee of up to $30 for each check that is returned. The added fee must be paid, along with the full amount of the check, within seven days of receiving notice of the returned check.

FDCPA ? Fair Debt Collection Practices Act Prohibits third-party debt collectors from employing deceptive or abusive conduct in the collection of consumer debts incurred for personal, family or household purposes. This Act does not pertain to financial institutions that collect debt that they originated.

The bank sends the customer a message indicating that a check has been returned unpaid "due to non-sufficient funds" in the account. Depending on the bank, this fee can be between $25 and $40 for each bad check.

Because banks don't want you to overdraw your account, NSF fees are quite high?most Canadian financial institutions charge around $45 per transaction.