Rhode Island Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Choosing the right legal document format could be a battle. Naturally, there are plenty of layouts available on the Internet, but how can you discover the legal form you need? Make use of the US Legal Forms site. The services gives a large number of layouts, for example the Rhode Island Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), that you can use for organization and private requirements. All the varieties are inspected by experts and meet up with state and federal specifications.

Should you be previously listed, log in in your account and click on the Download option to find the Rhode Island Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). Make use of account to look through the legal varieties you might have acquired formerly. Visit the My Forms tab of your account and get an additional version of your document you need.

Should you be a new consumer of US Legal Forms, listed here are easy instructions so that you can follow:

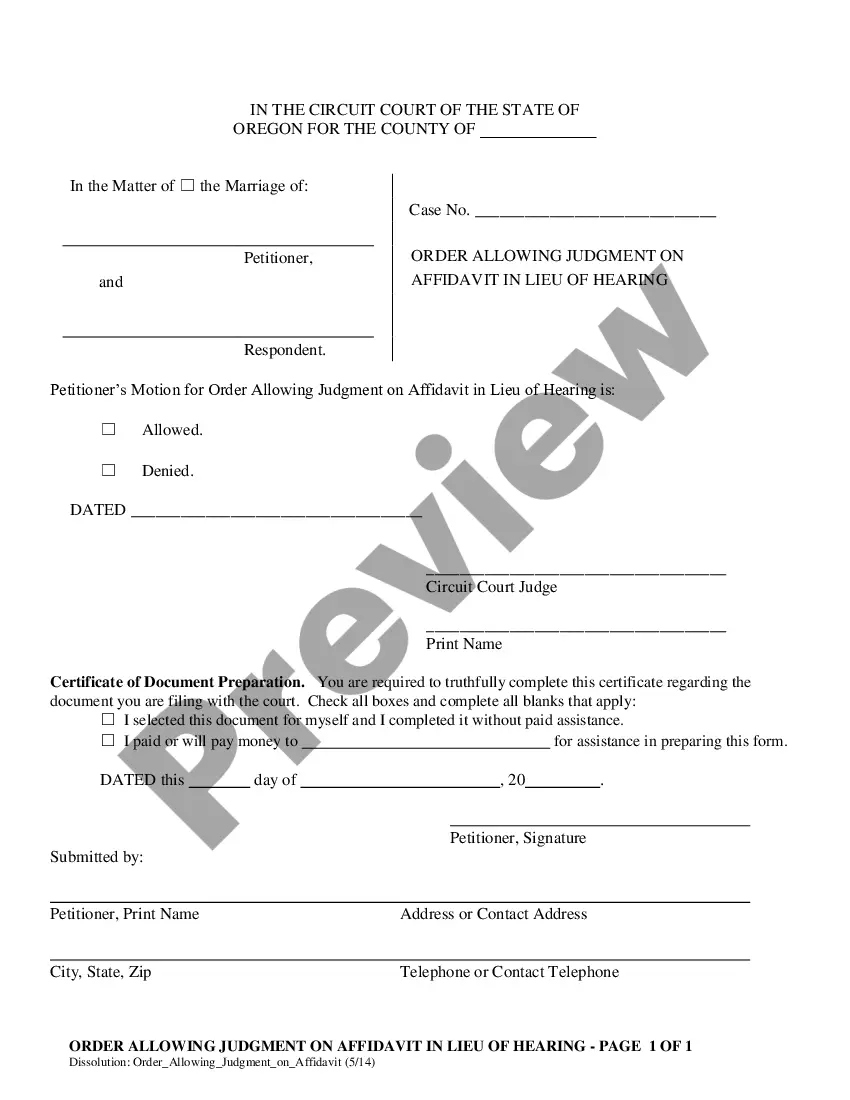

- Initial, ensure you have selected the proper form for your city/county. It is possible to look over the shape making use of the Review option and look at the shape information to make sure this is the right one for you.

- If the form does not meet up with your needs, make use of the Seach discipline to discover the appropriate form.

- Once you are certain that the shape is proper, go through the Get now option to find the form.

- Choose the rates prepare you would like and type in the essential info. Create your account and buy your order with your PayPal account or credit card.

- Opt for the data file format and download the legal document format in your gadget.

- Comprehensive, edit and print and signal the acquired Rhode Island Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

US Legal Forms is the most significant local library of legal varieties where you can see different document layouts. Make use of the company to download professionally-produced papers that follow state specifications.

Form popularity

FAQ

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

You may be responsible for repaying the entire amount of the check. While bank policies and state laws vary, you may have to pay the bank the entire amount of the fraudulent check that you cashed or deposited into your account. You may have to pay overdraft fees.

If payment is not made within thirty (30) days of this notice, you may be liable under 6-42- 3 of Rhode Island Commercial Law, in addition to the amount of the check, a collection fee of $25.00, and up to three (3) times the amount of the check, but in no case less than $200.00 and not more than $1000.00.

If You Receive a Bad Check The bank will reverse it from your account when a check written to you bounces so you'll see a debit for the same amount of the written check. You'll probably end up with an overdraft if you've already spent the money.

Rhode Island Civil Statute of Limitations: At a Glance The state of Rhode Island imposes a three-year limit for personal injury, professional malpractice (including medical), and product liability. Fraud and injury to property all carry a 10-year limit.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

When you cash or deposit a check and there's not enough funds to cover it in the account it's drawn on, this is also considered non-sufficient funds (NSF). When a check is returned for NSF in this manner, the check is generally returned back to you. This allows you to redeposit the check at a later time, if available.

Writing a bad check is a crime if the check writer knew that there were insufficient funds to cover the check and intended to defraud you. It is also a crime to forge a check or write a check.