Rhode Island Computer Software License Agreement and Data Base Update Agreement

Description

How to fill out Computer Software License Agreement And Data Base Update Agreement?

Are you presently located in a location where you frequently require documents for potential business or personal purposes.

There are numerous legal document templates available online, but finding reliable forms isn’t easy.

US Legal Forms offers thousands of document templates, including the Rhode Island Software License Agreement and Database Update Agreement, designed to meet federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Rhode Island Software License Agreement and Database Update Agreement anytime, if needed. Just click on the desired template to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Rhode Island Software License Agreement and Database Update Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the template you need and verify that it pertains to the correct region/area.

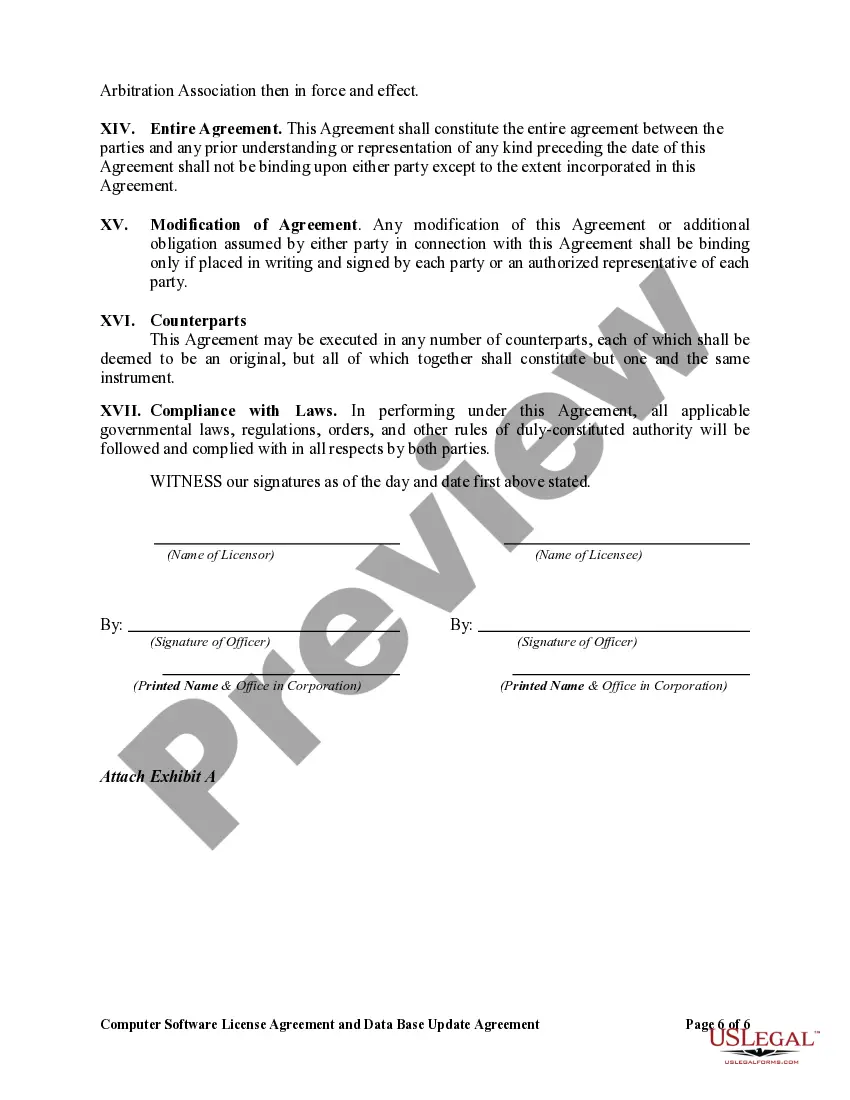

- Use the Preview button to view the document.

- Check the details to ensure that you have selected the correct template.

- If the template isn’t what you're looking for, utilize the Search area to find the template that suits your needs.

- If you locate the correct template, simply click Buy now.

- Choose the payment plan you want, provide the required information to create your account, and complete your purchase using your PayPal or credit card.

Form popularity

FAQ

You should carefully review the end user license agreement before accepting it. This agreement contains critical information regarding your rights, software limitations, and any responsibilities you might have. When dealing with the Rhode Island Computer Software License Agreement and Data Base Update Agreement, understanding these terms can protect you from potential legal issues in the future.

An SLA, or Service Level Agreement, focuses on the expected level of service between a provider and a client, while a EULA, or End User License Agreement, governs the use of software by the end user. Understanding these differences helps clarify your rights and obligations. When entering a Rhode Island Computer Software License Agreement and Data Base Update Agreement, both components may be relevant, depending on your needs.

The Intel software license agreement is a specific contract that governs the use of Intel software products. It outlines the terms, conditions, and restrictions associated with using Intel's software solutions. For users engaged with a Rhode Island Computer Software License Agreement and Data Base Update Agreement, ensuring compatibility with other agreements, such as those from major providers like Intel, is vital.

The purpose of a software license is to protect the rights of the software creator while giving users specific permissions to use the software. In essence, it defines the terms under which you can operate the software, thus preventing misuse. With the Rhode Island Computer Software License Agreement and Data Base Update Agreement, users gain access to essential software features legally and securely.

A software license agreement is a legal contract between a software provider and the user. This document outlines how the software can be used, the rights and obligations of both parties, and any limitations. In the context of the Rhode Island Computer Software License Agreement and Data Base Update Agreement, it ensures compliance with state laws while providing clarity on software utilization.

As of now, the sales tax rate in Rhode Island is set at 7%. This rate applies to most purchases; however, be aware of specific exemptions. For businesses navigating contracts such as the Rhode Island Computer Software License Agreement and Data Base Update Agreement, understanding the sales tax implications can greatly impact financial planning.

Registering for sales tax in Rhode Island is a straightforward process. You can complete the registration online through the Rhode Island Division of Taxation's website. Ensuring that you are registered is key for businesses dealing with contracts like the Rhode Island Computer Software License Agreement and Data Base Update Agreement.

Yes, if your business sells taxable goods or services in the U.S., you must register for sales tax. This registration informs the state of your activities and your obligation to collect tax. If you operate using the Rhode Island Computer Software License Agreement and Data Base Update Agreement, make sure to keep track of your sales tax responsibilities.

Tax sales in Rhode Island involve the sale of properties due to unpaid taxes. The state holds an auction where properties are sold to cover tax debts. For businesses involved in real estate or contracts like the Rhode Island Computer Software License Agreement and Data Base Update Agreement, understanding tax sales can be critical to ensure compliance and protect assets.

To acquire a sales tax permit in Rhode Island, you must register with the Rhode Island Division of Taxation. This can typically be done online through their official website. Securing this permit is essential for businesses that sell products or services, including those involving a Rhode Island Computer Software License Agreement and Data Base Update Agreement.