Rhode Island Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

If you aim to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents, which is accessible online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require. Various templates for business and personal purposes are organized by categories and claims, or keywords.

Use US Legal Forms to obtain the Rhode Island Software License Subscription Agreement with just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

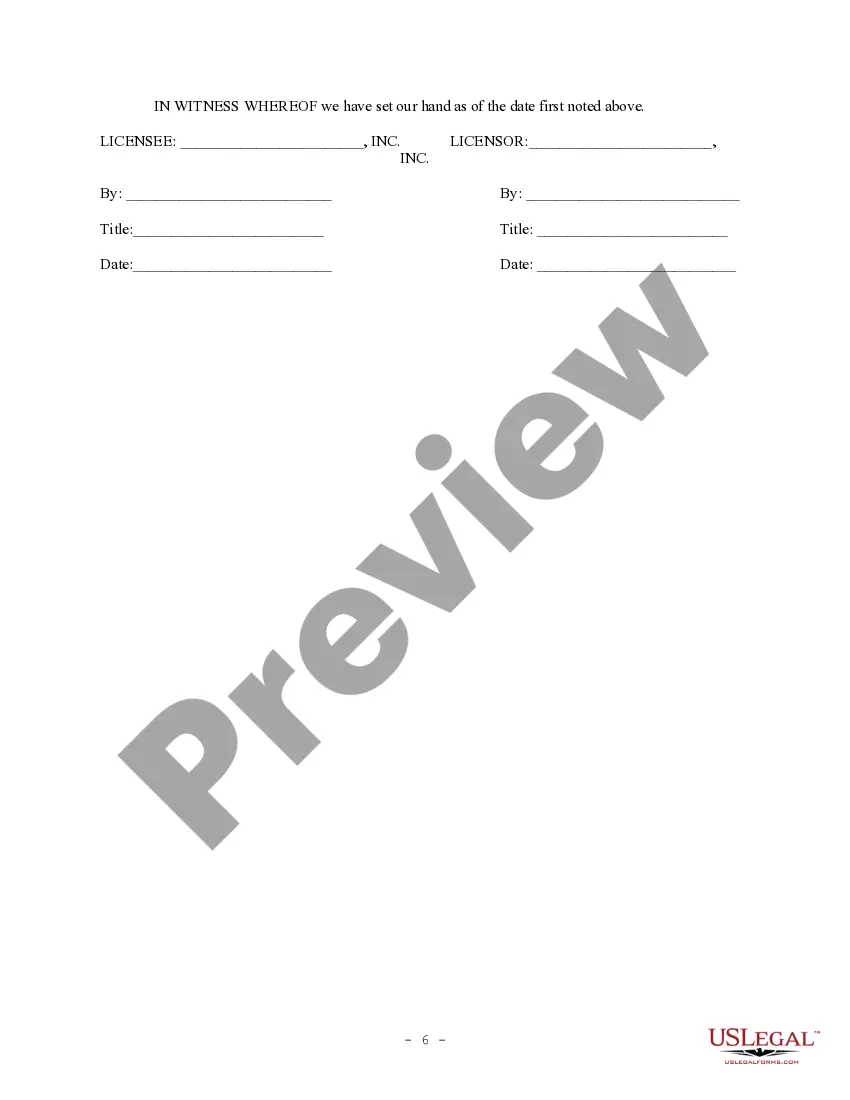

Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Rhode Island Software License Subscription Agreement. Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again. Complete and download, and print the Rhode Island Software License Subscription Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to find the Rhode Island Software License Subscription Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to examine the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, a subscription agreement is legally binding once both parties agree to its terms. This means that both the software provider and the user must adhere to the outlined conditions. In the context of a Rhode Island Software License Subscription Agreement, it is essential to understand your commitments to avoid any potential legal issues down the line.

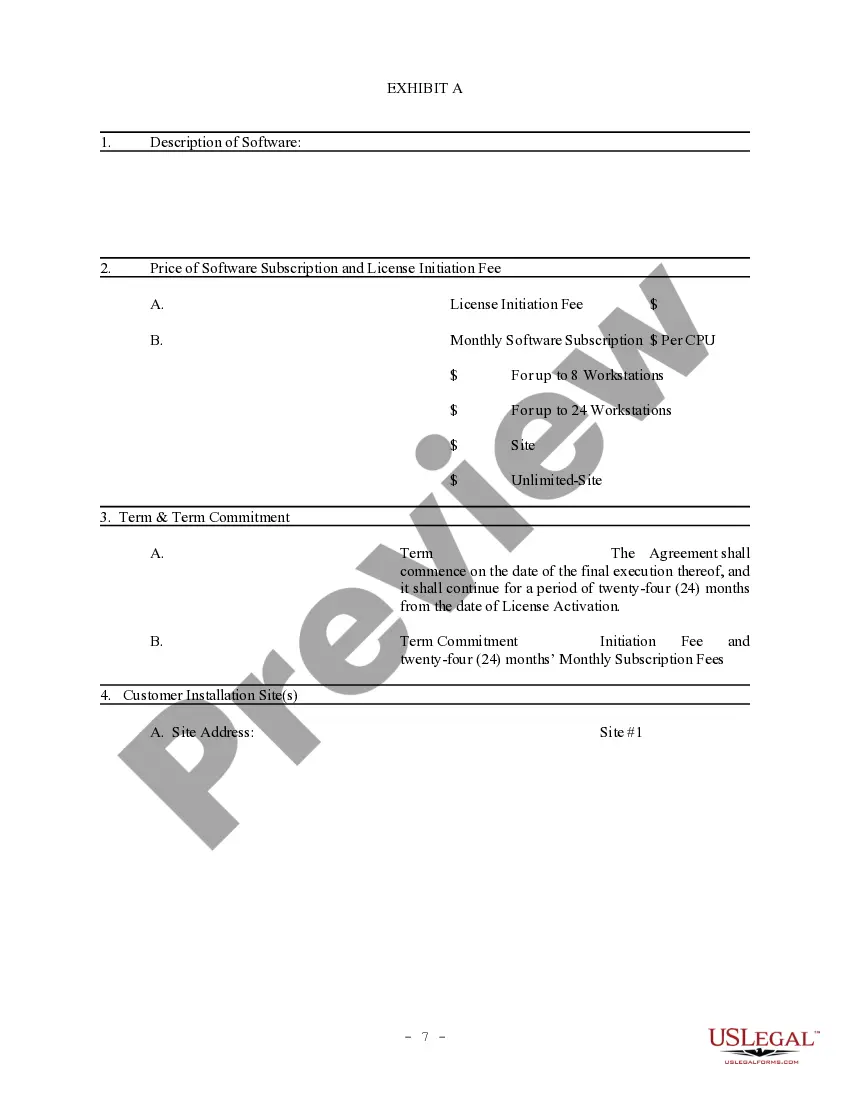

A software licensing agreement is a legal document that outlines the terms under which a user can access and use a software product. It defines the rights and responsibilities of both the software provider and the user. When it comes to a Rhode Island Software License Subscription Agreement, this document ensures clarity on subscription terms, usage rights, and any limitations.

A term license grants users access to software for a defined period, typically with a one-time payment. In contrast, a subscription license, as seen in a Rhode Island Software License Subscription Agreement, requires ongoing payments, often monthly or annually, to maintain access. This means subscribers receive continuous updates and support, enhancing the overall user experience.

A subscription agreement allows users to access software for a specified period in exchange for regular payments. This arrangement offers flexibility, as users can benefit from the latest updates and features without upfront costs. For those interested in a Rhode Island Software License Subscription Agreement, it ensures you have a clear understanding of your rights and obligations.

Rhode Island exempts certain items from sales tax, including most food products, prescription medications, and some medical devices. Additionally, specific services may also fall outside the taxable category. If you are unsure whether your Rhode Island Software License Subscription Agreement includes taxable items, consider consulting resources like uslegalforms to clarify your obligations and rights.

Software can be subject to tax depending on its nature and how it is delivered. In many cases, off-the-shelf software and software as a service (SaaS) fall under taxable categories in Rhode Island. When you engage in a Rhode Island Software License Subscription Agreement, be sure to review the tax obligations associated with your software to remain compliant.

Yes, Rhode Island requires general contractors to obtain a license if their work exceeds $1,000. This requirement applies to all types of construction projects, ensuring that contractors meet specific standards. If your business operates under a Rhode Island Software License Subscription Agreement and involves construction-related software, you must ensure compliance with licensing regulations to avoid penalties.

Yes, Rhode Island imposes sales tax on the sale of tangible personal property and certain services, including software. However, the tax treatment may vary for different types of software, such as custom versus standard products. When entering a Rhode Island Software License Subscription Agreement, it’s vital to understand how sales tax will apply to your subscription to avoid unexpected costs.

A RI 1065 is required for partnerships operating in Rhode Island, including multi-member LLCs taxed as partnerships. If your business enters into a Rhode Island Software License Subscription Agreement, and you have multiple partners, you'll need to file this form to report income and expenses. This filing ensures that all partners are properly accounted for in the state's tax system.

In Massachusetts, the sale of computer software is generally subject to sales tax. However, the tax applies differently based on whether the software is purchased as a tangible product or accessed via a subscription model. When considering a Rhode Island Software License Subscription Agreement, it's essential to understand the tax implications in your state to ensure compliance with local regulations.