Rhode Island Software Program License Agreement

Description

How to fill out Software Program License Agreement?

Are you situated in an environment where you regularly require documents for both professional and personal purposes almost every day.

There are numerous valid document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a wide array of form templates, such as the Rhode Island Software Program License Agreement, designed to meet state and federal requirements.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Software Program License Agreement at any time if needed. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Rhode Island Software Program License Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct region/county.

- Use the Preview button to review the template.

- Check the description to verify that you have selected the correct form.

- If the form does not match your needs, utilize the Search box to locate a form that suits your requirements.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you desire, complete the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

Form popularity

FAQ

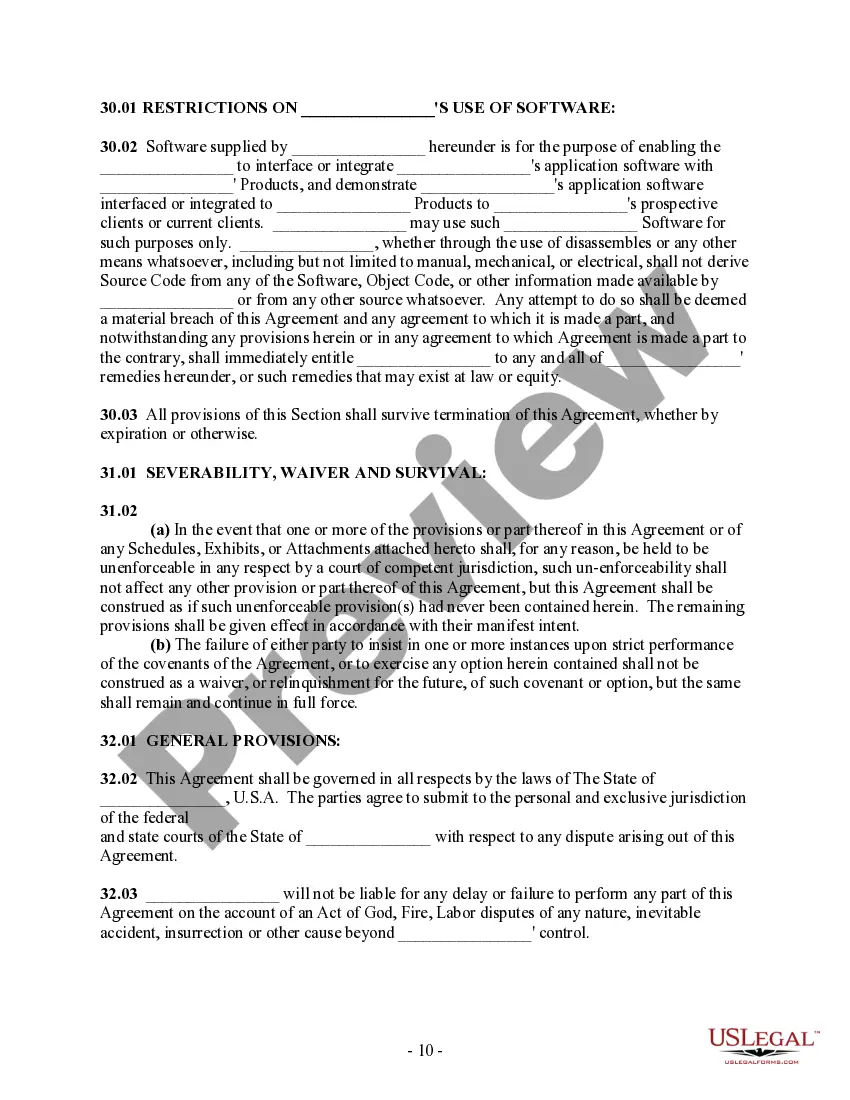

A software licensing agreement is a legal contract between a software developer and the end user. This agreement outlines how you can use the software, its limitations, and your rights as a user. When considering a Rhode Island Software Program License Agreement, it's important to understand the terms that dictate how you can access, install, and operate the software. This agreement helps protect both the creator's intellectual property and your rights as a consumer.

Yes, Rhode Island has implemented an e-file mandate for certain legal documents. This means that many documents must be filed electronically, which streamlines the process and enhances efficiency. By utilizing the Rhode Island Software Program License Agreement, users can ensure they are compliant with the e-filing requirements. Moreover, our platform provides tools and templates that facilitate the e-filing process, making it easier for you to meet these mandates.

In Rhode Island, you need to establish residency for a minimum of one year to be recognized as a resident for most purposes. This includes registering to vote, applying for in-state tuition, or receiving state benefits. Having a permanent address and maintaining a physical presence in the state during this time is also important. Understanding your residency status can impact your compliance with a Rhode Island Software Program License Agreement.

To establish an LLC in Rhode Island, you need to file the Articles of Organization with the Secretary of State. You must provide the name of your LLC, the registered agent's address, and the purpose of your business. Additionally, obtaining an Employer Identification Number (EIN) from the IRS is essential for tax purposes. Using a Rhode Island Software Program License Agreement ensures that your business operations comply with state laws, offering peace of mind.

An operating agreement in Rhode Island outlines the management structure and operational guidelines for a business entity, such as an LLC. This document is crucial for defining the roles of members, handling profit distribution, and complying with the Rhode Island Software Program License Agreement. A well-crafted operating agreement can prevent disputes and enhance business efficiency. You can find useful templates and information on the US Legal Forms platform to create your operating agreement.

Yes, a business license is often required in Rhode Island, depending on the type of business you plan to operate. It's essential to check local regulations and ensure compliance with the Rhode Island Software Program License Agreement. This step helps protect your business and fosters a smooth operational process. For comprehensive guidance, the US Legal Forms platform offers insightful resources for obtaining your business license.

The minimum tax for Rhode Island 1065 is subject to regulations from the state's Department of Revenue. It typically varies based on the income of the business partnership. Understanding the nuances of the Rhode Island Software Program License Agreement can help you navigate tax obligations effectively. For tailored assistance, consider using the resources available on the US Legal Forms platform.