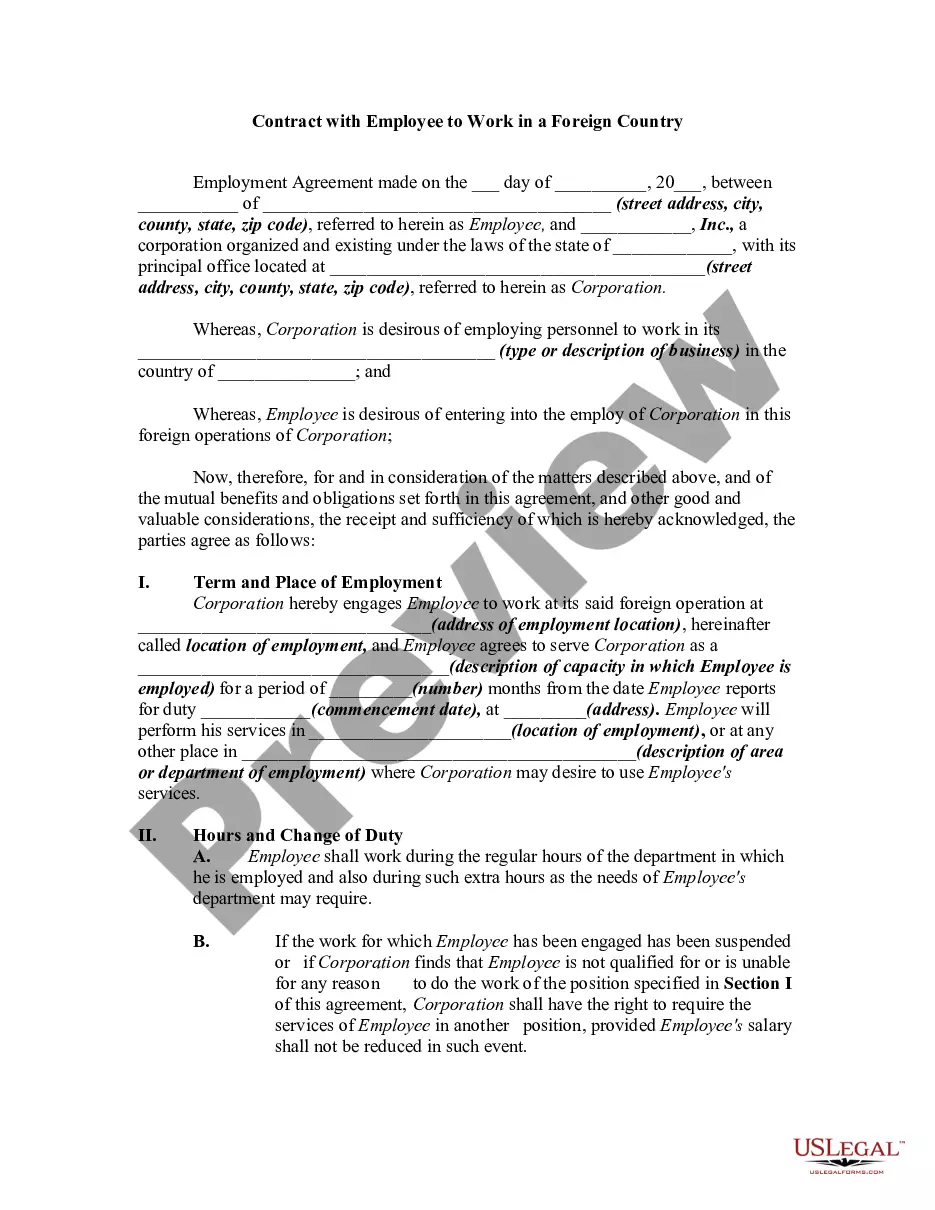

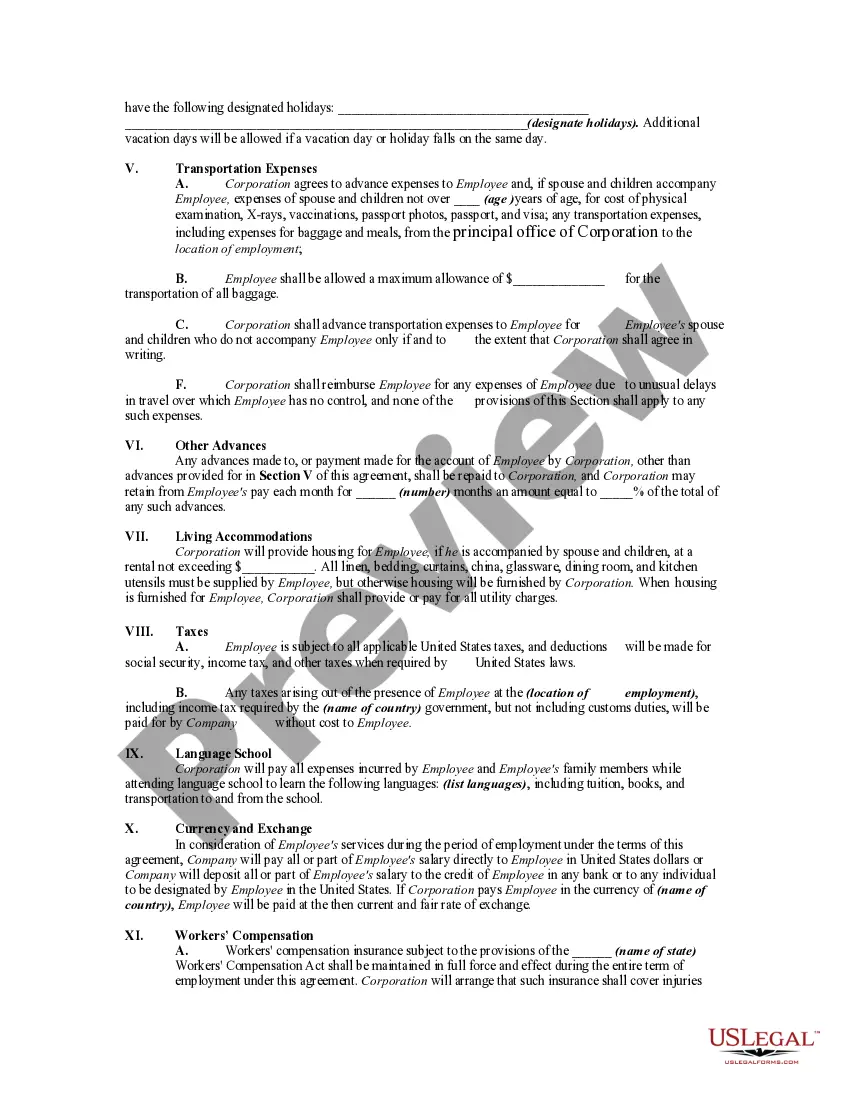

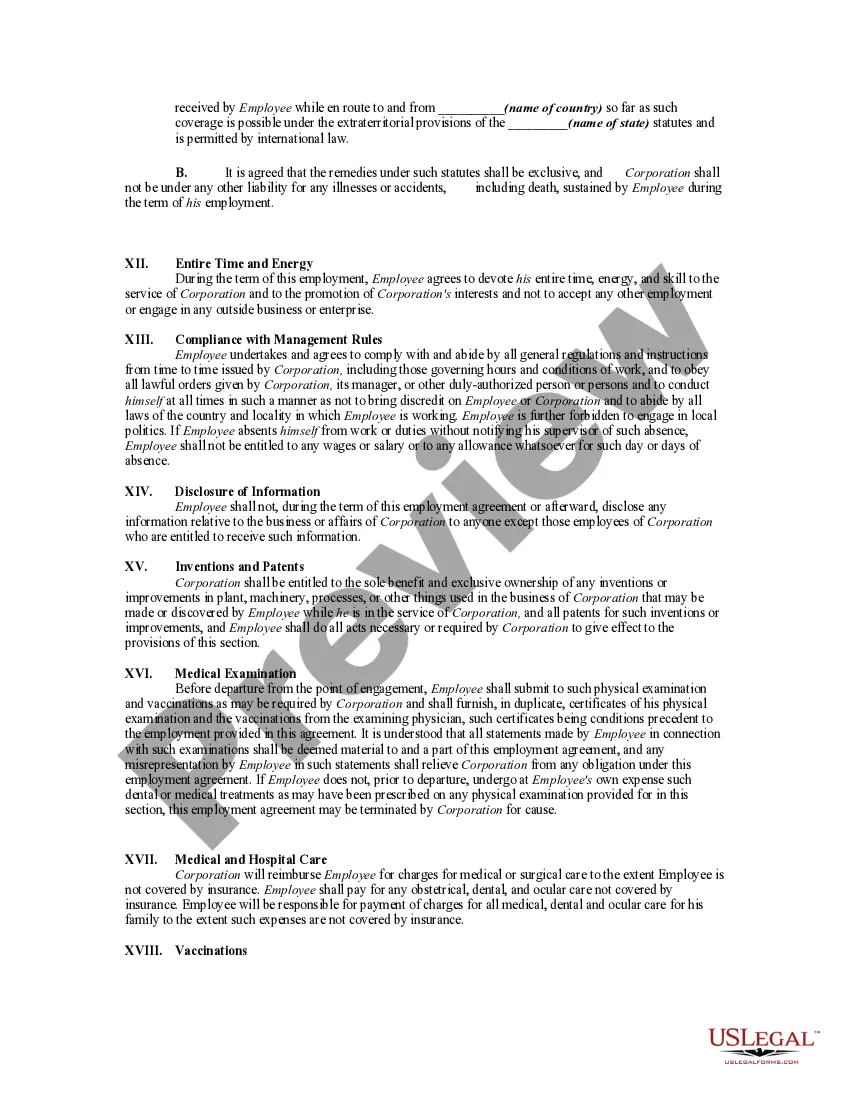

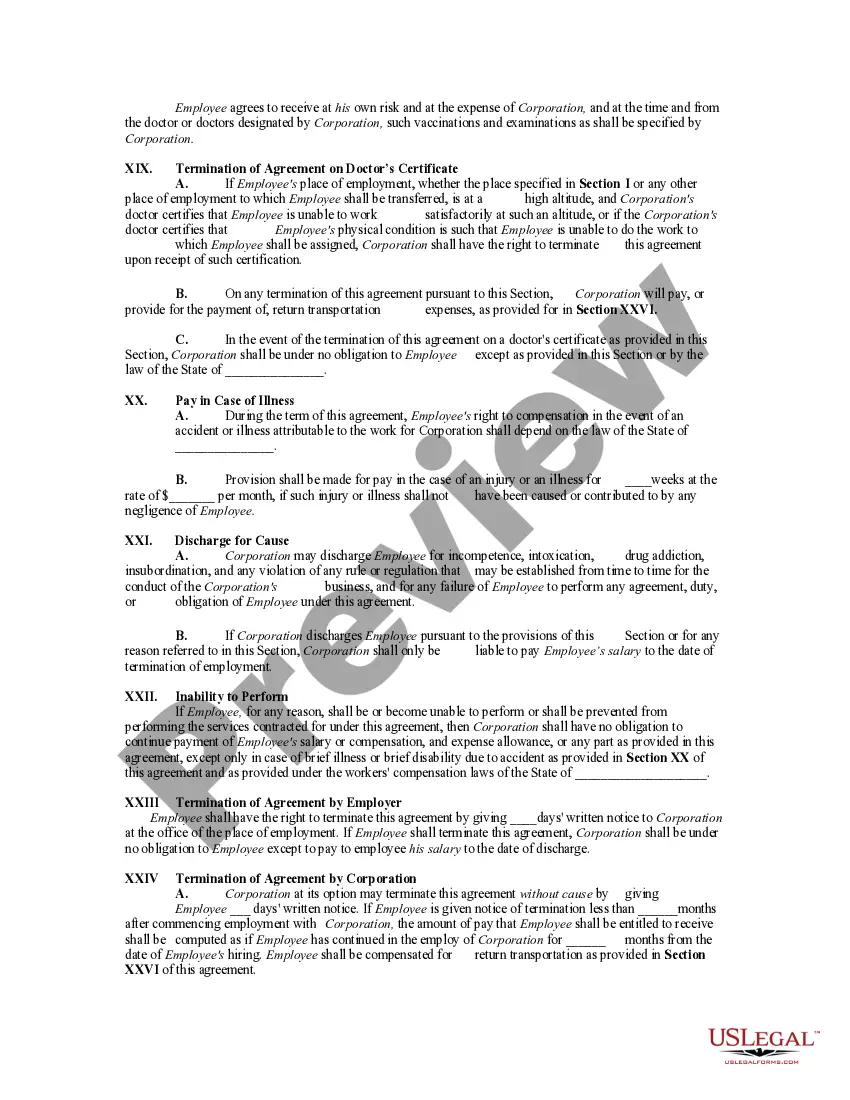

Rhode Island Contract with Employee to Work in a Foreign Country

Description

How to fill out Contract With Employee To Work In A Foreign Country?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or create.

By using the website, you can discover thousands of forms for both commercial and personal use, categorized by topics, states, or keywords.

You can access the most recent versions of forms like the Rhode Island Contract with Employee to Work in a Foreign Country in just moments.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

Once satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- If you already have an account, Log In to retrieve the Rhode Island Contract with Employee to Work in a Foreign Country from the US Legal Forms database.

- The Download button will be available for each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure to select the appropriate form for your state/area.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

In Bergen County, New Jersey, certain restrictions on Sunday sales remain in place due to local blue laws. Generally, retail stores cannot sell clothing, shoes, or household items on Sundays. If your business involves a Rhode Island Contract with Employee to Work in a Foreign Country, understanding the local laws in different states, like Bergen County's regulations, will help you navigate operational challenges.

Rhode Island does not follow a use it or lose it policy regarding vacation time. Employees have the right to carry over their unused vacation days, provided that their employer's policy allows it. When drafting a Rhode Island Contract with Employee to Work in a Foreign Country, it is crucial to clearly outline vacation policies to avoid confusion and ensure both parties understand their rights.

Blue laws, which restrict certain activities on specific days, still exist in some parts of the US. While many states have relaxed these regulations, certain areas may still enforce laws that limit retail activities on Sundays. For individuals considering a Rhode Island Contract with Employee to Work in a Foreign Country, it’s essential to understand local laws and regulations, including any potentially applicable blue laws.

The break law in Rhode Island ensures that employees receive adequate time for rest during their work shifts. Under this law, employees must receive a 30-minute break if they work a shift of more than 6 hours. This law helps maintain a healthy work-life balance, which can be especially vital for those involved in a Rhode Island Contract with Employee to Work in a Foreign Country.

Rhode Island is not generally seen as tax-friendly, especially for individuals with higher incomes. The state's tax structure can lead to higher tax burdens compared to other states. If you are entering into a Rhode Island Contract with Employee to Work in a Foreign Country, you should carefully analyze the tax implications. For assistance, uslegalforms can help you navigate contract details and ensure you understand your tax responsibilities.

Yes, you can work for a US employer while residing in a different country. However, doing so can create complex tax situations, particularly regarding a Rhode Island Contract with Employee to Work in a Foreign Country. It’s crucial to review international tax laws and discuss your situation with a tax expert to ensure compliance and avoid surprises.

Self-employment tax in Rhode Island consists of both Social Security and Medicare taxes, which total approximately 15.3%. This tax applies to net earnings from self-employment. If you are operating under a Rhode Island Contract with Employee to Work in a Foreign Country, being aware of these tax implications is crucial. You may want to use platforms like uslegalforms to draft compliant contracts that take these factors into account.

Yes, Rhode Island does tax remote workers, regardless of where the work is performed, as long as you are a resident. Your income can be subject to state income tax, which includes wages earned through a Rhode Island Contract with Employee to Work in a Foreign Country. It's essential to be aware of your tax obligations, especially when working from a different country.

Rhode Island is often considered a high tax state, particularly when compared to other regions. The state's income tax rates can be relatively high, with a maximum rate reaching up to 5.99%. Additionally, you may need to consider how a Rhode Island Contract with Employee to Work in a Foreign Country could be impacted by state tax rules. For clarity on your specific situation, consider consulting a tax professional.

US employment laws might apply to employees working overseas, especially if the employer maintains a significant connection to the U.S. corporate structure. Businesses creating a Rhode Island Contract with Employee to Work in a Foreign Country should familiarize themselves with both US and foreign labor laws to ensure compliance and protect both the company and its employees.