Rhode Island Corporation - Consent by Shareholders

Description

How to fill out Corporation - Consent By Shareholders?

Have you ever found yourself in a scenario where you require documents for both business or individual tasks nearly every workday? There's an abundance of legal document templates available online, but finding reliable versions isn't easy.

US Legal Forms offers thousands of template documents, such as the Rhode Island Corporation - Consent by Shareholders, which are designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Subsequently, you can download the Rhode Island Corporation - Consent by Shareholders template.

- Look for the form you require and confirm it is for the appropriate city/state.

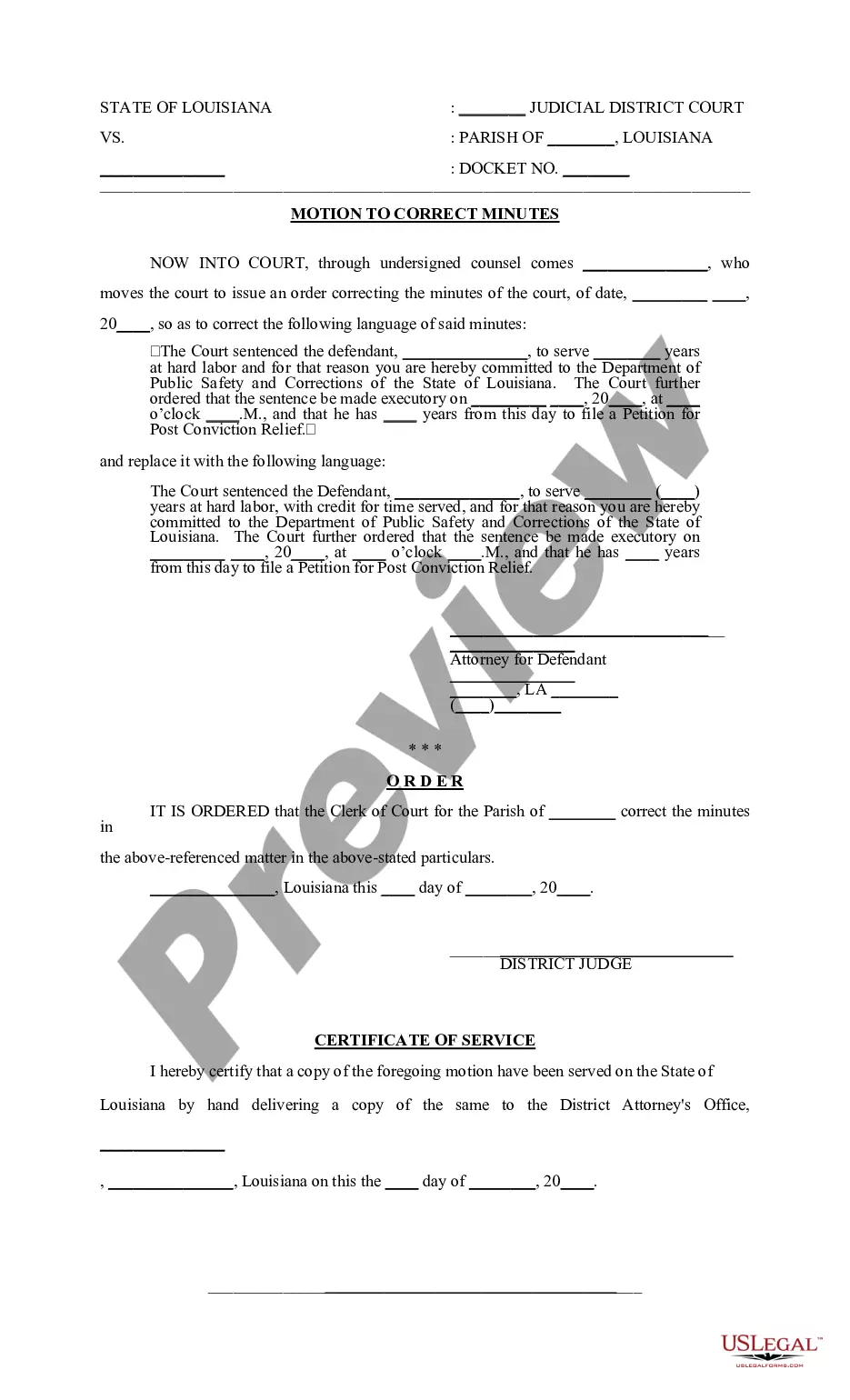

- Use the Review button to inspect the form.

- Check the summary to ensure you have selected the right form.

- If the form isn’t what you're looking for, utilize the Search section to find the form that suits your needs and criteria.

- Once you find the correct form, click Get now.

- Choose the payment plan you prefer, complete the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

To get a DBA (Doing Business As) in Rhode Island, you must file the appropriate paperwork with the state. This involves selecting a unique business name and completing the DBA application, which can often be done online or by mail. A DBA is essential if you want to operate under a name different from your legal business name. With a Rhode Island Corporation - Consent by Shareholders, filing a DBA is a straightforward process that UsLegalForms can assist with to ensure compliance.

Typically, registering a business in Rhode Island can take anywhere from a few days to a few weeks. Factors such as the type of business entity and the completeness of your application can influence the timeline. Opting for a Rhode Island Corporation - Consent by Shareholders can streamline the process, making it easier for you to get your business up and running. Using platforms like UsLegalForms can help you expedite filing and ensure all documents are correctly submitted.

You may need to register your business in another state if you are planning to operate there. Each state has its own laws and requirements, so a Rhode Island Corporation - Consent by Shareholders may need to be registered elsewhere for compliance. If your business will be conducting operations outside Rhode Island, consider checking specific requirements in the states you plan to expand into. Proper registration helps you avoid legal problems.

If your business is not registered, you may face significant legal consequences. Operating unregistered can result in fines or penalties, and your personal assets might be at risk if legal issues arise. A registered Rhode Island Corporation - Consent by Shareholders separates personal and business liabilities, offering essential protections. By taking prompt action to register, you enhance your legitimacy and protect your interests.

Yes, you need to register your business in Rhode Island to operate legally. This registration helps ensure that your Rhode Island Corporation - Consent by Shareholders complies with local laws. By registering, you also gain access to essential protections and benefits that come with establishing a recognized business entity. Additionally,it's a vital step to avoid potential legal issues down the line.

Incorporating in Rhode Island involves filing your Articles of Incorporation with the Secretary of State and paying the necessary fees. You must also create bylaws and appoint a registered agent. Using a service like US Legal Forms can simplify the incorporation process by providing the required forms and straightforward instructions. This will help you efficiently set up your Rhode Island Corporation - Consent by Shareholders.

After taxes, $100,000 in Rhode Island typically results in about $72,000 to $75,000, depending on your specific tax situation, deductions, and credits. Rhode Island has a progressive tax system, so your effective tax rate may vary based on other income. Understanding your tax implications is essential for planning your business finances and ensuring the sustainability of your Rhode Island Corporation - Consent by Shareholders.

Rhode Island offers a unique blend of opportunities for small businesses due to its strategic location and supportive local government. The state provides various resources, including business grants and mentorship programs designed to help startups thrive. If you are considering forming a new company, look into creating a Rhode Island Corporation - Consent by Shareholders, which can provide additional benefits.

Closing an LLC in Rhode Island requires you to file a formal dissolution with the Secretary of State. You also need to settle any outstanding debts and notify your members and creditors. After you take care of these steps, make sure to file the Articles of Dissolution. Following these guidelines helps ensure that you properly wind down your Rhode Island Corporation - Consent by Shareholders without complications.

To start an S Corp in Rhode Island, you first need to incorporate your business as a corporation by filing Articles of Incorporation. After that, you must file Form 2553 with the IRS to elect S Corporation status. This process can be streamlined by using platforms like US Legal Forms, which provide templates and guidance to help ensure compliance. This allows you to focus more on the operational aspects of your Rhode Island Corporation - Consent by Shareholders.