Rhode Island Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

Are you in a situation where you require documents for either business or personal use almost every day.

There are numerous legal document templates accessible online, but finding reliable versions is not easy.

US Legal Forms offers a vast array of form templates, including the Rhode Island Consulting Agreement - with Former Shareholder, tailored to comply with federal and state requirements.

Take advantage of US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that you can utilize for various uses. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and hold an account, simply Log In.

- After that, you can download the Rhode Island Consulting Agreement - with Former Shareholder template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm that it is for the correct area/county.

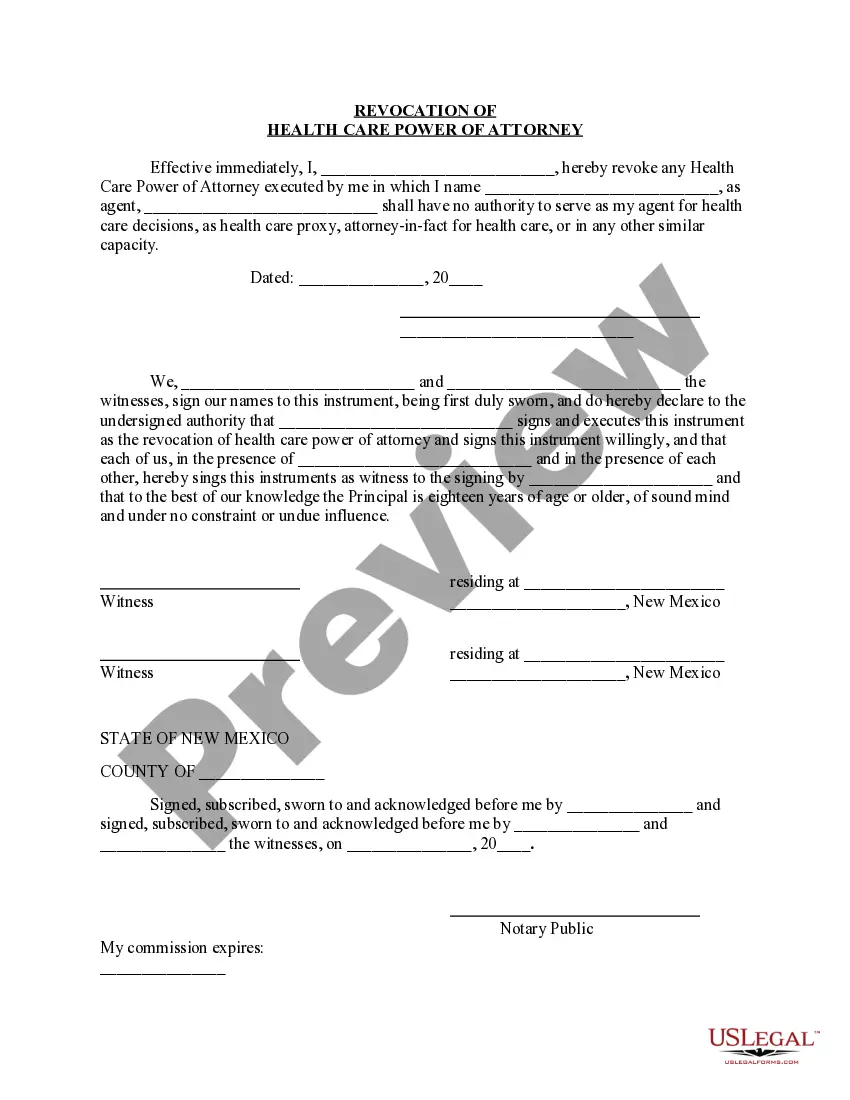

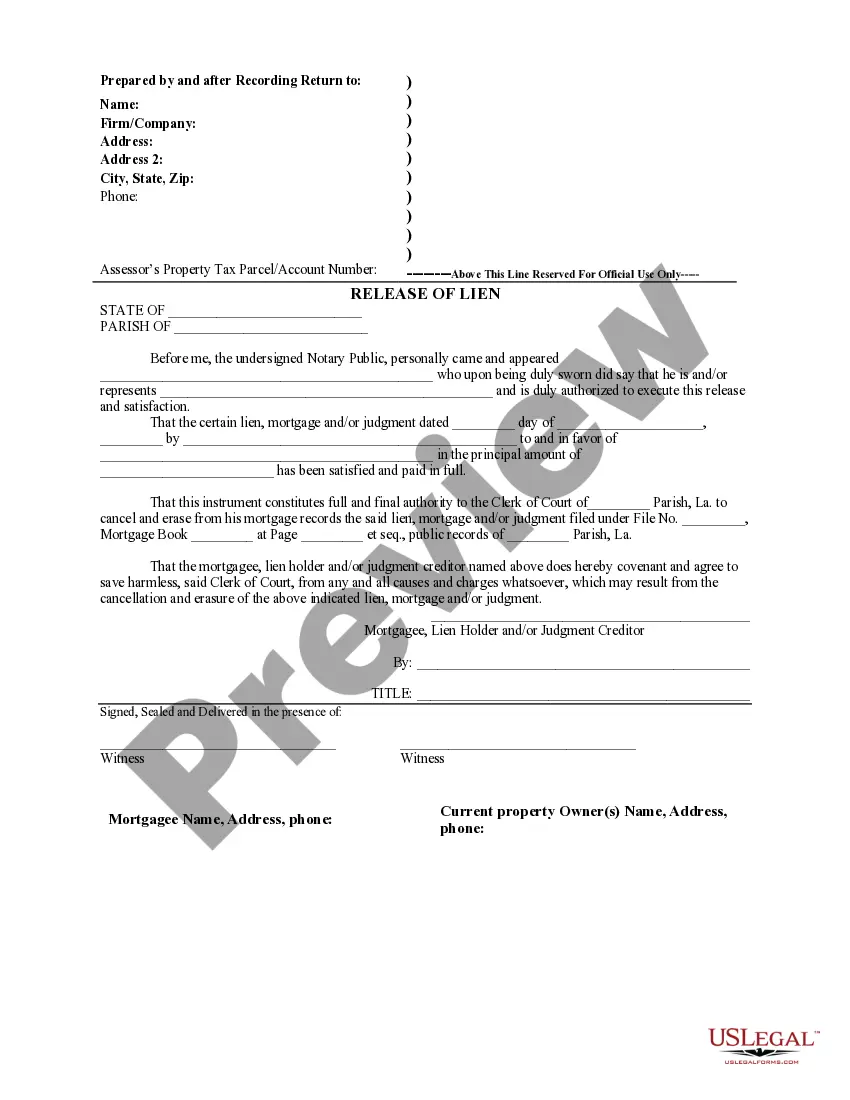

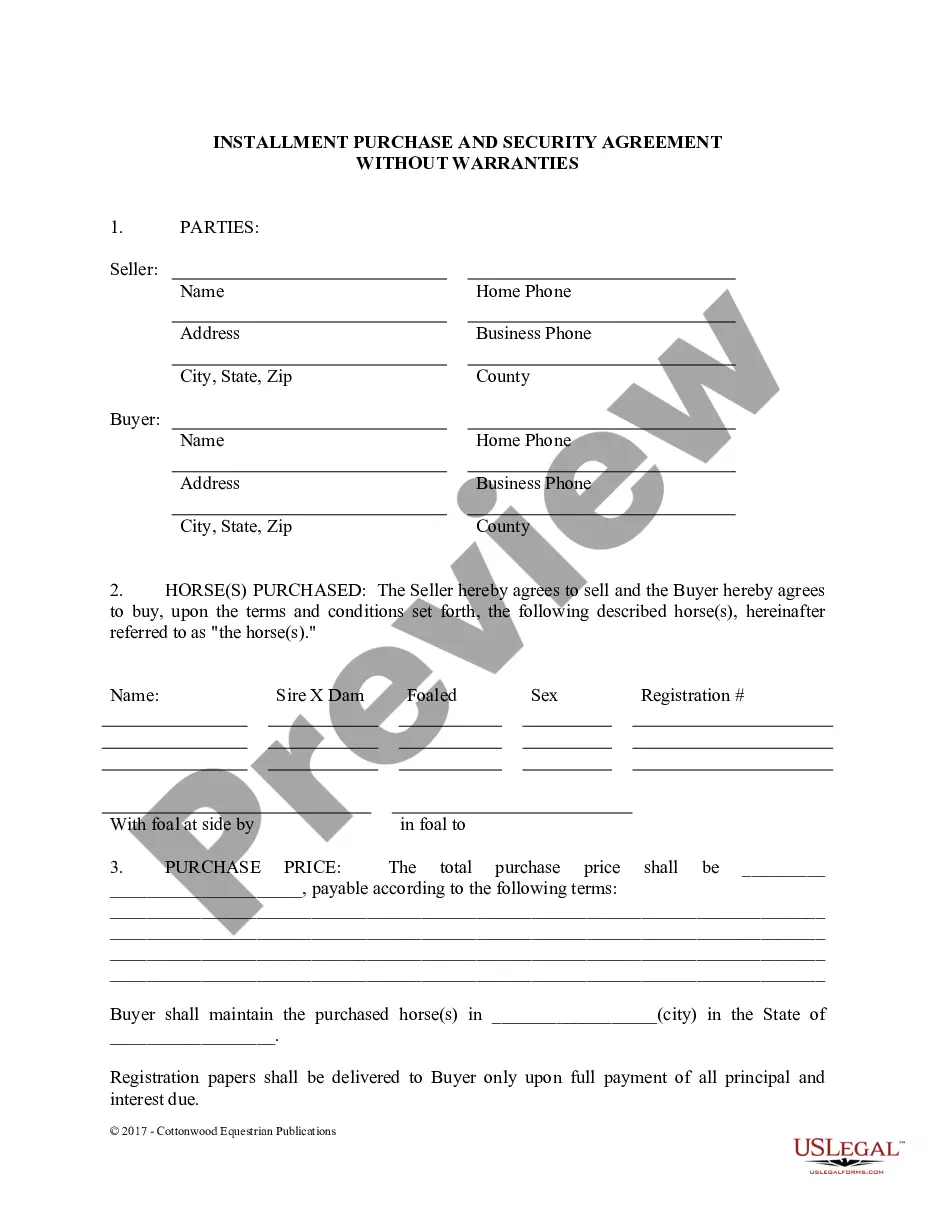

- Utilize the Preview button to review the document.

- Check the details to ensure you have selected the right form.

- If the form is not what you're looking for, utilize the Search field to locate a form that fits your requirements.

- Once you find the appropriate form, click on Get now.

- Select the pricing plan you desire, fill in the necessary information to create your account, and complete the purchase using PayPal or a credit card.

- Choose a convenient file format and download your version.

- Access all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the Rhode Island Consulting Agreement - with Former Shareholder anytime, if necessary. Just click on the needed form to download or print the document template.

Form popularity

FAQ

The basics of a shareholder agreement include outlining shareholder rights, profit distribution, and management responsibilities. It's also crucial to include provisions for resolving disputes and what happens if a shareholder wants to exit. Your Rhode Island Consulting Agreement - with Former Shareholder should reflect these key components to protect all involved.

Writing a consulting contract agreement starts with defining the scope of work and deliverables expected from the consultant. Include payment terms, deadlines, and termination clauses to protect all parties. For clarity and compliance in your Rhode Island Consulting Agreement - with Former Shareholder, consider using uslegalforms templates designed for your needs.

To change a shareholders agreement, you typically need the consent of all or a majority of shareholders, depending on your original agreement. Document any alterations clearly and ensure they comply with state laws. For ease of this process, consulting our uslegalforms resources can assist you in updating your Rhode Island Consulting Agreement - with Former Shareholder.

A comprehensive shareholder agreement should contain clauses on share allocation, voting rights, transfer of shares, and dispute resolution procedures. It is beneficial to tailor these elements to fit your company’s specific needs. By crafting a Rhode Island Consulting Agreement - with Former Shareholder, you can ensure all vital aspects are addressed.

Writing a shareholder agreement involves specifying key terms that govern share ownership and management. Focus on clarity and detail, including provisions for dispute resolution and amendments. You may also want to explore platforms like uslegalforms for templates suited for your Rhode Island Consulting Agreement - with Former Shareholder.

To write up a shareholder agreement, start by outlining the roles and responsibilities of all shareholders. Include essential details such as share distribution, decision-making processes, and exit strategies. For assistance in creating a Rhode Island Consulting Agreement - with Former Shareholder, consider utilizing resources from uslegalforms.

In Rhode Island, a shareholder agreement does not necessarily need to be notarized to be legally enforceable. However, notarization can add an extra layer of authenticity and help prevent disputes. It is wise to discuss this option with a legal professional when drafting your Rhode Island Consulting Agreement - with Former Shareholder.

The pass-through entity tax rate in Rhode Island varies based on the income levels of the business entity and its owners. This tax structure is designed to be fair and to align with the state's overall tax policies. For those drafting a Rhode Island Consulting Agreement - with Former Shareholder, considering this tax rate is critical for structuring agreements that cover compensation and profit sharing.

member LLC in Rhode Island typically does not need to file Form 1065, as it is considered a disregarded entity for tax purposes. Instead, the income is reported directly on the owner's personal tax return. However, when working on a Rhode Island Consulting Agreement with Former Shareholder, it may be useful to outline the tax responsibilities of the LLC to avoid future complications.

The pass-through entity tax allows income earned by pass-through entities to be taxed only at the individual level rather than at the business level. This approach simplifies tax reporting and potentially lowers the overall tax burden for owners. In a Rhode Island Consulting Agreement - with Former Shareholder, discussing the implications of this tax is vital for transparent financial planning among stakeholders.