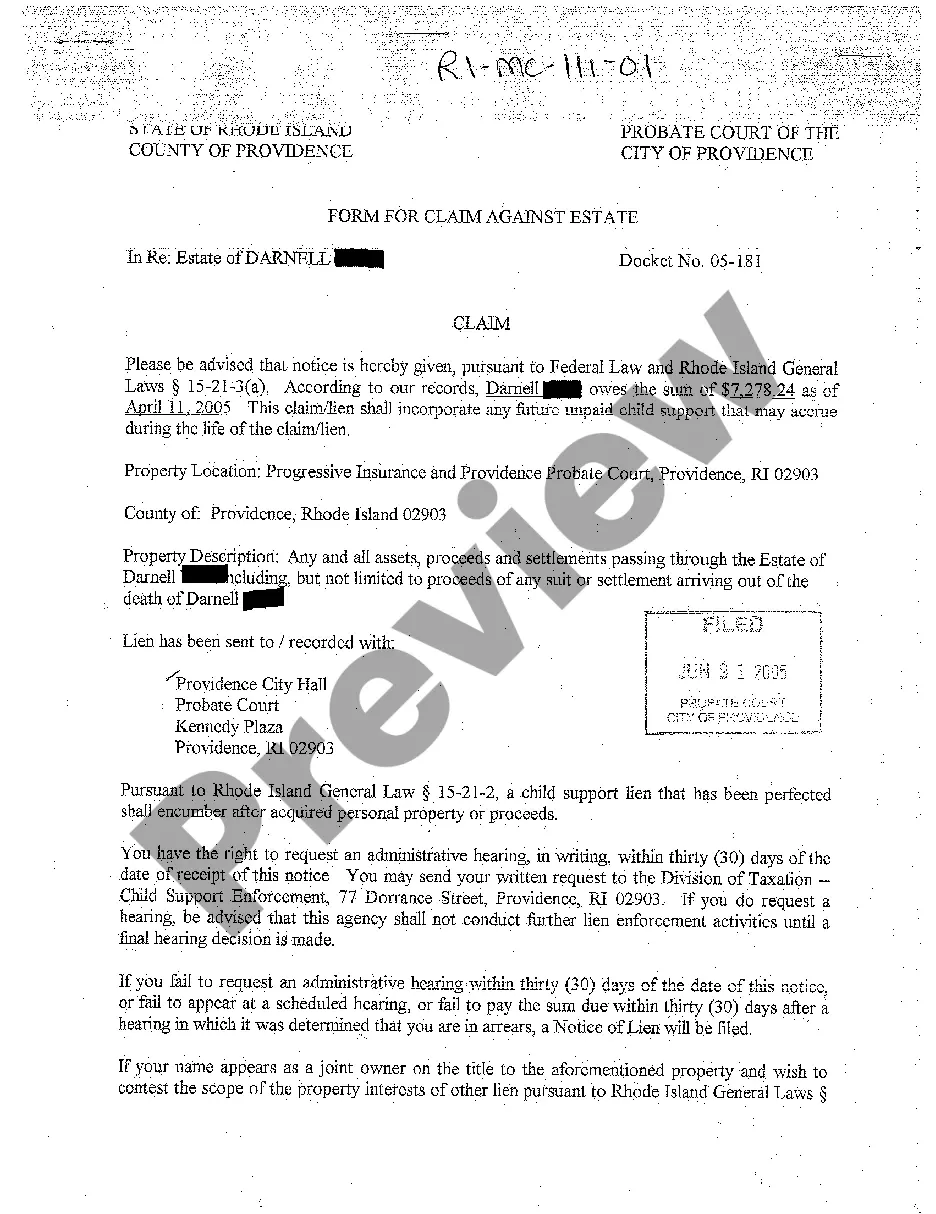

Rhode Island Form for Claim Against Estate

Description

How to fill out Rhode Island Form For Claim Against Estate?

Among lots of paid and free samples that you’re able to get on the internet, you can't be certain about their accuracy. For example, who made them or if they are qualified enough to take care of the thing you need those to. Keep relaxed and make use of US Legal Forms! Locate Rhode Island Form for Claim Against Estate templates made by skilled legal representatives and avoid the expensive and time-consuming process of looking for an lawyer and after that having to pay them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all your previously downloaded documents in the My Forms menu.

If you are utilizing our platform the first time, follow the guidelines listed below to get your Rhode Island Form for Claim Against Estate easily:

- Ensure that the file you see is valid in your state.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or look for another sample using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you’ve signed up and bought your subscription, you can utilize your Rhode Island Form for Claim Against Estate as often as you need or for as long as it stays active in your state. Edit it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Since most states do not impose a state gift tax, most people can reduce their state estate tax bill by making lifetime gifts. In most cases, assets transferred during life will not incur a state level gift tax and will not be subject to state estate tax at the donor's death.

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The maximum Rhode Island estate tax rate is 16%, which is significantly lower than the maximum federal estate tax rate of 40%. This state estate tax is in addtion to the federal estate tax. The federal estate tax falls on the estate of the person who died, not on the people who inherit that property.

Rhode Island Although the Ocean State adjusts its estate tax exemption annually for inflation, it still has a fiendishly low threshold. At only $1,595,156 for 2021, Rhode Island's exemption amount is one of only three in the nation that is less than $2 million. Rates range from 0.8% to 16%.

The Internal Revenue Service announced today the official estate and gift tax limits for 2020: The estate and gift tax exemption is $11.58 million per individual, up from $11.4 million in 2019.

If you die without a will in Rhode Island, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Rhode Island must consider them your children, legally.

The Rhode Island estate tax rate is much lower than the federal estate tax rate of 40%. The maximum state rate, imposed on very large estates, is 16%.

Assets exempt from US federal estate tax include: Securities that generate portfolio interest; Bank accounts not used in connection with trade or business in the US; and. Insurance proceeds.

1The Will must be filed with the probate court in the county where the decedent lived within 30 days.2A Petition for Probate must be filed with the probate court as well. This requests the appointment of an executor.