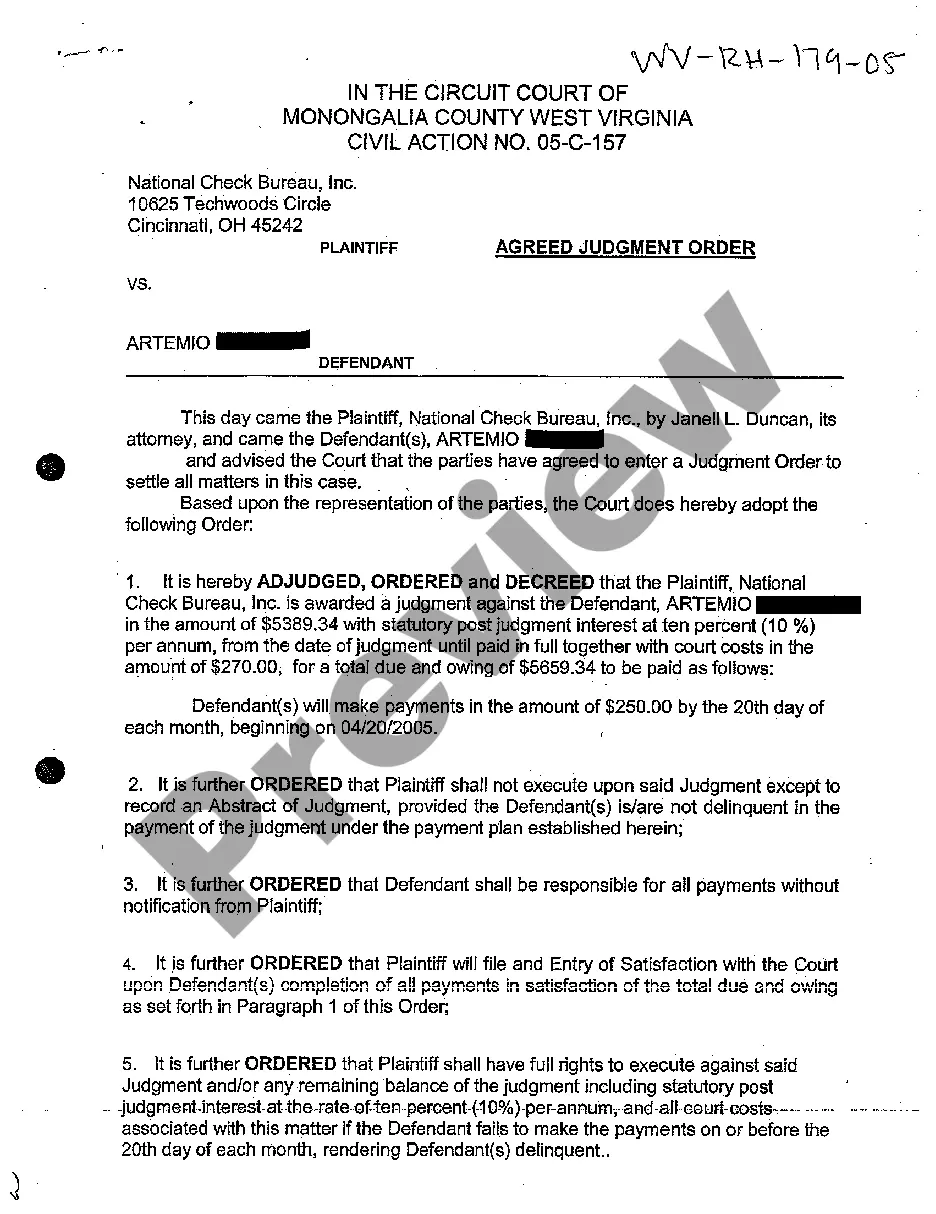

Rhode Island Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Rhode Island Notice Of Assignment To Living Trust?

Creating papers isn't the most uncomplicated process, especially for those who almost never work with legal papers. That's why we advise making use of correct Rhode Island Notice of Assignment to Living Trust samples made by professional lawyers. It allows you to eliminate difficulties when in court or dealing with formal institutions. Find the files you need on our site for high-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the template web page. Right after accessing the sample, it’ll be stored in the My Forms menu.

Users with no an active subscription can easily get an account. Look at this simple step-by-step guide to get your Rhode Island Notice of Assignment to Living Trust:

- Ensure that the sample you found is eligible for use in the state it is needed in.

- Verify the file. Make use of the Preview option or read its description (if available).

- Click Buy Now if this file is what you need or utilize the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these simple actions, you are able to fill out the form in an appropriate editor. Check the completed info and consider asking an attorney to examine your Rhode Island Notice of Assignment to Living Trust for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

UDT is an abbreviation for under declaration of trust, which is the legal language used in some trust instruments to indicate that the grantor is both creating the trust and controlling its assets.Most personal trusts are trusts under agreement, or "UA," in which the grantor and the trustee are different parties.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.