Puerto Rico General Liens Questionnaire

Description

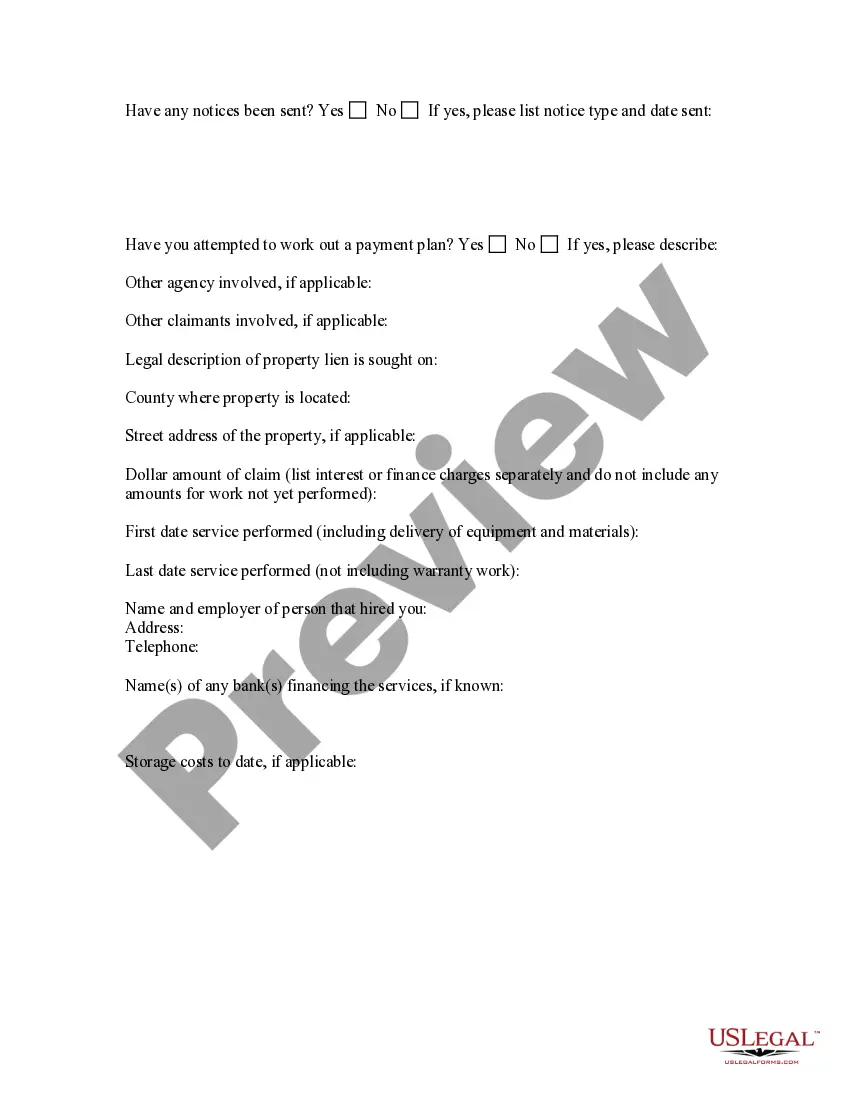

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out General Liens Questionnaire?

Are you currently within a place in which you require paperwork for either company or specific uses just about every working day? There are a variety of legitimate document layouts available on the Internet, but getting kinds you can rely on is not easy. US Legal Forms gives 1000s of develop layouts, just like the Puerto Rico General Liens Questionnaire, that are published in order to meet federal and state specifications.

Should you be currently familiar with US Legal Forms internet site and get your account, basically log in. Afterward, you may download the Puerto Rico General Liens Questionnaire design.

Unless you provide an bank account and would like to begin using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your right city/county.

- Use the Preview switch to check the shape.

- Read the information to ensure that you have selected the correct develop.

- In the event the develop is not what you are looking for, utilize the Look for area to obtain the develop that fits your needs and specifications.

- Whenever you obtain the right develop, click on Buy now.

- Choose the costs prepare you need, fill out the desired information and facts to generate your money, and pay for the transaction with your PayPal or bank card.

- Decide on a practical data file file format and download your version.

Find every one of the document layouts you might have purchased in the My Forms food list. You can aquire a extra version of Puerto Rico General Liens Questionnaire anytime, if possible. Just go through the essential develop to download or printing the document design.

Use US Legal Forms, the most considerable selection of legitimate kinds, to save efforts and prevent blunders. The services gives expertly produced legitimate document layouts which can be used for a selection of uses. Create your account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

In summary, owning property in Puerto Rico comes with the responsibility of paying property taxes twice a year to CRIM and notifying them of any changes that may increase the property's value.

A US citizen could prevent the application of the estate tax by simply establishing his/her domicile in Puerto Rico, or any other possession.

CRIM is the agency responsible for determining and collecting property taxes. The agency bills twice a year; the first bill is in July (first semester) and the second in January (second semester). It is important that you review the bills CRIM sends out every six months.

If you are a resident of of Puerto Rico, you will need to declare your capital gain tax responsibility when you file your end of year taxes. No taxes will be withheld at the closing. If you are a non-resident of Puerto Rico selling a property in Puerto Rico, that 15% capital gains tax will be withheld at closing.

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

Currently, 29 states, including Puerto Rico, The US Virgin Islands, and Washington DC allow for tax lien sales, and each of these areas has different rules and regulations surrounding tax lien sales.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

Yes. Although that the Constitution of the Commonwealth of Puerto Rico provides that no person may be imprisoned for debt, the right to receive child support supersedes any other type of debt. Therefore, a person who fails to pay child support may be incarcerated.