Puerto Rico Clauses Relating to Transactions with Insiders

Description

How to fill out Clauses Relating To Transactions With Insiders?

You can devote hours on the Internet searching for the authorized document format that suits the federal and state requirements you want. US Legal Forms supplies thousands of authorized forms that are examined by specialists. You can easily download or print the Puerto Rico Clauses Relating to Transactions with Insiders from the services.

If you have a US Legal Forms bank account, you can log in and click on the Down load switch. Afterward, you can complete, revise, print, or signal the Puerto Rico Clauses Relating to Transactions with Insiders. Each and every authorized document format you purchase is the one you have forever. To obtain one more backup of the acquired kind, check out the My Forms tab and click on the related switch.

If you work with the US Legal Forms website the very first time, adhere to the basic directions below:

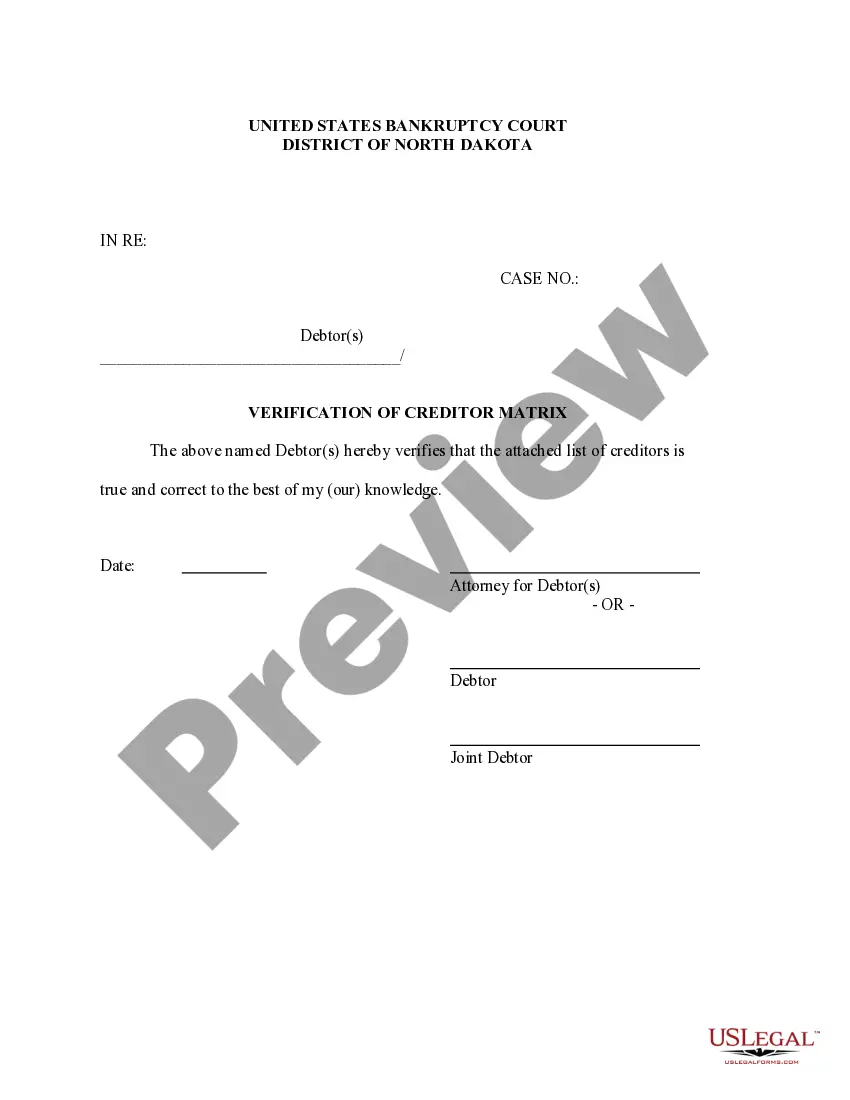

- First, ensure that you have chosen the best document format for that area/area of your liking. Read the kind information to make sure you have chosen the correct kind. If accessible, make use of the Preview switch to check through the document format as well.

- In order to locate one more variation in the kind, make use of the Lookup area to find the format that meets your needs and requirements.

- When you have discovered the format you need, click Get now to continue.

- Choose the pricing strategy you need, type your qualifications, and register for a free account on US Legal Forms.

- Complete the financial transaction. You may use your credit card or PayPal bank account to fund the authorized kind.

- Choose the file format in the document and download it for your system.

- Make modifications for your document if possible. You can complete, revise and signal and print Puerto Rico Clauses Relating to Transactions with Insiders.

Down load and print thousands of document web templates using the US Legal Forms site, that provides the most important variety of authorized forms. Use expert and state-distinct web templates to handle your organization or personal requires.

Form popularity

FAQ

As Puerto Rico is under United States sovereignty, U.S. federal law applies in the territory, and cases of a federal nature are heard in the United States District Court for the District of Puerto Rico.

In addition to granting U.S. citizenship to Puerto Ricans, the Jones-Shafroth Act separated powers among the island's three branches of government and established a bill of rights. With the outbreak of World War I, U.S. officials viewed Puerto Rico as vital to protecting the newly-opened Panama Canal.

What is PROMESA? The Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) is legislation intended to help address the fiscal crisis in Puerto Rico.

Jones-Shafroth Act, U.S. legislation (March 2, 1917) that granted U.S. citizenship to Puerto Ricans. It also provided Puerto Rico with a bill of rights and restructured its government.

Under President Woodrow Wilson, the Jones-Shafroth Act (ch. 148, 39 Stat. 951) was enacted on March 2, 1917. This law granted U.S. citizenship to Puerto Ricans, and separated the territory's executive, judicial, and legislative offices into distinct government branches.

(66 Stat. 327), signed by the President on July 3, 1952. On July 25, 1952, after final ratification by the constitutional convention to accept the constitution as approved by the Congress, the Governor of Puerto Rico proclaimed the establishment of the Commonwealth of Puerto Rico under the new constitution.

Puerto Rico is a territory of the United States. Territory status limits the island's full political, economic, and social development.

Motorcycles ? Motorcycles in Puerto Rico must be driven with boots and gloves on. There were apparently some people operating motorcycles in just sandals. Mopeds ? Mopeds in Puerto Rico can be driven by those only sixteen years of age, whereas for a car, without supervision, you must be eighteen years old or older.