Puerto Rico Clauses Relating to Capital Calls

Description

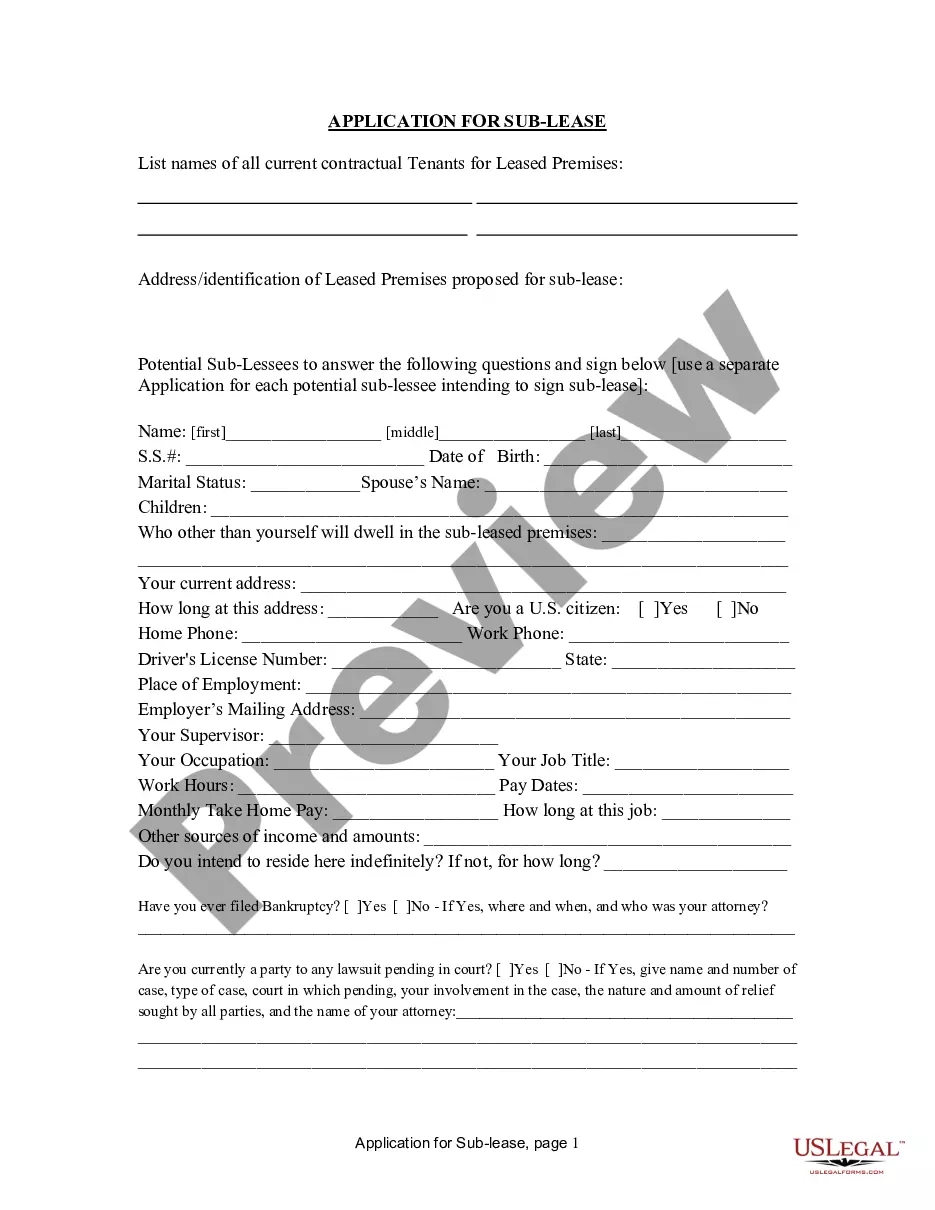

How to fill out Clauses Relating To Capital Calls?

If you wish to comprehensive, down load, or print out lawful file templates, use US Legal Forms, the biggest assortment of lawful types, which can be found on the web. Use the site`s simple and practical search to discover the files you will need. Various templates for enterprise and personal purposes are sorted by types and states, or keywords. Use US Legal Forms to discover the Puerto Rico Clauses Relating to Capital Calls in a handful of click throughs.

If you are presently a US Legal Forms consumer, log in to the account and click on the Download key to find the Puerto Rico Clauses Relating to Capital Calls. Also you can gain access to types you in the past delivered electronically in the My Forms tab of your account.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form to the right area/region.

- Step 2. Take advantage of the Review method to look over the form`s articles. Don`t forget about to see the information.

- Step 3. If you are unsatisfied with the type, make use of the Search discipline near the top of the display screen to get other types of the lawful type design.

- Step 4. When you have identified the form you will need, go through the Buy now key. Pick the costs strategy you like and include your qualifications to sign up on an account.

- Step 5. Approach the deal. You can utilize your bank card or PayPal account to complete the deal.

- Step 6. Find the formatting of the lawful type and down load it on the system.

- Step 7. Full, revise and print out or sign the Puerto Rico Clauses Relating to Capital Calls.

Every single lawful file design you buy is your own eternally. You possess acces to each type you delivered electronically inside your acccount. Select the My Forms section and select a type to print out or down load once again.

Compete and down load, and print out the Puerto Rico Clauses Relating to Capital Calls with US Legal Forms. There are thousands of skilled and express-certain types you can use for the enterprise or personal needs.

Form popularity

FAQ

Long-term capital gains are subject to a special tax rate of 15%. Short-term capital gains are subject to the regular gradual rates. In the case of long-term capital gains, Puerto Rican non-resident foreign nationals are subject to a flat withholding rate of 25%.

Therefore, in many cases, a U.S. citizen or resident cannot avoid U.S. income taxation on gains associated with appreciation in investment assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico.

Puerto Rico's Act 20 and Act 22 provide generous tax incentives to U.S. companies and individuals who establish a bona fide residence in Puerto Rico. Under U.S. law, a bona fide resident of Puerto Rico is not subject to U.S. income taxes on income derived from sources within Puerto Rico.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

The property must be owned by the Individual Investor as sole owner or together with the spouse; and. File an Annual Report with the Government of Puerto Rico with a filing fee of $5,000.

Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012. They need to buy a residency on the island and live there at least half of the year.