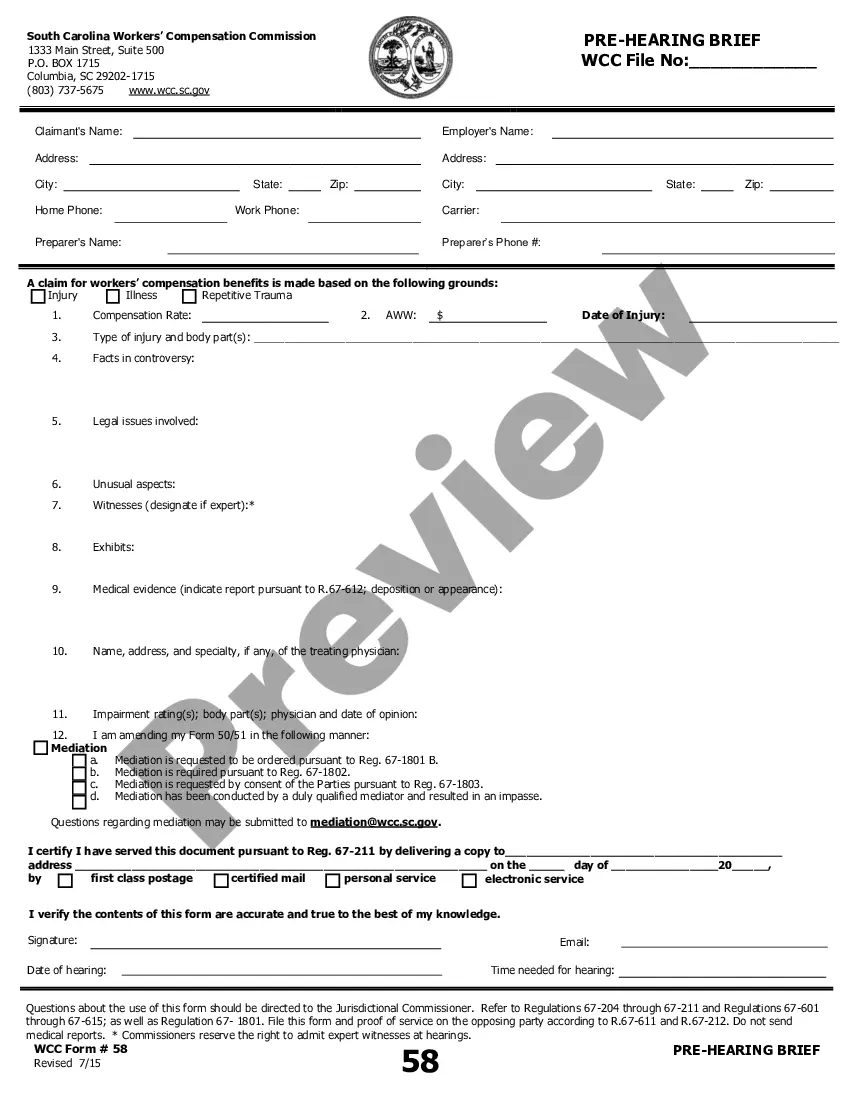

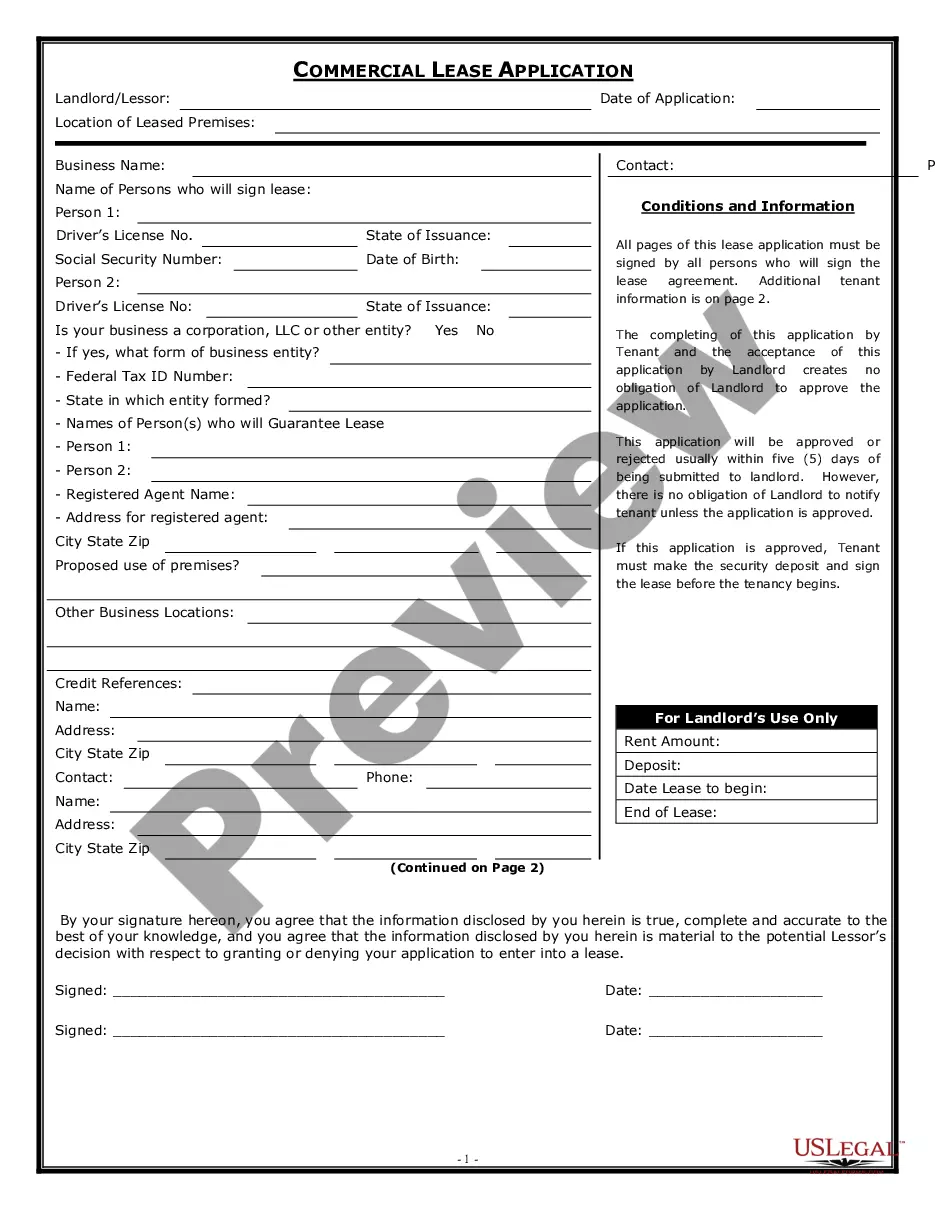

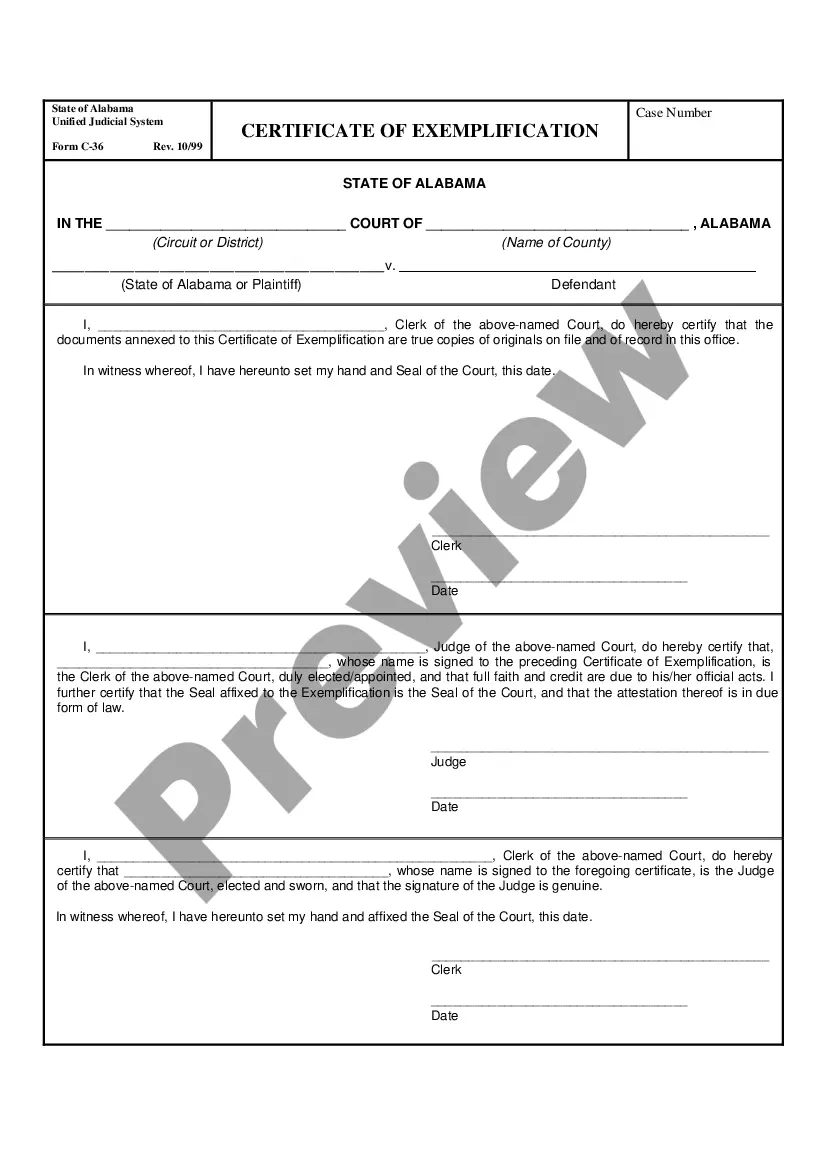

This oil, gas, and minerals document is a report form documenting information of sellers and purchasers that enter into a legally binding obligation to sell and purchase real property at the expiration of or during a lease term. In a lease purchase agreement, a party agrees to purchase a particular piece of real property within a certain timeframe, usually at a price determined beforehand.

Puerto Rico Lease Purchase Report

Description

How to fill out Lease Purchase Report?

US Legal Forms - among the greatest libraries of lawful types in the USA - offers an array of lawful document layouts you may obtain or print out. Utilizing the site, you will get 1000s of types for organization and individual functions, sorted by types, says, or key phrases.You can find the most up-to-date models of types like the Puerto Rico Lease Purchase Report in seconds.

If you have a monthly subscription, log in and obtain Puerto Rico Lease Purchase Report through the US Legal Forms catalogue. The Obtain option will show up on every develop you perspective. You get access to all formerly downloaded types from the My Forms tab of your accounts.

In order to use US Legal Forms the very first time, allow me to share simple directions to get you started off:

- Be sure you have chosen the right develop for the town/region. Go through the Review option to analyze the form`s content material. Look at the develop description to actually have selected the appropriate develop.

- In the event the develop does not fit your demands, take advantage of the Look for industry near the top of the screen to discover the one which does.

- In case you are happy with the form, verify your selection by clicking the Get now option. Then, opt for the costs strategy you prefer and supply your qualifications to sign up for the accounts.

- Approach the transaction. Use your charge card or PayPal accounts to accomplish the transaction.

- Select the format and obtain the form on the device.

- Make adjustments. Complete, modify and print out and signal the downloaded Puerto Rico Lease Purchase Report.

Every format you added to your money does not have an expiration particular date which is your own permanently. So, if you want to obtain or print out yet another copy, just visit the My Forms segment and click on the develop you need.

Obtain access to the Puerto Rico Lease Purchase Report with US Legal Forms, probably the most considerable catalogue of lawful document layouts. Use 1000s of skilled and status-specific layouts that meet up with your organization or individual requires and demands.

Form popularity

FAQ

Sales and Use Taxes (SUT) Designated professional services and business-to-business services (B2B) are subject to a SUT of four percent (4%). A merchant is required to collect said tax as a withholding agent responsible for the payment of the Sales and Use Tax.

Documenting Your Puerto Rican Shipments A shipment to Puerto Rico doesn't need to go through customs because it is a domestic package.

The rental market in Puerto Rico is currently very soft with a 12.3-percent vacancy rate, up from 10.0 percent in 2010 and 7.4 percent in 2000 due to continued population loss resulting in an increasing number of vacancies.

Puerto Rico is part of the U.S. Customs territory and therefore no customs duties are assessed on products coming from the mainland United States. There is, however, a 11.5 percent excise tax (sales tax) applied on products imported into the island, as well as on those produced locally.

Puerto Rico sales and use tax is in Spanish ?Impuesto a las Ventas y Uso,? aka IVU. The tax rate is 11.5%; the municipality where the sale took place receives 1% of that and the government of Puerto Rico receives the remaining 10.5%.

International. Puerto Rico is a United States territory. If you're visiting from any part of the U.S., you don't have to exchange your currency, update your cell phone plan for international service, or go through customs or immigration. An unforgettable Caribbean getaway is within easy reach ? no passport required.

Puerto Rico is part of the U.S. customs territory - therefore, U.S. customs laws apply. Imported goods must be reported to the U.S. Customs Service (Customs and Border Protection-CBP), where they are inspected to ensure compliance with U.S. law.

Currently, Puerto Rico is considered an unincorporated territory of the US. This means that the USPS considers Puerto Rico to be domestic shipping, but some private carriers (like FedEx or UPS) consider Puerto Rico to be international.