Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business

Description

How to fill out Contract With Independent Contractor To Perform Advertising Services To A Financial Services Business?

Make use of the most extensive legal library of forms. US Legal Forms is the perfect place for finding up-to-date Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business templates. Our service offers a huge number of legal forms drafted by licensed legal professionals and sorted by state.

To get a sample from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you need and buy it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

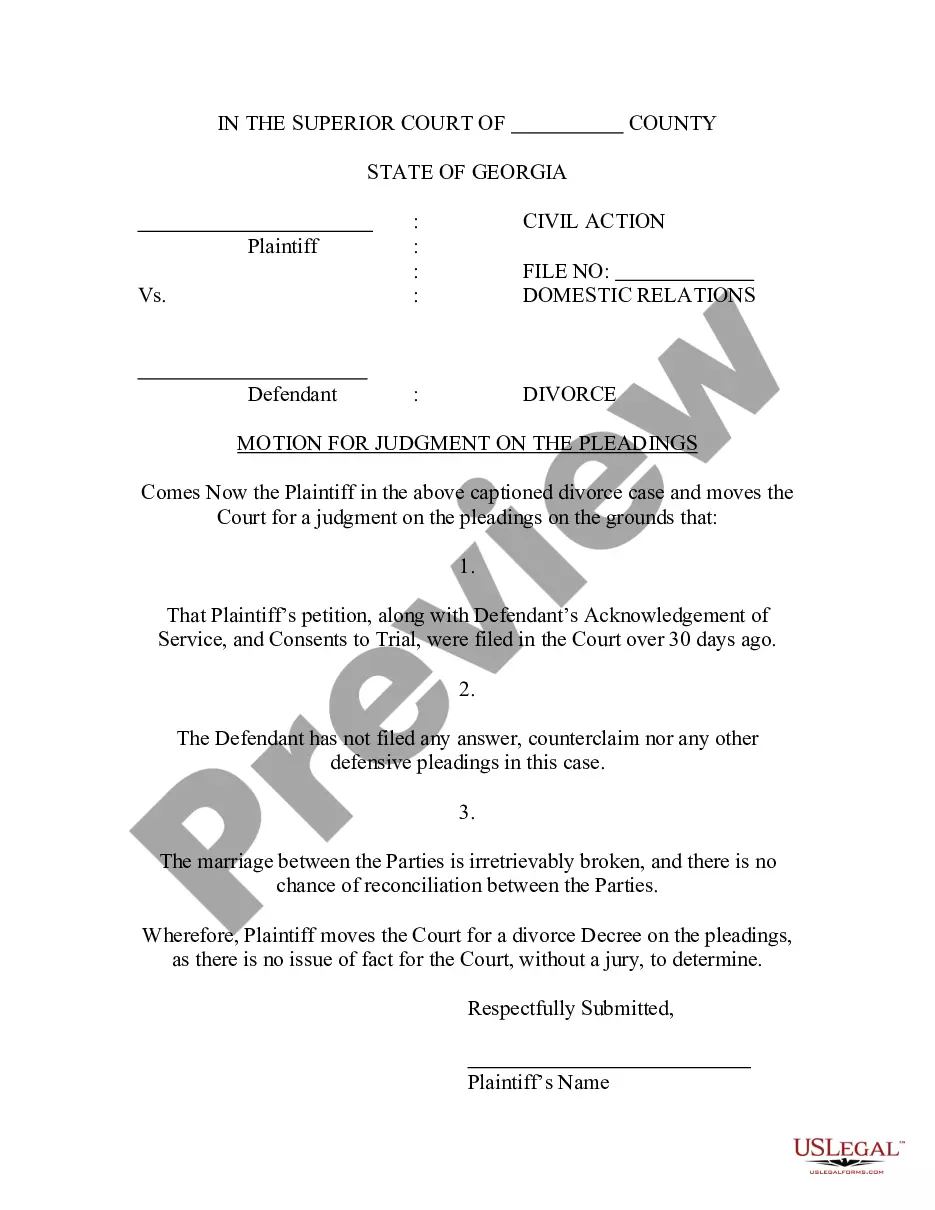

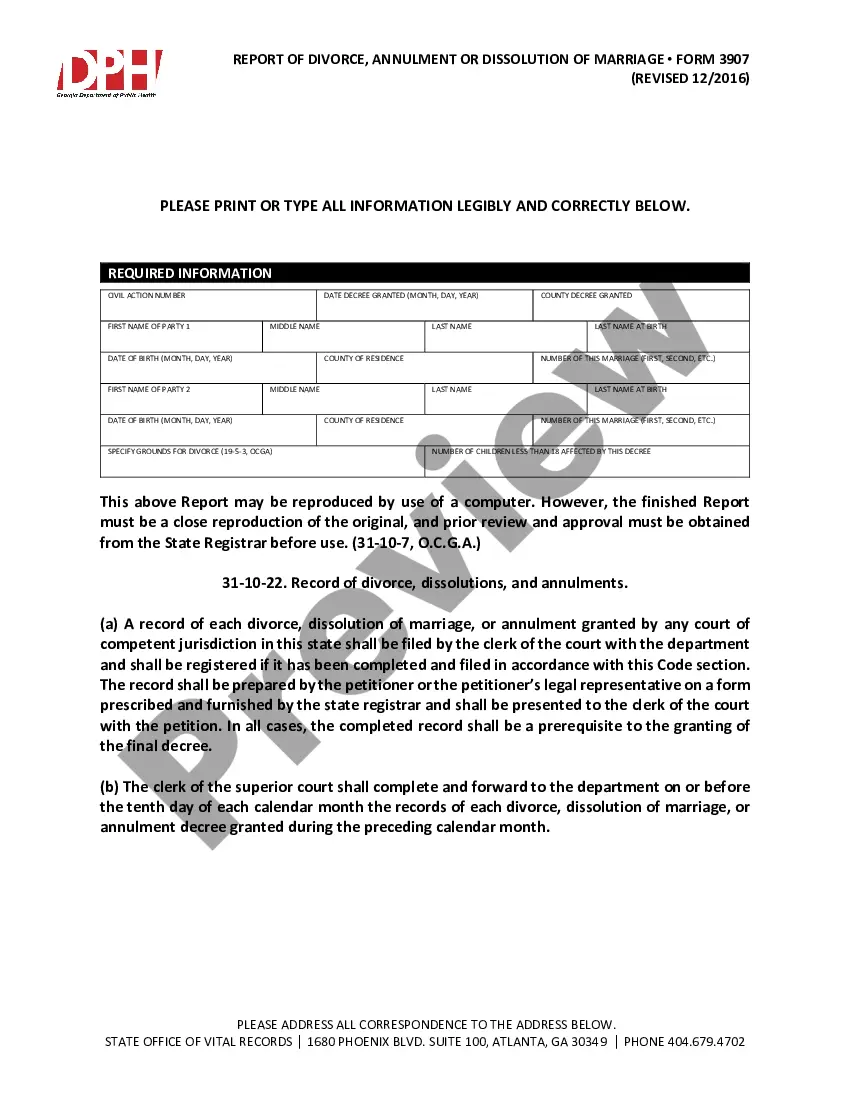

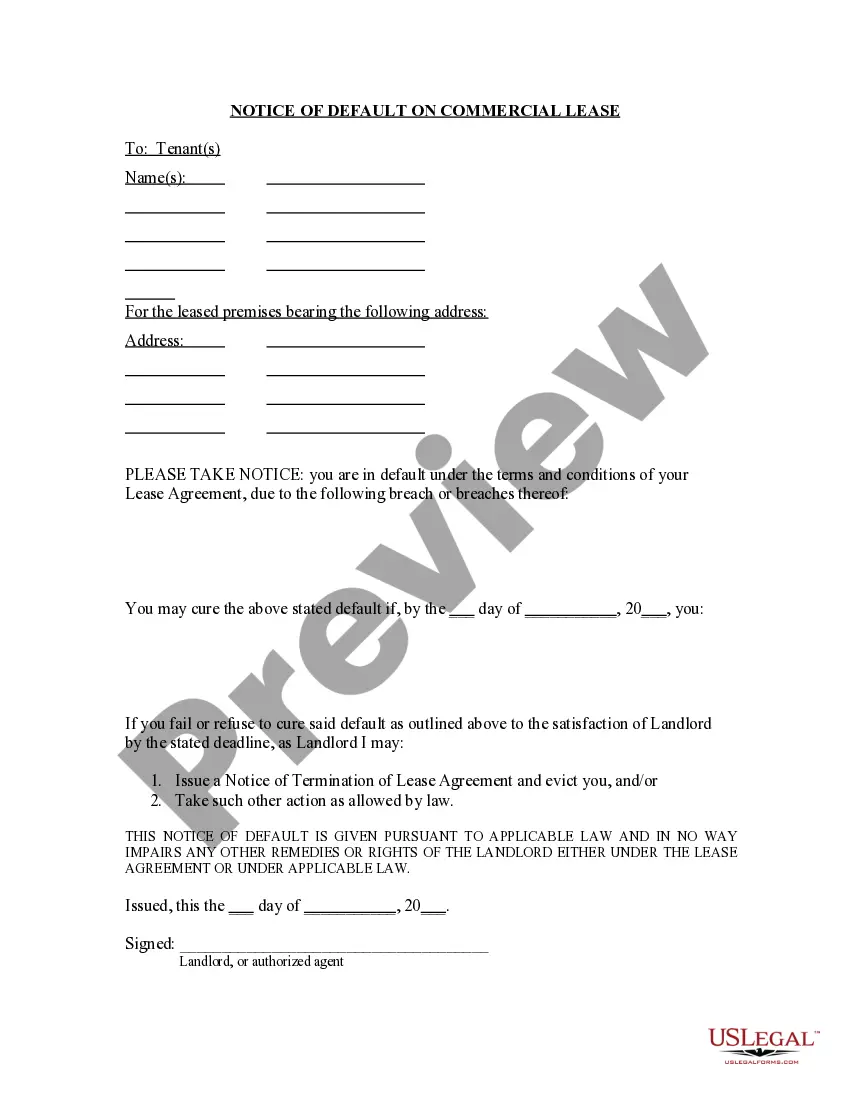

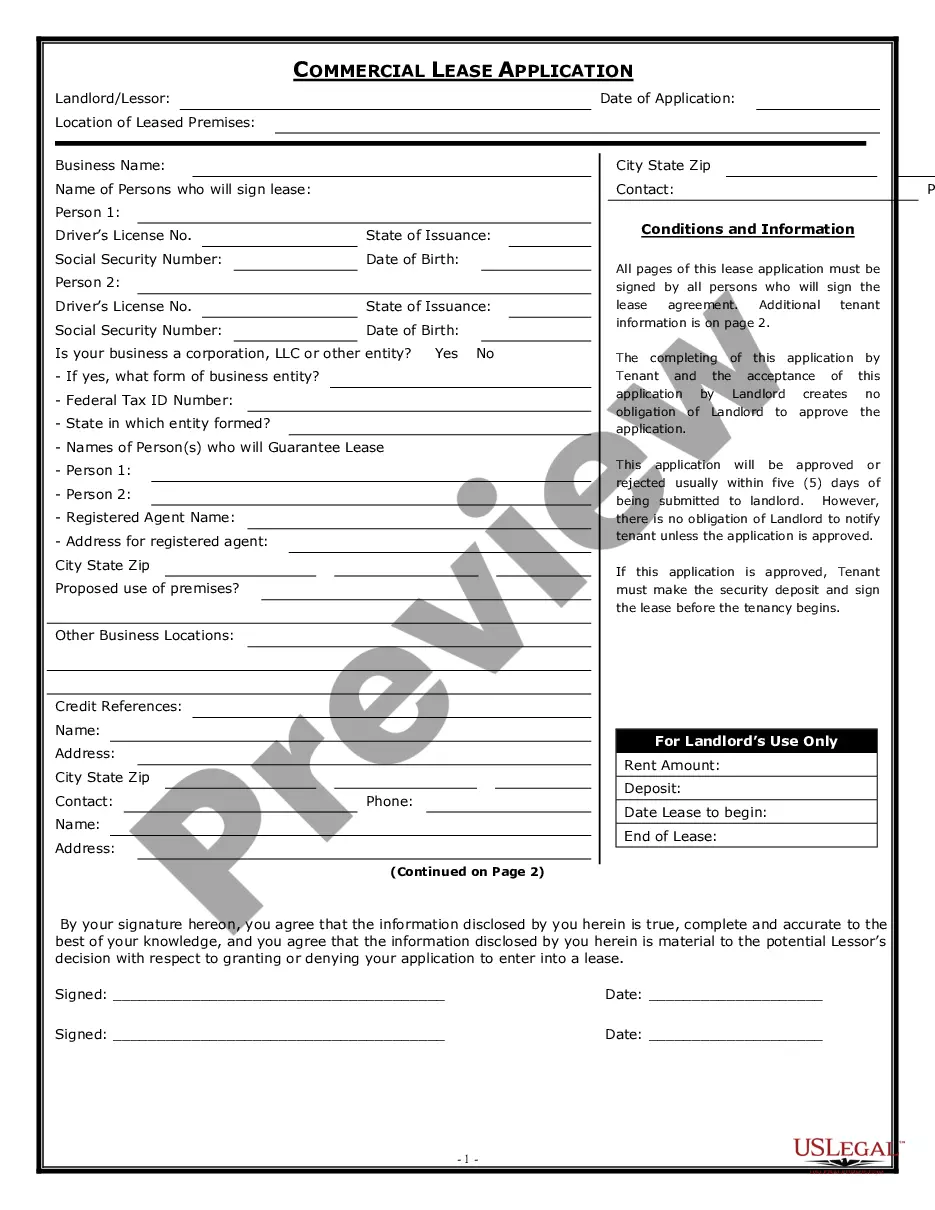

- In case the form has a Preview option, use it to check the sample.

- If the template does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the debit/visa or mastercard.

- Select a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill in the Form name. Join thousands of pleased customers who’re already using US Legal Forms!

Form popularity

FAQ

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.Under CARES Act II, unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Liaising with the client to elucidate job requirements, as needed. Gathering the materials needed to complete the assignment. Overseeing the assignment, from inception to completion. Tailoring your approach to work to suit the job specifications, as required.

Get established as a business. Obtain professional materials like business cards and fliers. Build a social media presence. Set up a website.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).