Puerto Rico Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Successor To Party To Agreement?

Are you inside a placement that you need paperwork for either organization or individual functions virtually every day? There are tons of legal document web templates available online, but finding versions you can trust isn`t simple. US Legal Forms delivers a large number of develop web templates, such as the Puerto Rico Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement, that happen to be created to fulfill federal and state needs.

If you are presently familiar with US Legal Forms site and get a merchant account, merely log in. Afterward, you are able to download the Puerto Rico Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement template.

If you do not come with an account and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for that right town/region.

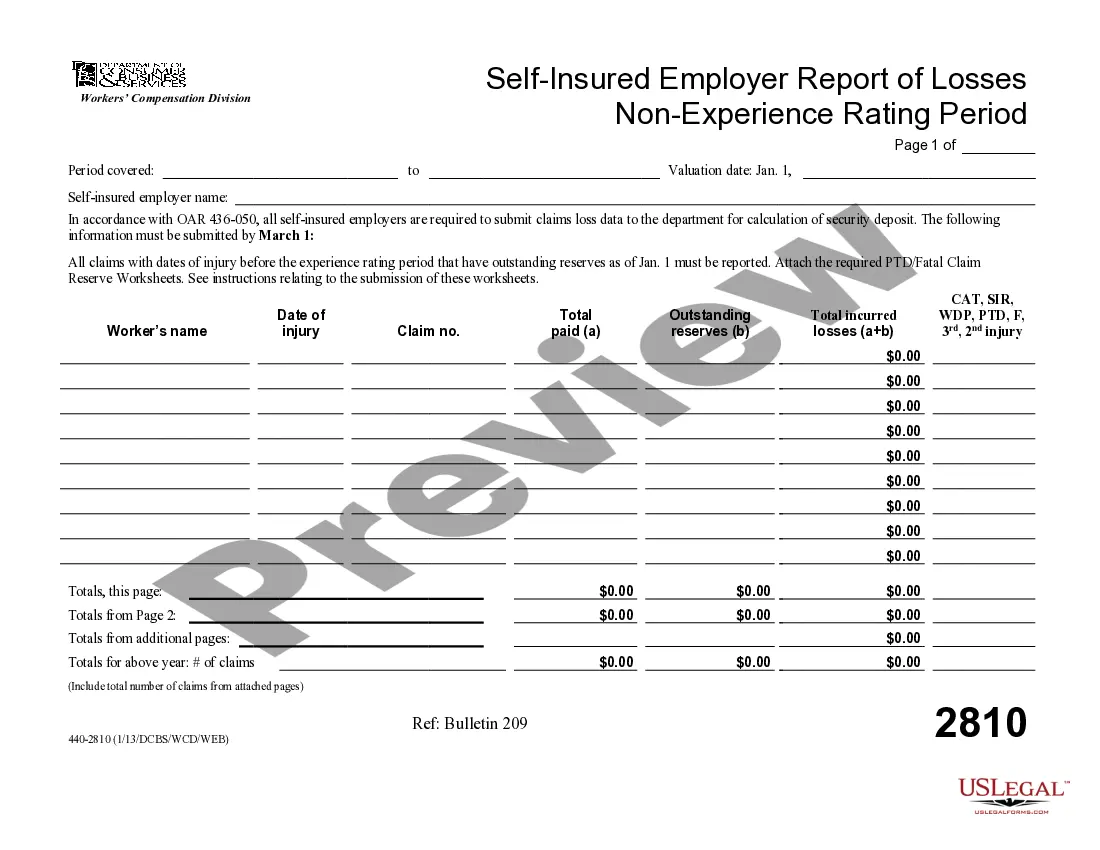

- Utilize the Preview switch to review the shape.

- Look at the outline to ensure that you have chosen the appropriate develop.

- If the develop isn`t what you`re searching for, utilize the Research industry to discover the develop that meets your requirements and needs.

- Once you discover the right develop, click Purchase now.

- Pick the costs strategy you would like, fill in the necessary details to make your bank account, and buy the order using your PayPal or bank card.

- Decide on a hassle-free file structure and download your duplicate.

Find all of the document web templates you may have bought in the My Forms food selection. You can get a extra duplicate of Puerto Rico Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement whenever, if needed. Just select the needed develop to download or printing the document template.

Use US Legal Forms, probably the most extensive assortment of legal kinds, in order to save time and steer clear of mistakes. The support delivers appropriately created legal document web templates which can be used for a range of functions. Produce a merchant account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth. Puerto Rico LLC Taxes - Northwest Registered Agent northwestregisteredagent.com ? llc ? taxes northwestregisteredagent.com ? llc ? taxes

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

A Puerto Rico Limited Liability Company (LLC) has these benefits: 100% foreign ownership, limited liability, one member, one manager, no required minimum share capital, and English is the official second language.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.