The Contract For Land Related Services form, agreement is entered into by the parties shown on the execution page of this agreement, the parties are referred to as the Company and the Contractor. By the agreement, company engages the services of a contractor as an independent contract landman on terms and conditions.

Puerto Rico Contract For Land Related Services

Description

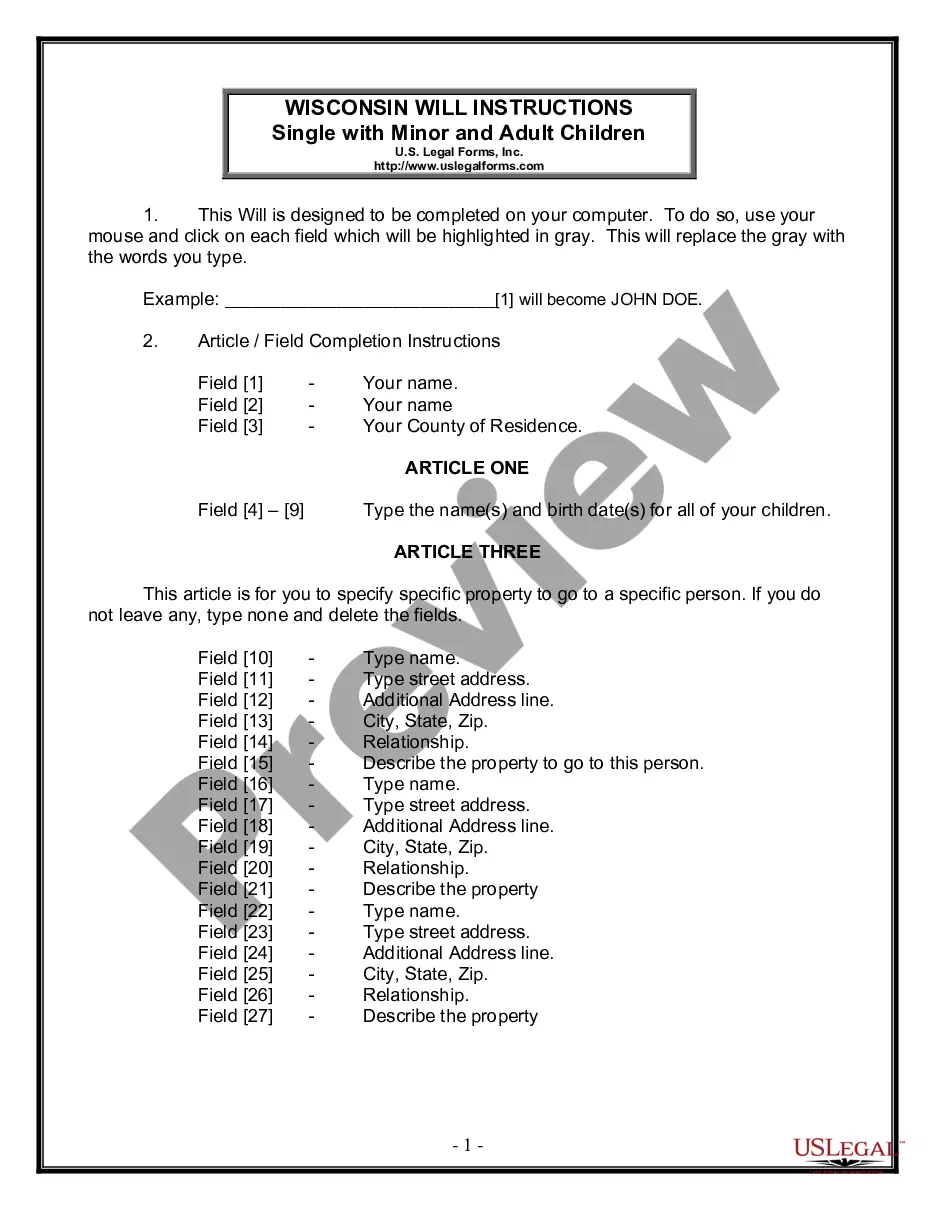

How to fill out Contract For Land Related Services?

Are you in the placement where you will need files for possibly company or individual reasons almost every day? There are a lot of legitimate papers templates accessible on the Internet, but finding types you can trust is not straightforward. US Legal Forms provides a large number of kind templates, just like the Puerto Rico Contract For Land Related Services, which are created to meet state and federal requirements.

In case you are already knowledgeable about US Legal Forms internet site and also have your account, merely log in. After that, you can download the Puerto Rico Contract For Land Related Services template.

If you do not provide an accounts and would like to begin using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is to the right area/area.

- Make use of the Preview option to check the form.

- See the outline to actually have chosen the appropriate kind.

- In case the kind is not what you`re looking for, take advantage of the Search area to discover the kind that suits you and requirements.

- Once you get the right kind, click on Acquire now.

- Choose the pricing program you need, complete the necessary information to generate your account, and pay for your order utilizing your PayPal or charge card.

- Pick a hassle-free data file formatting and download your copy.

Locate all the papers templates you might have purchased in the My Forms food selection. You may get a extra copy of Puerto Rico Contract For Land Related Services whenever, if possible. Just select the required kind to download or produce the papers template.

Use US Legal Forms, probably the most substantial assortment of legitimate kinds, in order to save time and stay away from mistakes. The assistance provides expertly manufactured legitimate papers templates that you can use for a range of reasons. Produce your account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

Applying for the Individual Resident Investor Act There is a $750 fee due with your application, which you are to submit to the Office of Industrial Tax Exemption. Upon approval, you will be required to pay a one-time $5,000 acceptance fee.

Since 2012, Puerto Rico has offered investors ? primarily mainland Americans ? one of the most attractive deals in the world: move to the commonwealth and pay no taxes on interest, dividends or capital gains, all while living on a balmy and culturally vibrant Caribbean island without having to surrender US citizenship.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

As has been widely reported, Puerto Rico's Act #20 and Act #22 provides incentives for high net worth U.S. citizens to move to Puerto Rico and potentially reduce their 39.6% federal income tax (plus any applicable state tax) to a 0% ? 4% Puerto Rico income tax rate.

To enjoy these Puerto Rico tax incentives, you must qualify as a bona fide Puerto Rican resident by passing three tests?the presence test, the tax home test, and the closer connection test?to prove your intention for living in Puerto Rico long term.

Once you live in Puerto Rico, your passive income is now ?Puerto Rico source income,? and Section 933 of the Internal Revenue Code says you don't have to pay federal taxes on Puerto Rico source income. Act 60 says you don't have to pay Puerto Rico taxes on passive income.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

Taxable items consist of tangible personal property, taxable services, admissions, digital products and ?bundled transactions.? Excluded from this definition include professional associations and certain membership fees; stamps issued by professional associations, the Commonwealth of Puerto Rico or the federal ...