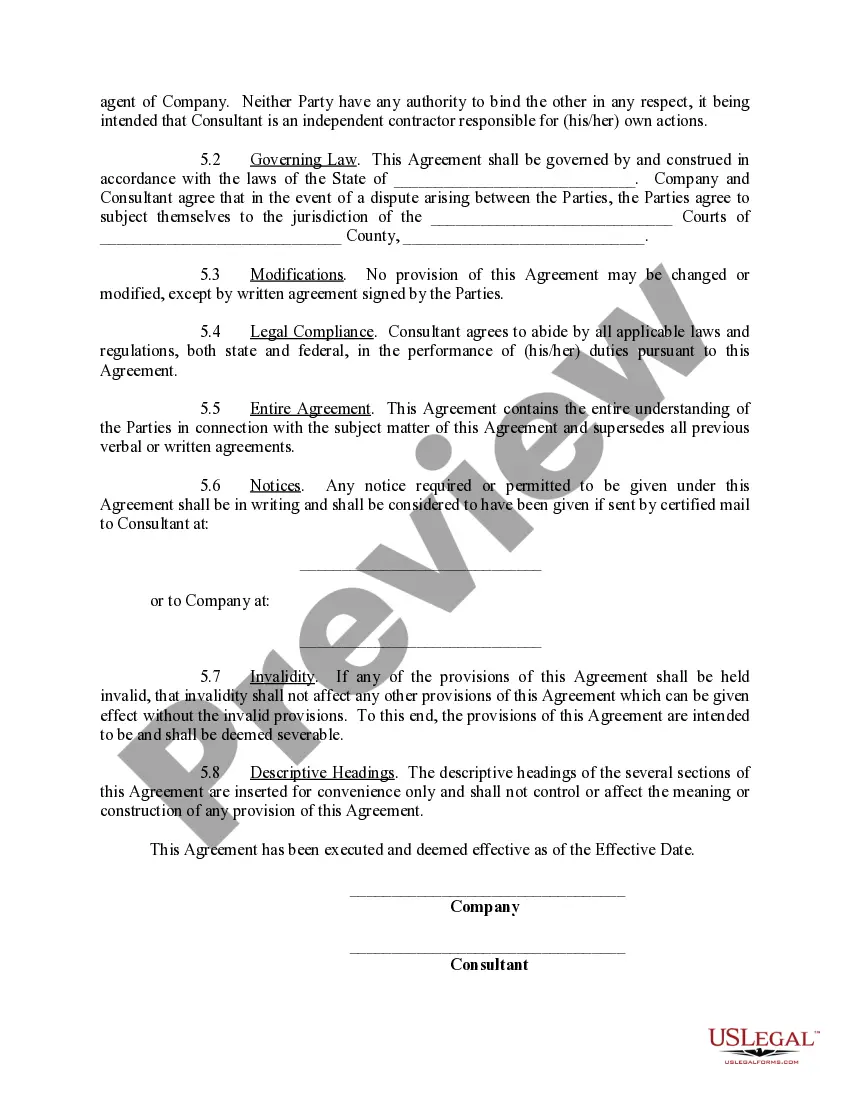

This forms is an agreement between a company and a former employee. Included in this agreement are terms, services and compensation information.

Puerto Rico Consulting Agreement with Former Employee

Description

How to fill out Consulting Agreement With Former Employee?

If you have to total, obtain, or printing lawful document web templates, use US Legal Forms, the biggest selection of lawful varieties, which can be found on the Internet. Utilize the site`s easy and practical search to get the documents you want. Different web templates for organization and specific uses are categorized by types and claims, or keywords. Use US Legal Forms to get the Puerto Rico Consulting Agreement with Former Employee in just a number of clicks.

Should you be currently a US Legal Forms client, log in to the bank account and then click the Download button to find the Puerto Rico Consulting Agreement with Former Employee. You can also accessibility varieties you formerly saved in the My Forms tab of your bank account.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the form for the proper area/nation.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Never forget to learn the information.

- Step 3. Should you be not satisfied together with the kind, use the Look for field near the top of the screen to locate other versions in the lawful kind format.

- Step 4. Once you have identified the form you want, select the Purchase now button. Opt for the pricing program you choose and add your qualifications to sign up on an bank account.

- Step 5. Process the purchase. You can use your charge card or PayPal bank account to perform the purchase.

- Step 6. Choose the format in the lawful kind and obtain it on your own device.

- Step 7. Comprehensive, revise and printing or indication the Puerto Rico Consulting Agreement with Former Employee.

Every lawful document format you acquire is your own permanently. You may have acces to every kind you saved within your acccount. Go through the My Forms segment and select a kind to printing or obtain again.

Be competitive and obtain, and printing the Puerto Rico Consulting Agreement with Former Employee with US Legal Forms. There are thousands of skilled and express-particular varieties you can utilize for your personal organization or specific demands.

Form popularity

FAQ

The rule of 3 in consulting suggests that you should present your ideas in groups of three to enhance clarity and retention. This principle applies well when drafting a Puerto Rico Consulting Agreement with Former Employee, as it allows you to summarize key points effectively. By focusing on three main objectives or terms, you simplify complex information and make it easier for both parties to understand. This approach fosters better communication and collaboration.

The 7 C's of consulting refer to clarity, competence, credibility, communication, collaboration, creativity, and commitment. Each of these elements plays a vital role in delivering effective consulting services, especially in a Puerto Rico Consulting Agreement with Former Employee. By focusing on these principles, you ensure a productive relationship and successful outcomes. Emphasizing these C's can set the foundation for a strong consulting engagement.

Writing a consulting contract agreement involves detailing the objectives, terms, and conditions of the engagement. Begin with a clear introduction of the parties involved and the purpose of the Puerto Rico Consulting Agreement with Former Employee. Follow this with specific clauses on payment, confidentiality, and termination. For ease, consider using a platform like uslegalforms to access templates that guide you through the process.

To structure a Puerto Rico Consulting Agreement with Former Employee, start by defining the scope of services. Clearly outline the roles, responsibilities, and expectations of both parties. Include terms regarding compensation, confidentiality, and duration of the agreement. Lastly, ensure that both parties sign the document to validate it legally.

A consultancy agreement and an employment agreement serve different purposes and legal frameworks. A consultancy agreement typically allows for more flexibility and independence for the consultant, while an employment agreement establishes a more structured relationship with defined roles and responsibilities. In the context of a Puerto Rico Consulting Agreement with Former Employee, this difference can have significant implications for both parties, especially regarding benefits, taxes, and obligations. Understanding these distinctions helps in making informed decisions.

The 183-day rule is a guideline used to determine residency for tax purposes in Puerto Rico. If an individual spends 183 days or more in Puerto Rico during the tax year, they may be considered a resident for tax obligations. This rule is essential to consider when drafting a Puerto Rico Consulting Agreement with Former Employee, as it can impact tax liabilities. Always consult with a tax professional to navigate this complex area effectively.

Consulting does not typically qualify as employment in the traditional sense. Instead, it represents a professional relationship where a consultant offers expertise on a project basis. In a Puerto Rico Consulting Agreement with Former Employee, the consulting arrangement can differ significantly from a standard employment role, particularly regarding benefits and tax implications. Understanding this distinction is crucial for both parties involved.

A consulting agreement is indeed a specific type of contract. It outlines the terms and conditions under which a consultant provides services to a client. In the context of a Puerto Rico Consulting Agreement with Former Employee, it details the expectations and deliverables between the former employee and the company. Therefore, while all consulting agreements are contracts, not all contracts are consulting agreements.

Act 75 is another name for Law 75 in Puerto Rico, which governs exclusive distribution agreements. It provides protections against unjust termination and establishes the rights of distributors. If you are drafting a Puerto Rico Consulting Agreement with a Former Employee, knowing the stipulations of Act 75 can help you navigate compliance issues effectively.

Law 75 refers to the statute in Puerto Rico that protects the rights of exclusive distributors and dealers. This law is designed to prevent unfair termination and ensure fair treatment in distribution agreements. Understanding Law 75 is vital when formulating a Puerto Rico Consulting Agreement with a Former Employee to maintain compliance and uphold rights.