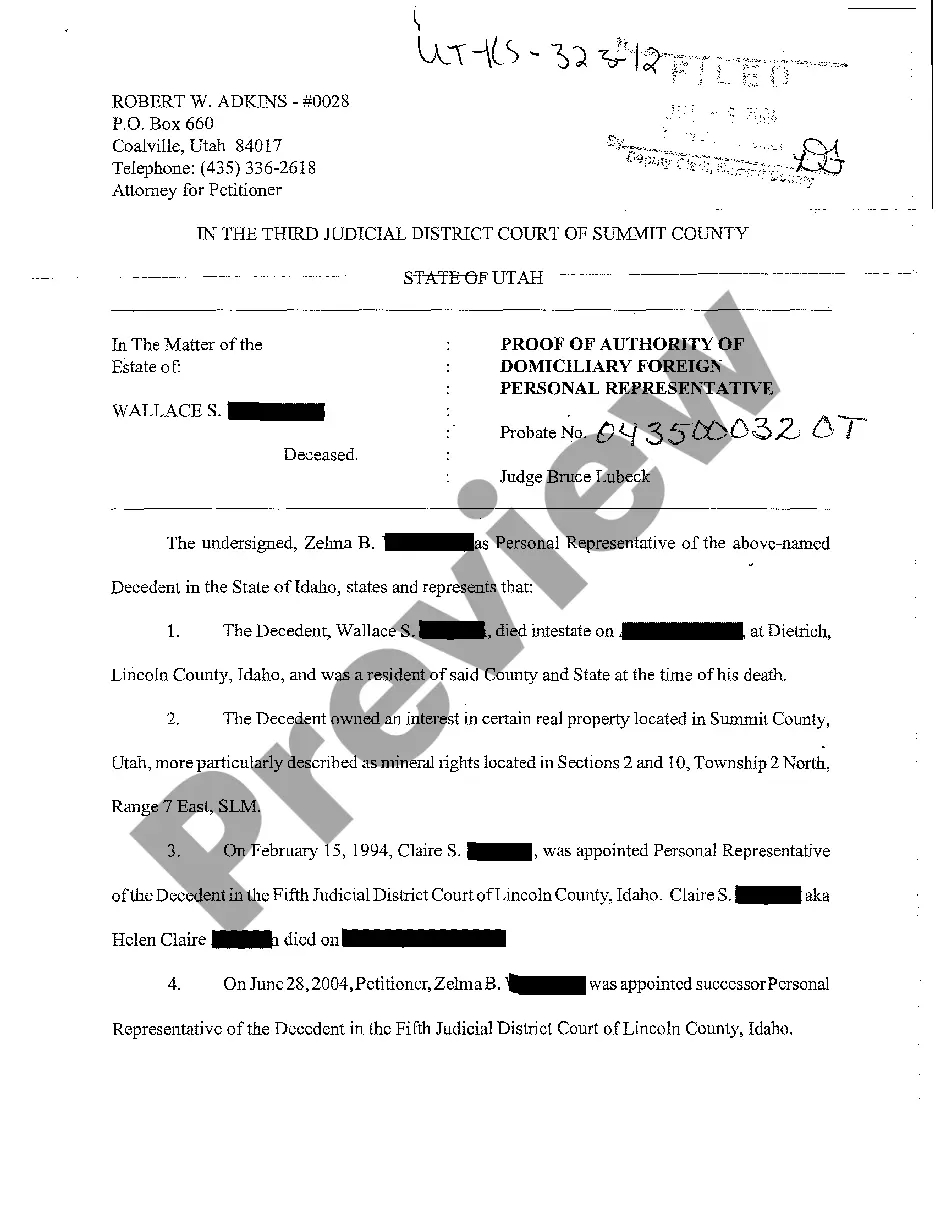

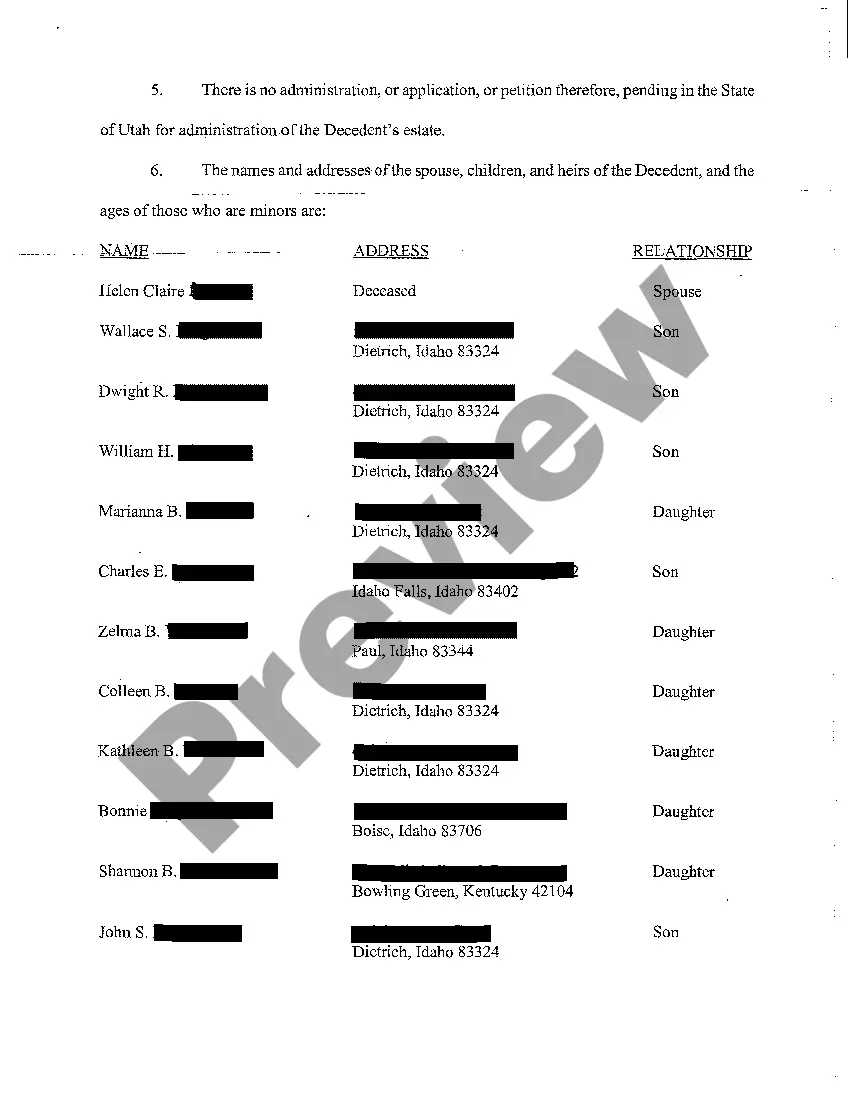

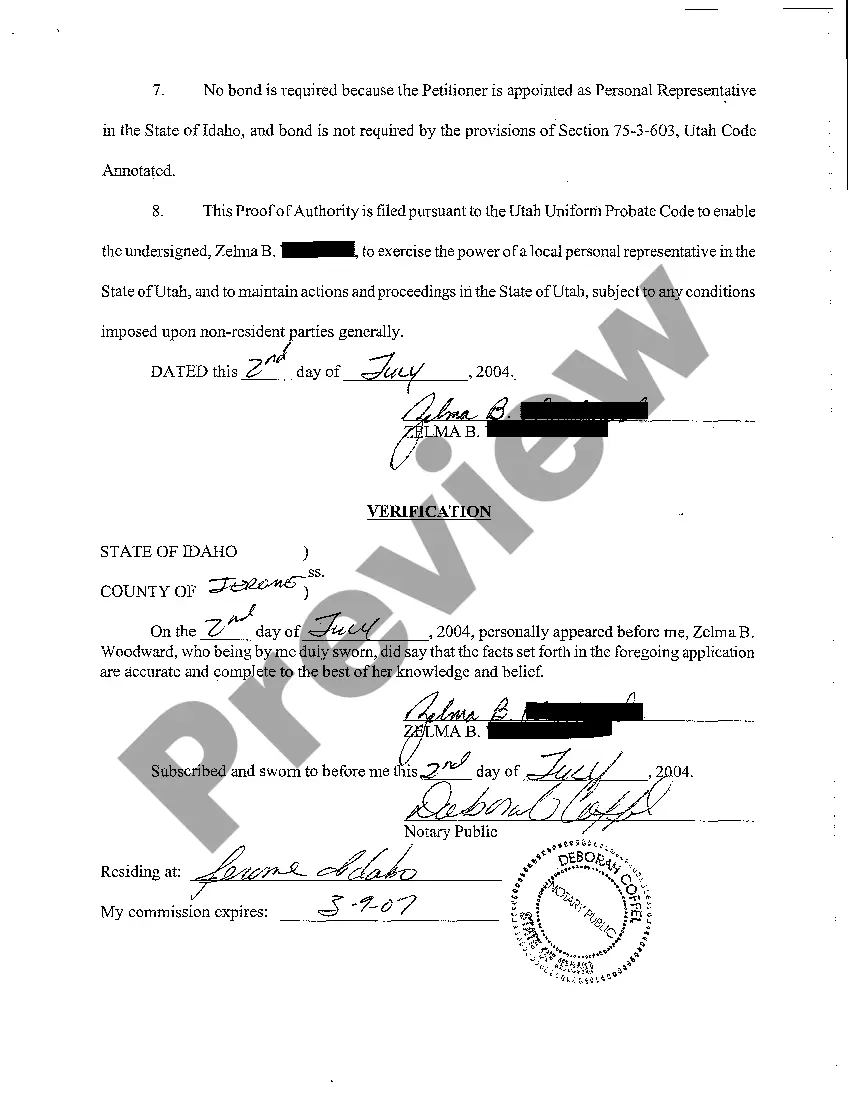

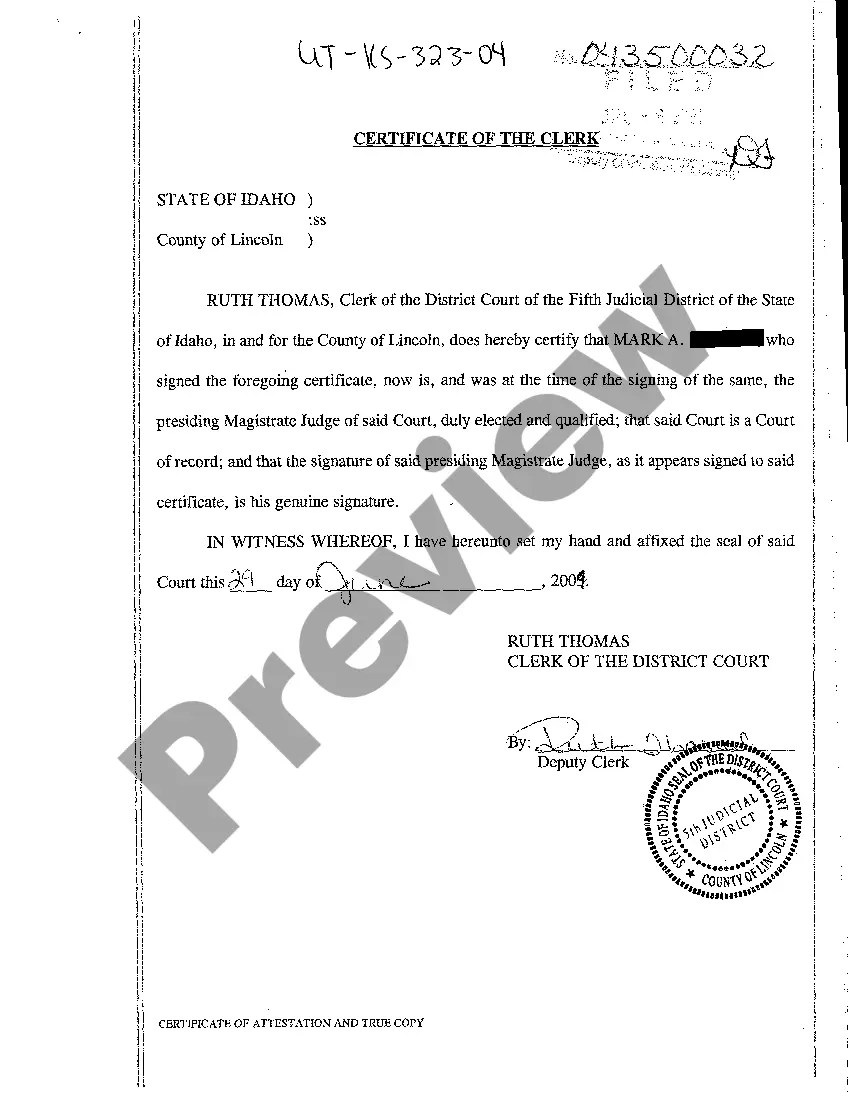

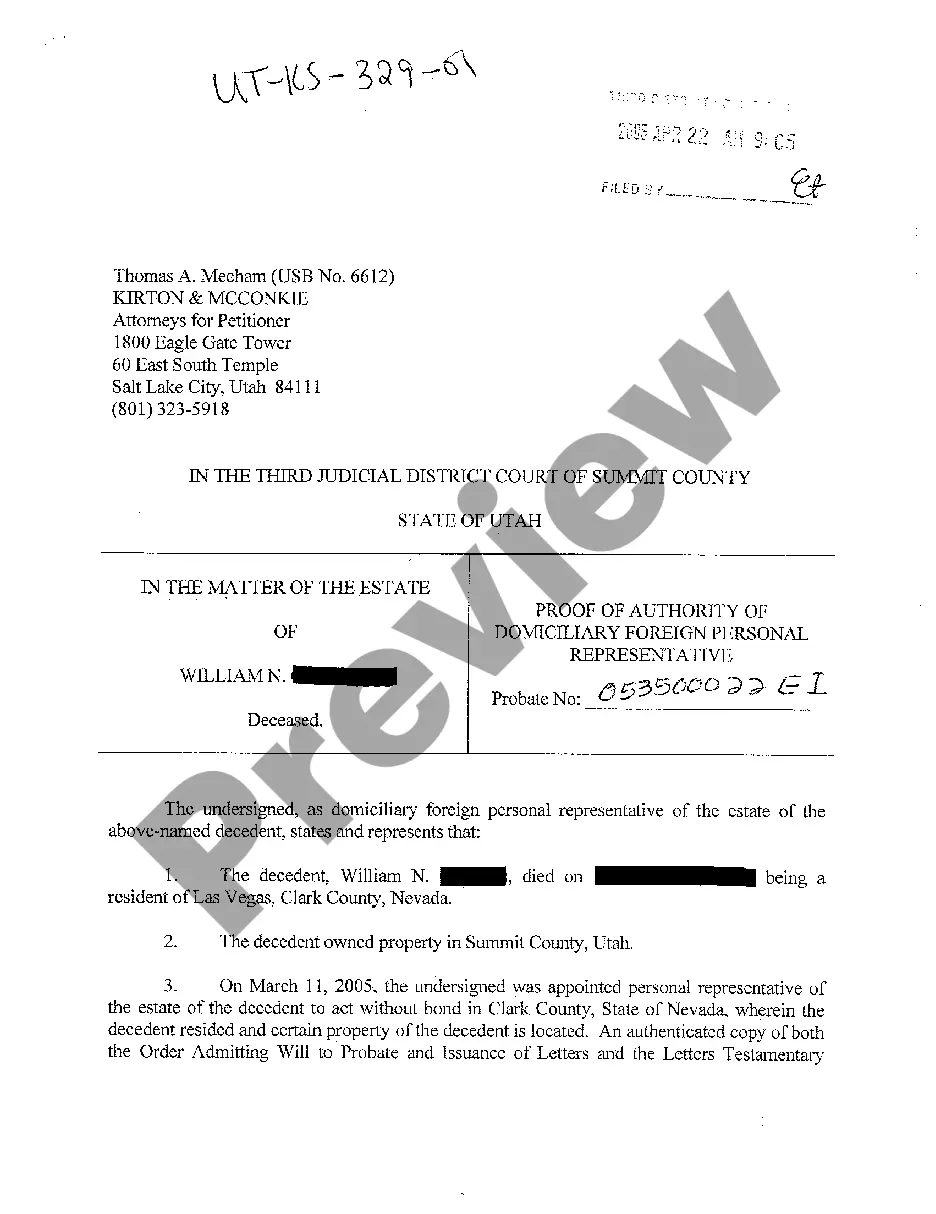

Utah Proof of Authority of Domiciliary Foreign Personal Representative

Description

How to fill out Utah Proof Of Authority Of Domiciliary Foreign Personal Representative?

Among lots of paid and free samples which you get on the internet, you can't be sure about their reliability. For example, who created them or if they are competent enough to deal with the thing you need these to. Always keep relaxed and use US Legal Forms! Discover Utah Proof of Authority of Domiciliary Foreign Personal Representative samples developed by skilled attorneys and avoid the costly and time-consuming procedure of looking for an attorney and after that having to pay them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access all of your previously downloaded files in the My Forms menu.

If you’re using our service the first time, follow the instructions listed below to get your Utah Proof of Authority of Domiciliary Foreign Personal Representative with ease:

- Make sure that the file you discover applies in your state.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or look for another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you have signed up and bought your subscription, you can utilize your Utah Proof of Authority of Domiciliary Foreign Personal Representative as often as you need or for as long as it remains active where you live. Edit it in your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

In most cases, all businesses in Utah are required by law to register with the Utah Department of Commerce, Division of Corporations and Commercial Code, the Utah Department of Workforce Services, the Utah State Tax Commission, the Utah Labor Commission, Internal Revenue Service and with local municipalities to obtain

If you go this route, your certificate will arrive within four to six weeks. Delays can occur if the office needs to request additional information. When you receive the certificate, it should be displayed prominently at your office or place of business.

A Certificate of Authority is a document that provides statesother than the one in which your business is registeredall of a business's important information, including official name, owners' names, and legal status (limited liability company, corporation, limited partnership, etc.).

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

Generally speaking, a business registration certificate is what allows the state to identify and recognize your business as a separate legal entity. Upon the successful completion of the filing process, the state will confer the legal benefits of registration on your business.

A Certificate of Authority (CA) is a license issued by the state to an insurance company that allows the company to conduct its business. Insurance companies acquire COAs by sending an application to the state along with all of the required documentation.

To register your business in Utah, you must file a Foreign Registration Statement (Foreign Limited Liability Company) with the Utah Division of Corporations and Commercial Code (DCCC). You can download a copy of the application form from the DCC website.

To request a Letter of Good Standing to sell your business, complete form TC-42S, Application for a Letter of Good Standing for a Successor in Business. You can submit the form in one of the following ways: Online at Taxpayer Access Point (TAP) under the Business section tap.utah.gov. Fax 801-297-7699.

In short, a state ID number (certificate of authority) and an EIN number are two different things. One is given to you by the federal government. The other tax identification number is given to you by the state.