Puerto Rico Stipulation of Ownership of Mineral Interest in Specific Lands

Description

How to fill out Stipulation Of Ownership Of Mineral Interest In Specific Lands?

Finding the right authorized file web template can be quite a have a problem. Naturally, there are a variety of web templates available on the net, but how would you find the authorized develop you want? Utilize the US Legal Forms internet site. The service provides a huge number of web templates, including the Puerto Rico Stipulation of Ownership of Mineral Interest in Specific Lands, that you can use for enterprise and personal needs. Each of the varieties are inspected by pros and satisfy state and federal specifications.

If you are previously listed, log in in your accounts and then click the Acquire key to have the Puerto Rico Stipulation of Ownership of Mineral Interest in Specific Lands. Make use of accounts to appear throughout the authorized varieties you have ordered previously. Proceed to the My Forms tab of your accounts and get one more duplicate from the file you want.

If you are a brand new customer of US Legal Forms, listed below are basic instructions so that you can stick to:

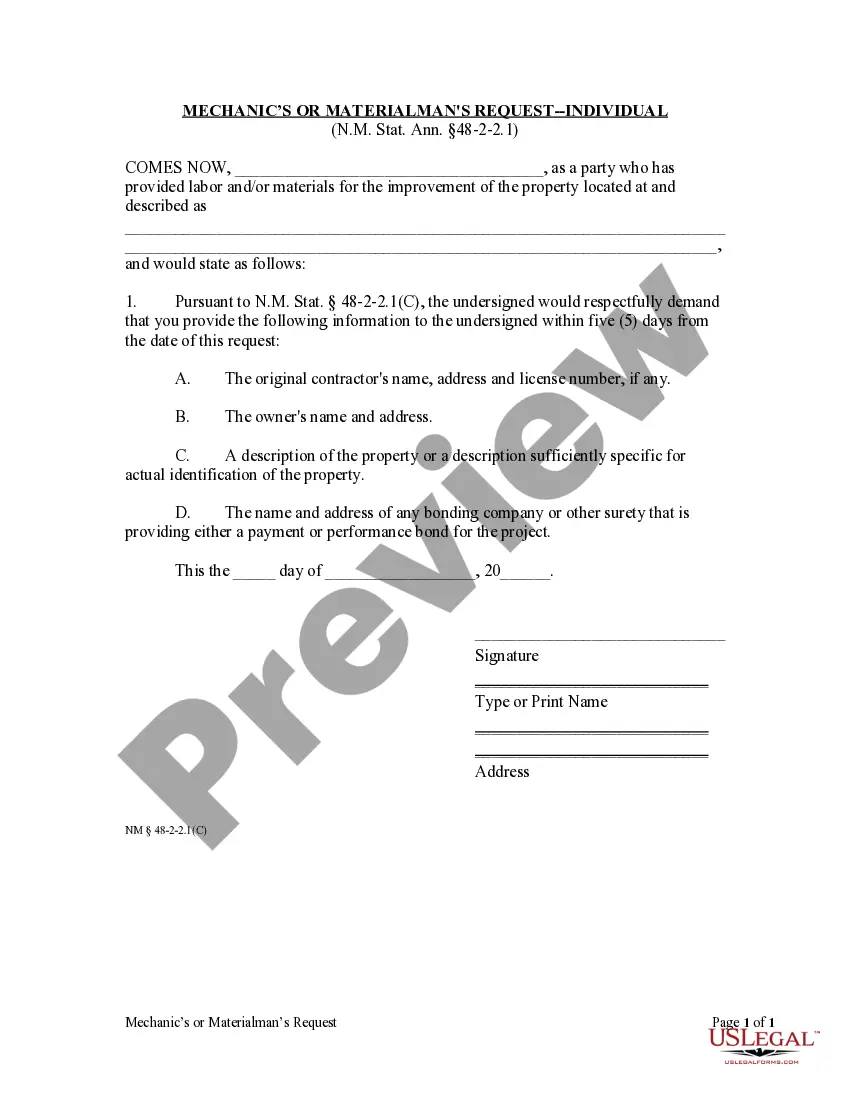

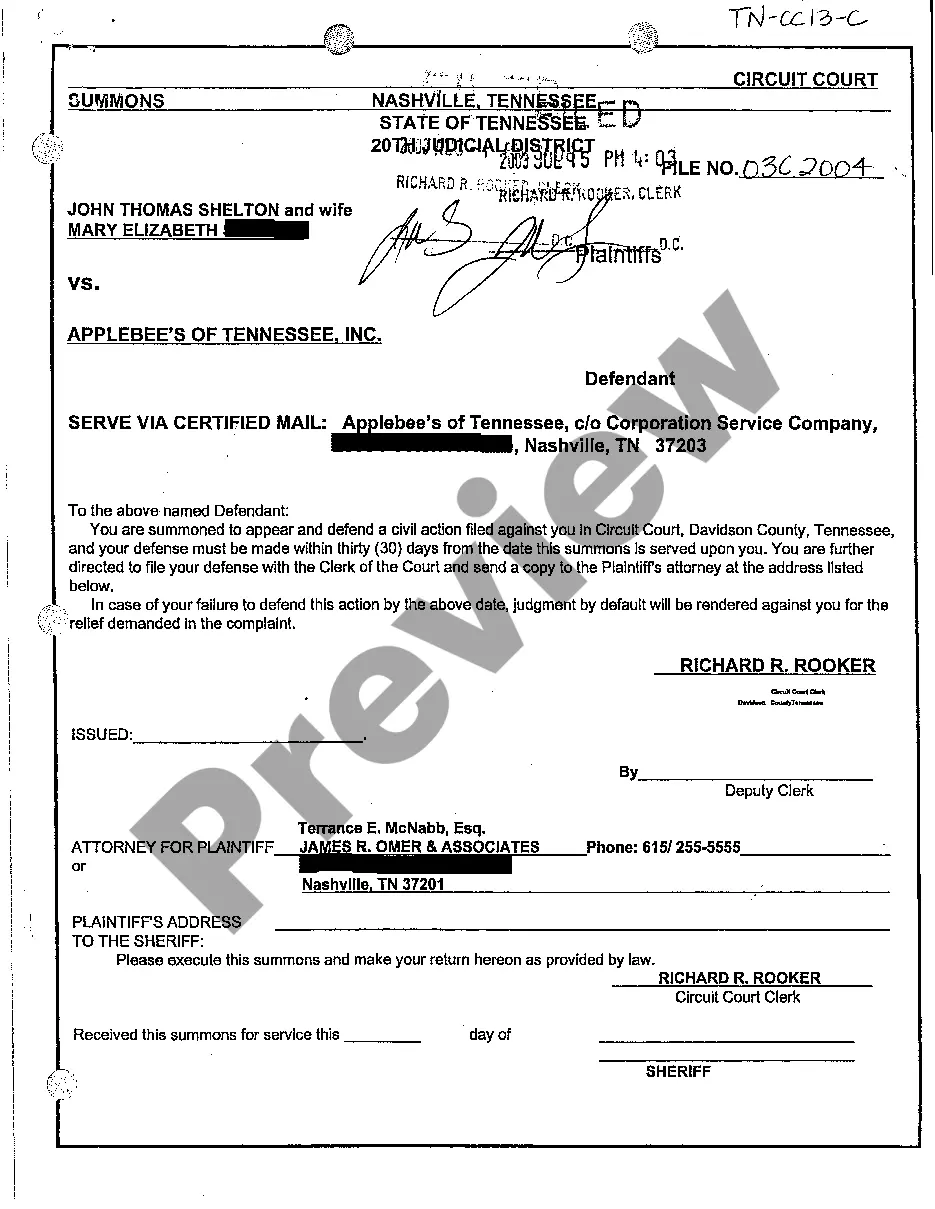

- Initially, ensure you have selected the proper develop for your personal town/county. You may check out the form utilizing the Preview key and study the form description to guarantee this is the best for you.

- When the develop is not going to satisfy your needs, make use of the Seach industry to find the correct develop.

- Once you are sure that the form would work, select the Buy now key to have the develop.

- Opt for the prices plan you would like and type in the essential info. Create your accounts and pay for the transaction making use of your PayPal accounts or charge card.

- Opt for the document structure and down load the authorized file web template in your gadget.

- Complete, modify and printing and indicator the received Puerto Rico Stipulation of Ownership of Mineral Interest in Specific Lands.

US Legal Forms will be the most significant local library of authorized varieties where you can discover different file web templates. Utilize the service to down load expertly-made files that stick to status specifications.

Form popularity

FAQ

If you intend to conduct a mineral rights search in Texas, here are several approaches you could take into consideration: Get in touch with a Title Company. ... Hire a Landman. ... Contact the Texas Railroad Commission. ... Consult with an Expert. ... Go over Public Records. ... Examine the Property Deed. ... Check the County Clerk's Office.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.

Mineral Interest (MI) When the mineral rights are conveyed to another person or entity, they are ?severed? from the land, and a separate chain of title begins. When a person owns less than 100% of the minerals, they are said to own a fractional or undivided mineral interest.

Working Interest: The operating interest under an oil and gas lease. The owner of the working interest has the exclusive right to exploit the minerals on the land. This is only the right to expend money, NOT the right to recoup revenues.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

With its vast reserves of oil and gas, Texas has specific guidelines around inherited mineral rights. In Texas, if mineral rights aren't explicitly mentioned in a will, they typically pass along with the surface land unless there's a prior legal document that separates them.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).