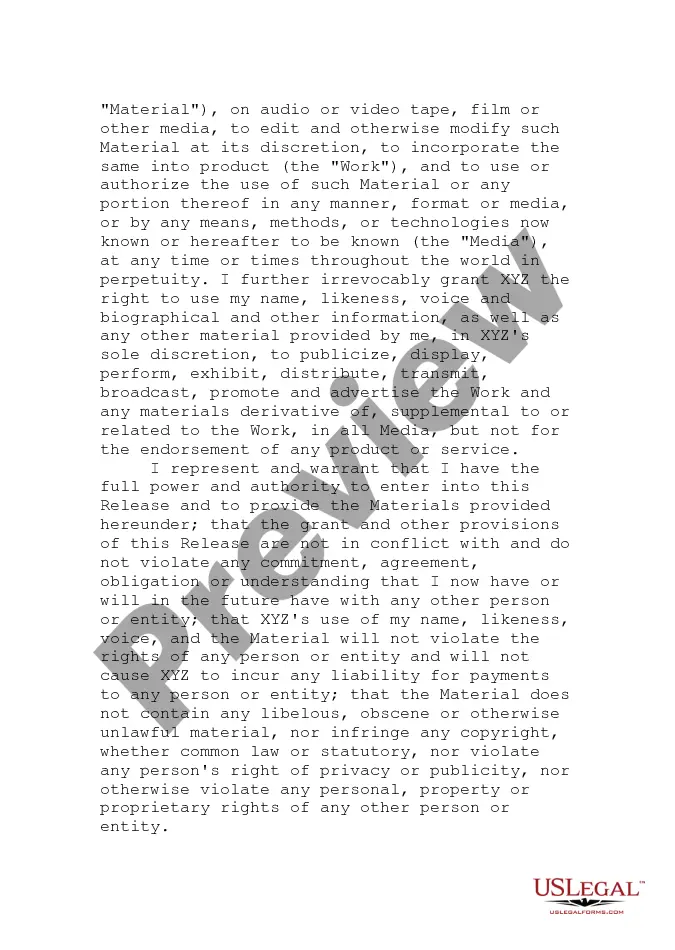

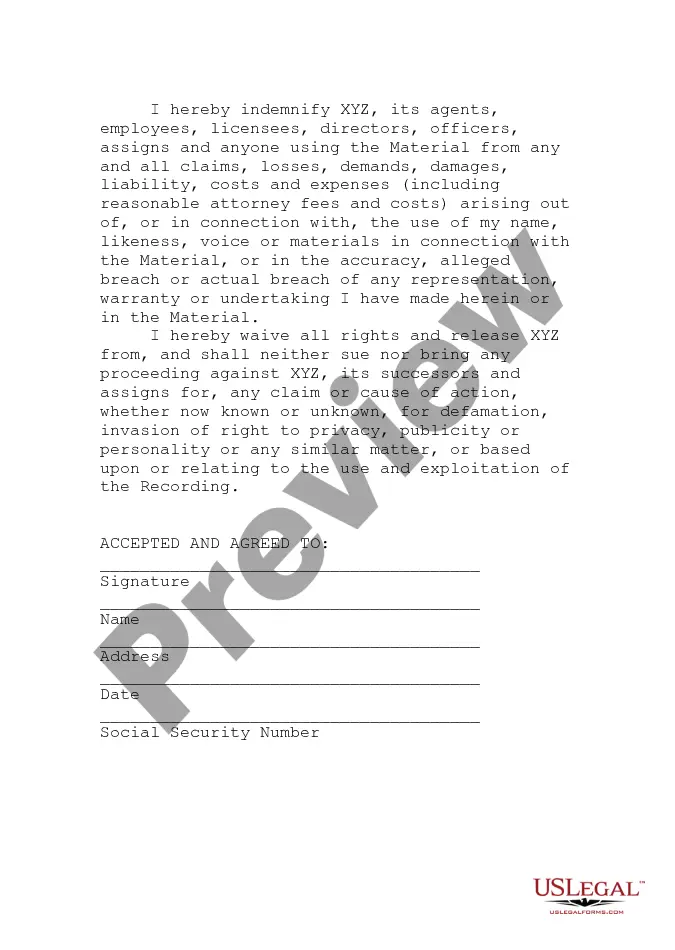

Puerto Rico Materials Release

Description

How to fill out Materials Release?

US Legal Forms - one of the biggest libraries of lawful varieties in America - provides an array of lawful document templates you can download or produce. Using the site, you will get a huge number of varieties for organization and individual purposes, categorized by groups, suggests, or keywords and phrases.You will discover the newest models of varieties like the Puerto Rico Materials Release in seconds.

If you have a registration, log in and download Puerto Rico Materials Release from the US Legal Forms catalogue. The Obtain button will appear on every single develop you perspective. You get access to all previously downloaded varieties in the My Forms tab of the accounts.

If you wish to use US Legal Forms for the first time, listed here are simple recommendations to obtain started:

- Ensure you have selected the best develop to your town/state. Select the Preview button to check the form`s articles. See the develop outline to actually have selected the appropriate develop.

- In the event the develop doesn`t fit your specifications, utilize the Search area on top of the screen to get the one that does.

- Should you be pleased with the form, confirm your option by clicking the Purchase now button. Then, opt for the pricing program you prefer and supply your credentials to sign up on an accounts.

- Process the transaction. Make use of your Visa or Mastercard or PayPal accounts to complete the transaction.

- Find the formatting and download the form on the product.

- Make adjustments. Fill up, edit and produce and indication the downloaded Puerto Rico Materials Release.

Each and every format you included with your account lacks an expiration day and it is yours forever. So, in order to download or produce an additional copy, just proceed to the My Forms segment and click on around the develop you require.

Obtain access to the Puerto Rico Materials Release with US Legal Forms, by far the most considerable catalogue of lawful document templates. Use a huge number of professional and express-specific templates that fulfill your company or individual requires and specifications.

Form popularity

FAQ

As a U.S. territory, shipments to Puerto Rico are not considered exports so duties are not applied. There is, however, a state sales tax and a county sales tax.

The 7% withholding represents a withholding at source from every payment made by a person (including a corporation or partnership), who is engaged in a trade or business or in the production of income in Puerto Rico, to a corporation, partnership or individual, for services rendered in Puerto Rico.

Entities in Puerto Rico are identified through a taxpayer ID known as the Employer Identification Number (EIN), which is issued by the US Internal Revenue Service (IRS). Unlike other jurisdictions, the local Treasury does not issue a separate identification number.

Puerto Rico is part of the U.S. Customs territory and therefore no customs duties are assessed on products coming from the mainland United States. There is, however, a 11.5 percent excise tax (sales tax) applied on products imported into the island, as well as on those produced locally.

The return and the corresponding payment may only be made electronically through SURI. To access SURI, access our webpage at .hacienda.pr.gov or directly into SURI through . Payment must be made by electronic fund transfer ("ACH Credit" and "ACH Debit") or credit card (VISA/MasterCard).

Puerto Rico is part of the U.S. customs territory - therefore, U.S. customs laws apply. Imported goods must be reported to the U.S. Customs Service (Customs and Border Protection-CBP), where they are inspected to ensure compliance with U.S. law.

Is Electronic Export Information required for shipments that clear a U.S. port but are ultimately destined for Puerto Rico? No. Shipments that are entered into the U.S. from a foreign country with an ultimate destination of Puerto Rico are not required to be filed in the Automated Export System.

Currently, Puerto Rico is considered an unincorporated territory of the US. This means that the USPS considers Puerto Rico to be domestic shipping, but some private carriers (like FedEx or UPS) consider Puerto Rico to be international.