Puerto Rico Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

Are you currently in the situation where you require documents for either business or personal purposes almost all the time.

There are numerous legitimate document templates available online, but obtaining forms you can trust isn’t straightforward.

US Legal Forms offers a vast array of form templates, such as the Puerto Rico Personal Shopper Services Contract - Self-Employed Independent Contractor, which can be tailored to comply with federal and state regulations.

Once you obtain the correct form, click on Buy now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and purchase the transaction with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Puerto Rico Personal Shopper Services Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

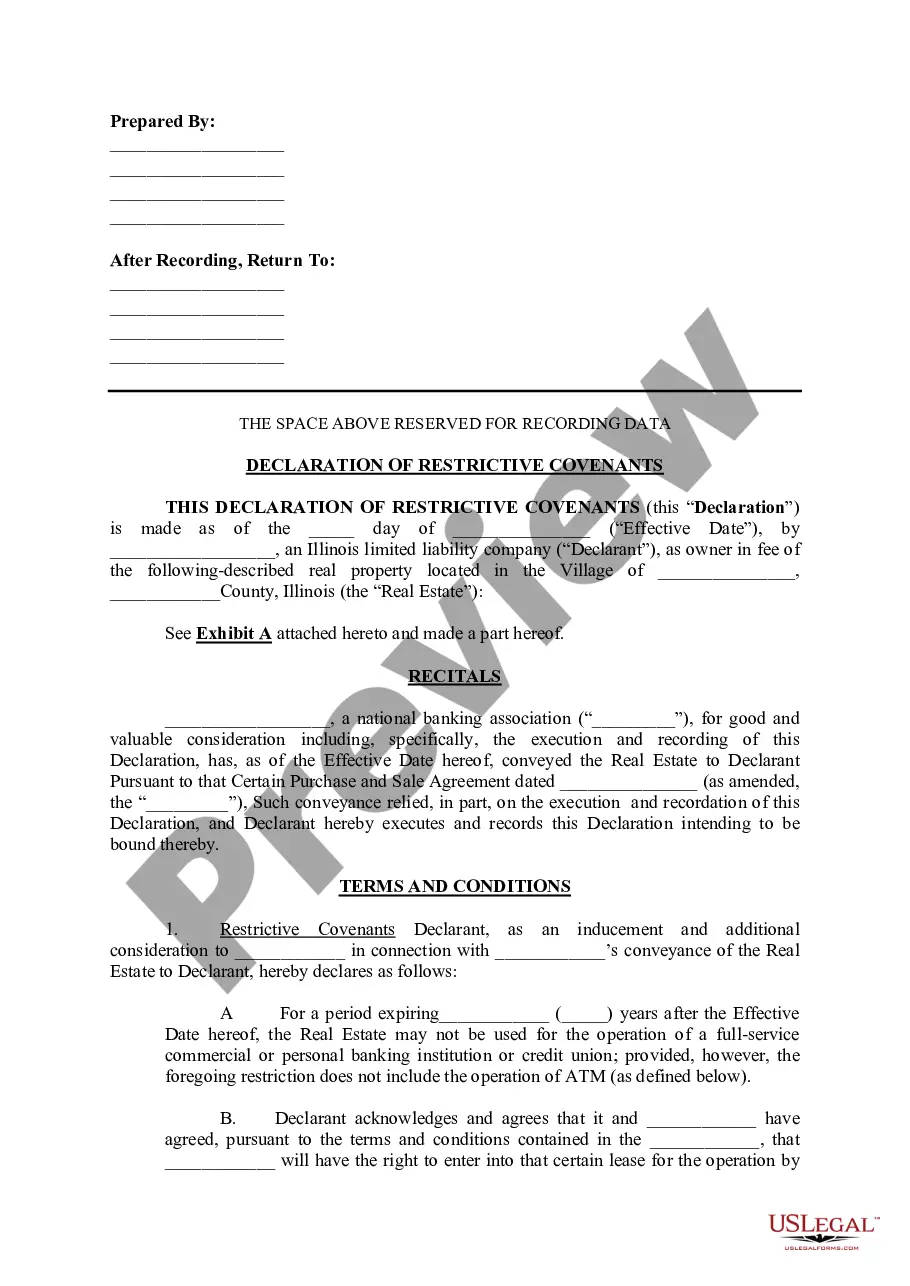

- Use the Preview button to review the form.

- Read the description to verify that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that fits your needs.

Form popularity

FAQ

Yes, if you receive a 1099 form, you are typically classified as self-employed. This status indicates that you earned income through your own business activities, rather than as an employee. If you work under a Puerto Rico Personal Shopper Services Contract, receiving a 1099 emphasizes your role as a self-employed independent contractor.

The terms 'self-employed' and 'independent contractor' often carry the same meaning, but context matters. Saying you are self-employed may emphasize your entrepreneurial spirit, while independent contractor may highlight your specific service agreements. In a Puerto Rico Personal Shopper Services Contract, clarity in your status can enhance your professionalism.

Independent contractors must gather all relevant documents to file taxes, including income statements and expense receipts. Keep track of your earnings and any costs associated with your Puerto Rico Personal Shopper Services Contract. Using resources like uslegalforms can help you understand the specific items you need to prepare for filing.

In Puerto Rico, the equivalent of a federal 1099 form is known as the Forma 480. This form is used to report income earned as a self-employed independent contractor. If you receive payments while working under a Puerto Rico Personal Shopper Services Contract, be sure to request this form for accurate tax reporting.

Yes, independent contractors file their taxes as self-employed individuals. This means you must complete specific tax forms that reflect your earnings and expenses associated with your Puerto Rico Personal Shopper Services Contract. Understanding the filing process is crucial for managing your finances and staying compliant.

Yes, Puerto Rico imposes a self-employment tax on income earned as a self-employed individual. This tax applies to independent contractors, so it's important to factor it into your financial planning. Utilizing tools like uslegalforms can simplify your understanding of these taxes and help you navigate the requirements effectively.

Yes, professional services are generally taxable in Puerto Rico. When you provide your services as a self-employed independent contractor, you must collect sales tax on those services and report it accurately. Keep in mind that working within the framework of a Puerto Rico Personal Shopper Services Contract helps ensure you comply with local tax regulations.

Yes, an independent contractor is considered self-employed. This classification means that they operate their own business and have the freedom to control their work schedule and the services they provide. If you are entering into a Puerto Rico Personal Shopper Services Contract as a self-employed independent contractor, you will enjoy the flexibility and autonomy that come with this status.

A merchant registration certificate in Puerto Rico is an official document that allows individuals and businesses to operate legally. This certificate is essential for anyone engaging in commerce, including self-employed independent contractors. By obtaining this certificate, you demonstrate your commitment to following local laws as a Puerto Rico Personal Shopper Services Contract - Self-Employed Independent Contractor, enhancing your professional reputation.

Yes, Puerto Rico does require certain individuals, including self-employed independent contractors, to obtain a business license depending on their specific field. This license ensures that you comply with local regulations and can operate your business legally. If you are drafting a Puerto Rico Personal Shopper Services Contract - Self-Employed Independent Contractor, it's wise to understand these requirements fully to avoid any legal issues.