Puerto Rico Stone Contractor Agreement - Self-Employed

Description

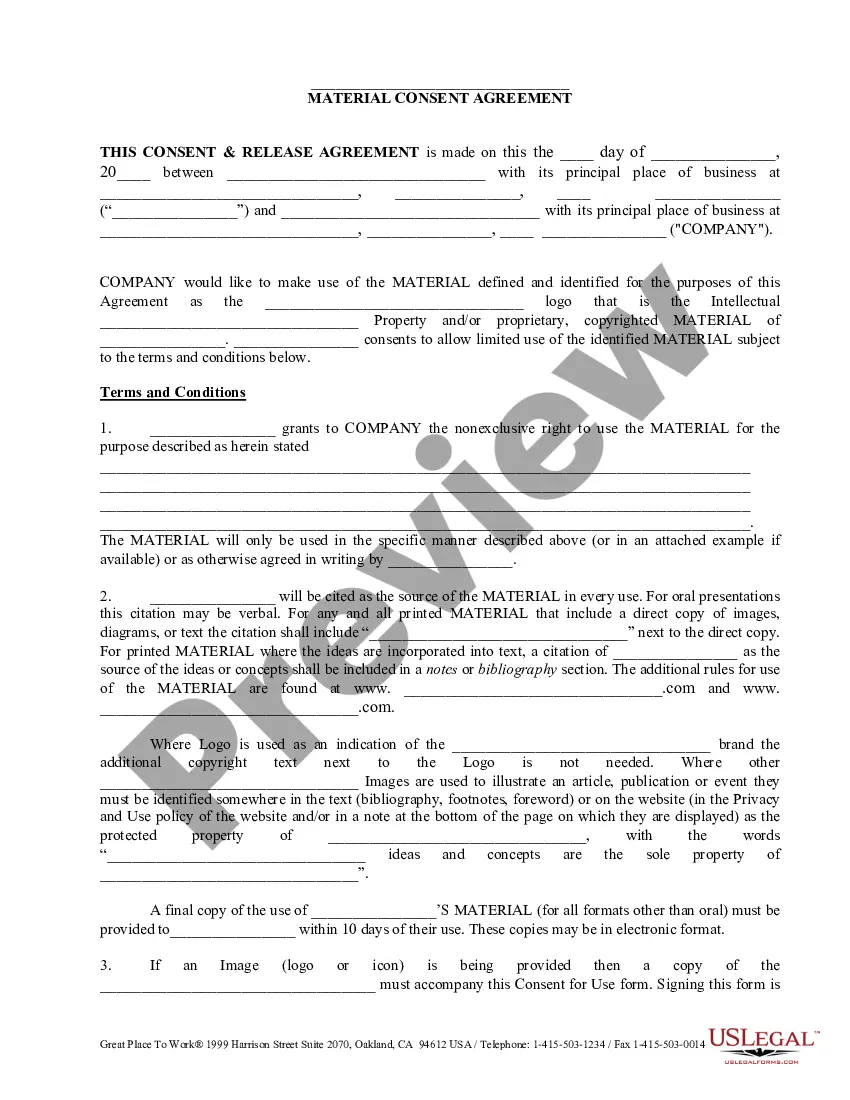

How to fill out Stone Contractor Agreement - Self-Employed?

If you require comprehensive, obtain, or print official document templates, utilize US Legal Forms, the largest collection of legal forms, that is accessible online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to locate the Puerto Rico Stone Contractor Agreement - Self-Employed within a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Puerto Rico Stone Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to obtain the Puerto Rico Stone Contractor Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read through the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Get now option. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the deal.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Puerto Rico Stone Contractor Agreement - Self-Employed.

Form popularity

FAQ

Filling out an independent contractor form requires you to include your personal information, the project details, and payment terms. Make sure to clearly outline the responsibilities and timelines involved. The Puerto Rico Stone Contractor Agreement - Self-Employed serves as a reliable guide, ensuring you capture all necessary components in the form.

Independent contractors do file their taxes as self-employed individuals. This filing means reporting income and expenses on Schedule C, which is part of the overall tax return. Utilizing the Puerto Rico Stone Contractor Agreement - Self-Employed from uslegalforms can help clarify income sources, thus simplifying your filing process.

Yes, Puerto Rico does impose a self-employment tax on income earned by self-employed individuals. This tax contributes to social insurance programs and is crucial for those operating independently. It is advisable to consult a tax professional to understand how the Puerto Rico Stone Contractor Agreement - Self-Employed may impact your tax obligations.

Filling out an independent contractor agreement involves inserting your details and those of the contractor, including names and addresses. Next, detail the nature of the work, payment structure, and duration of the contract. The Puerto Rico Stone Contractor Agreement - Self-Employed template provides user-friendly fields for information, making this task manageable.

Writing an independent contractor agreement begins by clearly defining the project scope, including services to be provided and deadlines. It is essential to specify payment terms, such as compensation rates and invoicing procedures, to avoid confusion. Using a template, like the Puerto Rico Stone Contractor Agreement - Self-Employed from uslegalforms, can streamline this process and ensure compliance with local regulations.

Law 75 in Puerto Rico regulates the relationship between manufacturers and their representatives. It provides protections for commercial relationships, ensuring that distributors and independent contractors receive fair treatment. If you are a self-employed individual in Puerto Rico, understanding the implications of Law 75 is important, and a Puerto Rico Stone Contractor Agreement - Self-Employed can help navigate these legal frameworks.

Both terms can be used interchangeably, but they may convey slightly different nuances. 'Self-employed' emphasizes autonomy in business, while 'independent contractor' highlights a contractual relationship with clients. Regardless of the term you choose, a well-structured Puerto Rico Stone Contractor Agreement - Self-Employed can provide clarity and structure to your work arrangement.

Yes, an independent contractor is indeed classified as self-employed. They operate independently, managing their own contracts and clients. The Puerto Rico Stone Contractor Agreement - Self-Employed can help solidify this status and ensure that all parties involved understand their roles and obligations clearly.

employed individual is someone who works for themselves rather than for an employer. Key qualifications include the ability to offer services independently, manage one's business, and handle taxes independently. Utilizing a Puerto Rico Stone Contractor Agreement SelfEmployed can help clarify expectations and enhance professionalism in these arrangements.

Yes, an independent contractor is considered self-employed. This means that they operate their own business, providing services under a contract without being fully integrated into another company's workforce. The Puerto Rico Stone Contractor Agreement - Self-Employed serves as a vital tool for these contractors, helping them outline their services, responsibilities, and payment terms.