Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

If you require to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the premier collection of official templates available online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal use are categorized by types and states, or keywords. Utilize US Legal Forms to locate the Puerto Rico Data Entry Employment Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you receive is yours indefinitely. You have access to every document you downloaded within your account. Visit the My documents section and select a document to print or download again.

Complete, acquire, and print the Puerto Rico Data Entry Employment Agreement - Self-Employed Independent Contractor with US Legal Forms. There are countless professional and state-specific templates you can use for your business or personal needs.

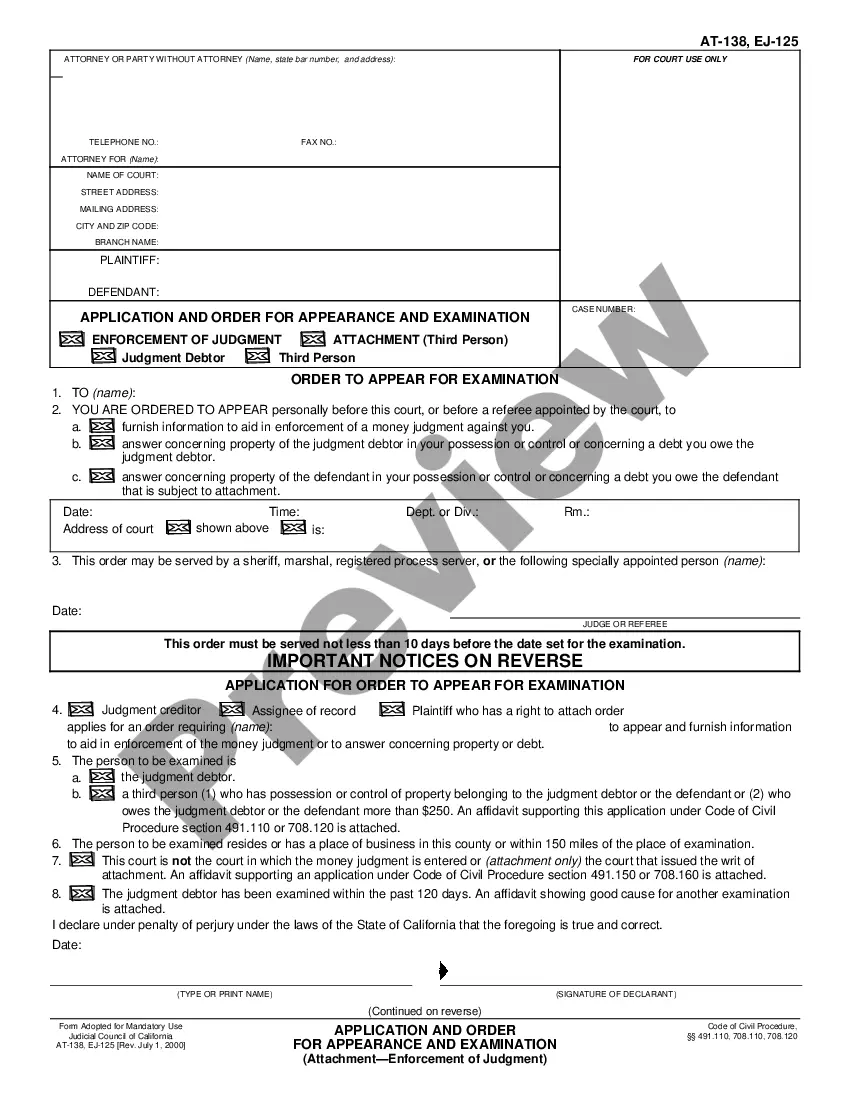

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review feature to examine the document’s content. Don’t forget to read the outline.

- Step 3. If you are dissatisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Select your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Retrieve the format of the legal document and download it to your device.

- Step 7. Fill out, edit, print, or sign the Puerto Rico Data Entry Employment Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

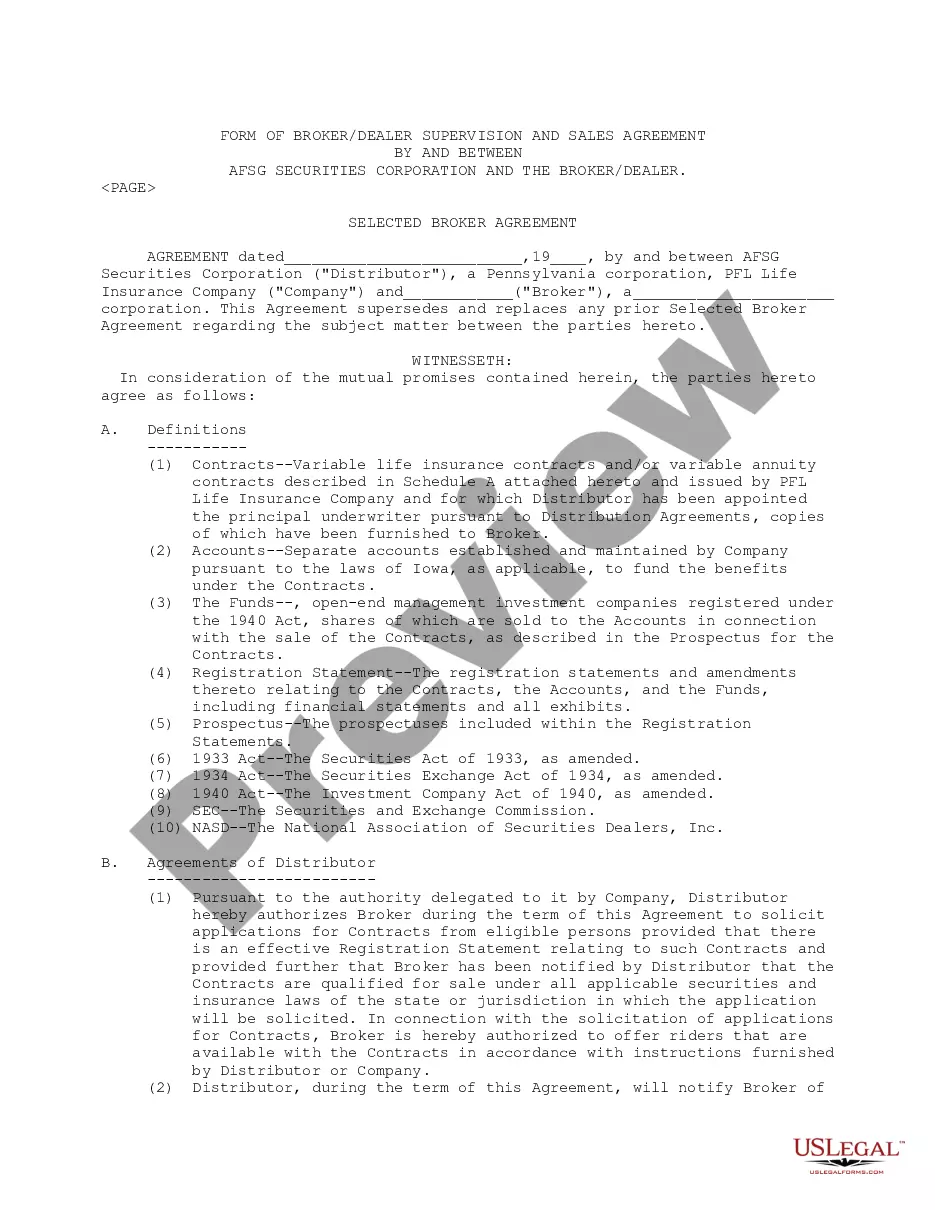

Writing an independent contractor agreement begins with titling the document and stating the names of involved parties. After that, describe the work scope, payment terms, timelines, and termination clauses. Utilizing a reliable platform like US Legal Forms can simplify this process by providing templates for the Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor, ensuring you cover all essential aspects.

To fill out an independent contractor form, start by entering your name, address, and tax identification number. Next, detail the services you will provide and include compensation details to reflect your agreement. Remember that clear terms in the Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor can help avoid misunderstandings later.

An independent contractor typically fills out a W-9 form for tax purposes, alongside the Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor. This agreement should outline the work to be done, payment terms, and any other necessary legal conditions. Keeping organized paperwork helps both the contractor and the hiring entity maintain clarity and compliance.

Filling out an independent contractor agreement, such as the Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor, requires you to start with the contractor's personal information. Next, clearly define the scope of work, payment terms, and duration of the contract. Make sure to include any specific conditions and responsibilities to protect both parties.

The 183-day rule refers to the tax residency status for individuals living or working in Puerto Rico. If you are present in Puerto Rico for 183 days or more during the year, you may be considered a tax resident. Understanding this rule is crucial when crafting a Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor as it affects your tax obligations.

The equivalent of a 1099 in Puerto Rico is referred to as form 480. This form serves a similar purpose by reporting income for self-employed individuals. When engaging in work outlined in a Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor, you should prepare to issue and receive form 480 to remain compliant with local tax laws.

No, an I-9 form is not the same as a 1099. The I-9 is used to verify employment eligibility in the United States, while the 1099 form reports income earned by self-employed individuals. If you're concluding a Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor, ensure you handle both forms appropriately to meet legal requirements.

Form 480 is a tax form used in Puerto Rico for reporting various types of income. If you work as an independent contractor, you may use this form to report income you earn throughout the year. Including the crucial details in your Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor can help ensure you meet all filing requirements.

Yes, Puerto Rico levies a self-employment tax on individuals who are self-employed. When you work as an independent contractor, it’s important to understand these tax obligations to avoid penalties. A well-structured Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor can guide you through these requirements.

Yes, Puerto Ricans can receive a 1099 form. This type of form is typically used to report income for self-employed individuals, including independent contractors. If you are working under a Puerto Rico Data Entry Employment Contract - Self-Employed Independent Contractor, you may receive a 1099 at the end of the tax year, reflecting your earnings.