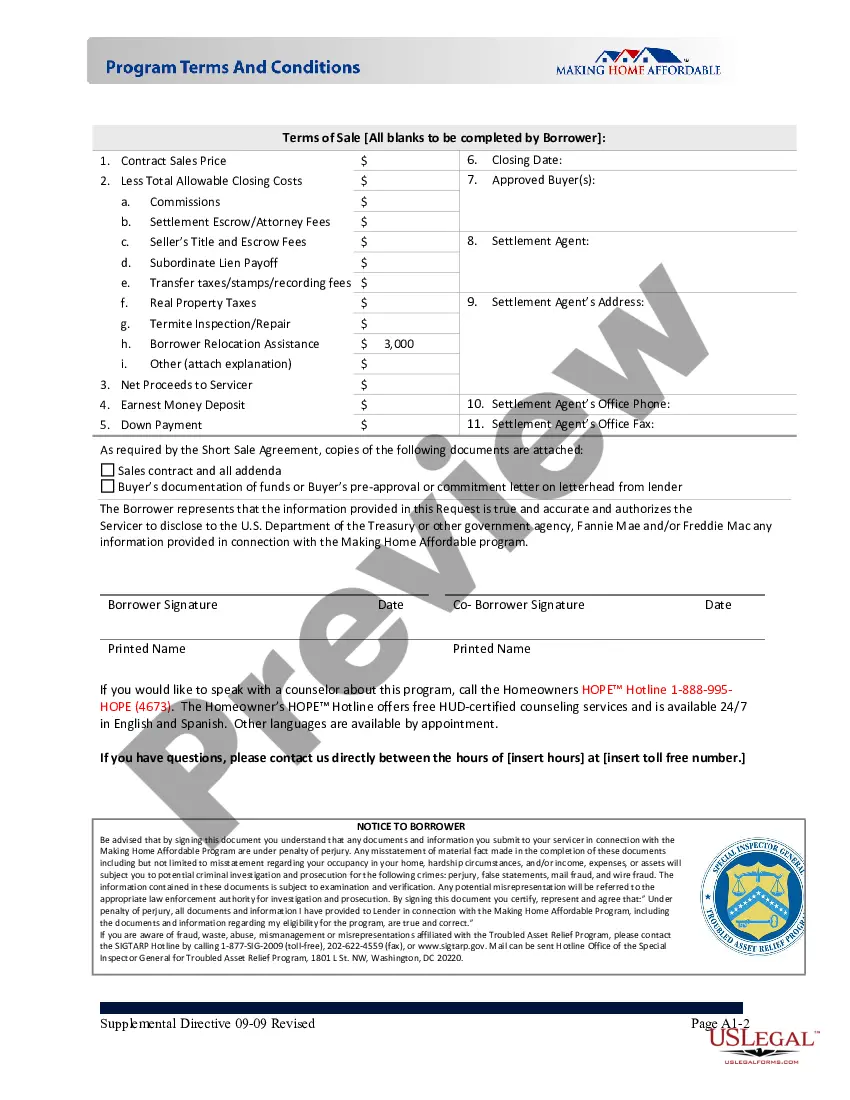

Puerto Rico MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

It is feasible to spend time online attempting to locate the sanctioned document format that satisfies the federal and state requirements you desire.

US Legal Forms offers an extensive collection of legal forms that are reviewed by professionals.

You can conveniently obtain or print the Puerto Rico MHA Request for Short Sale from our service.

Initially, ensure that you have chosen the correct document format for your desired state/location.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Puerto Rico MHA Request for Short Sale.

- Each legal document format you acquire is yours indefinitely.

- To receive another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

Form popularity

FAQ

Rule 22 in Puerto Rico pertains to the legal framework guiding mortgage modifications and short sales. This regulation helps homeowners navigate the processes involved in a Puerto Rico MHA Request for Short Sale more smoothly. By adhering to Rule 22, you can ensure that your short sale request aligns with legal guidelines, which can ultimately facilitate a faster resolution. Utilizing resources like uslegalforms can provide you with necessary documents and guidance in accordance with Rule 22.

Yes, Puerto Rico offers a unique tax structure that provides significant advantages, including a capital gains loophole. Individuals who qualify as residents can potentially avoid federal capital gains taxes on investments made after moving to Puerto Rico. This can be particularly beneficial for those engaging in a Puerto Rico MHA Request for Short Sale, as it allows you to retain more financial benefits from your sale. Understanding this loophole can significantly impact your financial planning.

The 183-day rule in Puerto Rico refers to the regulation that determines an individual’s residency status for tax purposes. If you spend 183 days or more in Puerto Rico within a given year, you are considered a resident and subject to local taxes. This rule is crucial for those looking to benefit from the Puerto Rico MHA Request for Short Sale, as residency can affect eligibility for certain tax incentives. Understanding this rule helps you make informed decisions regarding your residency and financial future.

To transfer a deed in Puerto Rico, you need to prepare a formal deed document, which should include the details of the property and the parties involved. It's essential to have the deed notarized by a certified notary. After that, you must submit the deed to the Registry of Property in Puerto Rico for official recording. This process is especially important if you are involved in a Puerto Rico MHA Request for Short Sale, as it might affect the sale terms.

The Home Buyer Assistance Program in Puerto Rico is designed to support individuals in purchasing a home. This program offers financial aid for down payments and other associated costs, making homeownership more attainable. If you're filing a Puerto Rico MHA Request for Short Sale, resources from this program can be incredibly beneficial.

As mentioned earlier, a credit score of at least 620 is generally needed to buy a house in Puerto Rico. A score at this level not only opens doors to loans but also empowers buyers in negotiating terms with lenders. When considering a Puerto Rico MHA Request for Short Sale, a solid credit history can further ease your process.

The 500 acre law in Puerto Rico refers to regulations surrounding land use and development, specifically involving large tracts of land. This legislation aims to promote responsible land use while encouraging economic growth within the territory. If you plan to buy property and file a Puerto Rico MHA Request for Short Sale, understanding these laws can be vital.