Puerto Rico Waiver Annual Meeting of Directors

Description

How to fill out Waiver Annual Meeting Of Directors?

Finding the right legal papers web template could be a battle. Naturally, there are plenty of templates accessible on the Internet, but how can you get the legal kind you want? Use the US Legal Forms internet site. The support delivers a large number of templates, like the Puerto Rico Waiver Annual Meeting of Directors, that you can use for enterprise and personal requirements. Every one of the types are examined by professionals and meet up with federal and state requirements.

When you are already authorized, log in to your accounts and click the Acquire key to get the Puerto Rico Waiver Annual Meeting of Directors. Utilize your accounts to search throughout the legal types you may have acquired previously. Proceed to the My Forms tab of your own accounts and get another version of the papers you want.

When you are a brand new end user of US Legal Forms, here are straightforward guidelines for you to adhere to:

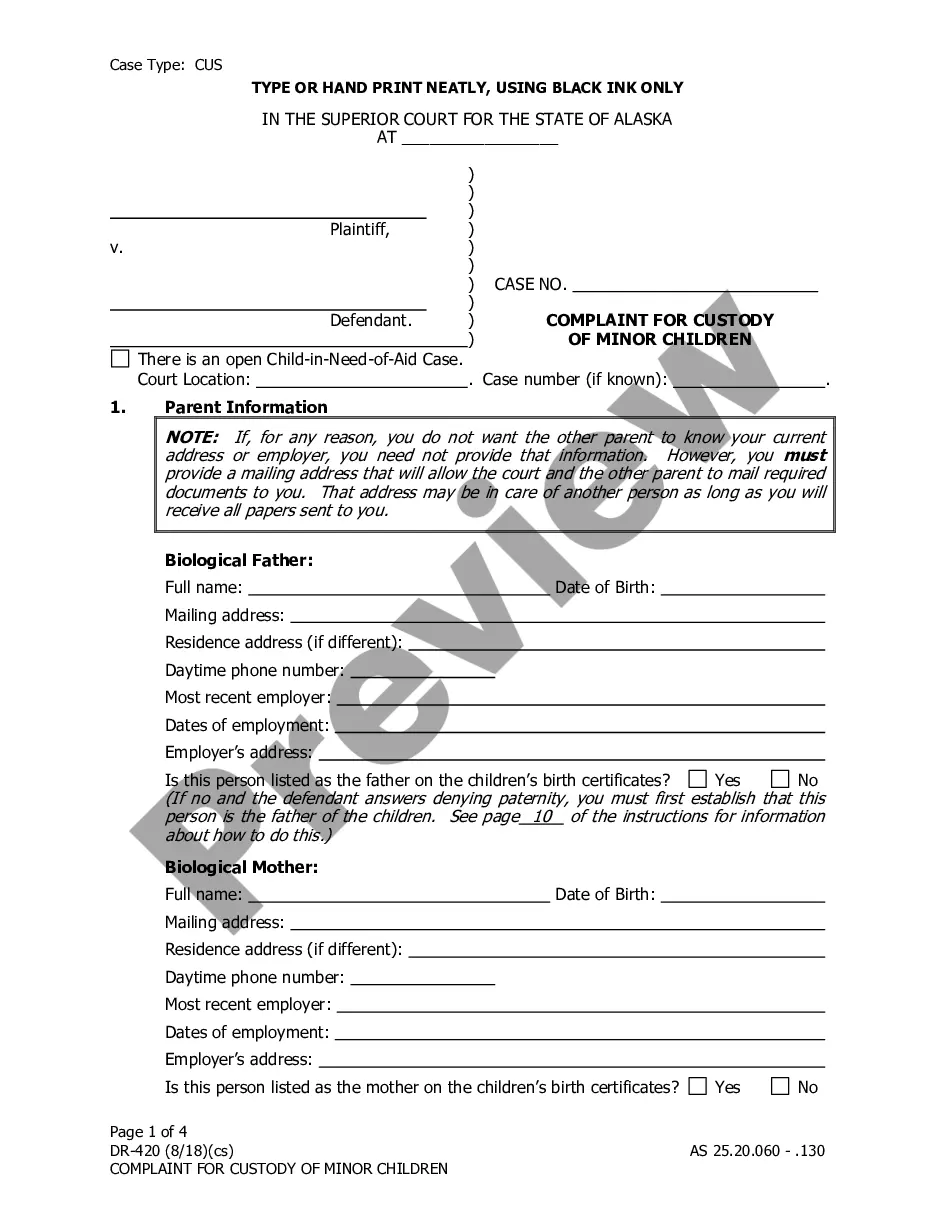

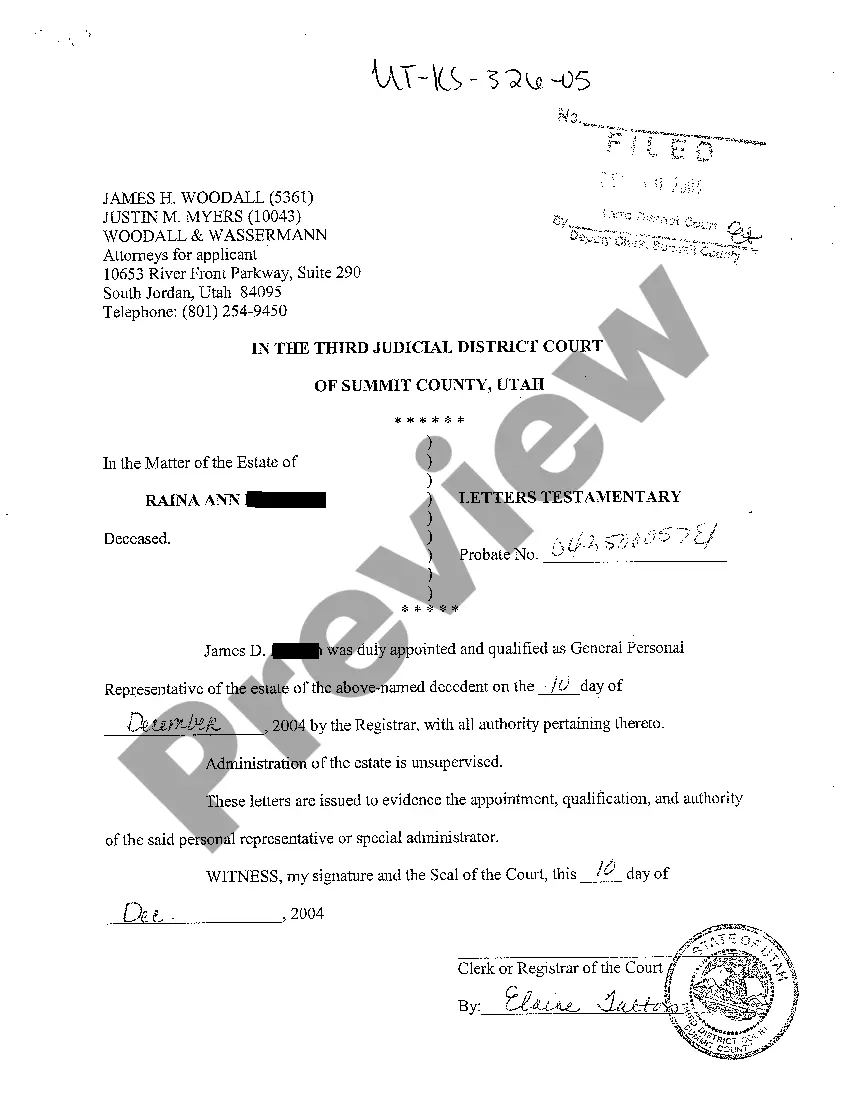

- Initial, ensure you have chosen the correct kind for your personal city/area. You are able to look over the form using the Preview key and browse the form outline to make certain this is the best for you.

- In the event the kind will not meet up with your requirements, use the Seach field to discover the right kind.

- When you are sure that the form is acceptable, select the Purchase now key to get the kind.

- Pick the rates program you want and enter the necessary details. Design your accounts and buy the transaction with your PayPal accounts or Visa or Mastercard.

- Pick the data file format and obtain the legal papers web template to your system.

- Full, edit and printing and signal the acquired Puerto Rico Waiver Annual Meeting of Directors.

US Legal Forms may be the biggest local library of legal types where you can find a variety of papers templates. Use the service to obtain expertly-created paperwork that adhere to condition requirements.

Form popularity

FAQ

A domestic corporation is taxable in Puerto Rico on its worldwide income. A foreign corporation engaged in trade or business in Puerto Rico is taxed at the regular corporate tax rates on income from Puerto Rico sources that is effectively connected income.

Tax Free First Year: Puerto Rico offers a tax deduction of 100% on real estate and personal property taxes during the first-year of operations. One Shareholder: A minimum of only one shareholder is allowed for Puerto Rico corporations. No Authorized Capital: There is no authorized minimum capital requirement.

You will need to follow these five key steps when you incorporate a business in Puerto Rico: Reserve the name of the business you wish to incorporate in Puerto Rico. ... Appoint a legal representative. ... Establish the company bylaws. ... Register the company. ... Open a corporate bank account.

To start a corporation in Puerto Rico, you must file the Certificate of Incorporation with the Department of State. You can file the document online or by mail. The Certificate of Incorporation costs $150 to file. Once processed by the state, this document formally creates your Puerto Rico corporation.

Foreign LLCs only need to file the Certificate of Authorization and pay state fees in order to do business in Puerto Rico.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.