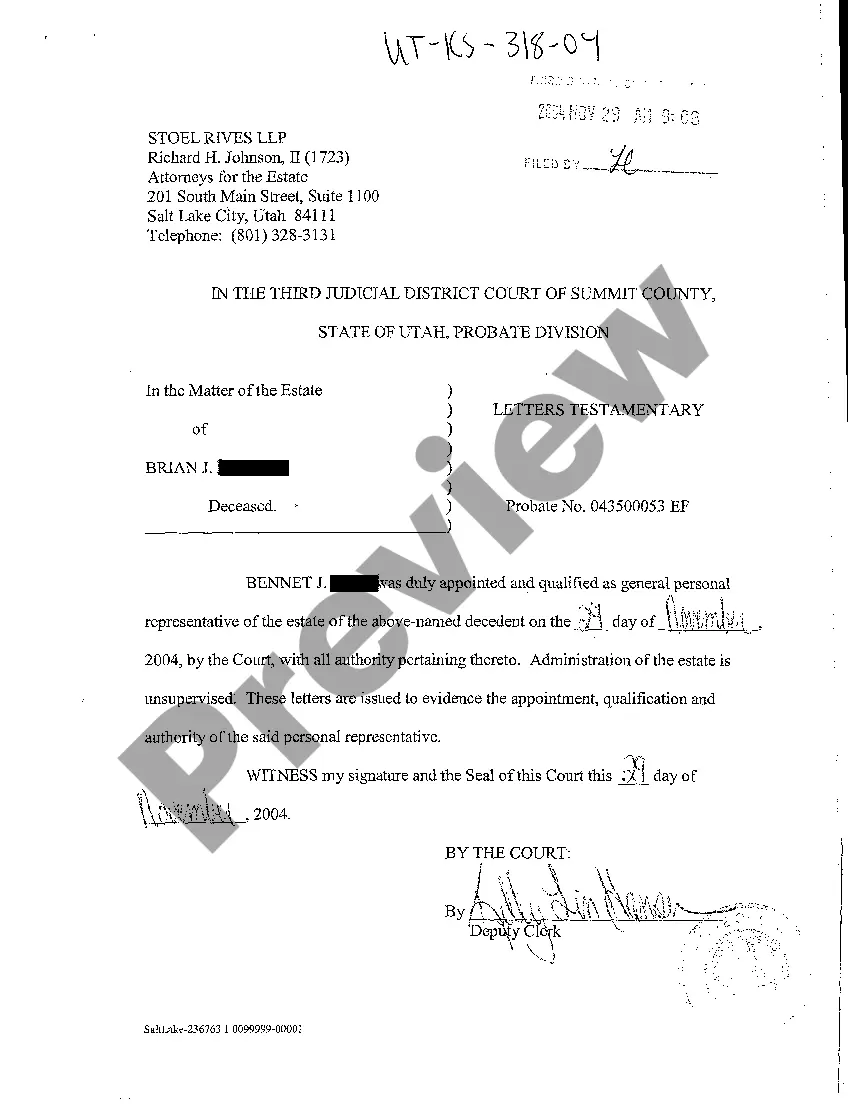

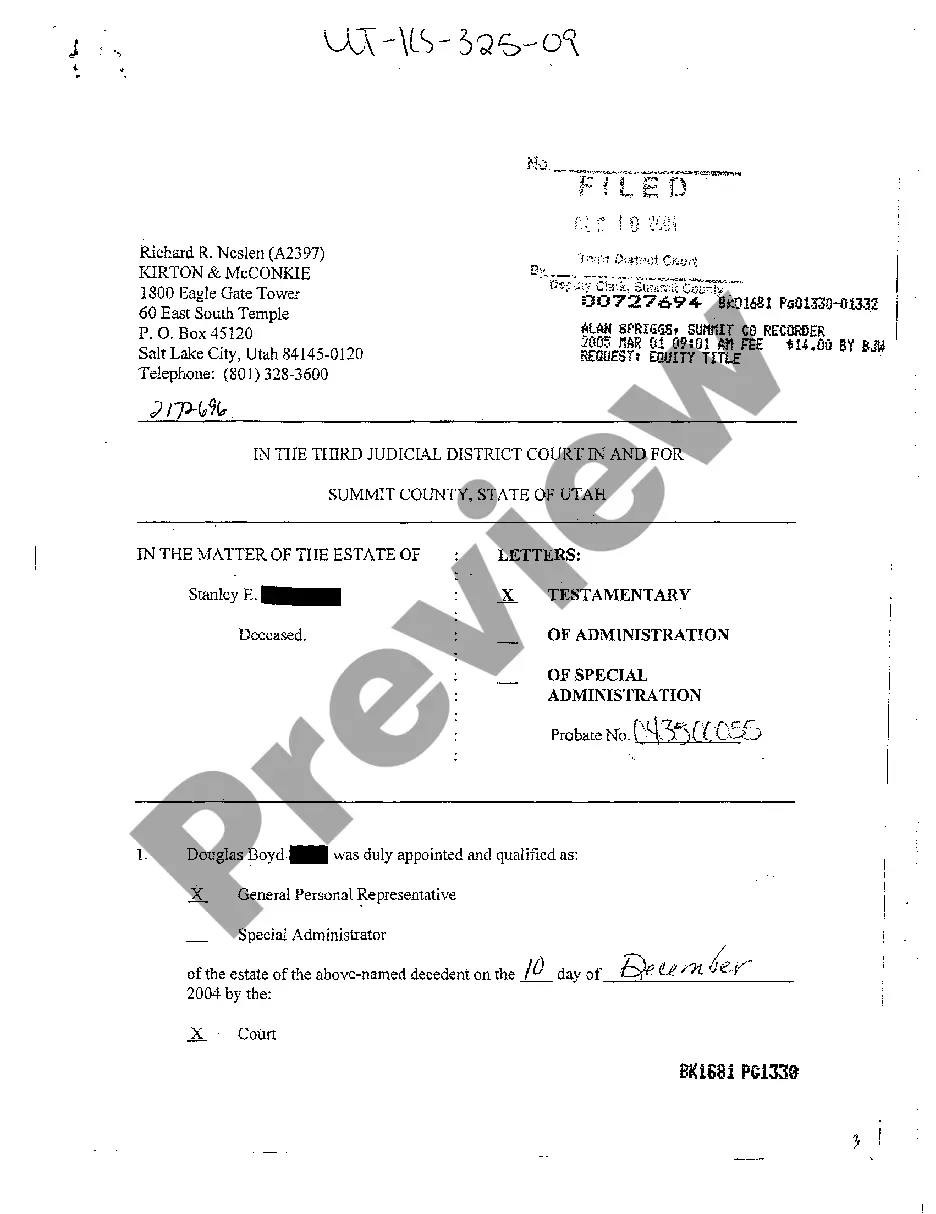

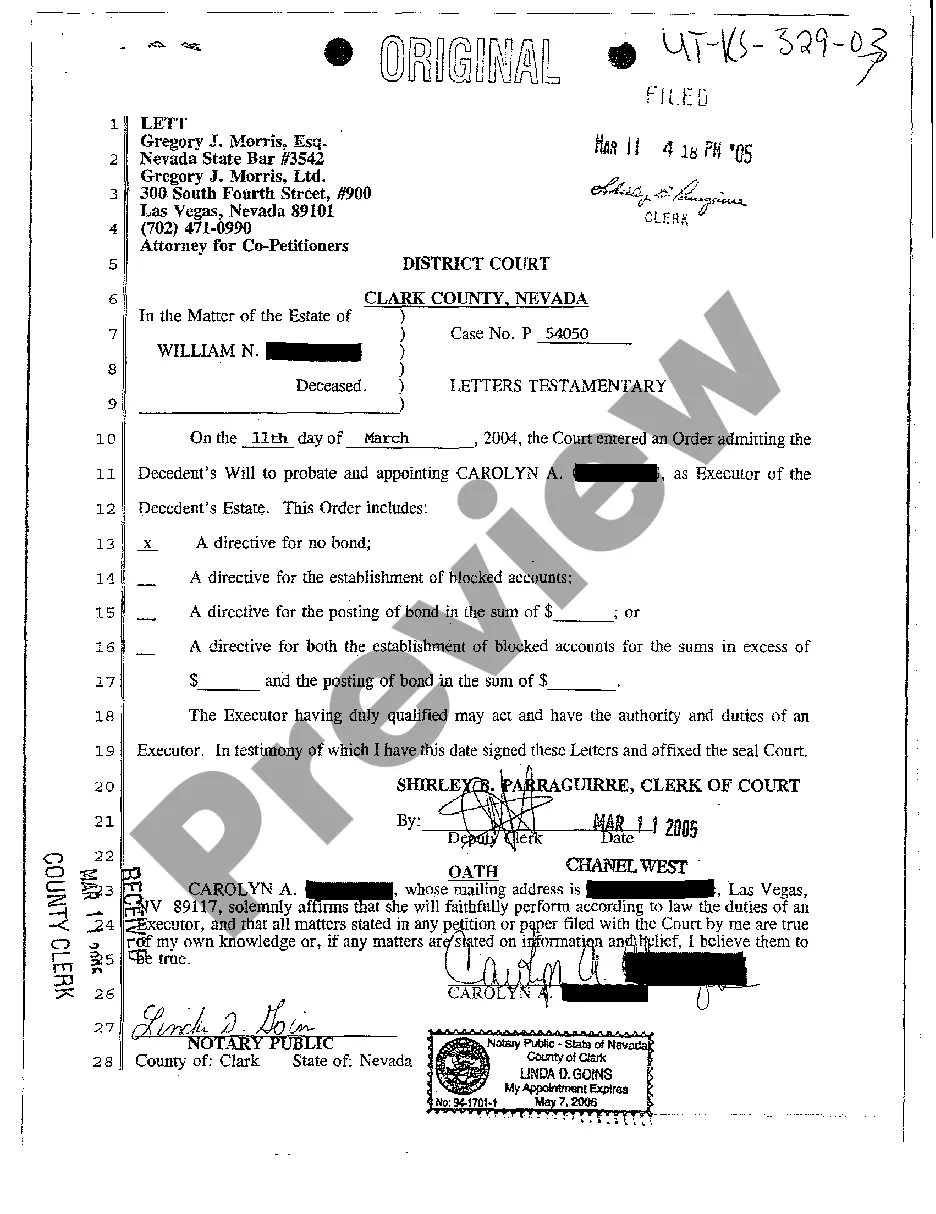

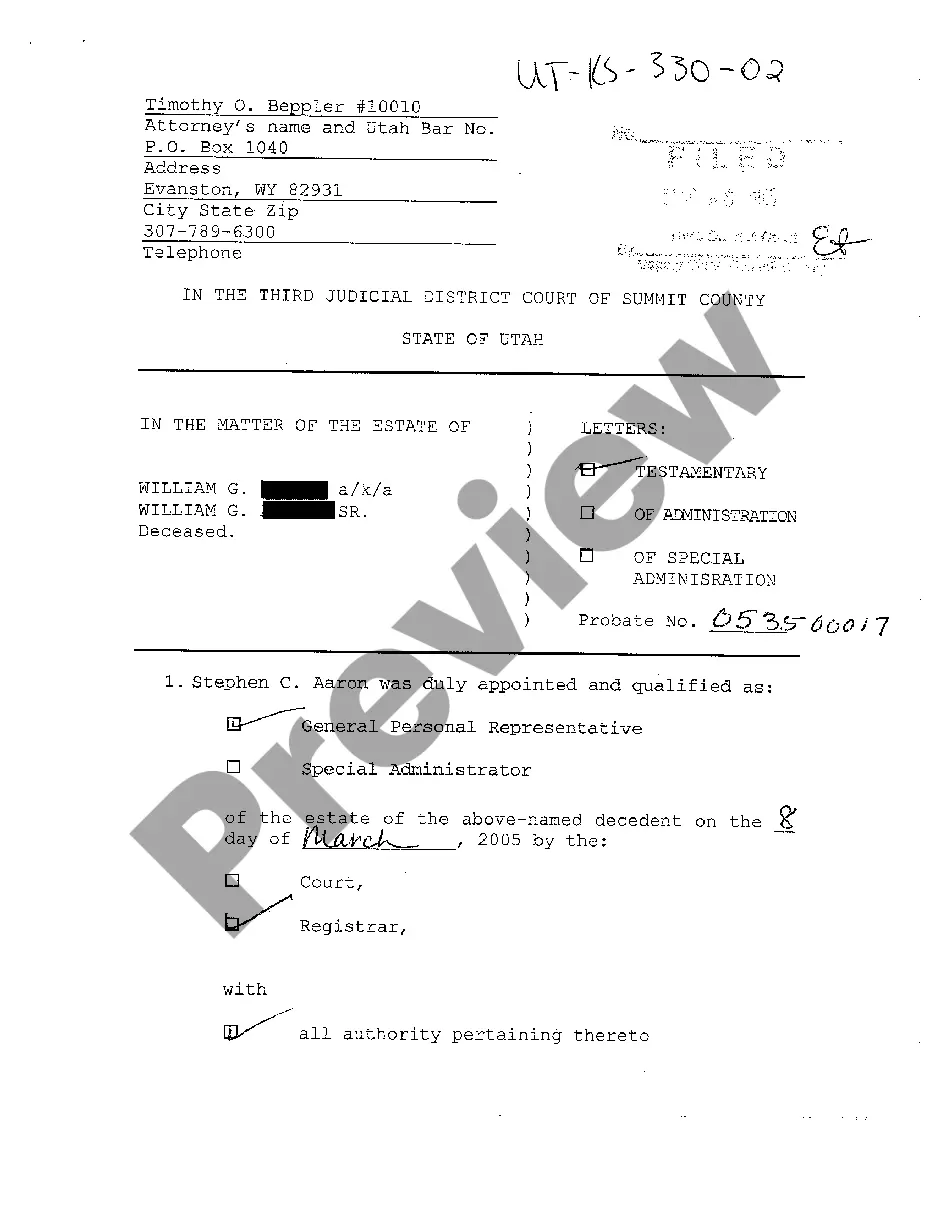

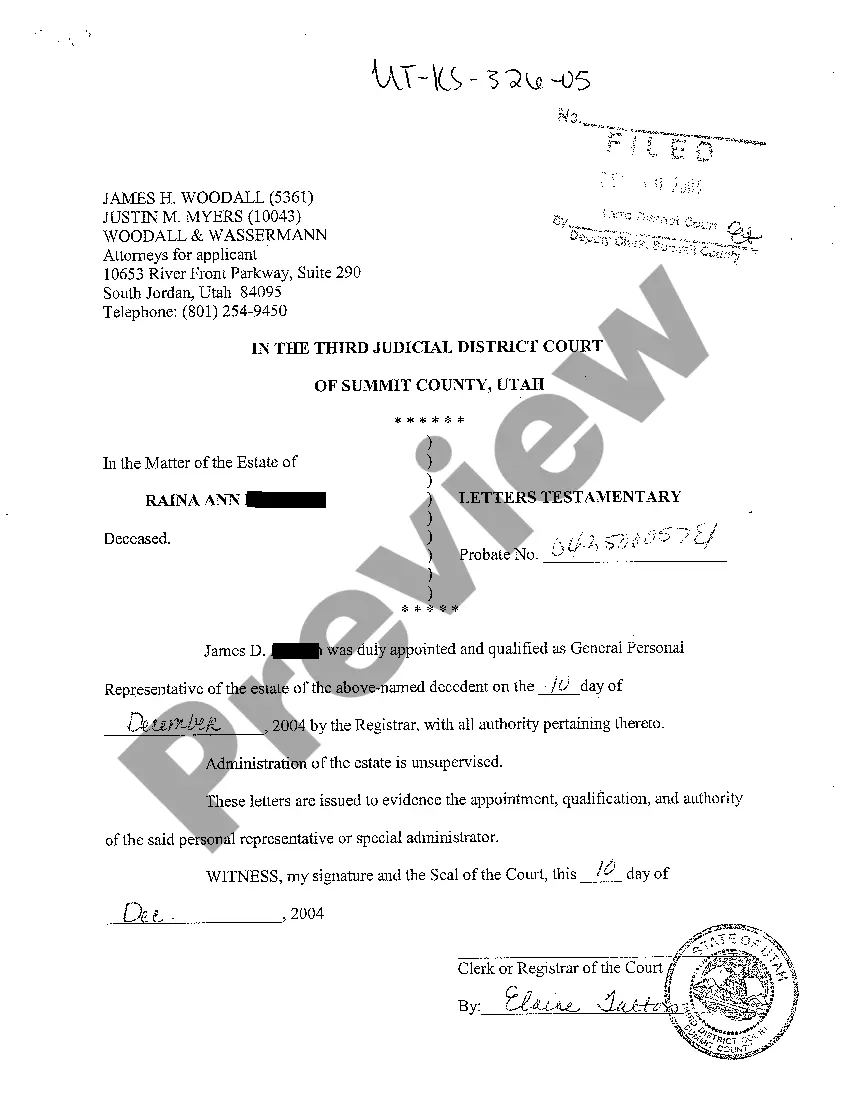

Utah Letters Testamentary

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Utah Letters Testamentary?

Among numerous paid and free examples that you get on the net, you can't be sure about their reliability. For example, who created them or if they’re skilled enough to take care of what you require them to. Always keep calm and utilize US Legal Forms! Discover Utah Letters Testamentary templates developed by professional legal representatives and prevent the costly and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your previously acquired templates in the My Forms menu.

If you’re making use of our service the first time, follow the instructions listed below to get your Utah Letters Testamentary quickly:

- Make sure that the document you find applies where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you’ve signed up and bought your subscription, you may use your Utah Letters Testamentary as many times as you need or for as long as it stays active in your state. Revise it with your favored offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

It begins when a person, usually a family member, petitions the court to probate the estate and appoint a personal representative. The personal representative then administers the estate. This includes paying debts and claims against the estate, selling property (if required), and distributing assets.

Informal probate allows the estate to be probated through an administrative process without any court involvement and no court hearings. The estate is opened by an application and can be opened the day that the application is filed, or within a few days.

In Utah, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

A common question asked of estate planning attorneys is how to obtain a copy of a deceased person's last will and testament or other probate court records. Because probate files are public court records that anyone can read, if a will has been filed for probate then you should be able to obtain a copy of it.