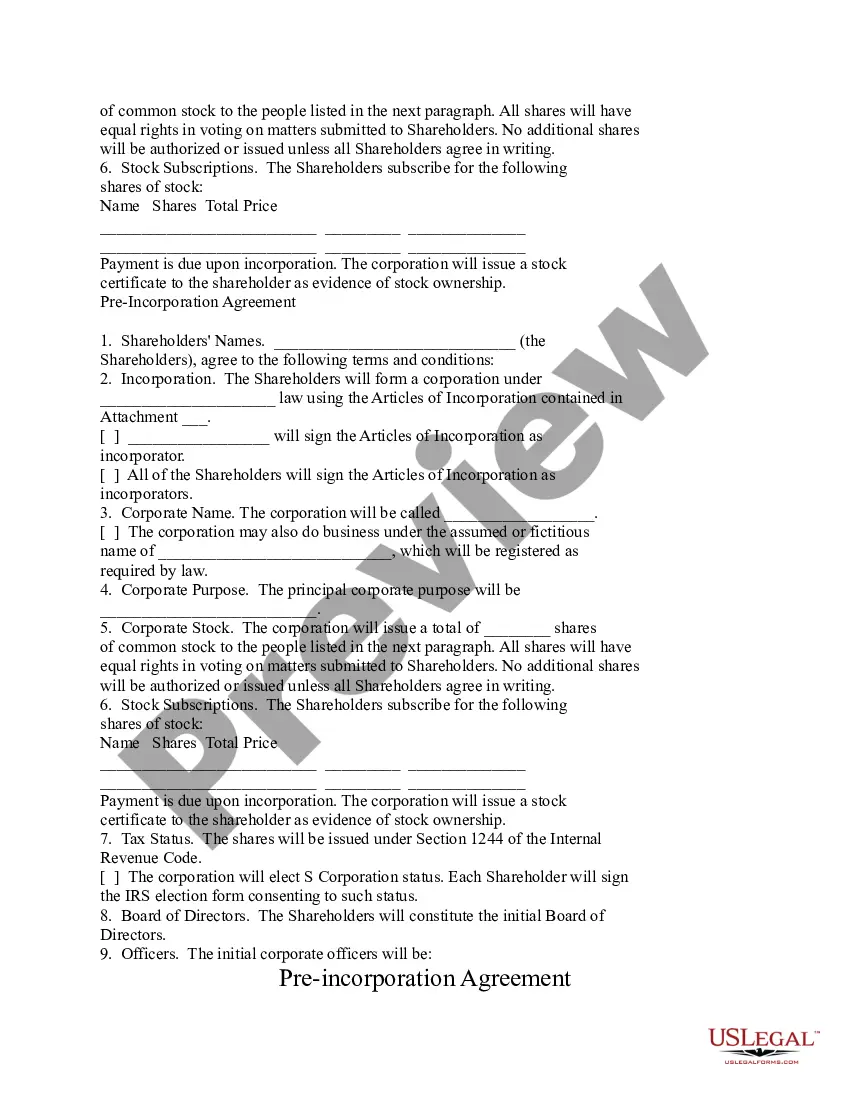

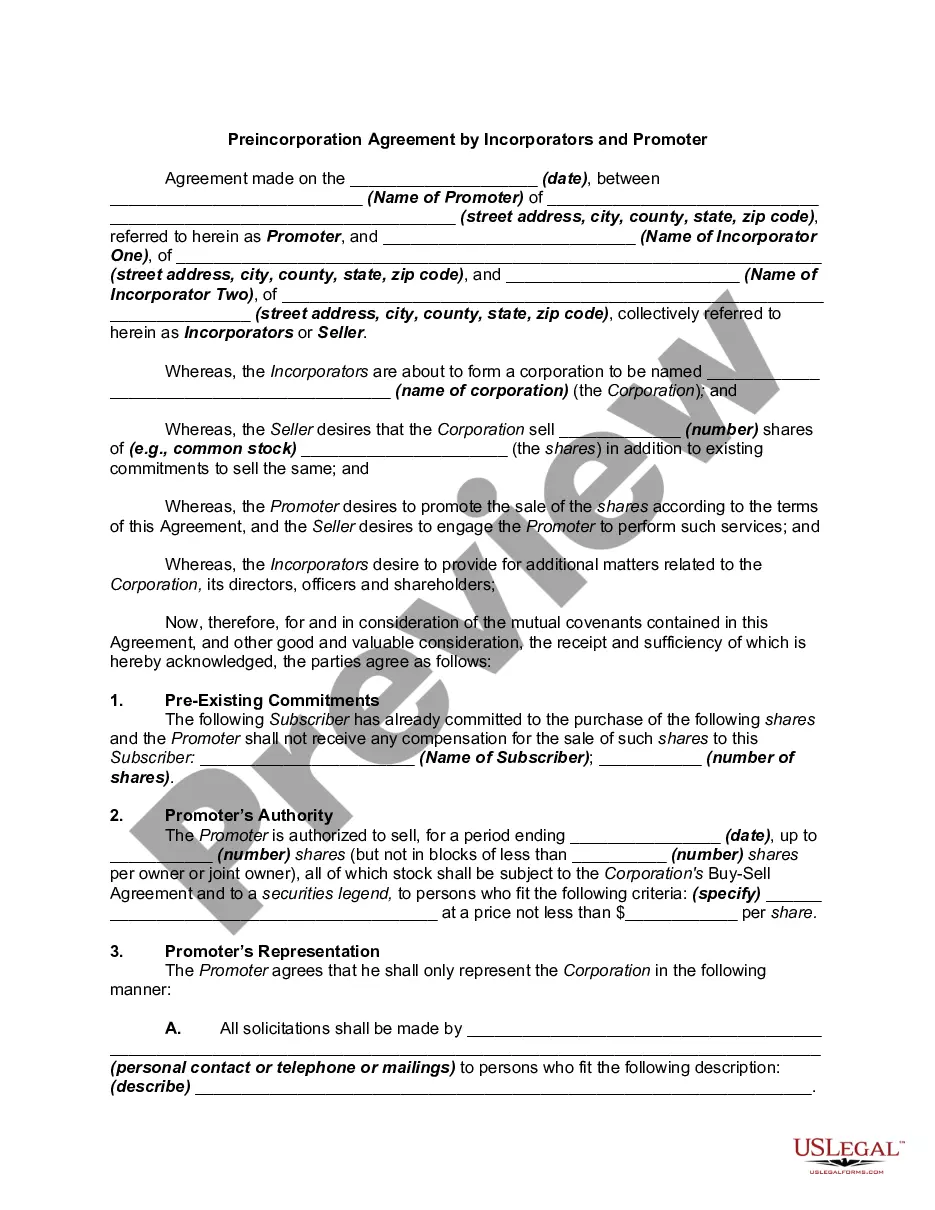

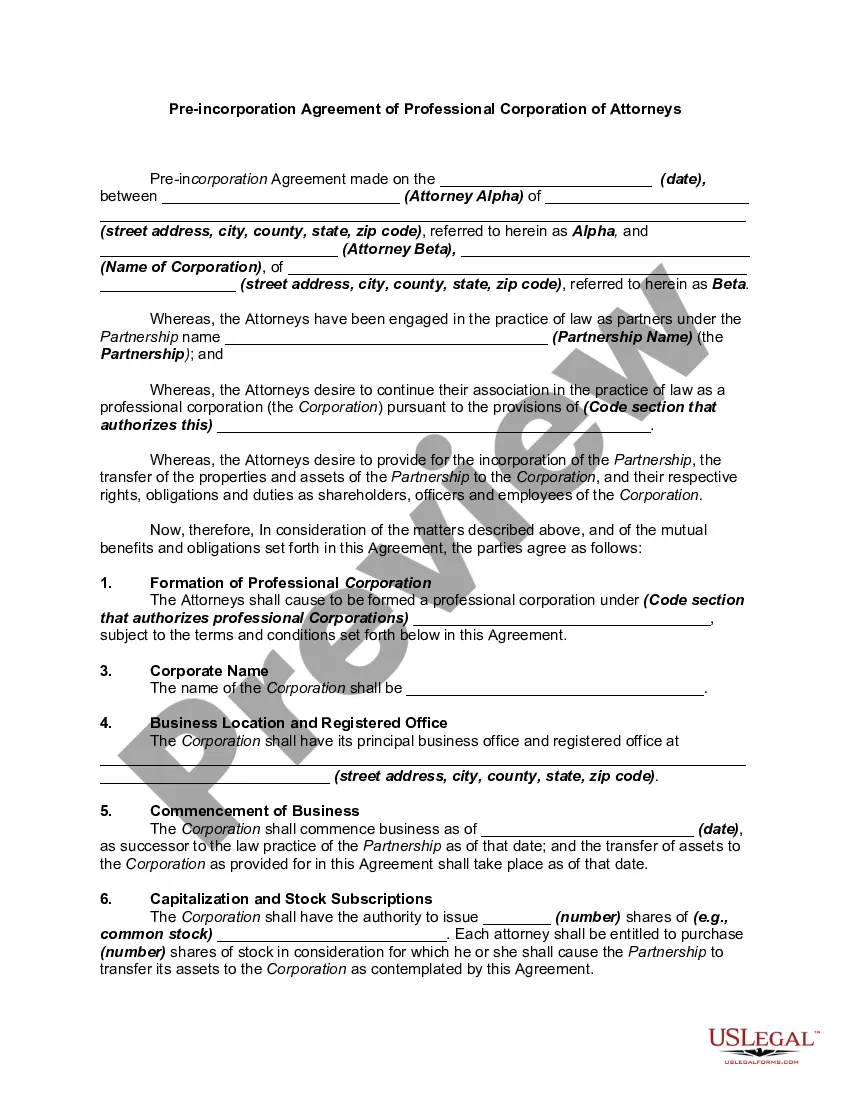

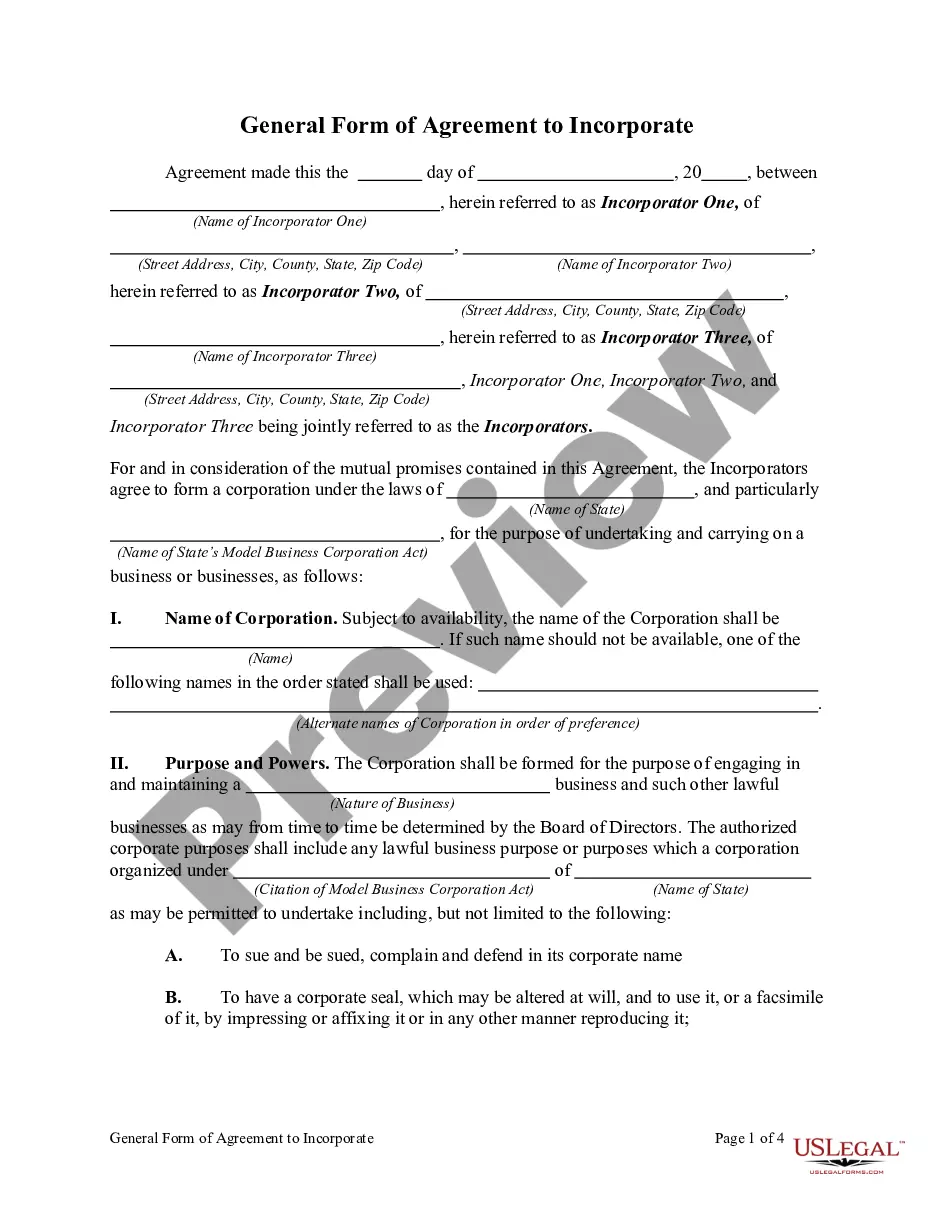

Puerto Rico Pre Incorporation Agreement

Description

How to fill out Pre Incorporation Agreement?

US Legal Forms - one of many most significant libraries of lawful types in America - offers a wide range of lawful papers layouts it is possible to acquire or print out. Utilizing the website, you will get 1000s of types for business and specific reasons, sorted by categories, suggests, or key phrases.You will discover the latest models of types much like the Puerto Rico Pre Incorporation Agreement within minutes.

If you currently have a monthly subscription, log in and acquire Puerto Rico Pre Incorporation Agreement from the US Legal Forms local library. The Obtain switch will show up on every kind you view. You get access to all in the past acquired types in the My Forms tab of your accounts.

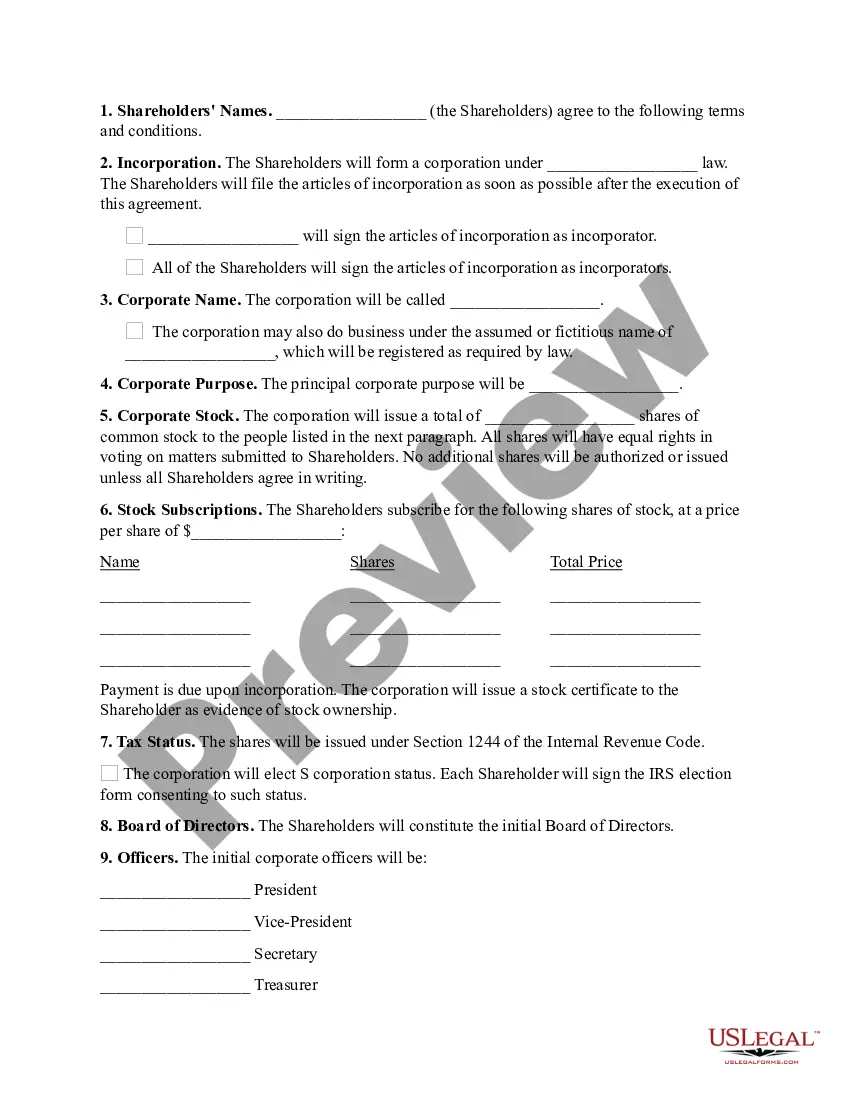

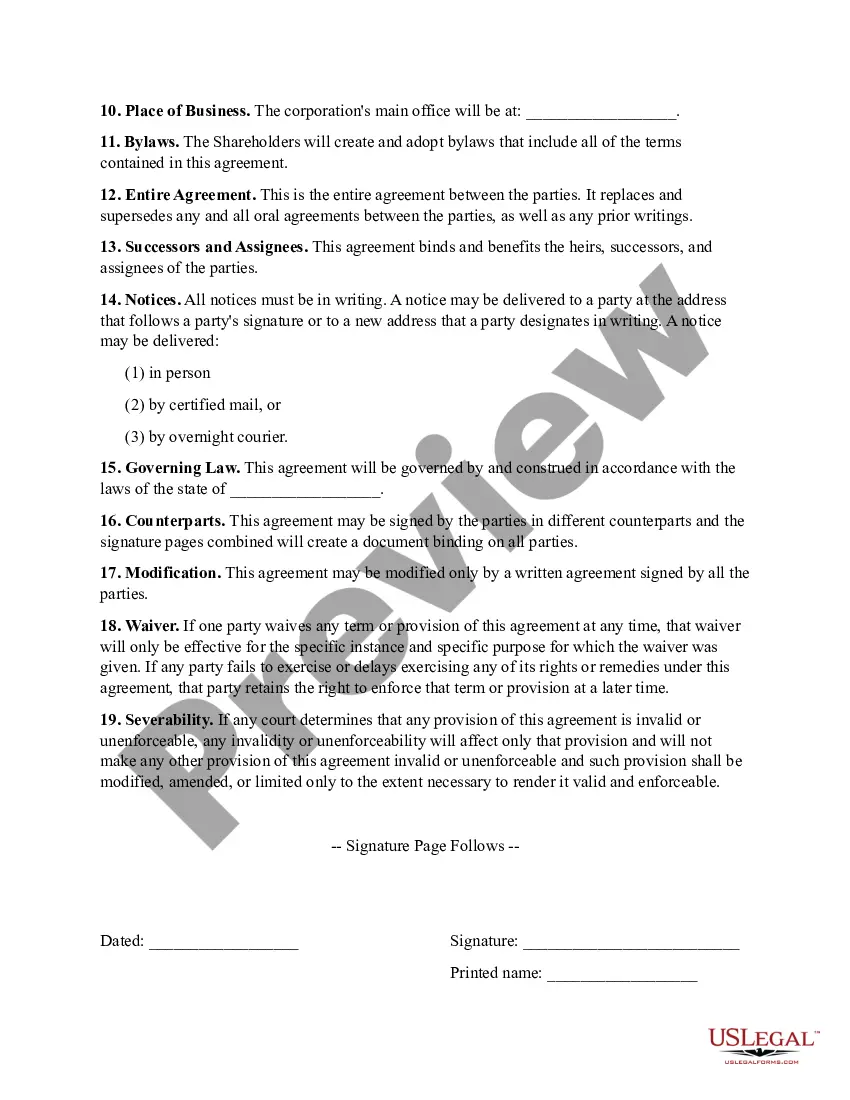

If you would like use US Legal Forms the first time, here are simple guidelines to help you started out:

- Be sure you have selected the proper kind to your town/county. Click on the Review switch to check the form`s content. Browse the kind explanation to ensure that you have selected the correct kind.

- In the event the kind does not satisfy your demands, utilize the Research field on top of the monitor to discover the one which does.

- In case you are pleased with the form, validate your option by simply clicking the Get now switch. Then, opt for the pricing plan you favor and supply your qualifications to sign up on an accounts.

- Method the transaction. Make use of Visa or Mastercard or PayPal accounts to accomplish the transaction.

- Find the formatting and acquire the form on the gadget.

- Make adjustments. Fill out, revise and print out and signal the acquired Puerto Rico Pre Incorporation Agreement.

Each and every template you put into your account lacks an expiration day and is also your own forever. So, in order to acquire or print out one more backup, just proceed to the My Forms segment and then click in the kind you require.

Get access to the Puerto Rico Pre Incorporation Agreement with US Legal Forms, by far the most comprehensive local library of lawful papers layouts. Use 1000s of specialist and express-specific layouts that meet your company or specific demands and demands.

Form popularity

FAQ

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth.

Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written. We recommend a written LLCA that is signed by all members.

In theory, the LLC is capable of acting outside the US. It must, however, fulfill the same conditions as the corporation in terms of an official U.S. location and an official U.S. contact person.

Foreign LLCs only need to file the Certificate of Authorization and pay state fees in order to do business in Puerto Rico.

Yes, a business can be 100% foreign owned by either legal persons (?legal entities?) or natural persons (?individuals?). 2. How long does it take to register a company in Puerto Rico?

Entities in Puerto Rico are identified through a taxpayer ID known as the Employer Identification Number (EIN), which is issued by the US Internal Revenue Service (IRS). Unlike other jurisdictions, the local Treasury does not issue a separate identification number.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.