Puerto Rico Partnership Agreement for Corporation

Description

How to fill out Partnership Agreement For Corporation?

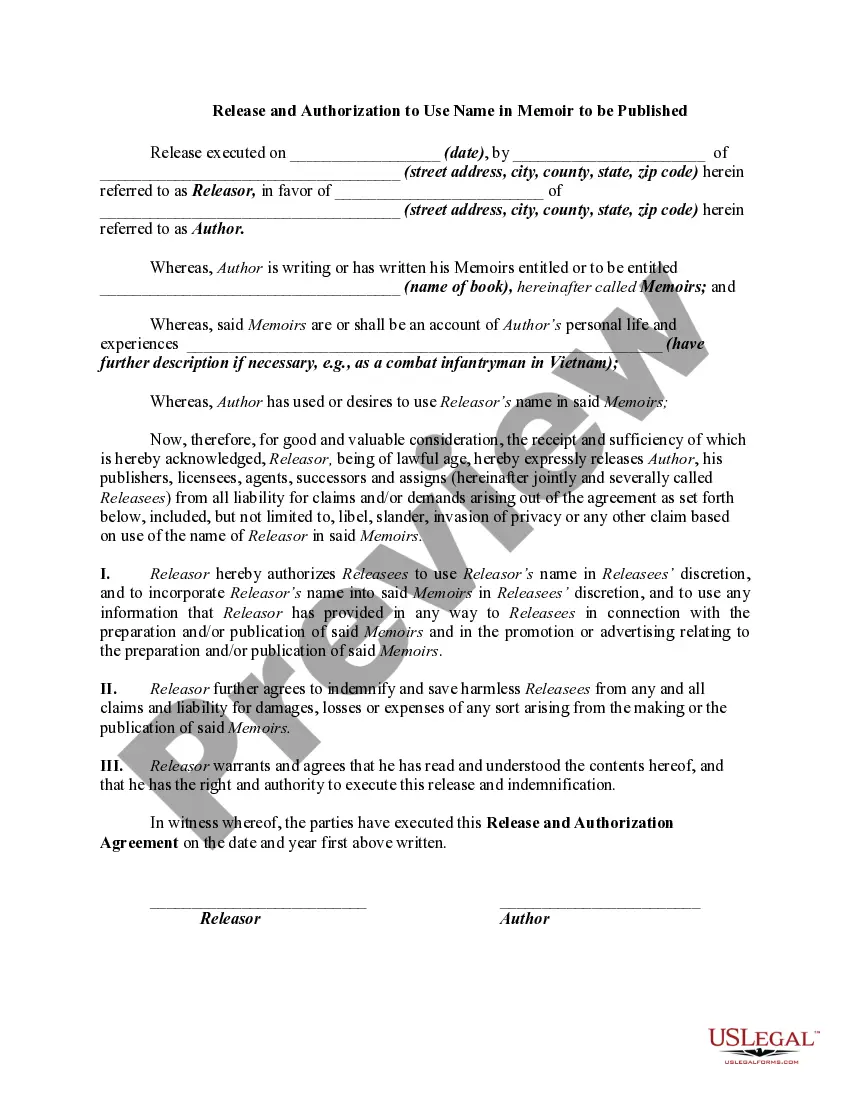

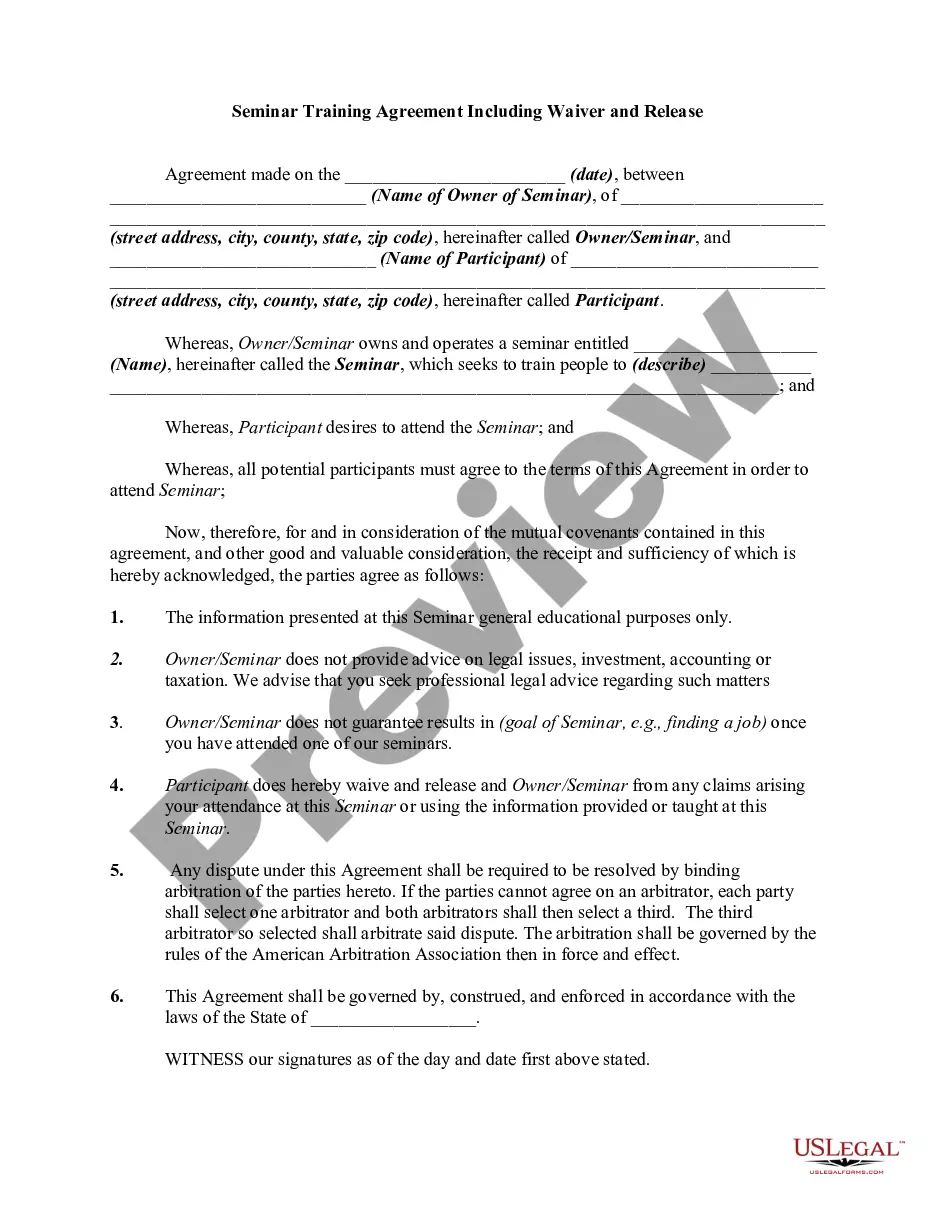

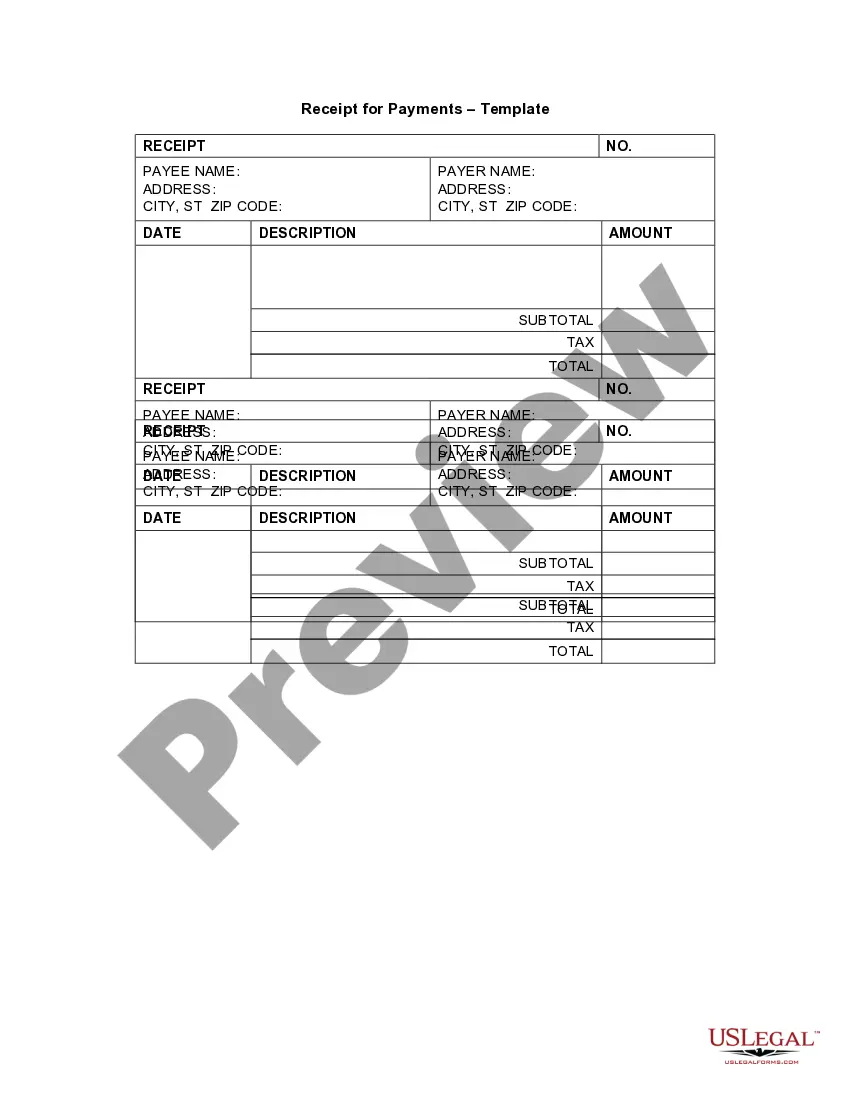

You can dedicate several hours online attempting to locate the legal document format that fulfills the state and federal requirements you need.

US Legal Forms provides an extensive selection of legal templates that have been reviewed by professionals.

It is easy to download or print the Puerto Rico Partnership Agreement for Corporation from the platform.

If available, take advantage of the Preview button to browse through the document format as well. To find another version of the form, utilize the Search field to locate the template that matches your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Puerto Rico Partnership Agreement for Corporation.

- Each legal document format you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and press the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the appropriate document format for the region/city of your selection.

- Review the form description to ensure you've selected the correct one.

Form popularity

FAQ

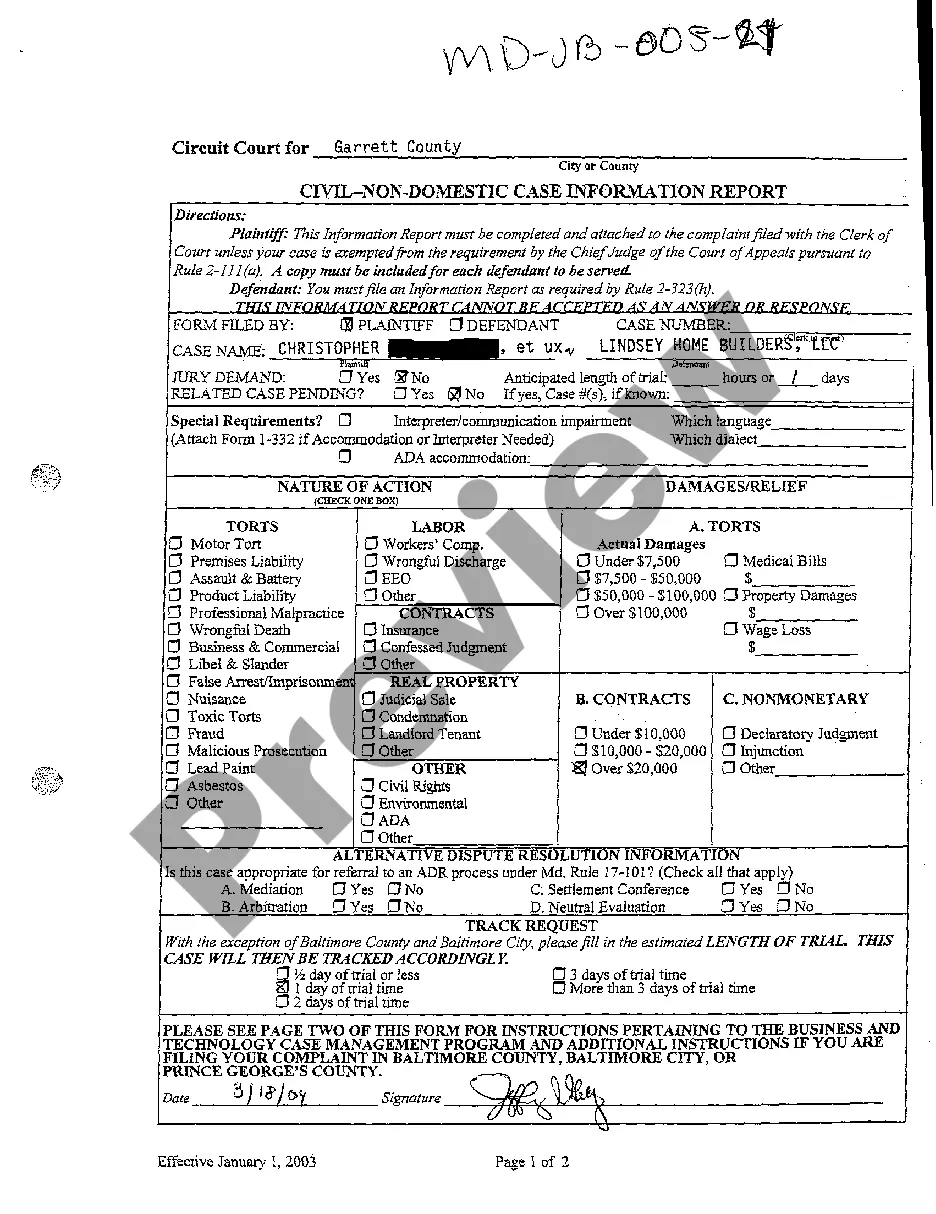

How to Incorporate in Puerto Rico. To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

In addition to a strong legal framework, highly skilled bilingual workforce and outstanding infrastructure, the aggressive tax incentives that Puerto Rico offers, make the island a highly attractive destination to conduct businesses.

Domestic Corporations Are those created under the General Corporations Act of Puerto Rico. That is, these are corporations of Puerto Rico. Foreign Corporations Are those created under the laws of other countries and states of the United States.

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

Alternatively, businesses organized under the laws of a state of the United States or a foreign country may register to be authorized to conduct business within Puerto Rico as a foreign corporation. These businesses must file with the Puerto Rico State Department a Certificate of Authorization to do Business.

A U.S. company that wishes to do business in Puerto Rico may choose to either form a new subsidiary entity or register an existing company. In order to determine the best option, the company should consult an attorney familiar with tax laws and the company's business activities and structure.

U.S. businesses can operate in one or several states or they can operate in a foreign country. Most businesses must register where they are doing business, and that might mean registering as a domestic or foreign business, or both.

A domestic corporation is taxable in Puerto Rico on its worldwide income. A foreign corporation engaged in trade or business in Puerto Rico is taxed at the regular corporate tax rates on income from Puerto Rico sources that is effectively connected income.

Puerto Rican trade is facilitated by the island's inclusion in the U.S. Customs system, and Puerto Rico's most important trading partner, by far, is the United States. The island also carries on significant trade with Singapore, Japan, Brazil, and Ireland and other European countries.

2 As a result, although Puerto Rico belongs to the United States and most of its residents are U.S. citizens, the income earned in Puerto Rico is considered foreign- source income and Puerto Rico corporations are considered foreign.