Puerto Rico Research Agreement

Description

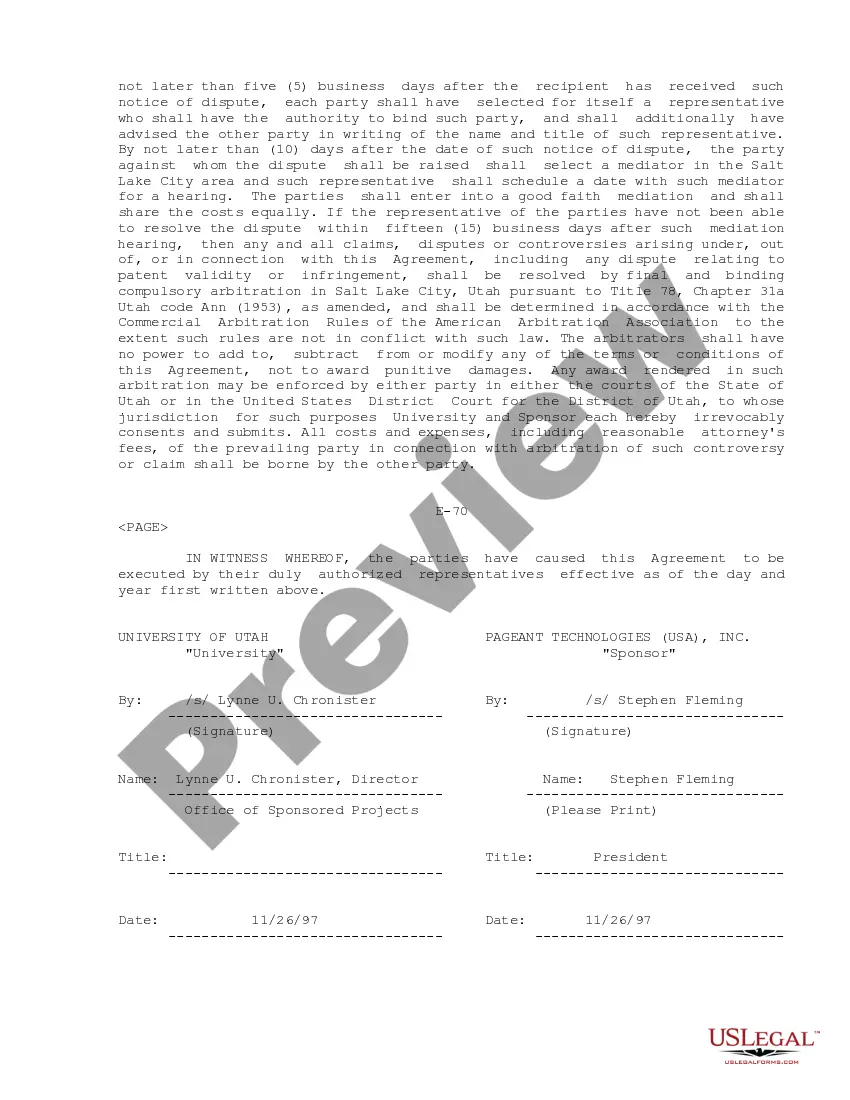

How to fill out Research Agreement?

US Legal Forms - one of many largest libraries of legitimate varieties in the States - gives a wide array of legitimate file web templates you are able to obtain or produce. Utilizing the web site, you will get a huge number of varieties for enterprise and specific uses, categorized by classes, says, or keywords and phrases.You can get the latest variations of varieties much like the Puerto Rico Research Agreement within minutes.

If you already possess a monthly subscription, log in and obtain Puerto Rico Research Agreement from the US Legal Forms collection. The Acquire key can look on every form you see. You get access to all formerly acquired varieties in the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, here are straightforward instructions to help you began:

- Ensure you have selected the correct form for your town/area. Go through the Review key to analyze the form`s articles. Look at the form outline to actually have chosen the appropriate form.

- When the form does not match your demands, use the Lookup industry on top of the display screen to get the the one that does.

- If you are pleased with the form, validate your choice by visiting the Buy now key. Then, select the prices program you favor and offer your references to register for the profile.

- Process the purchase. Utilize your Visa or Mastercard or PayPal profile to finish the purchase.

- Select the format and obtain the form on the gadget.

- Make alterations. Fill up, change and produce and indication the acquired Puerto Rico Research Agreement.

Each design you added to your bank account lacks an expiration time and it is your own property forever. So, in order to obtain or produce yet another duplicate, just go to the My Forms portion and then click about the form you want.

Obtain access to the Puerto Rico Research Agreement with US Legal Forms, one of the most extensive collection of legitimate file web templates. Use a huge number of professional and state-particular web templates that meet up with your company or specific requires and demands.

Form popularity

FAQ

100% exemption from Puerto Rico income taxes on interest and dividends. 100% exemption from Puerto Rico income taxes on all short-term and long-term capital gains generated after the individual becomes a bona-fide resident of Puerto Rico (?Puerto Rico Gain?).

Individuals who qualify for Act 60 also enjoy significant tax breaks, including a 100% tax exemption from Puerto Rico income taxes on: Dividends. Interest. Short-term and long-term capital gains.

Estates of residents of Puerto Rico who are considered citizens of the United States, under Subtitle B, Chapter II of the United States Internal Revenue Code, are allowed an exemption which is the greater of (i) $30,000.00 or (ii) that proportion of $60,000 which the value of that part of the decedent's gross estate ...

75% property tax exemption for real and personal property. 50% municipal tax exemption. 100% exemption form income withholding taxes on payments of dividends and other profit distributions. Isolation of proceeds and benefits paid by international insurers are not subject to income taxes.

As with any investment, there are pros and cons to consider. Puerto Rico offers many advantages to homeowners, including a lower cost of living, tax benefits, beautiful weather and beaches, and a rich culture.

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.

Puerto Rico offers great tax incentives to LLCs and individuals who move to Puerto Rico, including a 4% income tax and exemptions from paying taxes on capital gains, interest, or dividends (for individuals and businesses that meet the requirements).

Qualifying businesses, foreign or local, with an office in Puerto Rico get a 4% fixed income tax rate under Act 20 for exporting services. Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012.