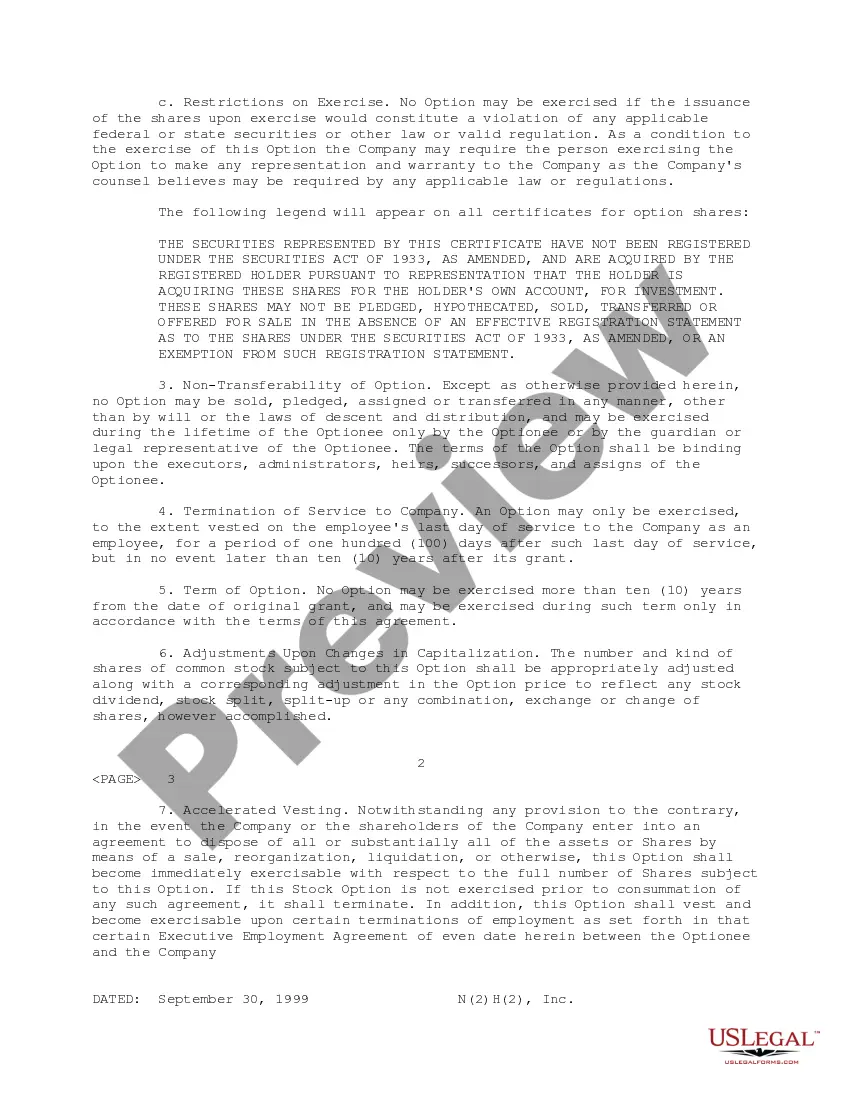

Puerto Rico Nonqualified Stock Option Agreement of N(2)H(2), Inc.

Description

How to fill out Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

You are able to commit time online trying to find the legitimate file format that suits the federal and state requirements you will need. US Legal Forms offers 1000s of legitimate types which are examined by professionals. You can actually obtain or produce the Puerto Rico Nonqualified Stock Option Agreement of N(2)H(2), Inc. from my services.

If you already have a US Legal Forms accounts, you are able to log in and click the Down load switch. Afterward, you are able to complete, change, produce, or signal the Puerto Rico Nonqualified Stock Option Agreement of N(2)H(2), Inc.. Every single legitimate file format you buy is yours forever. To get one more version of any acquired develop, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website the very first time, stick to the basic instructions listed below:

- First, be sure that you have selected the right file format to the region/metropolis of your choosing. Browse the develop outline to ensure you have picked out the appropriate develop. If readily available, utilize the Review switch to check throughout the file format too.

- If you wish to discover one more edition of your develop, utilize the Search area to obtain the format that fits your needs and requirements.

- When you have discovered the format you need, click on Buy now to carry on.

- Find the pricing plan you need, type your qualifications, and register for your account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal accounts to purchase the legitimate develop.

- Find the file format of your file and obtain it to the gadget.

- Make alterations to the file if necessary. You are able to complete, change and signal and produce Puerto Rico Nonqualified Stock Option Agreement of N(2)H(2), Inc..

Down load and produce 1000s of file web templates using the US Legal Forms web site, that provides the most important selection of legitimate types. Use specialist and state-particular web templates to tackle your small business or personal requirements.

Form popularity

FAQ

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

NSOs are subject to ordinary income tax and reported as W-2 wages for employees.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares. What Is a Non-Qualified Stock Option (NSO), and How Is It ... Investopedia ? ... ? Investor Taxes Investopedia ? ... ? Investor Taxes

However, when you sell an option?or the stock you acquired by exercising the option?you must report the profit or loss on Schedule D of your Form 1040. If you've held the stock or option for one year or less, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income. How to Report Stock Options on Your Tax Return - TurboTax - Intuit intuit.com ? investments-and-taxes ? how... intuit.com ? investments-and-taxes ? how...

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling) Tax Time: Making Sense Of Form W-2 When You Have Stock Compensation forbes.com ? brucebrumberg ? 2019/01/22 forbes.com ? brucebrumberg ? 2019/01/22

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

Tax Rules for Nonstatutory Stock Options When you exercise the option, you include, in income, the fair market value of the stock at the time you acquired it, less any amount you paid for the stock. This is ordinary wage income reported on your W2, therefore increasing your tax basis in the stock.

NSOs are subject to ordinary income tax and reported as W-2 wages for employees. They are also subject to federal and state income taxes as well as Social Security and Medicare taxes. Guide to non-statutory stock options (NSOs) - Empower empower.com ? the-currency ? money ? gui... empower.com ? the-currency ? money ? gui...