Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement

Description

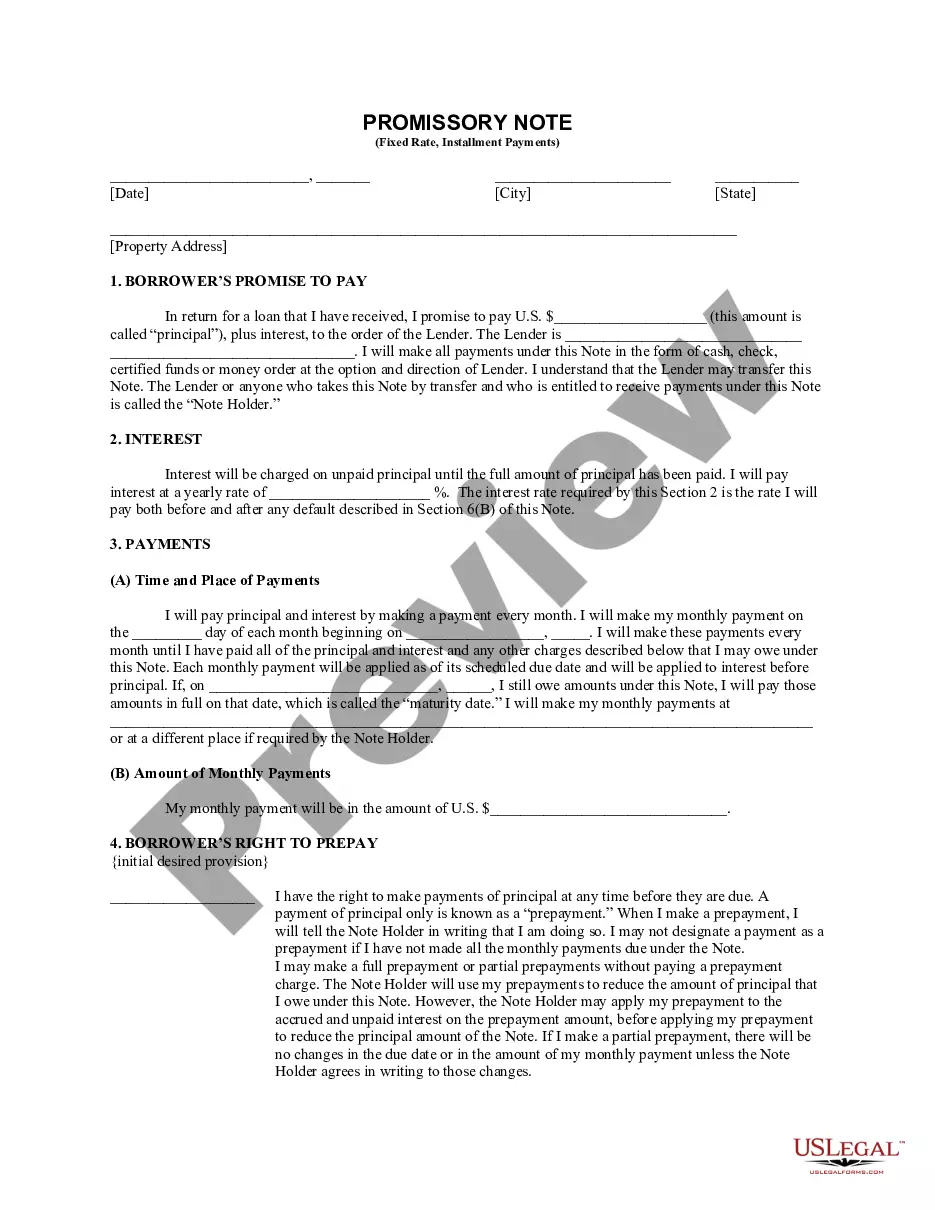

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

US Legal Forms - a prominent repository of legal templates in the United States - offers a selection of legal document formats that you can download or print.

By navigating the site, you can find thousands of templates for commercial and personal purposes, categorized by type, state, or keywords. You can easily locate the latest templates, such as the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement, in just a few moments.

If you are a subscriber, Log In and download the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved templates in the My documents section of your account.

Choose the format and download the document to your device.

Make modifications. Complete, modify, print, and sign the saved Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement.

Every document you added to your account does not expire and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you require.

Access the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement through US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a vast array of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have selected the correct template for your state/region. Click the Preview button to review the content of the template.

- Examine the description of the document to confirm that you have chosen the right template.

- If the template does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the template, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the payment.

Form popularity

FAQ

ERISA does not apply to retirement plans specifically designed for Puerto Rico, including the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement. Instead, these plans adhere to distinct guidelines applicable in Puerto Rico, which allows for different pension plan structures. Engaging with local legislation is essential for compliance, so you can effectively manage retirement benefits. For assistance with creating or understanding these agreements, uslegalforms offers valuable resources that can guide you through the process.

Generally, ERISA does not apply to foreign pension plans since it is designed for plans that operate within the United States. Special agreements, such as Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreements, can exist separately from ERISA regulations. Companies must consider local laws and regulations, as compliance requirements may vary by jurisdiction. To navigate these complexities effectively, using resources like uslegalforms can simplify finding the right solutions.

Retirement plans not subject to ERISA include certain governmental plans and church plans, which fall outside the jurisdiction of federal pension law. Additionally, plans like the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement often operate independently of ERISA regulations. These agreements provide flexibility in structure and funding, tailored to the specific needs of employers and employees. Understanding these distinctions allows business leaders to make informed decisions for their retirement planning.

As mentioned earlier, deferred compensation is primarily nonqualified. This means it does not adhere to the same regulatory framework as qualified plans. For individuals interested in establishing a Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement, recognizing the characteristics of nonqualified plans can aid in optimizing retirement savings and understanding flexibility in contributions.

One downside of deferred compensation is that it can lead to significant tax liabilities when the income is eventually received. Employees may also face a risk of losing deferred funds if the employer experiences financial difficulties. Understanding the implications of a Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement is vital, as it can help mitigate some of these risks through careful planning.

The Employee Retirement Income Security Act (ERISA) generally does not apply to Puerto Rico retirement plans. Puerto Rico has its own set of laws governing retirement plans, which differ from ERISA regulations. Therefore, when exploring options like a Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement, it is important to consult legal guidance specific to Puerto Rico to ensure compliance and optimal benefits.

Deferred compensation plans can be either qualified or nonqualified, but many common plans, such as those offered under section 457 or 409A, are nonqualified. This means they do not meet the requirements set by the IRS for qualified plans. For those in Puerto Rico, understanding these differences, especially in the context of a Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement, is essential to navigate retirement planning effectively.

Deferred compensation typically includes wages, bonuses, and other forms of payment that an employee chooses to receive at a later time. This can be beneficial for individuals planning their financial future, as it allows them to manage their tax liability strategically. A Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement can be an advantageous tool for individuals seeking to maximize their retirement income while minimizing immediate tax impacts.

A 457 deferred compensation plan is not a qualified plan. Instead, it functions as a nonqualified plan, which allows employees to defer a portion of their income until retirement or a later date. This type of plan offers flexibility in terms of contribution limits and tax treatment. For those considering a Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement, understanding the distinctions is crucial to making informed decisions.

Setting up a nonqualified deferred compensation plan involves several steps, including defining the plan's structure and goals. Start by consulting with a financial advisor or attorney experienced in the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement. They can guide you through compliance, documentation, and communication with your employees. Utilizing the US Legal Forms platform can also simplify this process, providing templates and guidance.