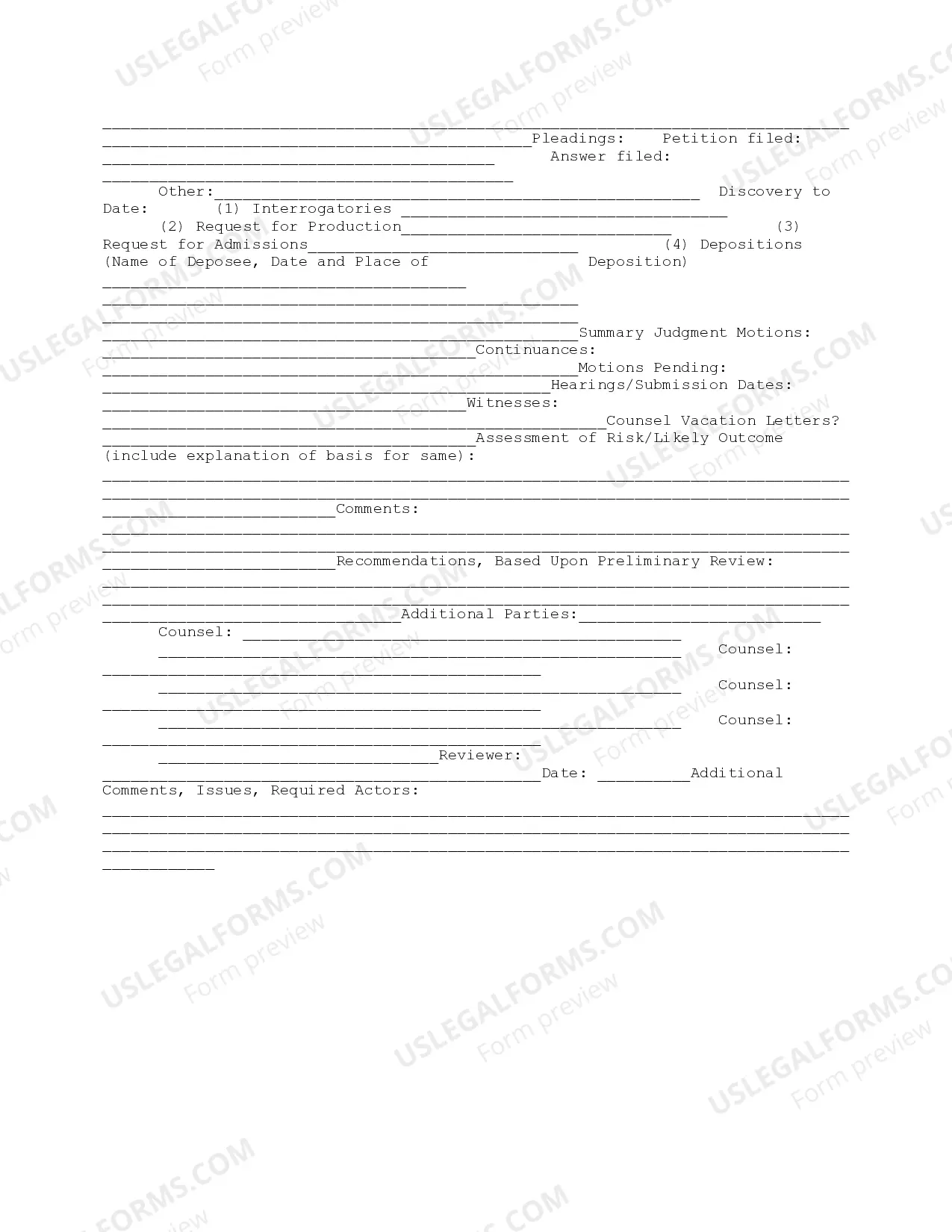

This due diligence form is a workform to be prepared for each pending or threatened claim or investigation brought against the company in business transactions.

Puerto Rico Litigation Workform

Description

How to fill out Litigation Workform?

Are you in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal form templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of document templates, including the Puerto Rico Litigation Workform, designed to meet both state and federal regulations.

Once you find the correct form, click on Buy now.

Choose the pricing plan you want, fill in the required details to create your account, and process your payment through PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Litigation Workform template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to ensure that you have selected the right document.

- If the form is not what you are looking for, use the Search area to find a template that fits your needs.

Form popularity

FAQ

The 183 day rule in Puerto Rico states that individuals must reside in Puerto Rico for at least 183 days during a tax year to be considered a tax resident. This rule helps determine your tax obligations and access to local benefits. If you need help understanding your rights or filing requirements, the Puerto Rico Litigation Workform can be a valuable resource.

Living on $2000 a month in Puerto Rico can be manageable, depending on your lifestyle. Housing costs, groceries, and transportation will significantly influence your budget. If you face legal issues affecting your living situation, consider using the Puerto Rico Litigation Workform to facilitate any needed legal actions.

Yes, Puerto Rico has specific customs regulations that require travelers to fill out a customs form upon entry. This form helps authorities track goods and ensure compliance with local laws. When dealing with legal matters related to customs, the Puerto Rico Litigation Workform can assist in navigating any legal challenges.

Establishing residency in Puerto Rico involves physically living there for a minimum period, typically 183 days a year. You will also need to register with the local authorities, obtain a Puerto Rican driver's license, and ensure your tax obligations align with Puerto Rico's regulations. The Puerto Rico Litigation Workform can guide you through the legal aspects of this process.

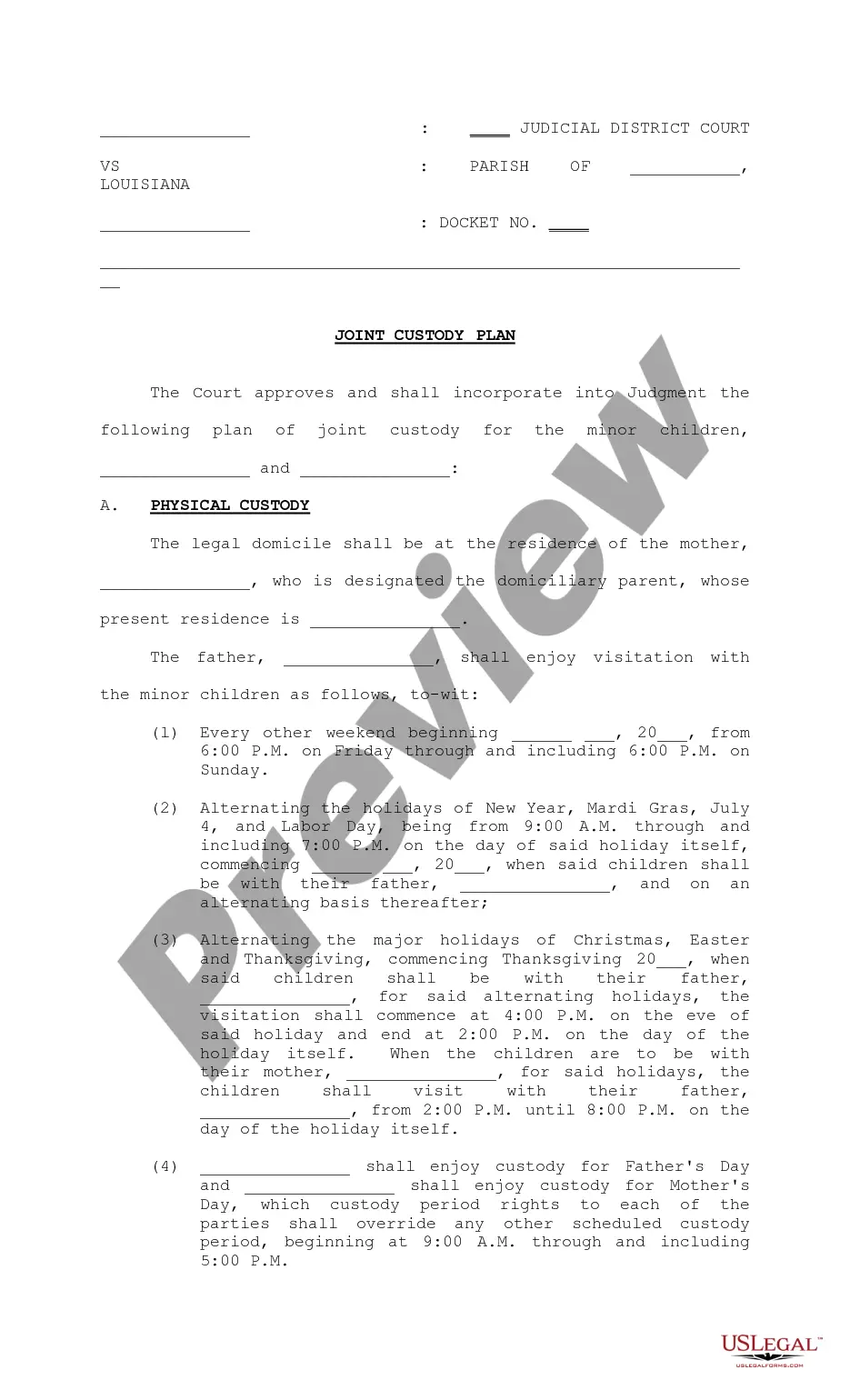

Yes, you can sue in Puerto Rico. The judicial system in Puerto Rico allows individuals to file lawsuits in various civil and criminal matters. To initiate a case, you may use the Puerto Rico Litigation Workform, which simplifies the legal process and ensures you meet all necessary requirements.

Even though you may be covered by these laws, your employee may not be. Title VII and the ADA protect any U.S. citizen employed outside of the United States, absent any conflict with foreign law (not a foreign practice, policy, custom or preference) or employed in the U.S. by a foreign employer.

Despite this systemic second-class treatment, residents of Puerto Rico, like those of Guam, American Samoa and the U.S. Virgin Islands, are entitled to equal protection of the laws of the United States.

Act 80 (the Unjust Dismissal Act) regulates employment termination of employees hired for an indefinite term. Puerto Rico is not an 'employment at will' jurisdiction.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Only the "fundamental rights" under the federal constitution apply to Puerto Rico, including the Privileges and Immunities Clause (U.S. Constitution, Article IV, Section 2, Clause 1, also known as the Comity Clause) that prevents a state from treating citizens of other states in a discriminatory manner, with regard to